Here's your "rally."

Here's your "rally."

You'd better be making money in the markets because your cash, your home, your savings, your income – everything else you have has been slashed 5% in the past 18 days in order to make you feel better about the markets. Americans have roughly $100Tn in Dollar-denominated assets and it cost us $5Tn in less than 3 weeks to prop up the markets. Was it worth it? Will the next 5% be worth it too?

Welcome to the World of weak-Dollar policies. The Fed confirmed it's rumored $1Tn extension of QE on the 24th, by extending ZIRP through 2014 (and we did the math on the price of that policy last Thursday), $1Tn is nearly a 10% expansion of our Money Supply so of course the Dollar begins selling off but one would think the equally easy ECB would balance it out a bit but, so far, not at all as the Euro was already unnaturally weak against the Dollar out of fear of a currency collapse. As that comes off the table, even the Trillions of Euros being shoveled into bailouts seem RESPONSIBLE when compared to our own Fed's constant money drops. At least the EU demands to see some sort of balance sheet improvements before they hand out funds…

So far, the chart remains the same and we have the same gap up from $131.20 on the SPY to our $132 ceiling (see yesterday's notes) that we have had day after day after day as the pre-market programs do their very best to give us the illusion of strength – even while our currency is collapsing and that $132 we can get for one of our SPY shares buys 5% less stuff than it did 3 weeks ago.

So far, the chart remains the same and we have the same gap up from $131.20 on the SPY to our $132 ceiling (see yesterday's notes) that we have had day after day after day as the pre-market programs do their very best to give us the illusion of strength – even while our currency is collapsing and that $132 we can get for one of our SPY shares buys 5% less stuff than it did 3 weeks ago.

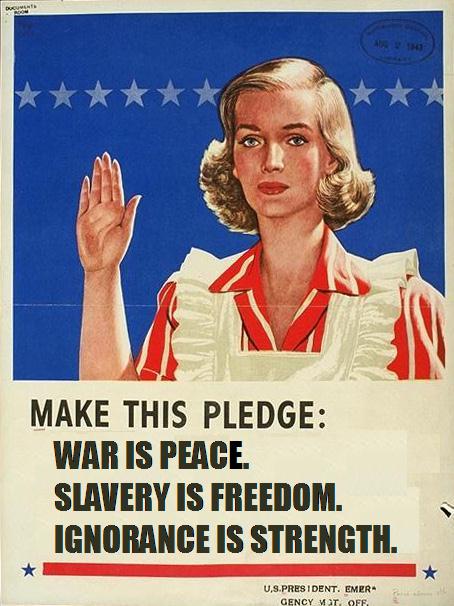

But the chart LOOKS good and we got our official "golden cross" yesterday but, funny thing – it did not set off a buying frenzy – did it? One might pause to wonder why buyers are ignoring the most significant technical buy signal the markets can give if one were inclined to think but that is an activity that is actively discouraged in America these days and believe me – they'll know if you try it!

That's right, we are now arresting people for tweeting as homeland security yanked Leigh Van Bryan off a plane, detained him and sent him home because this bartender from Ireland tweeted "Free this week, for quick gossip/prep before I go and destroy America." They also arrested his friend, Emily Bunting, for being stupid enough to travel with him.

While obviously a poor choice of words for someone about to go on a trip to America, it's not about that but about the fact that EVERY LITTLE THING YOU SAY is duly noted and recorded and analyzed and, when a little red light pops up on someone's screen – acted upon to make sure you and your poorly-chosen friends don't use that freedom of speech thing to say anything the Government doesn't like. When did we decide to live like this?

While obviously a poor choice of words for someone about to go on a trip to America, it's not about that but about the fact that EVERY LITTLE THING YOU SAY is duly noted and recorded and analyzed and, when a little red light pops up on someone's screen – acted upon to make sure you and your poorly-chosen friends don't use that freedom of speech thing to say anything the Government doesn't like. When did we decide to live like this?

Nothing you do is private anymore, this wasn't even a general tweet, this was directed to his friend Melissa and the reason I think it's important to discuss here is because there are still people who don't believe that TradeBots are holding up the markets by similarly attacking any trades they don't like. If the Government is going to follow every single keystroke you make and listen to every phone conversation you have – don't you think they're capable of making sure you also trade the way they want?

Our Corporate Masters demand no less as they transform this once-free Nation into a State of Wage Slavery, with room at the top for the privileged few only and believe me – if you are not the one who is currently monitoring the conversations of others, or at least getting reports on what other people are saying – then it's not you!

Our Corporate Masters demand no less as they transform this once-free Nation into a State of Wage Slavery, with room at the top for the privileged few only and believe me – if you are not the one who is currently monitoring the conversations of others, or at least getting reports on what other people are saying – then it's not you!

Speaking of wage slavery, Republican leaders are adopting model legislation proposed by the American Legislative Exchange Council, a national corporate-financed conservative organization that is also assisting the Republican push to require voter identification cards to suppress the vote of minorities, young people and other constituencies that tend to favor the Democratic Party.

There is little doubt that politics is also behind the Republicans’ push for right-to-work laws: they see an opportunity to further weaken unions, which are far more likely to support Democrats — as well as health care reform and a higher minimum wage — by slashing their funding and their donating power.

Much like the way every stroke of your keyboard is being checked lest you have an errant thought, the ALEC is just another one of those lobbying groups set up by the usual suspects (Kochs, Coors, Oilin, Castle Rock, XOM, the American Petroleum Institute…) to micro-manage their control of state legislatures and to make sure they get the best Government that money can buy – this Big Brother Organization only has to watch a select few, the people who are supposedly there to do "the people's business" – and make sure they vote the way they're "supposed to."

This is why the "Liberals" lose. Logically, Liberals should have their own groups that bribe Congresspeople and ruthlessly enforce their positions to make sure they squeeze every single vote they can under maximum duress, but Liberals think that's "icky" and tend not to support that kind of activity. So, inevitably, they lose! When one group in a "Democracy" is willing to do whatever it takes to win and the other group has a line they won't step over – it's only a matter of time before we marginalize the weak, isn't it?

Don't worry though, unless I'm being far too optimistic, we are still a decade or two away from having televisions that watch us that we are not allowed to turn off and there's still enough play in the system for us to make sure we are one of "THEM" before we find that door to the top 1% slammed forever in our faces so let's just keep our heads down and stay out of trouble while we scramble up the ladder while there's still a ladder left to climb.

Manipulated markets can be fun because they are predictable. For instance, the Dollar was jammed down this morning and we took the opportunity to short oil again at $99.30 in Member Chat at 7:32 and it's already back at $98.85 at 8:30 and that's a very nice $450 per contract gain in an hour playing the Futures. Our long bets are for oil to not hold $100, despite all the free money sloshing around but, meanwhile, it's a great opportunity for us to make these quick in and out plays – taking advantage of the fake buyers to make real sales at unsustainable prices.

Manipulated markets can be fun because they are predictable. For instance, the Dollar was jammed down this morning and we took the opportunity to short oil again at $99.30 in Member Chat at 7:32 and it's already back at $98.85 at 8:30 and that's a very nice $450 per contract gain in an hour playing the Futures. Our long bets are for oil to not hold $100, despite all the free money sloshing around but, meanwhile, it's a great opportunity for us to make these quick in and out plays – taking advantage of the fake buyers to make real sales at unsustainable prices.

Likewise the Russell (/TF) spiked to just high of our 800 shorting spot and dropped a quick 5 in that same hour and gold (/YG) is back at the $1,750 line we've been using and the S&P (/ES), of course, hit 1,320.25 before falling all the way back to 1,315. I know it doesn't sound like much but, in the Futures, the S&P is good for $12.50 per 0.25 so a 5-point drop is $250 per contract. Make $250 200 days a year and it starts adding up to real money!

We got our little dip in the morning (and the Egg McMuffins are paid for) so now we wait for the open and hopefully get another chance to sell into the morning excitement. We're not too gung-ho bearish right now because we're expecting Greece to be "fixed" – again – and the ADP jobs report this morning shows a gain of 170,000 jobs in January so, with the Dollar down below 79 and EU markets up 1.5% on PMI optimism, you would think we'd be off to the races.

BUT (and it's a big but) the ADP report was expected to be 182,000 and last month's stunning 325,000 has now been revised down 10% to 292,000 so not a good net overall. We get the usual 400,000 lost jobs tomorrow and Friday is the dreaded January Non-Farm Payroll Report as January is a big adjustment month and expectations are for a positive 170,000 jobs in what is usually a fairly weak part of the year. It's POSSIBLE but, if that's what the market is counting on to justify this rally – I'm not buying it.

Still, I have promised to be bullish if we can hold our final two breakout levels of Dow 12,749 and NYSE 7,866 for 48 hours and you would think it wouldn't be so hard as we had both of those levels taken when the Dollar was 5% higher than it is now and, rather than raise my bar 5% to compensate – I stand ready to switch of my brain at these now-discounted levels. That's not too much to ask, is it?

Until then, color me skeptical as we continue to sell these f'ing daily pops.