Courtesy of Bruce Krasting.

I got a laugh out of this headline:

Delta Airlines and the Pilots Association are suing the Exim bank for financing Air India. I think they have a great case. I hope they win.

Exim gives cheap money to India so it can buy Boeing planes. This story “sounds” good as exports mean jobs and business is booming at Boeing. You can count on Obama showing up in Seattle sometime, and crowing about all the jobs he has created thanks to the cheap money deals.

I wonder what he will be saying to the folks who work for the airlines. They don’t get cheap money, so they can’t buy the new aircraft they need to compete with the likes of Air India on the profitable transatlantic routes. (The basis for the suit.)

The only winners in this story will be the lawyers. The losers will be “us”. We will pay for it in the form of higher airfares, more debt and deficits.

Is this an example of an unintended consequences, or just stupidity?

.

A Greek, a Portuguese and a Spaniard are talking to god:

The Spaniard and the Portuguese ask, “When will our countries be free of debt?”

God answers, “In 100 years for Portugal and 150 years for Spain.”

The Iberians respond in dismay, “But, our children's children will be dead by then.”

When the Greek asks God the same question for his country, God answers, “I don't know — I'll be dead by then.”

.

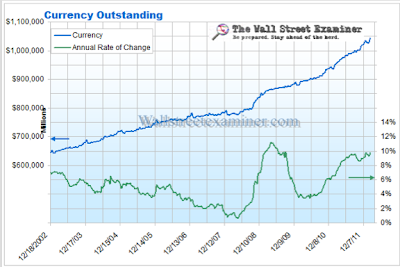

Lee Adler at Wall Street Examiner has some interesting data on the amount of printed money outstanding:

Two things caught my eye. The recent percentage rate of increase has not been seen since the crisis days of 2008. The second thing is just the sheer amount of paper money “out there”.

I have only questions regarding the rate of increase. Are these 100-dollar bills ending up in the USA? Or are they going out of the country? Are they being used to transact business? Or are they being used as a store of wealth? I believe it is all of the above.

The $1.05 Trillion of outstanding currency comes to 7% of GDP. That is up from 5% in 2007. The increase of $300 Billion represents a 40% increase while the economy was basically flat. If this was all in 100-dollar bills it would stack up 700 miles high. Didn't Bernanke say the Fed wasn’t printing money?

He's increased that pile by 250 miles. He's printed enough to carpet all of D.C.

Gold has had a nice goose of late. There are many reasons for it to repricing higher. Deep in the corner of the demand is all this paper sloshing around. Sooner or later, it will seek to hide somewhere safer than in paper under a mattress. I suspect some of it did today.

.