More free money!

That's the way we like to start the day as the BOE pumps another $75Bn into the mix and, best of all, their currency went UP on the news because "whisper numbers were for $100Bn." Now that we know the magic formula, we can start a rumor that the Fed will print $3Tn and then, when they ONLY print $2.5Tn – the Dollar will become much more valuable. See, I'm starting to think like a Central Banker!

Also in the "bad news must be good news" pile as Greek Finance Minister Evangelos Venizelos (wouldn't it suck to live in Greece with a name like Bob Smith?) heads to Brussels with NO DEAL. That's right there is still no deal on the Greek bailout that has boosted the markets by 22% since October. They do claim that the only remaining issue is pension cuts but all the Florida voters who picked Romney will soon find out how easy that is to accomplish.

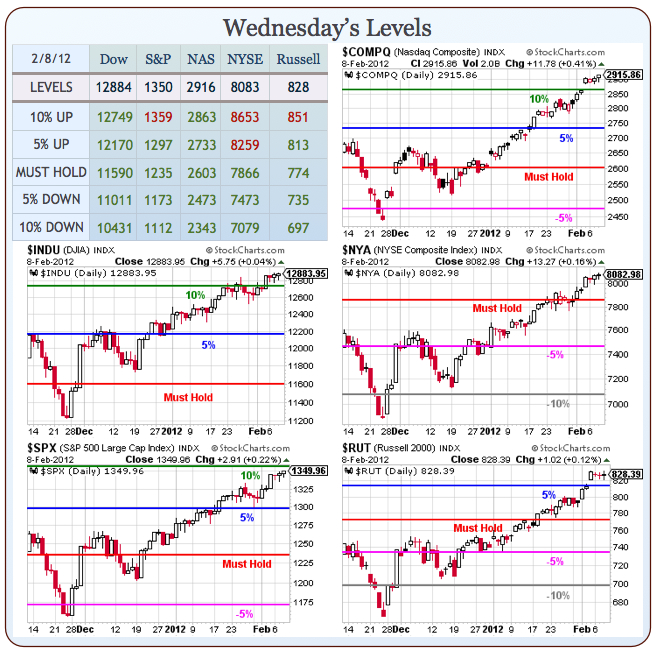

Just last February, I was writing a Thursday post titled "Greece is the Word" where I warned that the 4.23% CDS rate hitting Greek bonds was unsustainable and that turned us bearish right at the top of the rally at S&P 1,344. Yesterday, the S&P was back to 1,349 and I wonder if Greece never happened – would I have continued to be bullish with the markets at this level?

Just last February, I was writing a Thursday post titled "Greece is the Word" where I warned that the 4.23% CDS rate hitting Greek bonds was unsustainable and that turned us bearish right at the top of the rally at S&P 1,344. Yesterday, the S&P was back to 1,349 and I wonder if Greece never happened – would I have continued to be bullish with the markets at this level?

On the whole, even WITH the snowballing Greek crisis, we "only" fell to 1,249 in March so, with Greece all fixed – maybe we can afford to be a bit more bullish. I'll be more comfortable with the upside once we see that Greece is not a "sell on the news" event but, as I noted yesterday, our last 10 bullish picks did quite well and a few of them are still playable and certainly there are still opportunities out there to pick up good stocks fairly cheaply.

Take DMND, for example. Last night, the stock fell from $37 to $20.50 as the beleaguered company will have to restate their last two years of earnings and that sent the CEO and two CFO's out the door and does, in fact, constitute a "material adverse change" that will allow PG to, at their discretion, terminate their deal to merge their Pringles division into DMND in exchange for a 57% ownership in what was SUPPOSED to be a $2.5Bn valued company (so $1.4Bn of new DMND stock would be distributed to PG shareholders).

With DMND valued (at $20) at about $450M with no CEO and no CFO – you can imagine that PG shareholders may not be too wild about handing over their $1.5Bn-valued Pringles division in exchange for 57% of the combined $1.95Bn (theoretically) entity or just $1.1Bn.

With DMND valued (at $20) at about $450M with no CEO and no CFO – you can imagine that PG shareholders may not be too wild about handing over their $1.5Bn-valued Pringles division in exchange for 57% of the combined $1.95Bn (theoretically) entity or just $1.1Bn.

Clearly DMND, at $20 is in no position to make up that missing $300M – HOWEVER, should they toss in $150M in cash then the very act of PG green-lighting the deal can pop them back to $35 and everyone's problem is solved. The question is, will the restated earnings justify someone lending DMND $150M (because they don't have the cash on tier books and they are already $500M in debt.

We have two contracts of a speculative DMND spread in our $25,000 Portfolio from the last time they crashed and that was the June $37/45 bull call spread at $2.24, selling the June $20 puts for $1.85 for net .39 on the spread. I imagine we'll be back to scratch on that trade today, maybe even with a chance to sell a couple of more June puts for a good price as it's still a nice little company without the Pringles deal but it will be a while before all the disappointed investors find the exits.

Financials are still my favorite upside play. If Greece is "fixed" (8:30 update – it is!) and the rest of the PIIGS don't explode tomorrow, then XLF was $16.92 last February and now, $4Tn of Global bailouts later, it's not even back to $15. BAC was already our One Trade to make for 2012. Back on January 5th I pointed out that BAC was, by itself, estimated to contribute 14.1% of the S&P's entire earnings growth for the year. Therefore, we decided, there was no real point playing anything but BAC as it gave us better leverage with better hedges than the S&P would and, anyway, I did think they would have a much better year.

Financials are still my favorite upside play. If Greece is "fixed" (8:30 update – it is!) and the rest of the PIIGS don't explode tomorrow, then XLF was $16.92 last February and now, $4Tn of Global bailouts later, it's not even back to $15. BAC was already our One Trade to make for 2012. Back on January 5th I pointed out that BAC was, by itself, estimated to contribute 14.1% of the S&P's entire earnings growth for the year. Therefore, we decided, there was no real point playing anything but BAC as it gave us better leverage with better hedges than the S&P would and, anyway, I did think they would have a much better year.

BAC was $5.75 at the time and is now $8.28 so a nice 44% gain in the stock already and our $5 Jan buy/write (buying the stock and selling the Jan $5 puts and calls for $2.55) netted $3.20/4.10 and is already netting $4.43, which is up 38% WAY ahead of schedule and very likely on its way to the full 56% gain for the year. Using the very conservative spread we set up, $32,000 invested in the spread can already be cashed for $44,300 and the loss on the FAZ hedge is $1,000 so a net of $11,300 is an overall 35% gain in 34 days.

I strongly suggest going over that trade if you like that kind of investing as that's what we'll be looking for going forward.

BUT (and it's a big but) I am not interested in jumping into new trades today because Greece may indeed be a "sell on the news" event and, this being Thursday already, I think it would be prudent to wait for the weekend and, if we then see the S&P over 1,350 and the Russell over 833 and XLF over $15 then it's going to be easy to construct plays similar to BAC that should keep us nicely ahead of inflation in this seemingly bullet-proof market.

BUT (and it's a big but) I am not interested in jumping into new trades today because Greece may indeed be a "sell on the news" event and, this being Thursday already, I think it would be prudent to wait for the weekend and, if we then see the S&P over 1,350 and the Russell over 833 and XLF over $15 then it's going to be easy to construct plays similar to BAC that should keep us nicely ahead of inflation in this seemingly bullet-proof market.

We went over the usual TERRIBLE news in Member Chat this morning and I won't go over it here for fear of ruining the "soar and ignore" atmosphere that our Central Banksters have been working so hard to create this year. Last year, the Dollar was at 78 – lower than it is this morning and it plunged all the way down to 72.70 (6.66%) in May – a move that saved the market from falling below 1,250 as the dollar devalued faster than stocks.

Everything old is new again in 2012, with the Dollar down 4% in the last 4 weeks and the S&P up 6% so let's keep an eye on that critical 78.50 line on the Dollar, as a failure there can pave the way for another round of asset value destruction for the American people in order to prop up market prices. That would mean $1.33 and higher on the Euro and $1.59 or better on the rapidly expanding Pound. Without those benchmarks – stocks would have to advance based on economic outlook and expanding earnings and, as a poker player – I can tell you that those are not cards they are currently holding.

So let's be careful out there – still.