Courtesy of John Rubino.

It looks like Greece will get its debt restructuring, which presumably delays its collapse by a few months. So now the spotlight shifts to the other functionally bankrupt eurozone countries which have no choice but to demand the same deal.

Portugal, by general consensus, is next in line. It hasn’t blatantly lied about its problems the way Greece has. And it hasn’t accumulated quite as much debt as Greece, though at 105% of GDP its government is still deep in the danger zone.

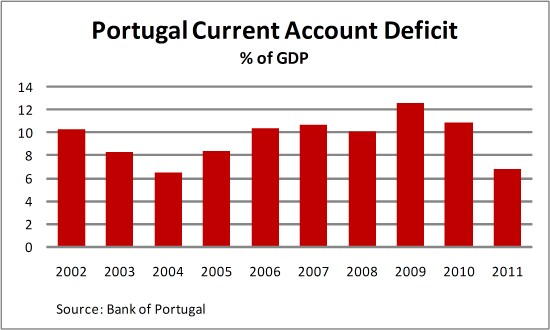

But for the past decade it has run truly massive trade deficits. In order to pay down its debt it will need to generate trade surpluses going forward, but without the ability to devalue its currency to make exports cheaper, that’s not likely.

So as with Greece, austerity leads to depression:

Bailed-out Portugal’s recession seen worsening

(AP) LISBON, Portugal — Portugal’s recession will deepen this year under the weight of austerity measures meant to reduce public debt, the bailed-out country’s central bank predicted Tuesday.Portugal is trying to free itself from a huge debt burden that forced it to ask for a euro78 billion ($100 billion) financial rescue package last year to avoid bankruptcy.

But the Portuguese economy, one of the frailest among the 17 countries that use the euro as its currency, is buckling under the austerity cuts and fueling investor fears about the bloc’s chances of recovery from its two-year-old sovereign debt crisis.

The central bank said in a report it expects the economy to contract 3.1 percent this year. Last October, it forecast a 2.2 percent contraction in 2012.

As in bailed-out Greece, the government faces a dilemma as it tries to cut spending while at the same time fostering the growth it needs to settle its debts.

The jobless rate has climbed to a record 13.2 percent, and trade unions have staged strikes and protests against tax hikes and pay and welfare cuts.

Finance Minister Vitor Gaspar told lawmakers Tuesday he planned no new austerity measures this year. He said any funding shortfall would be made up through the sale of state property and gambling concessions.

Portugal went into a double-dip recession last year, contracting 1.6 percent, the central bank said. The economy will be “virtually stagnant” in 2013, it said.

The debt crisis has caused Portuguese living standards to drop, with the central bank estimating that disposable income would decline 11 percent between 2011 and 2013 — the duration of the bailout agreement.

Depression, in turn, leads to chaos:

Lisbon Protests: More Than 100,000 Rally Against Austerity In Portugal

LISBON, Feb 11 (Reuters) – More than 100,000 people packed Lisbon’s vast Palace Square on Saturday in the largest rally against austerity and economic hardships since the country resorted to an EU/IMF bailout last May, and organizers vowed to step up protests and labour action.The mass rally occurred just four days before Portugal’s international lenders were due to start the quarterly evaluation of the bailout implementation on Wednesday in the finance ministry building which overlooks the square by the river Tagus. They come amid concerns Portugal may need more bailout funds, if not a debt restructuring like Greece.

“We take this opportunity here to make our own evaluation on behalf of those who suffer daily,” Armenio Carlos, head of the country’s largest union, CGTP, told supporters as the crowd chanted: “IMF doesn’t call the shots here!”

“We have to step up the struggle,” he said. Carlos promised the next wave of rallies across Portugal as soon as on Feb. 29.

“The country needs to remove the rope from around its neck,” he said, saying that Portugal should try to renegotiate its debt rather than impose more austerity, an argument he has made consistently.

The peaceful rally under the banners of the 750,000-strong CGTP, which last month refused to sign a pact with the government on labour market reform, showed that social strife is running strong and likely to grow even though other unions agreed to the reforms demanded by the bailout terms.

The dynamic of austerity leading to depression leading to regime change will continue until Germany just gives up and bails out the whole eurozone periphery.

Visit John's Dollar Collapse blog here >