WTF Did All That Printed Money Go?

(2).jpg) Courtesy of Lee Adler of the Wall Street Examiner

Courtesy of Lee Adler of the Wall Street Examiner

Normally when we think of printing money, we are talking about the Fed buying Treasuries, or some other securities from the Primary Dealers. The PDs then take the cash and buy Treasuries from the government. The Fed's asset base is thereby increased, and an offsetting liability, bank reserves on the Fed's balance sheet, also increases. As long as those reserves lie dormant at the Fed and banks don't use them to increase lending, there's not much problem with consumer price inflation, which the Fed pretends is the only thing that matters.

The Fed's been getting away with this kind of printing for a long time now, but there's been some seepage of money into financial assets, driving prices of bonds to the stratosphere and triggering "beneficial" rallies in stocks, and more malevolent rallies in commodities, particularly crude oil, but "core" consumer prices have lain more or less dormant. That lets Bernanke and Co. off the hook because that's what they use to measure inflation, and that's what the mainstream media reports. There's "no inflation." That's more or less in a nutshell what has been happening the past few years.

But there's another, different, type of "printing", and this one is literal, honest-to- god printing! Dr. Bernankenstein wasn't joking when he said the Fed had a printing press in the basement (cue evil laughter). In fact all 12 Fed district banks have printing presses in the basement, and they use them every week. The kind of "printing" I'm talking about is the actual printing of currency-cash, Benjamins et. al. Each week the district Fed banks usually print a total of a billion to several billion in cash, load it in armored trucks, and ship it out to the hinterlands, places like Staten Island, Cleveland, and Afghanistan. The cash shows up as a liability-Federal Reserve Notes- on the Fed's balance sheet because cash, Federal Reserve Notes, are a promise to pay… what? In other words if somebody shows up at 33 Liberty Street, NY with a wheelbarrow full of cash and demanded that the Fed pay up, well then… never mind. Just take my word for it. It's a liability.

Also on the Liability side of the Fed's balance sheet as reported weekly in the Fed's H.4.1 statement are Treasury deposits, deposits by banks, also known as reserve deposits, reverse repos, Term Deposits of banks when the Fed offers them, and a mysterious category called Other deposits, which are vaguely identified as belonging to the GSEs, other government agencies (the CIA perhaps, hmm…?) and foreign official organizations, as well as the PPT (Plunge Protection Team)- the Exchange Stabilization Fund. But that's a whole 'nother story that we've covered before.

.png) For those unfamiliar with the basics of Accounting 101, which is, oh, say 100% of us, the idea is something like physics where for every action there's an equal but opposite reaction. The actual equation looks like this Assets = Liabilities + Capital.

For those unfamiliar with the basics of Accounting 101, which is, oh, say 100% of us, the idea is something like physics where for every action there's an equal but opposite reaction. The actual equation looks like this Assets = Liabilities + Capital.

In other words, when there's an increase or decrease in a liability, there must be an equal offsetting increase or decrease in an asset, or a different liability, or some combination of the above. Forget about Capital for the time being-it's essentially irrelevant for central bank purposes and I don't want to confuse the issue any more than I already have.

Therefore, by the laws of nature, physics, religion, Robert's Rules of Order, and double entry bookkeeping, normally bank reserves on the Fed's balance sheet fall when Treasury balances rise, and vice versa. Think about it. The Treasury spends and where does it go? Into the payee's bank account and therefore up go the banks' accounts at the Fed. Last week the Treasury deposited a net of $0.9 billion to its checking account at the Fed as proceeds from debt sales more than offset the government's normal weekly outlays. This change was minuscule and normally wouldn't have any impact on the Fed's other liabilities.

But in spite of the small inflow into the Treasury's account last week, bank reserve deposits at the Fed rose by $37 billion. If it wasn't from Treasury spending, where did all that money come from? Here's your answer, the mysterious "Other" deposits fell by $36 billion. Some "Other" paid entities with bank accounts $36 billion. That's a big number for one week, but the Fed gives absolutely no information on the inflows and outflows from these accounts. I there's there's a lot of 'splainin to do for moving around $36 billion in a week. So much for "transparency." The Fed only wants "transparency" if it will push the market up. Otherwise it's STFU.

Just the week before (ended February 8) the Treasury made an enormous withdrawal of about $71 billion to pay turn of the month bills. That's no mystery. It happens every month. About $59 billion of that showed up as reserve deposits as the government payments flowed into bank accounts and the banks instantly deposited the cash at the Fed since they don't have anything better to do with it. That too is as it should be. But wait a minute! What about the other $12 billion? The Fed certainly wasn't going to sell $12 billion in assets as the offsetting transaction to fund the rest of the Treasury withdrawal. The Fed's stated goal is to keep its balance sheet stable at least through June. So where did that $12 billion come from?

The Fed seemed to need to jump through hoops to fund that Treasury withdrawal since not not all of it made it back to the Fed's balance sheet in the form of bank reserves. Since the Fed didn't liquidate any assets to fill the gap, it needed to increase a different liability. In addition to increasing reverse repos which is a way of borrowing cash, one of the things the Fed did was to debit currency outstanding by a whopping $8 billion. Up went the basement garage doors and out went those trucks loaded with pallets of bundled Benjamins. We don't know whether the Fed initiated the currency transfer on its own or whether the Treasury or somebody else requested it. It's just another of those things that's hidden behind the Fed's wall of obscurity and obfuscation that the Fed calls "transparency." Good news= Transparent. Bad news= Black Ops News Blackout.

Much to my surprise, the Fed did the same thing last week, dispatching truckloads of cash totaling $7.2 billion. While something similar occurred last February, this 2 week printing spree was a new record. Again, we don't know who initiated the "job", but we do know that last week's "request" did not come through the NY Fed. The biggest chunk of it was issued from the basements of the Cleveland and Richmond Feds, of all places, followed by Atlanta and San Francisco. OK conspiracy theorists, Richmond is just down I-95 from DC (and CIA HQ in Langley), but Cleveland? Were the ATMs at the Rock and Roll Hall of Fame having a busy week?

Rather than a decrease in a liability being behind last week's printing, this time the asset side of the balance sheet looked like the culprit, as the Fed increased its securities holdings by a net of $18 billion while only liquidating $7.7 billion in undefined "Other" assets and around a billion of other "stuff." That left a $9.6 billion increase in assets that had to show up in liabilities. Only a little over $2 billion of it appeared as reserve deposits. The Fed had to make up the difference by loading up the trucks with pallets of cold, hard cash-$8 billion worth.

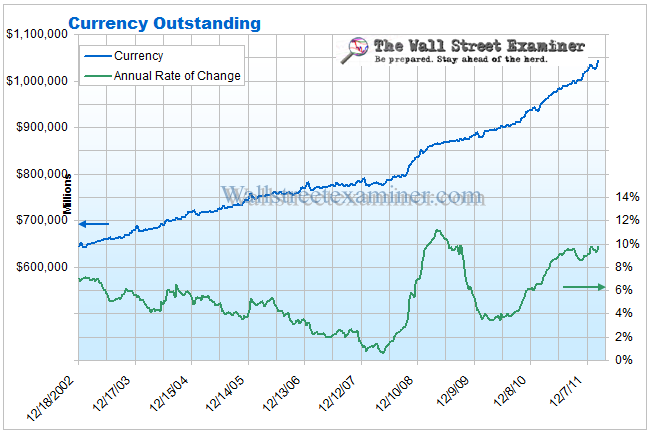

That 2 week, $15 billion increase in currency outstanding is a record. Furthermore, currency outstanding has now increased by 10% in the past 12 months. Here's a question. How and why does that happen in an economy that has only grown by 2.5%?

In fact, from 2003 until 2008, currency outstanding grew at a compound rate of 2.75%. Then from September to December of 2008, the Fed added 6% to the amount of currency outstanding. There was a similar surge from September 2010 and January 2011 and it's been pretty much pedal to the metal ever since. The last 2 weeks looks like an even greater acceleration. I don't know what to think of all this, but maybe it relates to confidence issues in some quarters. Perhaps it is related to the European financial crisis, as some players seek the "safety" of US dollars in safe deposit boxes rather than bank accounts, stocks, bonds, or gold. It certainly isn't due to a rapidly growing economy with a high demand for cash. And why Cleveland and Richmond? If that's not a WTF, what is? I'll leave the answers to your conspiratorial minds.

In spite of the curiousness of all this, the overall level of combined reserves on the Fed's balance sheet remains flat and is currently a neutral influence on market liquidity. As for the mountain of cash the Fed just put out on the street, consistent with the Fed's "transparency" policy it's a riddle, wrapped in a mystery, inside an enema.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE’s Professional Edition risk free for 30 days!