MORE FREE MONEY!

MORE FREE MONEY!

According to CNBC, the G20 is now considering a $2Tn rescue fund for EU bailouts, double the $1Tn they put in during the crisis in 2008. Of course the markets plunged in 2009 as it occurred to people that, if the banks needed $2Tn to be rescued, then we were in what leading economists refer to as "deep shit."

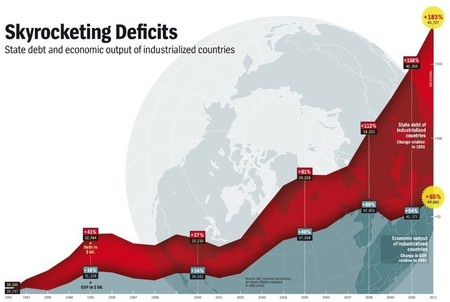

The plan is to combine the EFSF and the ESM to create a 1 Trillion Euro fund ($1.34Tn) and to augment that with the other $700Bn coming through the IMF (on top of the $350Bn already pledged). While $2,000,000,000,000 is a staggering amount of money – enough money to more than double the net worth of the bottom 40% of the planet – but, is it enough?

It's enough to kick the can down the road but Greece alone is $500Bn in debt and Ireland alone owes well over $2Tn externally (mostly to England), Italy owes $2.6Tn externally and $400Bn just to France and Spain is also at $2.6Tn of debt owed to other nations but they spread the pain around pretty evenly by comparison. That's the damages in the PIIGS before we even get to France ($5.6Tn), Germany ($5.5Tn), the UK ($9.8Tn) and, of course, the United States, which owes over $1Tn to Japan and the UK and another $2.5Tn to China within their $15Tn external debt load. How's that $2Tn looking now?

It's enough to kick the can down the road but Greece alone is $500Bn in debt and Ireland alone owes well over $2Tn externally (mostly to England), Italy owes $2.6Tn externally and $400Bn just to France and Spain is also at $2.6Tn of debt owed to other nations but they spread the pain around pretty evenly by comparison. That's the damages in the PIIGS before we even get to France ($5.6Tn), Germany ($5.5Tn), the UK ($9.8Tn) and, of course, the United States, which owes over $1Tn to Japan and the UK and another $2.5Tn to China within their $15Tn external debt load. How's that $2Tn looking now?

So let's not confuse can kicking with "fixing" as there is NOTHING about this $2Tn that fixes anything but the ability to roll over that $40Tn for another year. Unfortunately, in another 12 months, some portion of the $120Tn of unfunded liabilities that no one likes to discuss will also drop to the bottom line. The US alone will add over $2Tn of additional debt in 2012 and about $5Tn is expected of the others – but that was before they all pledged this new $2Tn that they will be lending themselves to pay themselves for the old debt while the add on new debt.

Let's keep in mind that the source of this "news" about $2Tn in aid is CNBC and, as of 8pm on Sunday, it's still not confirmed by legitimate news sources. Of course, CNBC is nothing more than the propaganda station for the top 1% and their agenda, differentiated from Fox only by the fact that Fox has shows like the Simpsons and Family Guy while CNBC has ridiculous cartoon characters like Kudlow and Cramer.

Let's keep in mind that the source of this "news" about $2Tn in aid is CNBC and, as of 8pm on Sunday, it's still not confirmed by legitimate news sources. Of course, CNBC is nothing more than the propaganda station for the top 1% and their agenda, differentiated from Fox only by the fact that Fox has shows like the Simpsons and Family Guy while CNBC has ridiculous cartoon characters like Kudlow and Cramer.

While tension over Iran has ratcheted up over the last few months, the price of oil and gasoline has leaped far beyond conventional supply and demand variables. Financial speculators are piling into the market, egged on by CNBC in particular, torquing the Iranian fear factor into ever-higher prices.

"Speculation is now part of the DNA of oil prices. You cannot separate the two anymore. There is no demarcation," said Fadel Gheit, a 30-year veteran of energy markets and an analyst at Oppenheimer & Co. in a great McClatchy research article on the subject, "I still remain convinced oil prices are inflated."

"These people (Wall Street Oil Traders) are not there to be heroes. They are there to make money. It's our fault because we are allowing them to do that," said Gheit. "Obviously these people are very strong, and the financial lobby is the strongest of any single lobby. I've been in this business 30 years, and I can tell you I think this is smoke and mirrors."

Let's keep in mind though, that just because we know a thing is being done with smoke and mirrors does not stop David Copperfield from making an Elephant disappear on stage. We know it's a trick but we sure can't stop it from happening and we sure can't find the elephant and we sure can't make it come back. Only if the audience stops the show, storms the stage, turns on the house lights and turns the theater upside down will we find the elephant and reveal the trick but – as noted by Gheit – they've been running this show for 30 years and the US Energy Cartel is strong enough that no one is going to stop this show – so we'll have to let it run it's course until the people tire of the same old tricks over and over again.

That's why USO was one of our top 10 picks in Wednesday's post. It was just $40.58 at the time, now $42 but the June $40/46 bull call spread is still $2.40 (up 20%) and the short SCO Oct $26 puts are $3.20 (down 6.66%) so a net .20 change on the overall trade. At some point between now and June, we do think oil prices will collapse but we could be wrong so it's good to have a long-term bullish trade to offset some of our short-term bearishness.

Now, on to Berkshire! As noted right at the top of their annual report, they have beaten the S&P's "book value" by an average of 10.6% a year since 1965 (46 years) and the net effect of that is that $1 has become $63.97 on the S&P over that time but $5,130.55 with Berkshire – what a difference 10% makes! After outperforming the S&P by 27% in 2008, Berkshire has fallen behind the past 3 years. This is not because Buffett is losing it but because Buffett's style, like ours, is not to chase rallies. When stocks are cheap, we buy them – not sell them. When stocks are expensive, we sell them – not buy them. This is not a popular approach but it does tend to get the job done over the long haul.

Now, on to Berkshire! As noted right at the top of their annual report, they have beaten the S&P's "book value" by an average of 10.6% a year since 1965 (46 years) and the net effect of that is that $1 has become $63.97 on the S&P over that time but $5,130.55 with Berkshire – what a difference 10% makes! After outperforming the S&P by 27% in 2008, Berkshire has fallen behind the past 3 years. This is not because Buffett is losing it but because Buffett's style, like ours, is not to chase rallies. When stocks are cheap, we buy them – not sell them. When stocks are expensive, we sell them – not buy them. This is not a popular approach but it does tend to get the job done over the long haul.

Buffett highlights the acquisition of Lubrizol and it should be noted that, when Berkshire acquires a company like that, they are acquiring CEO James Hambrick and his management team with the intention of giving him access to capital to expand his business. Already they have done 3 acquisitions for $493M because Berkshire is structured in such a way that there is no red tape between identifying a good opportunity and closing on the contracts – no one is more efficient at it than Buffett and Berkshire. This gives them huge advantages as they are taken seriously as CEOs all over the World go to bed at night dreaming they will be woken up by a phone call from Warren Buffett.

Berskshire's insurance division made $9Bn (pre-tax) last year. In 2004, they only had one insurance company that made $393M. What happened in 2005? Katrina and Rita. Insurance companies went on sale and no one would touch them – except Buffett, who is very proud that his operating companies spent $8.2Bn for property, plant and equipment in 2011, 95% of it in the USA and expects to top that record in 2012.

Berskshire's insurance division made $9Bn (pre-tax) last year. In 2004, they only had one insurance company that made $393M. What happened in 2005? Katrina and Rita. Insurance companies went on sale and no one would touch them – except Buffett, who is very proud that his operating companies spent $8.2Bn for property, plant and equipment in 2011, 95% of it in the USA and expects to top that record in 2012.

Buffett is, of course, with us on our Bank of America deal. While we used option spreads to maximize our upside potential, Buffett went with $5Bn of 6% preferred stock and warrants to buy 700M more shares at $7.14 (another $5Bn) ANYTIME before Sept 2nd, 2021 – now THAT'S a cheap call!

Berkshire also accumulated 63.9M shares of IBM at $10.9Bn ($170.57/share), which is 7.6% and makes him the largest shareholder of IBM, as well as AXP (8.8%), KO (5.5%) and WFC (7.6%). Keep in mind that the profits from the shares of these and many other stock holdings are unrealized and are not reflected as company profits (like our Income Portfolio). As with our Income Portfolio – Warren just likes to build positions in companies that will pay dividends for the long haul.

There is an excellent section, beginning on page 6 and through 7 where Buffett explains something I am constantly trying to get Members to understand – PRICE is not important. When you like a stock, you want it to go DOWN in PRICE so you can buy more of it for less money. The VALUE does not change (assuming no change in circumstances) just because a stock is in or out of favor. As Buffett says:

The logic is simple: If you are going to be a net buyer of stocks in the future, either directly with your own money or indirectly (through your ownership of a company that is repurchasing shares), you are hurt when stocks rise. You benefit when stocks swoon. Emotions, however, too often complicate the matter: Most people, including those who will be net buyers in the future, take comfort in seeing stock prices advance. These shareholders resemble a commuter who rejoices after the price of gas increases, simply because his tank contains a day’s supply.

Charlie and I don’t expect to win many of you over to our way of thinking – we’ve observed enough human behavior to know the futility of that – but we do want you to be aware of our personal calculus. And here a confession is in order: In my early days I, too, rejoiced when the market rose. Then I read Chapter Eight of Ben Graham’s The Intelligent Investor, the chapter dealing with how investors should view fluctuations in stock prices. Immediately the scales fell from my eyes, and low prices became my friend. Picking up that book was one of the luckiest moments in my life.

I do expect to win many of you over, so I urge you to read Berkshire's report in detail and Graham's book if you are so inclined as well. Keep in mind that Value Investors are not short sellers – it is more of a patience game. We made our first buy in the income Portfolio in over 3 months last week as the S&P showed a little strength at our breakout lines. I hope we have reasons to do a little more buying next week – I'm still a bit skeptical but we'll just have to go with the flow at this point.