On the "Simple" Extension of the 2% Reduction in Payroll Taxes

Courtesy of Bruce Krasting

This week our leaders in D.C. extended the payroll tax deduction for another ten months. The new law also extends Unemployment Benefits, and it allows for a continuation of the old payouts to Doctors for Medicare reimbursements. The cost of the legislation is $110b for the rest of the year. There are some minor offsets to this expense in out years. (We will never see those offsets.)

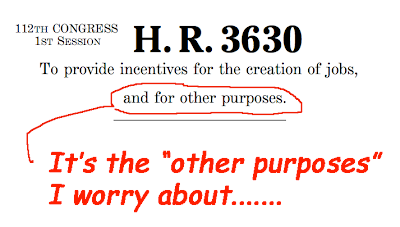

This legislation should have been easy to draft because it is was just an extension of what had been agreed to, two months ago. But that’s not the case. H.R. 3630 is 386 pages long. The Bill includes some interesting things:

*The Keystone Pipe line is a “go”:

The President, acting through the Secretary of State, shall grant a permit relating to issuance of permits with respect to certain energy-related facilities and land transportation crossings on the international boundaries of the United States for the Keystone XL pipeline project.

There is still “wiggle room” on the pipeline. Obama can nix the deal, but he has to do it over the next 60 days, and he has a tough obstacle:

The President shall not be required to grant the permit if the President determines that the Keystone XL pipeline would not serve the national interest.

Obama cannot make a strong argument that the Keystone XL pipeline is not in the national interest. And he knows it. Therefore, I conclude the pipeline will happen. The president folded on this one. Environmentalists will be unhappy.

*There is a new provision for eligibility for unemployment benefits. In the future, some states will require you to pee in a cup:

(A) Testing an applicant for unemployment compensation for the unlawful use of controlled sub- stances as a condition for receiving such compensation.

(B) Denying such compensation to such applicant on the basis of the result of such testing.

(C) The term ‘controlled substance’ has the meaning given such term in section 102 of the Controlled Substances Act (21 U.S.C. 802).

In case you were wondering, marijuana is a controlled substance under U.S.C 802. Something like this might reduce those seeking UE benefits by 30-40%……

*There is regulatory relief from the EPA on environmental standards set for boilers. The bottom line is that they can continue to burn dirty fuel. More pissed off environmentalists.

*The Bill calls for a one-year extension of the 100% “Bonus” tax depreciation allowance. The Congressional Budget Office (CBO) set the price tag for this at $28 billion. This is a gift to American companies. I think it is a payoff to GE’s Jeff Immelt for all the “hard work” he has done for Obama.

*There are new restrictions on Tribal Grants (the “party pooper” rules):

A State to which a grant is made under section 403 shall maintain policies and practices as necessary to prevent assistance being used in any transaction in:

(i) any liquor store;

(ii) any casino, gambling casino, or gaming establishment; or

(iii) any retail establishment which provides adult-oriented entertainment in which performers disrobe or perform in an unclothed state for entertainment.

*96 pages (a quarter of the total document) is committed to changes in the rules and laws relating to flood insurance. Quite frankly, I’m not sure what it all means. My take is that the areas designated as being in a flood zone are going to be significantly expanded in various regions of the country. There are new limitations on insurance payments for second homes. If you own a home near an existing designated flood area, you should take a look at this. There may be a dozen (or more) ways you might be getting screwed in these 96 pages.

There is a new requirement that any new mortgage from Fannie or Freddie, or ANY refi of an existing F/F mortgage, will require private flood insurance. This makes sense, but it will substantially restrict the availability of mortgages on the coasts and on many rivers.

*Another 144 pages are dedicated to the sale of new narrow and broadband licenses by the FCC. While it may have been necessary for Congress to act on broadband sales, the inclusion of this section in the Bill was payoff to some folks in exchange for votes. The Bill permits a total of $3b to be spent in the next few years preparing for the sale. After that, the CBO expects $3b a year from sales for the next seven years. There is a lot of money for both the government and private sector players in these sales. It’s not clear who will get “fat” from the new licenses, but it’s clear that someone will.

*Section 1327, ENTERPRISE GUARANTEE FEES, discusses fees that will be set by Fannie Mae and Freddie Mac in the future. The language is vague, the info in brackets is mine:

PHASED INCREASE REQUIRED.—The Director (of the FHFA) shall require (Fannie and Freddie) to charge a guarantee fee (for any new or refinanced mortgage) after the date of enactment of this section.

AMOUNT.—The amount of the increase required shall be determined by the Director to appropriately reflect the risk of loss, but not less than an average increase of 10 basis points for each year.

What the hell does this mean? Theoretically, the fees could be set very high. The fees would be set by the head of the FHFA (currently Edward DeMarco). The costs (and the increases over time) will take Fannie and Freddie out of the mortgage market at some point. Other lenders will step in and compete with F/F as the Agencies price themselves out of the market for new mortgages. Along the way, mortgage credit will become harder to get, and cost more. The bankers' lobbyists were, no doubt, behind this.

I think that Senator Richard Shelby also had a hand in this section. This language is designed to tie Obama’s hands, should he try to force F/F to alter mortgage lending terms/pricing, in an effort to provide a backdoor stimulus to housing.

The new legislation does not apply to FHA. I read this to mean that Obama will try to use FHA as his tool to stimulate housing.

The subtleties here are important. Republicans don’t want F/F to be a dog of economic policy. The Democrats do. This is another reason why the election has a lot riding on it.

*The Bill provides a 100% tax on unemployment benefits for an individual making $750,000 or a couple making $1,500,000.

I found this interesting. What has been created is a means tax (based on income). I doubt that there was much opposition to this given the high-income threshold. But once a means tax is employed as a tool to control spending, it will quickly extend to other forms of entitlement obligations. (See comments below regarding Medicare). A means test for millionaires that restricts them from getting UE benefits is one thing. When the same concept is applied to Social Security benefits, it will be a different kettle of fish.

*There is language restricting the availability of food stamps:

ENDING SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM BENEFITS FOR MILLIONAIRES.—

DISQUALIFICATION FOR RECEIPT OF ASSETS OF AT LEAST $1,000,000.—

This is an asset test. It establishes that an individual who owns a home and or has a bank account in excess of $1,000,000 can’t get food stamps. I am not aware of an asset test being used before. This is of little significance as I doubt that there are too many folks who live in Mac-mansions that are also getting food stamps. But it sets an interesting precedent. We have both an income and asset means test on the books. Can a Federal tax on all assets be very far behind?

*Premiums on Medicare Part B and D will increase based on income. The higher charge kicks in when income exceeds $80,000. At $200,000 and above, the Medicare beneficiary will now pay the highest rates for that insurance.

This is a tweaking of an existing means test. Higher income seniors will pay more. This is more evidence that means testing for Social Security is in our future. If high-income seniors pay more for medical insurance, it stands to reason that the same rules will soon apply to SS.

*Federal workers will pay a greater percent of their retirement benefits. These benefits are heavily subsidized today. (Federal workers pay only 1/7th of the amount contributed currently). However, of the total $3b of increased contributions over the next decade, only $300mm is paid before 2016. In other words, the increased contributions have no consequence today, so this is a gift to all current federal workers.

It's clear to me that H.R. 3630 was really the outcome of a bunch of horse-trading between Reds and Blues. My read is that the Republicans got what they wanted on a number of key issues. The White House got what it wanted. Obama wants to say that he put $40 a week in everyone's pocket. That looks good going into an election. It's going to hurt like hell when it's reversed six-weeks after the election.