You can't fight the Fed.

You can't fight the Fed.

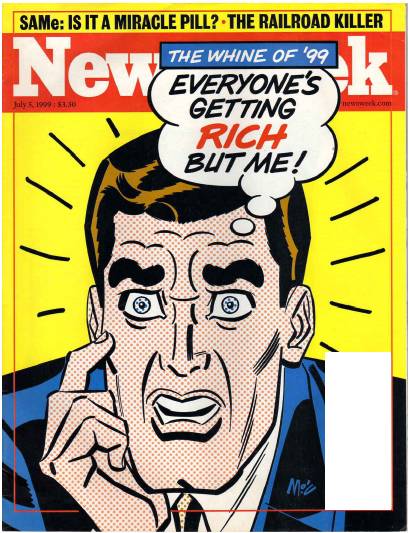

Whether this market is like 1929 or 1999 either way the bulls had a good run until it burst into flames – much as the people on the Hindenberg had a lovely trip across the Atlantic with a bit of a rough landing in New Jersey.

So let's not spoil the party by worrying about the Future (or even the present for that matter) – let's just look at all the lovely things we can buy and make 500% this year if the S&P breaks 1,360 and heads higher on a sea of freshly printed Dollars, Yen, Euros, Francs, Pounds and, possibly even Drachmas (but ixnay on the Uanyay – no one wants to talk about that!).

Gold has got to be a good inflationary bet and ABX has lots of it. Currently trading at $47.61, you can sell the Jan $40 puts for $3.05 and that obligates you to buy the stock at $40 and you can leverage that $3.05 by buying the Jan $43/52.50 bull call spread for $4.40 for a net cash outlay of $1.35 on the $9.50 spread. That's a potential for 603% upside at $52.50 but, even if they flatline at $47.50, it's still a $4.50 win on the spread and the short puts would expire worthless for a $3.15 profit and that means you are starting out 233% ahead and all ABX has to do is not blow it.

Gold has got to be a good inflationary bet and ABX has lots of it. Currently trading at $47.61, you can sell the Jan $40 puts for $3.05 and that obligates you to buy the stock at $40 and you can leverage that $3.05 by buying the Jan $43/52.50 bull call spread for $4.40 for a net cash outlay of $1.35 on the $9.50 spread. That's a potential for 603% upside at $52.50 but, even if they flatline at $47.50, it's still a $4.50 win on the spread and the short puts would expire worthless for a $3.15 profit and that means you are starting out 233% ahead and all ABX has to do is not blow it.

Now, I'm going to do this one time to make it clear on margin. If you DON'T have a Portfolio Margin account, TOS says the margin on the above trade (for selling the Jan $40 puts) is $390 per contract. 3 ounces of gold are $5,190. If you run this spread with 10 contracts, you'll have $1,350 cash out of pocket and $3,900 in margin so close enough to 3 ounces of gold but these 10 contracts make $3,150 if ABX is at the same price at the end of the year and $8,150 if ABX is higher.

Of course we're assuming ABX is well-correlated to gold (and it is the World's largest gold miner so not too much of a stretch there) but clearly you are more likely to make $3,150 on this ABX spread than you are to see your $5,190, 3-ounce gold purchase gain $3,150 (60% – gold $2,768) and how can 3 ounces of gold possibly give you a $8,150 gain (157% – gold $4,446) without ABX gaining the 5% it needs to put this trade entirely in the money?

Let's not forget to place our bets on the actual S&P as this balloon inflates away. Here's a very simple idea – SPY tracks the S&P very closely with little decay at about 10% of the index so we can bet that SPY stays over $135 through January with the Jan $115/125 bull call spread at $7.25 and we can offset that by selling the $120 puts for $6.85 for net .40 on the $10 spread. SPY is at $135.19 as of yesterday's close so we're 2,400% ahead on this trade to start if we simply hold $125 through January expirations (18th) – that should keep us ahead of inflation!

Let's not forget to place our bets on the actual S&P as this balloon inflates away. Here's a very simple idea – SPY tracks the S&P very closely with little decay at about 10% of the index so we can bet that SPY stays over $135 through January with the Jan $115/125 bull call spread at $7.25 and we can offset that by selling the $120 puts for $6.85 for net .40 on the $10 spread. SPY is at $135.19 as of yesterday's close so we're 2,400% ahead on this trade to start if we simply hold $125 through January expirations (18th) – that should keep us ahead of inflation!

This is how the rich folks do it to you – YOUR tax dollars are pledged to the markets with the Fed printing money it doesn't have that becomes a debt to you down the road. I'm sure you have heard people say or you may have said yourself about the Greeks that they deserve the high taxes and low wages that are now being forced on them because they lived above their means by spending money they didn't really have. Well – what the hell do you think we're doing?

So the Rich shall bitch and moan about how "awful" it is to have to pay taxes again and then, once the cameras stop rolling, they will pick up the phone and put about $500,000 of cash and margin into a trade like this and collect $1,000,000 in 12 months ($960,000 profit, the margin only costs artificially low interest that you are also subsidizing with your tax dollars and future debt) and pay their taxes and still have over 1,000% gains on cash while you drown in 8% inflation with your flat salary and lowered benefits.

So the Rich shall bitch and moan about how "awful" it is to have to pay taxes again and then, once the cameras stop rolling, they will pick up the phone and put about $500,000 of cash and margin into a trade like this and collect $1,000,000 in 12 months ($960,000 profit, the margin only costs artificially low interest that you are also subsidizing with your tax dollars and future debt) and pay their taxes and still have over 1,000% gains on cash while you drown in 8% inflation with your flat salary and lowered benefits.

Isn't it great to be rich?!?

Do you want another? Keep in mind that I have ZERO faith in this rally and I wouldn't play any of these trades with the S&P under 1,360 and I would stop out the trades if it fails to hold it down the road – I just want to make sure that – IF "they" are determined to maintain this charade of a market, that the average person out there has the tools to make the same money as the big boys. These are very simple trades with clearly defined goals and make nice inflation hedges regardless.

How about BAC? You know we love BAC – it's our One Trade for 2012. We had a nice pullback yesterday to $7.98 and, if you sell the Jan $7.50 puts for $1.20 – your worst outcome is you end up owning BAC for $7.50. That's .48 less than it is now so not a terrible penalty and you can use that $1.20 to buy the Jan $5/7.50 bull call spread at $1.75 for net .25 on the $2.50 spread that's 100% in the money as long as BAC holds $7.50. It doesn't have to go up – just hold $7.50 and you make 900% on your cash. According to TOS, the net margin on the short puts is just $1 so you are well over 100% returns on cash and margin – just like the big boys!

How about BAC? You know we love BAC – it's our One Trade for 2012. We had a nice pullback yesterday to $7.98 and, if you sell the Jan $7.50 puts for $1.20 – your worst outcome is you end up owning BAC for $7.50. That's .48 less than it is now so not a terrible penalty and you can use that $1.20 to buy the Jan $5/7.50 bull call spread at $1.75 for net .25 on the $2.50 spread that's 100% in the money as long as BAC holds $7.50. It doesn't have to go up – just hold $7.50 and you make 900% on your cash. According to TOS, the net margin on the short puts is just $1 so you are well over 100% returns on cash and margin – just like the big boys!

In the above example, if you are willing to own 1,000 shares of BAC at $7.50 ($7,500), you can enter 10 of these spreads and your worst downside case is owning the stock for $7,500 plus the $250 cash you need to cover the spread. If BAC does hold $7.50 through Jan 18th, you will make $2,250 profit and no longer be obligated to buy the stock (but you'll probably wish you had as I expect they'll be at $10+). Even if you have an IRA and have to put the whole $7,500 aside in margin, that's still a 30% gain in 12 months for a stock that flatlines for the year – not bad…

In the above example, if you are willing to own 1,000 shares of BAC at $7.50 ($7,500), you can enter 10 of these spreads and your worst downside case is owning the stock for $7,500 plus the $250 cash you need to cover the spread. If BAC does hold $7.50 through Jan 18th, you will make $2,250 profit and no longer be obligated to buy the stock (but you'll probably wish you had as I expect they'll be at $10+). Even if you have an IRA and have to put the whole $7,500 aside in margin, that's still a 30% gain in 12 months for a stock that flatlines for the year – not bad…

OK, three this morning is good. I think as long as we keep having this rally, I may as well put up a few of these each day so everyone in America can play along instead of just the rich folks. Keep in mind we already have long plays on these stocks, and many others, so, as I said, this is late to the game but better late than never said the guy who bought Yahoo at $250 and rode it to $350 in 1999 (now $15) – the trick is knowing when to sell!

At 2pm, we get the Fed minutes but it's the same QEvermore we talked about on January 26th, after the Wednesday meeting that these minutes are from – so what more do they think the minutes will say?

Meanwhile – we are STILL dubious that Greece is really fixed so we are still bearish in our short-term, aggressive virtual portfolios and that is VERY frustrating at the moment. Long-term, our Income Portfolio, which is meant to be conservative, is doing ridiculously well as we're about 70% bullish there. In January, we had a ton of bullish bets – far too many to go over, that were reviewed in the first 10 days and then again after 20 days. Generally, our premise remains long-term bullish, as we expect inflation to kick in and float everything to infinity and beyond but, short-term – every day we don't drop 300 points at the open is a Fundamental surprise to us…

Anyway, I'm going to stop writing now because I intended this to be a bullish piece as we TRY to get on the bandwagon but, even as I write this I see negative newsflow so, rather than get back in that mode, I'm going to watch CNBC for a while and let them tell me how great everything is. If that doesn't work, there's always one sure way to cheer people up – TOGA!

(photo from The Artist Known as WilliamBanzai7)