Treasury Market Panic Reversal Due To Little Known Forces Called Supply and Demand

Courtesy of Lee Adler of the Wall Street Examiner

The Treasury market panic saw a bit of a reversal this week, partly due to an unexpected, large increase in supply because of a sharp drop in Federal tax revenues over the past couple of weeks, and partly due to the market misunderstanding of Thursday morning’s news. The “better than expected” weekly unemployment claims data was one thing. Some piling on the “risk on” trade as a result of news of a deal for another Greek bailout, was another. But we are more interested in the more esoteric and little known drivers of prices, such as “supply” and “demand.”

The short term knee-jerk reactions of hedge fund traders to news “don’t impress me much.” For one thing, today’s news has a shelf life of about 20 seconds. Likewise, traders are prone to misinterpreting “news” depending on their currently predominant position.

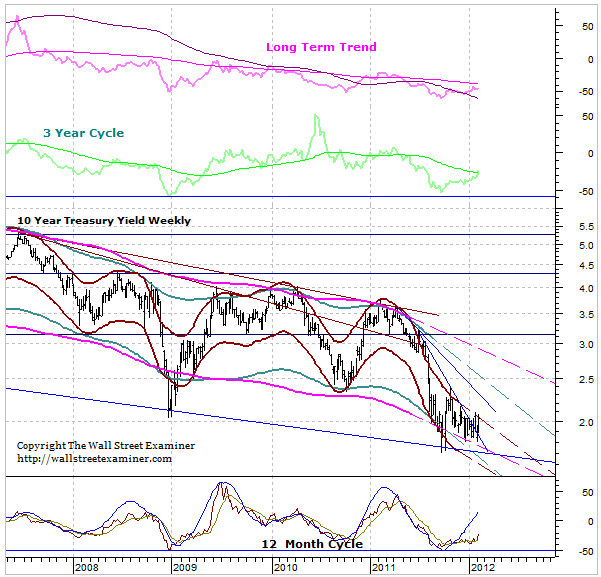

Since the boat is loaded long Treasuries, any “good” economic news triggers a one day selloff. When those selloffs come within the bounds of a trading range, they’re nothing more than noise. To confirm a reversal in Treasuries we need a bona fide breakout. First, the 10 year yield needs to break 2.10, and then it needs to break 2.40. If that were to happen, it would signal a long term reversal. There are some signs that we’re headed there, but we’re not there yet. The jury is still considering the case.

In recent weeks the Treasury buying panic was helped by reduced supply triggered by a massive bulge in withholding taxes from late December to late January. That bulge has now subsided, and the Treasury suddenly appears to be running short of cash. It made a surprise announcement today that it would need to raise a quick $20 billion in a 64 day CMB to be auctioned next week. What had been the beneficial impact of reduced supply could reverse into greater than expected supply in the weeks ahead if tax revenues fall short of the government’s optimistic estimates. The daily withholding data shows those revenues dropping but then pausing over the last few days, so it’s not completely clear yet where that trend is headed. The data for the coming week should give us a better handle.

We’ll also keep an eye on the dollar. The dollar’s strength last year was primarily due to capital flight out of Europe. If the fears that drove those flows should ease, the dollar will weaken along with reduced demand for Treasuries. There have been hints of that in conjunction with the ECB’s giant Long Term Refi Operation (LTRO) on December 21. The next one is scheduled for February 29. I’ll also continue to review the flows associated with that in the Fed Report update this weekend.