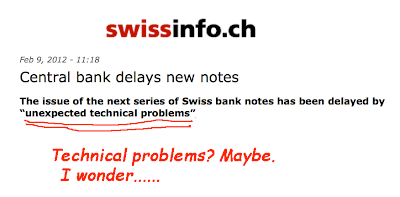

There is a curious story in the Swiss press today. On the surface it appears innocuous.

Paper money has been in transition for the last ten years. Most of the big issuers of paper have updated their bills to minimize forgery. The US has spent a bundle on this effort, and it too has had problems and delays with issuing the new, more complicated money. So my first thought about the Swiss delay was that this is more of the same. Technical printing problems are to blame.

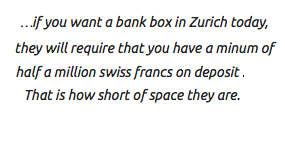

My second thought is that this is not a benign delay; something more than meets the eye is happening. There have been press reports in Switzerland that commercial banks are no longer able to meet client demand for safe deposit boxes. All of the boxes are apparently taken. As a result, people are renting safe deposit boxes in hotels. (Link)

A distinguished lady had hidden 65,000 euros in the heels of her shoes and her bra.

A Labrador is trained to sniff out banknotes in Chiasso.

A motorist was caught in early February with more than 200,000 euros hidden at the bottom of his suitcase.

In a survey of "the great capital flight", the daily La Repubblica suggests a rise of 50% of receivers of property along the border with Switzerland in late 2011 over the summer.

Interesting. What in hell is going on here? Why are safe boxes so much in demand? What is in these boxes? Is it gold? Probably. Cut and uncut diamonds? Probably. I don’t think that all these boxes are being filled with deeds, wills and other important papers. The vault boxes are being used as a store of wealth.

So I ask, “Is there paper money in these boxes?” The answer is,“Of course there is”. Bigger questions are, “How much paper money is going to boxes? And who’s putting it in there?”

Sadly, I don’t have an answer – only an opinion and some thoughts. I think that these boxes are filled with:

A) Hot money from Swiss banks with customers whose names and accounts that are in the process of being revealed to host country taxing authorities and,

B) New money from Italian, French and German citizens who fear that their Euros will lose value.

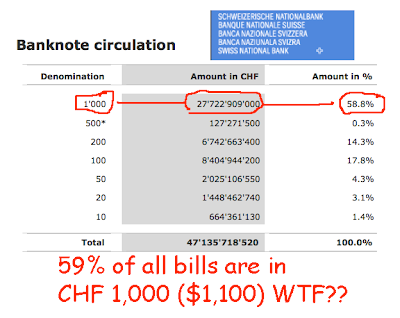

The Swiss National Bank would have to be fully aware of this. It would be seeing a huge demand for Swiss paper money. It is responsible for printing the bills, so it knows exactly what is happening. In fact, the SNB has been facilitating this for years. The following information on banknotes in circulation is from the SNB in 2010.

I would love to know what these numbers are in February of 2012. I'm assuming the paper money outstanding today is much larger than what existed at the end of 2010.

Note that 59% of all bills outstanding are of the 1,000 CHF denomination. This is crazy. It's the same as having $1,000 bills in the USA. Can you imagine going into a Starbucks to buy a paper and a coffee and tendering a $1,000 bill? It wouldn’t work in the US. The SNB provides the obvious explanation for the huge float in large denominations.

The high proportion of large denominations indicates that banknotes are used not only as a means of payment but also – to a considerable degree – as a store of value.

Right, the big bills are for stashing wealth away.

Thomas Jordan, the new interim head of the SNB, spoke yesterday about the intervention policy of the SNB. He was as clear as you can get. The SNB isn’t going to let the EURCHF peg fall below 1.2. Period:

We remain firmly committed to defending the minimum exchange rate of CHF 1.20 per euro.

This commitment applies at any time, from the moment the market opens in Sydney on Monday to when it closes in New York on Friday.

We will not tolerate any trading below the minimum rate in the relevant interbank market.

To enforce this policy, we are prepared to buy foreign currency in unlimited quantities if necessary.

Mr. Jordan is also responsible for issuing bank notes. Given that he is prepared to sell CHF to all comers in any market, at anytime of the day, he must also be willing to print more paper money to meet the demand.

I think this is exactly what is going on. When the 2011 information about Swiss banknotes in circulation is released, I anticipate a very big run up in bills outstanding, and most of those new bills will be of the CHF 1,000 variety. This is the same money that is now filling up those hotel vaults in Switzerland. The CHF banknotes are also leaving the country and ending up in mattresses all over the world.

What a ridiculous situation this is. Ten of billions of Francs are gathering dust. This money has no incentive to emerge, as interest rates in Switzerland are already negative. One is better off leaving the money in a box than in a bank.

The Swiss story is on the top of the list of arguments against currency intervention and monetary policies that drive interest rates to negative levels. The fact that Swiss hotel safe boxes are filling up with CHF 1,000 bills is proof of a failed policy.

I will report on the outstanding banknotes in Switzerland when the SNB makes the information available. A few closing thoughts:

1) The US Department of Justice (DOJ) must be tearing its hair out over this development. For years the DOJ has been trying to get the loot that Americans have hidden in Swiss banks. But now, thanks to the SNB, that hot money can find another “safe” home – a vault at a hotel.

2) I think there is a connection between the delay of the new Swiss banknotes and the current demand for large denomination bills. The SNB does not want any interruptions as the new notes are issued. It needs all the big bills it can get from the printers.

3) Forthcoming restrictions on the availability of CHF 1,000 notes wouldn't surprise me. Any Swiss citizen will be able to get as much as they want, but people coming over the border from Italy will be faced with restrictions. This, of course, would just add to the demand (fear factor). The most likely outcome would be a black market on the big bills.

This is the weirdest “bubble” I have seen. A mad dash for paper money. Like most bubbles, it is a result of manipulative monetary policy and an exchange rate regime that does not reflect supply and demand. Like all bubbles, it will eventually pop. And like all popped bubbles, that will cause a great deal of pain for all involved.