We're still waiting for a clear signal.

We're still waiting for a clear signal.

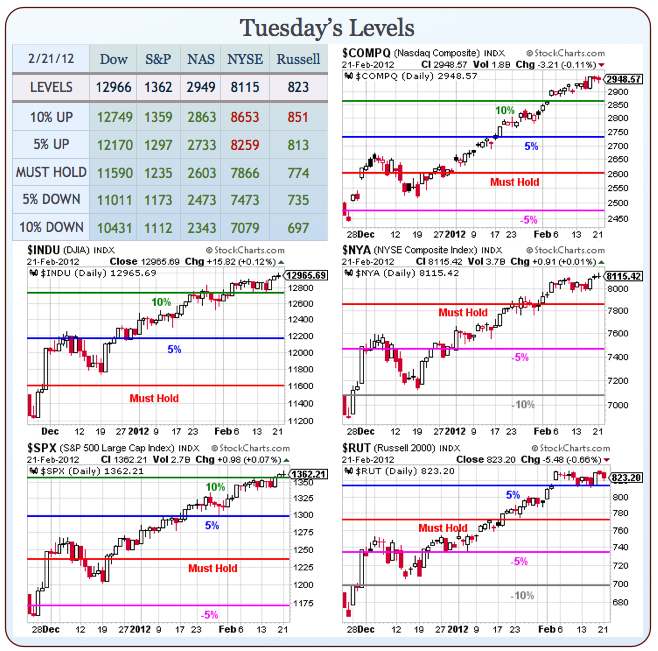

The S&P is finally over our 1,359 level but, so far, has not stayed over that line for a full session and we need two sessions over the line to confirm it. However, I did promise not to be bearish if we're over 1,360 and I think I got it all out of my system in the last few posts, as well as last night and this morning's Member Chat, where I outlined my case for for the oil glut and the collapse of the EU, which will lead to the collapse of Asia and the US – but not today.

Today there is a ton of money sloshing around in the system and we are clearly in a massive technical rally, which may (or may not) end at any moment. We discussed our February trade ideas from our morning posts on Monday's morning so I won't rehash them here but I do want to take a look at ways to leverage some trades to take full advantage of this non-stop rally as we have VERY CLEAR stop lines (our 10% lines) where we'll have a clear signal to get out or cover if ANY of the major indexes fail.

As with our early February trade ideas, we can add one more bullish trade each day that we're over the line and cash out the older trades that go well in the money and, of course, accumulate some Disaster Hedges (20-30% of your unrealized profits into protective hedges is a good rule of thumb as well as the cheapest form of protection – STOPS!).

My favorite disaster hedges are playing for a correction in the Dow or the Nasdaq which, if you are a Dow Theorist, would seem very likely based on the chart on the left but, so far, nothing matters to the bulls – who have their story and they are sticking to it – regardless of those pesky facts. Sorry, that's a bit bearish (bad habit). Anyway, my favorite disaster hedges are:

My favorite disaster hedges are playing for a correction in the Dow or the Nasdaq which, if you are a Dow Theorist, would seem very likely based on the chart on the left but, so far, nothing matters to the bulls – who have their story and they are sticking to it – regardless of those pesky facts. Sorry, that's a bit bearish (bad habit). Anyway, my favorite disaster hedges are:

SQQQ April $13/17 bull call spread for .70. This trade has a 471% upside potential by itself if SQQQ (currently $13.14) gains 30% by April expiration (58 days). That's a lot but SQQQ is a 3x ultra-short to the Nasdaq so a 10% drop in the Nas, back to 2,650 would do the trick and that's where we were at the beginning of the year, just 50 days ago.

Keep in mind a good hedge risks little to make a lot so we can offset the risk of losing .70 (although it's really and insurance policy you expect/HOPE to lose) by finding something we REALLY want to own – even if the Nasdaq falls 10%. AAPL is, for example, a nice company but a bit expensive at $515. Would you like to buy it for $300? If so, how about I PAY YOU $15 to do it? That would make your net entry on AAPL $285 so do you want my $15 or not? That's the offer you get for selling the AAPL 2014 $300 puts. If AAPL falls below $300, you will own 100 shares per contract at $300. If AAPL stays above $300, the bad news is you don't get to buy the shares at 40% off but the good news is you keep the $1,500 per contract you collected up front.

Keep in mind a good hedge risks little to make a lot so we can offset the risk of losing .70 (although it's really and insurance policy you expect/HOPE to lose) by finding something we REALLY want to own – even if the Nasdaq falls 10%. AAPL is, for example, a nice company but a bit expensive at $515. Would you like to buy it for $300? If so, how about I PAY YOU $15 to do it? That would make your net entry on AAPL $285 so do you want my $15 or not? That's the offer you get for selling the AAPL 2014 $300 puts. If AAPL falls below $300, you will own 100 shares per contract at $300. If AAPL stays above $300, the bad news is you don't get to buy the shares at 40% off but the good news is you keep the $1,500 per contract you collected up front.

$1,500 buys you 20 of the SQQQ spreads and leaves you with another $100 to go to the movies while you wait. TOS says the margin for selling the AAPL 2014 $300 puts is $3,000 so it's a 50% return on margin if AAPL stays over $300 for 2 years. Should the Nasdaq fall 10% and stay below 2,650 into our April expiration, 20 SQQQ $13/17 bull call spreads should pay out $8,000, good enough for an additional 26% discount on those AAPL shares – if you are lucky enough to get them for $300 ($30,000 for 100 shares).

Is that worth putting $3,000 of margin aside for? If you have a $250,000 portfolio and don't mind making AAPL 10% of it, you are buying $8,000 worth of protection against a short-term 10% drop which, even if you are completely unhedged otherwise, shouldn't cost you more than $25,000 (10%) if you are fully invested but decently diversified. Consider the end-game, your portfolio drops to $225,000 and you get $8,000 from the hedge ($232,000) and you end up spending $30,000 on AAPL (very simple worst-case example, of course).

That means you have $202,000 and 100 shares of AAPL, which are currently $51,500 so, if you VALUE AAPL at $500 or more (regardless of the price), you should have no fear of the downside using just this simple hedge. Also keep in mind, you are only committing to AAPL to save the $1,400 insurance fee for the SQQQ spread. If you already own 100 shares of AAPL as 20% of your $250,000 portfolio, you could also just sell 1 April $510 call for $27.50 and that gives you $2,750 which pays for your $8,000 insurance hedge ($1,400) and leaves you with $1,350 of protection on your AAPL stock (back to about $500). So many paths to free insurance….

That means you have $202,000 and 100 shares of AAPL, which are currently $51,500 so, if you VALUE AAPL at $500 or more (regardless of the price), you should have no fear of the downside using just this simple hedge. Also keep in mind, you are only committing to AAPL to save the $1,400 insurance fee for the SQQQ spread. If you already own 100 shares of AAPL as 20% of your $250,000 portfolio, you could also just sell 1 April $510 call for $27.50 and that gives you $2,750 which pays for your $8,000 insurance hedge ($1,400) and leaves you with $1,350 of protection on your AAPL stock (back to about $500). So many paths to free insurance….

Moving along then, in addition to SQQQ, I think the Dow could join the Transports for a 10% drop and DXD is also cheap at $13.42 but it's only a 2x ETF so we don't want to be so ambitious with our target. The April $13 calls are just .90 and we can sell the $15 calls for .35 for net .55 on the $2 spread. Again, keep in mind that the bull call spread, by itself, has a 263% upside potential so everything else we do is just to mitigate the cost of the insurance.

To make $8,000 on this spread we need to have 40 contracts for $2,200 and for this one let's look at other bullish offsets, like FDX April $80 puts at $1.10. Selling 10 of those nets $1,100 and pays for half of the bearish spread and, of course, it's very unlikely that the Dow goes up while FDX goes down and FDX is currently $91 and looking attractive at that price – especially if the market keeps going higher. Going longer, T is always nice to own (now $30.34) and you can agree to buy it for $25 in 2014 and get paid $2.15 per contract for doing so – fully offsetting 4 DXD spreads per short T put. SKX is cheap again at $12.69 and, if you are willing to buy it in October for $12, you can get paid $1.55 per contract for the $12 puts.

And that's a good transition to our bullish trade ideas. SKX sells sneakers and people wear sneakers so, if the consumer is truly coming back (and I have promised to be bullish so I will keep my opinion to myself other than to point out we're still short XRT in our virtual $25,000 Portfolio), then sketchers should be able to work past the slump they had in Q4 that knocked them back from $14.70 (which happened to be their 200 dma) to $12.69, which happens to be their 50 dma. Rather than spend money now, we can still sell those Oct $12 puts for $1.55 and use that to buy us an Oct $10/14 bull call spread for $2.20 for net .65 on the $4 spread that's already $2.69 in the money. I love these kinds of plays because all SKX has to do is hold $12 for 8 months and that's a 207% gain on cash right there – that's going to be plenty to keep us ahead of inflation and buy us a nice pair of Sketchers!

And that's a good transition to our bullish trade ideas. SKX sells sneakers and people wear sneakers so, if the consumer is truly coming back (and I have promised to be bullish so I will keep my opinion to myself other than to point out we're still short XRT in our virtual $25,000 Portfolio), then sketchers should be able to work past the slump they had in Q4 that knocked them back from $14.70 (which happened to be their 200 dma) to $12.69, which happens to be their 50 dma. Rather than spend money now, we can still sell those Oct $12 puts for $1.55 and use that to buy us an Oct $10/14 bull call spread for $2.20 for net .65 on the $4 spread that's already $2.69 in the money. I love these kinds of plays because all SKX has to do is hold $12 for 8 months and that's a 207% gain on cash right there – that's going to be plenty to keep us ahead of inflation and buy us a nice pair of Sketchers!

How about gas? Do you use gas? We hear a lot about oil going up and up and up because Iran will do this or that and we think it's all BS and we're aggressively shorting oil in our $25KP and will keep doing so even if it goes higher as it will eventually get real (we shorted the Futures this morning, in fact at $106) – but let's say it doesn't. XOM pays a very surprising $5 for selling the 2014 $65 puts, which is a 25% discount off the current $86.57 price, not even including the $5 you pocket. If you don't like oil enough to buy XOM for a 25% discount – don't sell the puts but those can be combined with the purchase of an SU ($34.88) 2014 $25/37 bull call spread at $6 for net $1 on the $12 spread that's $14.88 in the money. So you begin this trade up 1,388% if the stocks just flat-line, that's a good starting posture.

If you really, Really, REALLY want to own XOM at net $66 – what's the risk? These plays are great for skeptics like us, who are sidelined with cash and waiting for a drop that, so far, isn't coming. So, if the drop never comes – what are the stocks we do want to own? SU was in the $60s for most of 2008, topping out at $70 and fell all the way to $15 in the crash and quickly got back to the $30s so, unless we really hit the wrong window, timing-wise, this is a good target and, frankly, if SU is back at $15 just because the market collapses, I'll be screaming BUYBUYBUY about this one – just as we did in 2009.

Another way to give war a chance in the oil patch is to pick up a long play on USO ($40.58). Yes, we are short but if they do pop $107.50, then reality has left the building and the USO June $40/46 bull call spread at $2 makes $4 (200%) on it's own if oil goes up 10% ($116.60) and holds it into June expirations while you can over-cover with SCO ($33.47) October $26 puts at $3 for a net $1 credit on the $6 spread. So, if USO goes up 10%, you collect $6 and now you "risk" having SCO assigned to you at net $19, which is 43% off the current price and SCO is a 200% ultra-short so a 21% rise in oil to $127 would cause you to own SCO at net $19. I don't know about you but I will be THRILLED to own a lot of SCO at net $19 with oil at $127 so this is a trade that can make you happy twice.

Another way to give war a chance in the oil patch is to pick up a long play on USO ($40.58). Yes, we are short but if they do pop $107.50, then reality has left the building and the USO June $40/46 bull call spread at $2 makes $4 (200%) on it's own if oil goes up 10% ($116.60) and holds it into June expirations while you can over-cover with SCO ($33.47) October $26 puts at $3 for a net $1 credit on the $6 spread. So, if USO goes up 10%, you collect $6 and now you "risk" having SCO assigned to you at net $19, which is 43% off the current price and SCO is a 200% ultra-short so a 21% rise in oil to $127 would cause you to own SCO at net $19. I don't know about you but I will be THRILLED to own a lot of SCO at net $19 with oil at $127 so this is a trade that can make you happy twice.

I suspect you are already noticing a theme here. We are selecting trades that not only have huge upside potential on relatively small moves up in the market but also have downside protection of 15-20% built in (see "How to Buy A Stock for a 15-20% Discount") . Then we take insurance that pays us in full if the market falls just 10% so there is a HUGE window of opportunity in which we can both collect our insurance and still win our bullish bets. Clearly we will outperform the broad market in a downturn and, while we somewhat limit our upside, there's no need to be greedy.

In fact, let's say you have a $250,000 portfolio fully invested and well-diversified and you make the average S&P returns of 8% for 20 years. You would end up with a very nice $1.2M providing somewhere near the end you didn't hit a year like we had in 2008. Now, let's say we play our system much more conservatively, with only $125,000 invested and the rest in cash but our hedges outperform by just 5% for a 13% annual gain. After 20 years, that's $1.4M – more money made by playing it safer over the long run!

Cash on the side gives us margin to play with and also let's us take advantage of opportunities, like AAPL falling to $300… As our Members are seeing in our rapidly growing virtual Income Portfolio – we end up owning more of the stocks we are able to buy cheaply – the system essentially forces us to both buy low and sell high – not a bad combination.

Cash on the side gives us margin to play with and also let's us take advantage of opportunities, like AAPL falling to $300… As our Members are seeing in our rapidly growing virtual Income Portfolio – we end up owning more of the stocks we are able to buy cheaply – the system essentially forces us to both buy low and sell high – not a bad combination.

AA is still inexpensive at $10.40 and you don't need to do anything fancier with them than just sell the 2014 $10 puts for $2 for a net $8 entry (23% off). This is an easy concept, if you have a possible allocation for $15,000 of AA (1,400 shares), you can sell 8 short puts for $1,600 and all you tie up is $1,300 of ordinary margin against which you collect $1,600 up front (153%). All AA has to do is hold $10 through Jan 2014 and you keep that $1,600 and your margin is released. As AA goes higher and you become confident you won't need the $8,000 allocated to buying the first 800 shares, you can find something else you might want to buy and do it again. If AA drops back to their 2009 lows of $4.84, you will be forced to buy 800 shares for $10 but you have $8,600 on the side (your $7K remaining allocation and the $1,600 you collected) and you can buy 2,000 more shares for $4.84 ($9,680) and now you own 2,800 shares for your $15,000 plus $1,080 and net into AA at $5.74.

As I often say to new Members – if you don't REALLY want to own 2,800 shares of AA at $5.75, why on Earth would you be considering buying 1,500 for $10.40 or even shorting the puts to net 800 at $8. These are trade ideas for Fundamental traders with long-term convictions – much like a home buyer, we don't care about the current price of our stocks as we value them for the long haul and have no intention of either buying or selling based on short-term price fluctuations. As I said above, our goal IS to have the occasional AA put to us in a disaster. Our successful trades go back to cash and we end up with a better-than-expected quantity of stocks that we were able to pick up at a significant discount.

X ($28.49) is another one that's too cheap for a bull market. We already know autos are coming back and a glut of nickel is a good thing for keeping X's costs down so we can engineer a cheap entry by buying the stock for $28.49 and selling the Jan $25 calls for $8.50 and the 2014 $20 puts for $2.95 for a net $17.04/18.52 entry. If you are called away in January at $25 and the longer puts expire worthless, you gain $7.96 (46%) on your net $17.04 cash entry (there is margin too). The negative case here is that X drops and you are forced to double down at $20, which puts you in a 2x position at net $18.52 but, again – that's 35% off the current price – may all your bad entries yield such bargains!

X ($28.49) is another one that's too cheap for a bull market. We already know autos are coming back and a glut of nickel is a good thing for keeping X's costs down so we can engineer a cheap entry by buying the stock for $28.49 and selling the Jan $25 calls for $8.50 and the 2014 $20 puts for $2.95 for a net $17.04/18.52 entry. If you are called away in January at $25 and the longer puts expire worthless, you gain $7.96 (46%) on your net $17.04 cash entry (there is margin too). The negative case here is that X drops and you are forced to double down at $20, which puts you in a 2x position at net $18.52 but, again – that's 35% off the current price – may all your bad entries yield such bargains!

PEG ($30.92) is a utility provider in the Northeast. I like the Northeast (remind me to mention HOV for the same reason) as we weathered the crisis fairly well and, from a utility standpoint, we have great population density and very old facilities that can handle oil, coal, nat gas or nuclear so, whatever fuel is cheapest, PEG can usually take advantage of it. Not much earnings growth but a juicy $1.37 dividend which makes it attractive to buy the stock for $30.92, sell the Sept $30 calls for $2 and the $30 puts for $1.85 for a net $27.07/28.53 entry, which makes that annual dividend almost 5% in addition to the 10% you make if your stock is called away over $30 in just 7 months.

HOV (see, I remembered – $2.97) is a long-time PSW favorite. We had a good ride from the bottom at $1 and got out at $3 but I still like them long-term, much more so than other builders. If you want to be cool like us and buy HOV for $1.10, you still can by selling the 2014 $2 puts for .90 – what can be simpler than that? You risk owning them for net $1.10 but all they have to do is not drop 33% and you make 180% on .50 of ordinary margin in 22 months. That's a good ROI by any measure so, if you like housing (and companies with massive tax write-offs) – HOV is an excellent choice.

HOV (see, I remembered – $2.97) is a long-time PSW favorite. We had a good ride from the bottom at $1 and got out at $3 but I still like them long-term, much more so than other builders. If you want to be cool like us and buy HOV for $1.10, you still can by selling the 2014 $2 puts for .90 – what can be simpler than that? You risk owning them for net $1.10 but all they have to do is not drop 33% and you make 180% on .50 of ordinary margin in 22 months. That's a good ROI by any measure so, if you like housing (and companies with massive tax write-offs) – HOV is an excellent choice.

BAC ($8.11) is our "One Trade for 2012" and has already made us a ton of cash but we still love them at $8 if the S&P is marching over 1,360 and the volatile nature of the stock has kept the option premiums warm for us so we can take advantage of other people's fear by selling the 2014 $10 puts for $3.30 and buying the 2014 $3/7 bull call spread for $2.75. That is a net credit of .55 on a trade that makes $4.55 (827%) if BAC finishes over $10 but it's an aggressive trade that nets you into BAC for $9.45 under $10 with a bonus of $4 if they are over $7 for net $5.45 – so you still make $1.55 (280%) on cash if BAC drops to $7 and break-even is around $6.25, which is a 23% cushion on your entry. Again, the key with these is that a flatline pays you 280% while anything up from here is a bonus.

A more conservative play on BAC is selling the Jan $7.50 puts for $1.15 and buying the $7.50/10 bull call spread for $1.05 for a net .10 credit ($7.40 entry) as your worst case and a $2.10 profit if BAC goes up $1.89 into Jan expirations. It should also be pointed out that just selling the 2014 $7 puts for $1.55 requires just .70 in ordinary margin so a 221% return on capital in 22 months and you break even way down at $6.30, which is 22% off in the self-hedging play.

On the Regional side, we love HCBK ($6.94) but we've been heavy into them at $5 and many of our Members took 40% and ran at $7 so be warned. Since they pay a .32 dividend, I still like them, especially since we can sell the Jan $7 puts and calls for $1.80, which drops the net to $5.14/6.07 and that makes the dividend a lovely 6.2% addition to the $1.86 you make (36%) if the stock is called away over $7 in 10 months. We like plays with built in 12% protection that pay 42% a year when they work, don't we?

Last but not least is another favorite dividend payer of ours that gets no respect. FTR just cut their dividend to .40 but, with a stock price of $4.63, that's still pretty good. They are digesting a huge purchase of VZ assets and customers so it's been a rocky road and won't get better soon so this is in the "accumulate" category but you can buy the stock and sell the Jan 2014 $5 puts and calls for $2.20 for a net entry of $2.43/3.71 so we're talking about a 20% discount if a second round of the stock is put to you at $3.71 or a 105% profit if called away at $5 in January PLUS the .10 quarterly dividend, which works out to 16.4% annually against your $2.43 cash layout.

Last but not least is another favorite dividend payer of ours that gets no respect. FTR just cut their dividend to .40 but, with a stock price of $4.63, that's still pretty good. They are digesting a huge purchase of VZ assets and customers so it's been a rocky road and won't get better soon so this is in the "accumulate" category but you can buy the stock and sell the Jan 2014 $5 puts and calls for $2.20 for a net entry of $2.43/3.71 so we're talking about a 20% discount if a second round of the stock is put to you at $3.71 or a 105% profit if called away at $5 in January PLUS the .10 quarterly dividend, which works out to 16.4% annually against your $2.43 cash layout.

Let's keep in mind that I don't like ANY of these if the S&P can't hold 1,360 but, on the other hand, I don't think we'll be crying to own them as long-term investments so, just like our first 20 February picks, let's just consider buying 1 for each day the S&P is over our new, higher target of 1,360 while we're ready to cash out our earlier plays and these if we fail but, for now – I'll take those two disaster hedges and wait and see if they can shake us out of those first!

How's that for bullish?