Why do we scream at each other

This is what it sounds like

When doves cry – Prince

It's no coincidence that this week we will be hearing from Fed Governors Kocherllakota (1pm Tues), Hoenig (12:30 Weds), Plosser (1:30 Weds), and Bullard (9:15 Thurs) ahead of our 2-Year Note Auction (1pm Tues), 5-Year Note Auction (1pm Weds) and 7-Year Note Auction (1pm Thursday) as the Fed needs to bring out 4 of it's 5 most hawkish members to talk up the Dollar (by talking down QE3) to keep those rates paid as low as possible for Treasury.

Once the Hawks drive the rates down and the notes are sold, the Doves will once again be released to talk them back up by extolling the glories of QE3 – completely reversing whatever was said before just as the Hawks will once again be called upon to reverse what the Doves say at a later date – when they need rates to come back down. The joke of it all is that traders will react to each statement, every time, as if it's a "game changer" and adjust their positions to reflect the new reality of the moment. It reminds me of a quote from Orwell's 1984:

As soon as all the corrections which happened to be necessary in any particular number of The Times had been assembled and collated, that number would be reprinted, the original copy destroyed, and the corrected copy placed on the files in its stead. This process of continuous alteration was applied not only to newspapers, but to books, periodicals, pamphlets, posters, leaflets, films, sound-tracks, cartoons, photographs – to every kind of literature or documentation which might conceivably hold any political or ideological significance.

Day by day and almost minute by minute the past was brought up to date. In this way every prediction made by the Party could be shown by documentary evidence to have been correct, nor was any item of news, or any expression of opinion, which conflicted with the needs of the moment, ever allowed to remain on record. All history was a palimpsest, scraped clean and reinscribed exactly as often as was necessary. In no case would it have been possible, once the deed was done, to prove that any falsification had taken place.

After all, what is "the truth"? On the left we have a chart of industrial output ex-construction from Econoday. That would seem like a pretty definitive fact, wouldn't you think? But it's not a fact if nobody talks about it!

After all, what is "the truth"? On the left we have a chart of industrial output ex-construction from Econoday. That would seem like a pretty definitive fact, wouldn't you think? But it's not a fact if nobody talks about it!

December industrial output dropped 1.1 percent on the month and 2.0 percent on the year. Capital goods production was down 0.8 percent while intermediates slid 0.7 percent. Durable consumer goods (0.2 percent) managed a small gain but nondurables were just flat and energy contracted 2.0 percent. Regionally, much of the damage was caused by Germany where output slumped 2.7 percent, but France (down 1.3 percent) also struggled badly. Italy saw a much needed 1.4 percent gain but its second successive increase still failed to make up for a near-5 percent plunge in September. Spain advanced 0.9 percent, only its first positive reading in four months. Among the smaller member states, Greece witnessed a 2.4 percent monthly decline while Portugal was down 1.6 percent.

That seems pretty bad, doesn't it? As does this chart of EMU GDP which is in a horrific downturn and GDP for all of Europe CONTRACTED 0.3% in Q4 and those austerity measures for the PIIGS are only just starting to kick in while we are, in fact, CELEBRATING the complete subjugation of Greece and it's people to the will of the Troika and the Banksters who pull their strings. national statistics showed a mixed, and generally poor, performance by the larger member states. Germany suffered a 0.2 percent decline on the quarter while Italy was down 0.7 percent and Spain 0.3 percent yet none of this even slowed the rise of oil this month as it flew from $95.44 at the beginning of February to $105.28 this morning – up 10.3% in just over two weeks!

That seems pretty bad, doesn't it? As does this chart of EMU GDP which is in a horrific downturn and GDP for all of Europe CONTRACTED 0.3% in Q4 and those austerity measures for the PIIGS are only just starting to kick in while we are, in fact, CELEBRATING the complete subjugation of Greece and it's people to the will of the Troika and the Banksters who pull their strings. national statistics showed a mixed, and generally poor, performance by the larger member states. Germany suffered a 0.2 percent decline on the quarter while Italy was down 0.7 percent and Spain 0.3 percent yet none of this even slowed the rise of oil this month as it flew from $95.44 at the beginning of February to $105.28 this morning – up 10.3% in just over two weeks!

It wasn't the US GDP that cheered up the markets, fourth quarter flash gross domestic product slipped 0.2 percent on the quarter — the first contraction in real GDP since January through March 2009. The third quarter was revised to show a slightly stronger 0.6 percent gain and lowered workday adjusted annual growth by 0.7 percentage points to 2.0 percent. As usual with the flash report, the Federal Statistics Office provided no details behind the headline figures but it did indicate that investment made the only positive contribution to quarterly growth and that net exports were a drag.

It wasn't the US GDP that cheered up the markets, fourth quarter flash gross domestic product slipped 0.2 percent on the quarter — the first contraction in real GDP since January through March 2009. The third quarter was revised to show a slightly stronger 0.6 percent gain and lowered workday adjusted annual growth by 0.7 percentage points to 2.0 percent. As usual with the flash report, the Federal Statistics Office provided no details behind the headline figures but it did indicate that investment made the only positive contribution to quarterly growth and that net exports were a drag.

The Times of the nineteenth of December had published the official forecasts of the output of various classes of consumption goods in the fourth quarter of 1983, which was also the sixth quarter of the Ninth Three-Year Plan. Today's issue contained a statement of the actual output, from which it appeared that the forecasts were in every instance grossly wrong. Winston's job was to rectify the original figures by making them agree with the later ones.

As for the third message, it referred to a very simple error which could be set right in a couple of minutes. As short a time ago as February, the Ministry of Plenty had issued a promise (a "categorical pledge" were the official words) that there would be no reduction of the chocolate ration during 1984. Actually, as Winston was aware, the chocolate ration was to be reduced from thirty grams to twenty at the end of the present week. All that was needed was to substitute for the original promise a warning that it would probably be necessary to reduce the ration at some time in April.

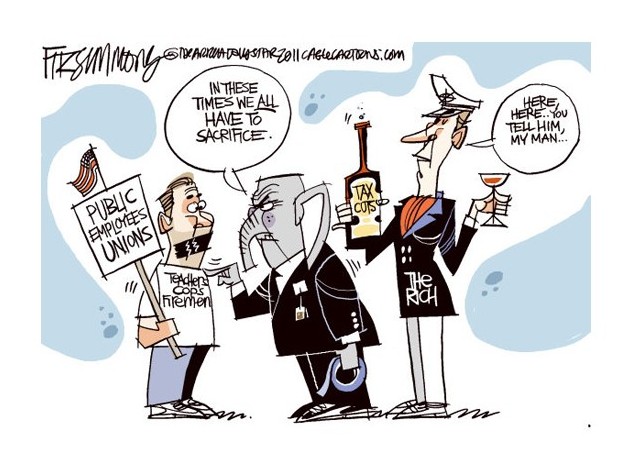

Our expectations are played with and adjusted by our own Trioka of Big Business, Government and their puppet Media and the FACT that Asia's Q4 GDP is even WORSE than the US and Europe's doesn't even rate a mention in our Mainstream Media, because it does not fit the narrative of the new bull market, of Greece being "fixed" and the joys of austerity that is being rammed down the throats of all the World's downtrodden masses – yearning for TV.

Our expectations are played with and adjusted by our own Trioka of Big Business, Government and their puppet Media and the FACT that Asia's Q4 GDP is even WORSE than the US and Europe's doesn't even rate a mention in our Mainstream Media, because it does not fit the narrative of the new bull market, of Greece being "fixed" and the joys of austerity that is being rammed down the throats of all the World's downtrodden masses – yearning for TV.

Fourth quarter gross domestic product in Asia/Pacific dropped 0.6 percent and was down 1.0 percent when compared with the same quarter a year ago. On an annualized basis, GDP contracted 2.3 percent. For the year 2011, GDP dropped 0.9 percent after expanding 4.4 percent in 2010. Yes, there was Fukushima but wasn't that supposed to come back at some point? At the moment, the Asian economy looks like it's been sealed in concrete as well.

"Who controls the past," ran the Party slogan, "controls the future: who controls the present controls the past." And yet the past, though of its nature alterable, never had been altered. Whatever was true now was true from everlasting to everlasting. It was quite simple. All that was needed was an unending series of victories over your own memory. "Reality control," they called it: in Newspeak, "doublethink."

Well, that's enough bearishness from me! How about that Economy, huh – gooooooooooooooo OIL!!!! I see the Dollar plunging to 78.95 this morning, down from 79.60 on Friday (1%) and the Futures are up almost 1% and oil is up another 2%, almost at $106 and gold is $1,735 so all must be well in the World – bless Big Brother…

"Don't you see that the whole aim of Newspeak is to narrow the range of thought? In the end we shall make thoughtcrime literally impossible, because there will be no words in which to express it. Every concept that can ever be needed will be expressed by exactly one word, with its meaning rigidly defined and all its subsidiary meanings rubbed out and forgotten."

Actually, we were shorting the pumped-up Futures in Member Chat this morning (just don't mention it to HomeSec!) as Friday's action was a page straight out of Market Manipulation 101 and I share David Fry's frustration as we were both feeling very good about our bearish bets until just after 11 on Friday when yet another low-volume rally took us back to the low-volume targets set in the Futures.

Actually, we were shorting the pumped-up Futures in Member Chat this morning (just don't mention it to HomeSec!) as Friday's action was a page straight out of Market Manipulation 101 and I share David Fry's frustration as we were both feeling very good about our bearish bets until just after 11 on Friday when yet another low-volume rally took us back to the low-volume targets set in the Futures.

Despite our EXTREME skepticism regarding this rally, TECHNICALLY it IS a rally and we continue with our February strategy of adding one more bullish position for each day the Dow holds 12,750 (now 13,000) that we initiated back on the 2nd, where our initial plays were the very aggressive FAS spreads – one of which expired Friday (Feb $77/80 bull call spread at $2, selling $75 puts for $1.50 for net .50) up 500% and the other (March $75/80 bull call spread at $3.05, selling $70 puts for $3 for net .05) is well on-track for the full 9,900% potential gain on cash with FAS currently at $91.86.

Both of those trades make 50% if you did the bull call spread without the offset and that's not so bad if you don't have margin – that's the kind of trades we like to get into when we're forced to take positions we don't really believe in. Another trick I mentioned that day was offsetting the same plays with stocks that you REALLY want to own if the market does do what you think and drops 20%, instead of rising 5% as it has SO FAR this month. Our offsetting short puts were:

- CHK Jan $17.50 puts sold for $2.05, now $1.20 – up 41%

- GE 2014 $17.50 puts sold for $2.50, now $1.44 – up 42%

- GOOG June $450 puts sold for $4, now $2.85 – up 28%

- ISRG Jan $310 puts sold for $10, now $8.80 – up 12%

- KO Jan $62.50 puts sold for $3, now $2.60 – up 13%

- MO 2014 $23 puts sold for $2.15, now $1.85 – up 14%

- PFE 2014 $20 puts sold for $2.65, now $2.75 – down 2%

- XOM Jan $65 puts sold for $2.50, now $2.30 – up 8%

XOM is still a great offset to bearish energy bets. The stock is at $85 and those $65 puts are almost 20% out of the money – so nearly margin-free in a PM account to use those offsets against aggressive bearish plays, like our SCO longs. Nonetheless, we were not done being bullish in February 2nd's morning post as we needed lots of bullish trade ideas for our one a day plan, our other three ideas were:

XOM is still a great offset to bearish energy bets. The stock is at $85 and those $65 puts are almost 20% out of the money – so nearly margin-free in a PM account to use those offsets against aggressive bearish plays, like our SCO longs. Nonetheless, we were not done being bullish in February 2nd's morning post as we needed lots of bullish trade ideas for our one a day plan, our other three ideas were:

- CHK 2014 $15/20 bull call spread at $2.65, selling $15 puts for $2.35 for net .30, now $1.35 – up 450%

- AA July $8/10 bull call spread at $1.40, selling 2014 $10 puts for $2.10 for net .70 credit, still .70 credit – even

- AMZN Jan $170/180 bull call spread at $5.20, selling Jan $110 puts for $4.15 for net $1.05, still $1.05 – even

So we have two that are still playable and one that is up 450% already – there's always a fresh horse to move to, right? On Friday, the 3rd, I ran short on time in the morning and was only able to put up the first 3 bullish trade ideas in the main post, adding the rest in our morning Alert to Members. Those were:

- BA 2014 $60/80 bull call spread at $11, selling 2014 $65 puts for $8 for net $3, now $3.35 – up 11%

- F 2014 $8/12 bull call spread at $2.40, selling $10 puts for $1.50 for net .90, now $1.40 – up 55%

- GS 2014 $80/110 bull call spread at $20, selling $90 puts for $12.50 for net $7.50, now $6.75 – down 10%

- SVU at $7.10, selling 2014 $7 puts and calls for $3.70 for net $3.40/5.20 (2nd number being your average on 2x if put to you below $7), now net $3.26 – on track (within 20%)

- HPQ 2014 $20/30 bull call spread at $5.60, selling $23 puts for $3 for net $2.60, now $3.26 – up 25%

- SKX July $11/13 bull call spread at $1.20, selling $11 puts for .90 for net .30, now .40 – up 33%

- 2 BTU 2014 $30 puts sold for $5.40 ($10.80), buying 1 Jan $40/50 bull call spread at $3.20 for net credit of $7.60, now $8.60 to buy back – down 13%

Still a few that are good to buy. Even SKX, although up 33% is "only" up .10 out of a possible $1.70 so plenty of room to run is SKX holds $13 through July expirations (now $13.04). This is how we get bullish in our long-term betting – step by step with long-term plays where we can deploy serious capital while we offset the short-term risk with more bearish shorter-term plays with MUCH LESS capital. Fighting the Fed is not our job – just a hobby…

Still a few that are good to buy. Even SKX, although up 33% is "only" up .10 out of a possible $1.70 so plenty of room to run is SKX holds $13 through July expirations (now $13.04). This is how we get bullish in our long-term betting – step by step with long-term plays where we can deploy serious capital while we offset the short-term risk with more bearish shorter-term plays with MUCH LESS capital. Fighting the Fed is not our job – just a hobby…

On Tuesday, the 7th, the Dollar was also back down at the 79 line and, in that morning's post, I discussed our trade idea for CSTR from the previous Member Chat, which was the Jan $45/60 bull call spread at $6, selling the Jan $42.50 puts for the same. That net $0 trade did very well as CSTR rocketed on earnings with the bull spread now netting $8 and the short $42.50 puts down to $4 for net $4 of profit (so far). What's the theme of these plays? We identify companies with strong fundamentals that we DO want to own, even if the market turns down and we construct trade ideas to give us entries at or below the current prices.

Could we have done better by being more aggressively bullish? Of course we could – but we sleep a lot better this way and the returns are just fine as they are. On Wednesday, the 8th, I was unable to find anymore bullish plays I liked but I reviewed the ones above in the morning post saying:

So let's not fear the rally. Of course we balance out our winners with a few bear hedges (see yesterday's Member Chat for TZA spread) to lock in some of our quick gains. Also, there's nothing wrong with taking some cash back off the table here as this "rally" is just ridiculous and, if the tide comes in this week or next, we'll be thrilled to get back to cash but, if we're going to head up forever – we can do this week after week so we're not going to miss much by sitting out a few!

The next day (Thursday), the BOE performed more QE of their own on a massive scale so we went back to the well on DMND, which had just fallen back to $20.50 (now $24.50 again, up 20%) and I re-cast our One Trade for 2012 on BAC and we also jumped on IRBT in our morning Alert to Members as that stock got slammed down to $25 and we were able to sell the Sept $25 puts for $3 for a net $22 entry and although IRBT is back to $26, those puts are now $3.30 so down 10% and I still like them for a net $21.70 entry.

We don't like to be bullish into the weekends – although Black Monday never does come – and that Monday I found nothing to be bullish about but last Tuesday (14th), on Valentine's day, we liked EXC and got back on our bullish horse (partying like it's 1929) on Wednesday morning with the following:

- ABX Jan $43/52.50 bull call spread at $4.40, selling $40 puts for $3.05 for net $1.35, Still $1.35 – even

- SPY Jan $115/125 bull call spread at $7.25, selling $120 puts for $6.85 for net .40, now $1 up 150%

- BAC Jan $5/7.50 bull call spread at $1.75, selling $7.50 puts for $1.20 for net .55, now .53, down 4%

In the morning Alert to Members, we added 3 very aggressive FAS trade ideas as we were already set to cash in our first 500% effort from way back on the 2nd. Those worked out great as we caught the week's lows, around $86.50 and, as with the first set, we added bullish offsets on a few stocks we REALLY wanted to buy if they got cheaper:

In the morning Alert to Members, we added 3 very aggressive FAS trade ideas as we were already set to cash in our first 500% effort from way back on the 2nd. Those worked out great as we caught the week's lows, around $86.50 and, as with the first set, we added bullish offsets on a few stocks we REALLY wanted to buy if they got cheaper:

- FAS March $70/75 bull call spread at $4.20, selling March $75 puts for $2.60 for net $1.60, now $3.20 – up 100%

- FAS March $80/85 bull call spread at $3.30, selling $71 puts for $4.10 for net $1, now $2.85 up 185

- FAS April $85/95 bull call spread at $5.10, selling $71 puts for $4.10 for net $1, now 4.85 – up 385%

- GS Jan $80 puts sold for $5.10, now $4.70 – up 8%

- GS Apr $100 puts sold for $2.35, now $1.65 – up 30%

- EDC March $125 calls sold for $3.20, now $3.70 – down 16%

- XOM Jan $70 puts sold for $3.30, now $3 – up 10%

- DMND March $22.50 puts sold for $2.30, now $1.45 – up 37%

That was bullish enough to last us another 10 days so, in Thursday morning's post, we looked at two short trade ideas we had picked up after the Fed Minutes on Wednesday (see Stock World Weekly) gave us no clear indication of QE3 and our new disaster hedges were:

- SQQQ March $12/14 bull call spread at $1, selling TZA March $18 puts for $1.03 for a .03 credit, now .35 credit – down 1,100%

- TZA March $19/23 bull call spread at $1.05, selling TZA March $18 puts for $1.03 for .02, now .52 credit – down 2,500%

Boy, when these spreads go bad, they REALLY go bad. Of course, as long as we only sell short puts on positions we REALLY want to own as a long-term hedge, no big deal and TZA is actually at $18.34 so it's all premium with the Russess testing our 835 line and still well below it's breakout at 851 – at which point we probably would no longer REALLY want to be ultra-short on that index!

There was just no way I was able to come up with another bullish play last Friday, into the long weekend and we pressed our oil puts in Member chat and then could only sit back in horror as oil was jammed up from $103 to $105.50 in after-hours trading. Today, all we can do is watch and wait on our option positions as the US markets are closed but Europe is up about a point as we wait for the announcement that Greece is fixed…. again.

I promise to be nice and bullish tomorrow if our levels hold – but I can't promise I'll like it!

The voice from the telescreen was still pouring forth its tale of prisoners and booty and slaughter, but the shouting outside had died down a little. The waiters were turning back to their work. One of them approached with the gin bottle. Winston, sitting in a blissful dream, paid no attention as his glass was filled up. He was not running or cheering any longer. He was back in the Ministry of Love, with everything forgiven, his soul white as snow. He was in the public dock, confessing everything, implicating everybody. He was walking down the white-tiled corridor, with the feeling of walking in sunlight, and an armed guard at his back. The longhoped-for bullet was entering his brain.

He gazed up at the enormous face. Forty years it had taken him to learn what kind of smile was hidden beneath the dark moustache. O cruel, needless misunderstanding! O stubborn, self-willed exile from the loving breast! Two gin-scented tears trickled down the sides of his nose. But it was all right, everything was all right, the struggle was finished. He had won the victory over himself. He loved Big Brother. – 1984 by George Orwell