My last weekend update is dated from January 30 so after a long hiatus, here is an update of our virtual portfolio. Since the last update, we have closed the AA Money portfolio due to a lack of enthusiasm (and activity) and I have stopped tracking the FAS strangle as the low VIX makes it hard to get rewarded for the risk! But we have added a small $5KP virtual portfolio which does not use any margin.

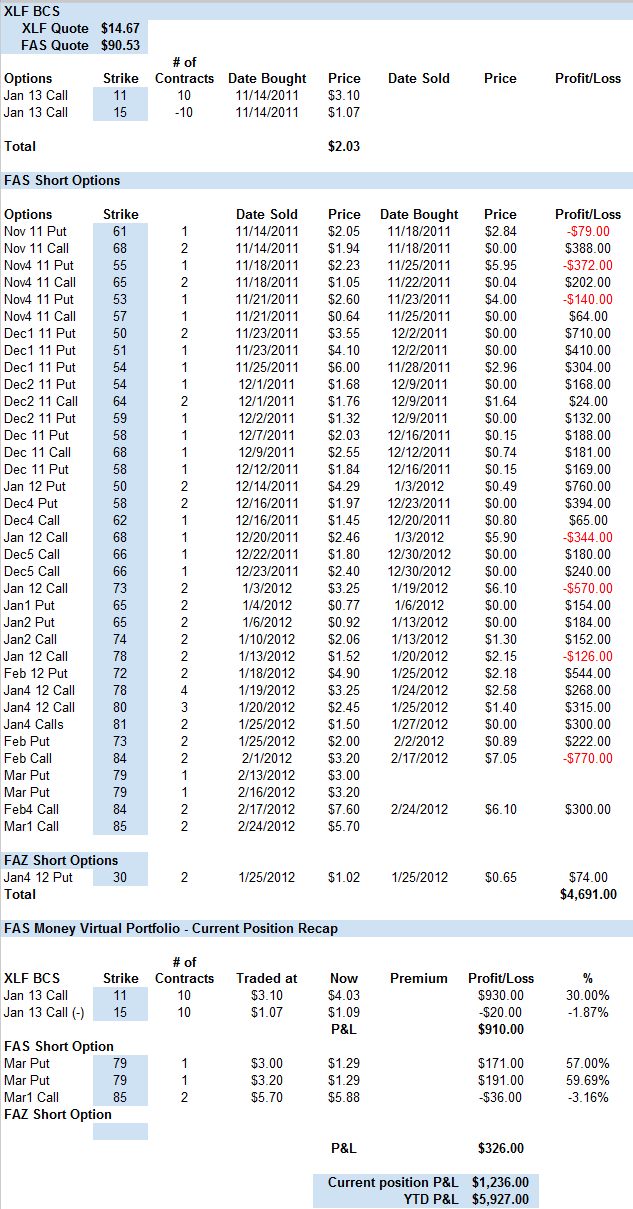

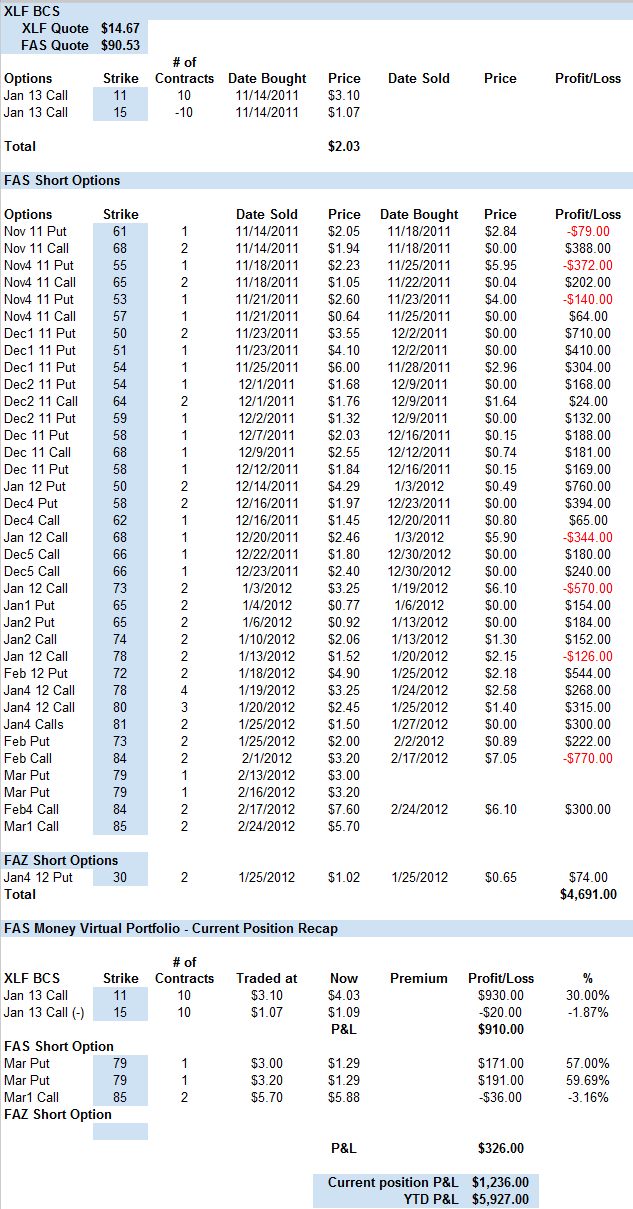

FAS Money

We have had to recover from a big move up by FAS and a low VIX which keeps option prices low. But the portfolio has gaine about 10% since the last update.

Last update P&L - $5499.00

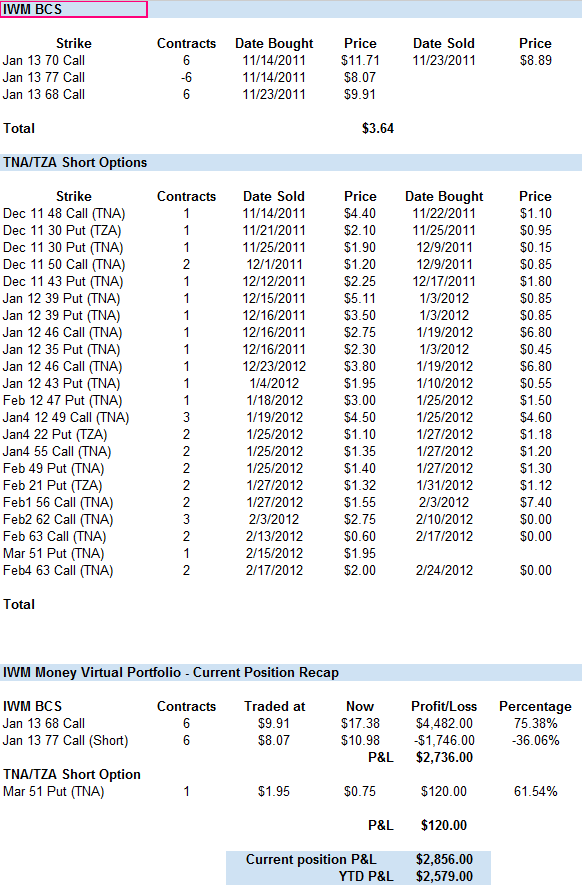

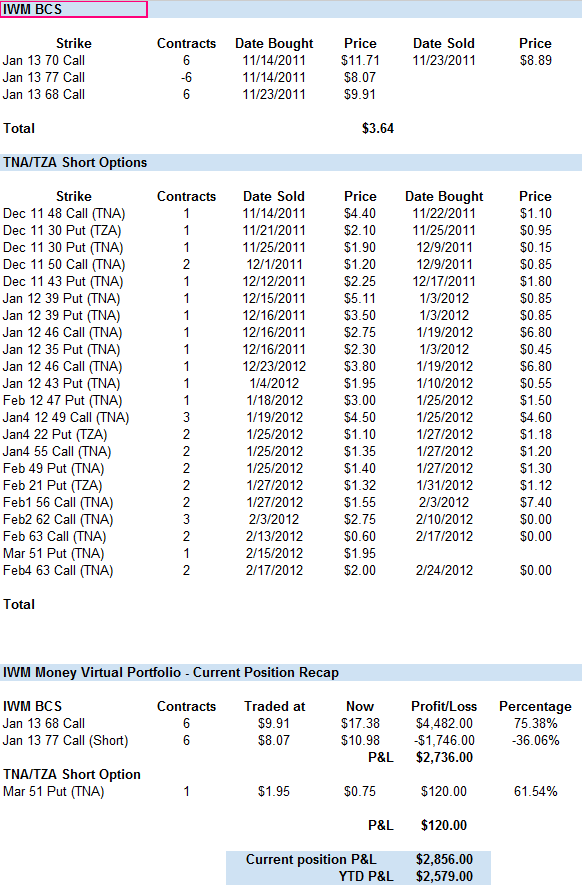

IWM Money

Not a

lot of activity in this portfolio where the main focus is on the large IWM BCS. But the portfolio has grown over 20% since the last update.

Last update P&L - $1998.00

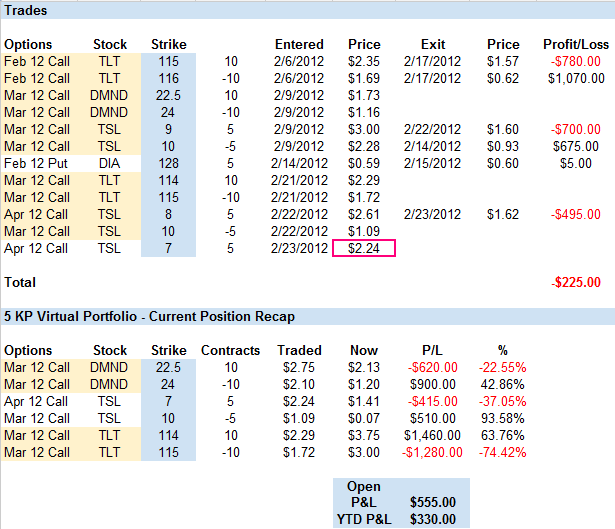

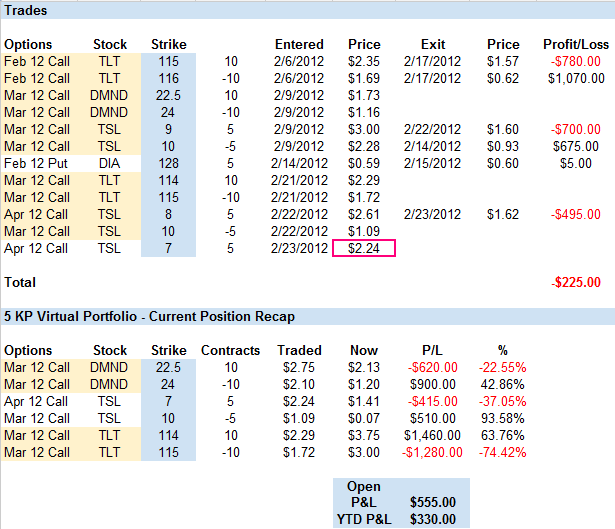

$5KP Portfolio

This is the virtual portfolio that replaced the AA Money portfolio. It does not use margin and we will keep holdings under $5K.

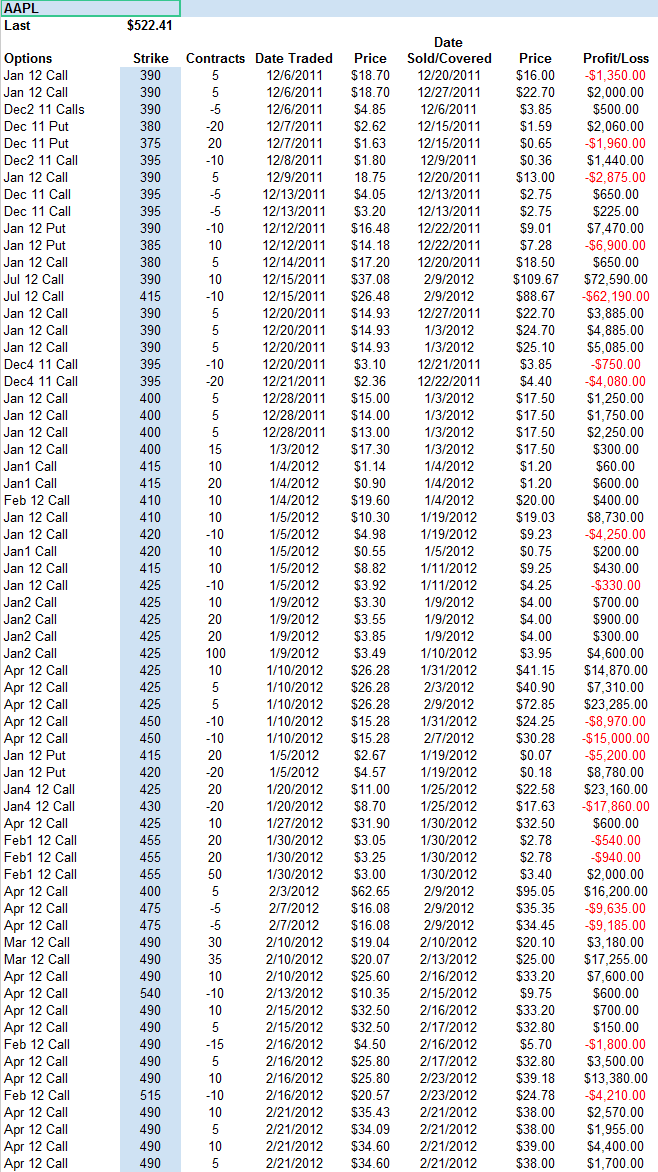

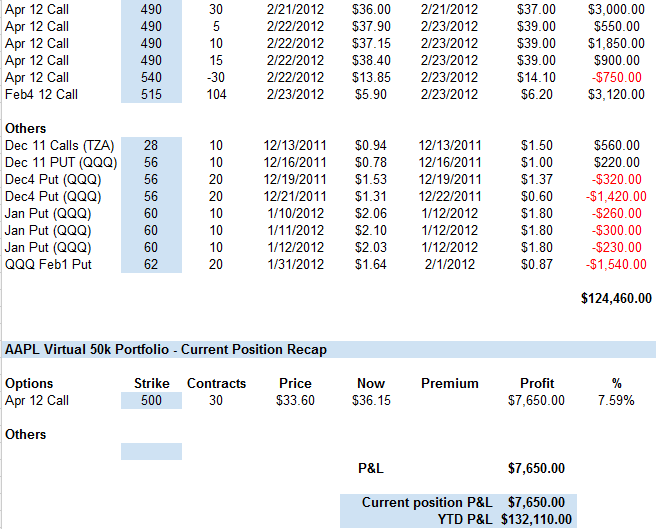

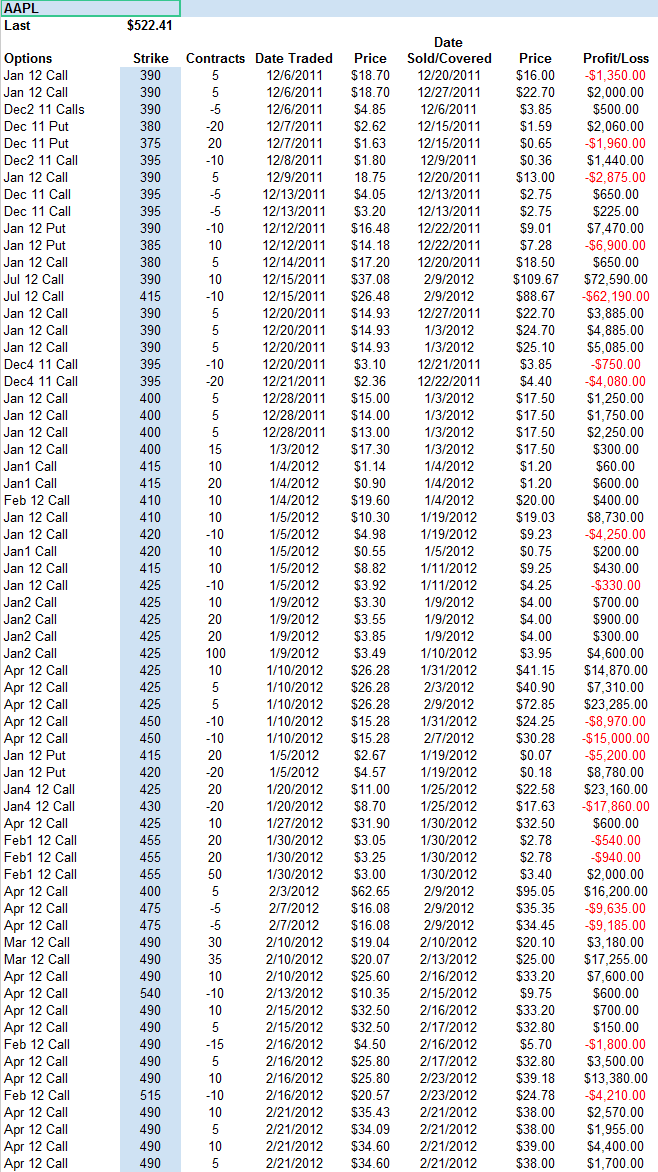

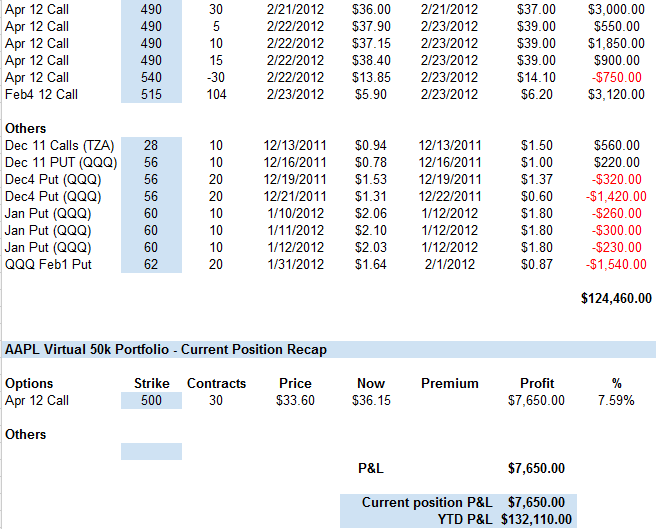

AAPL $50K Portfolio

What is there to say about this portfolio.... $132K of profit in a bit less than 3 months. Unbelievable and great job by lflan!

Last update P&L - $53,205.00

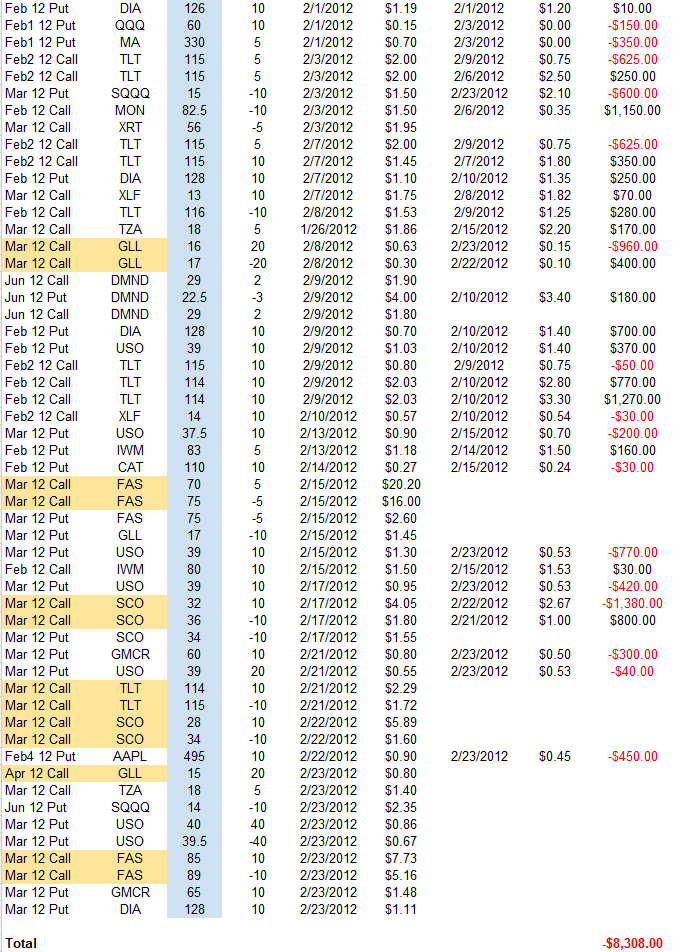

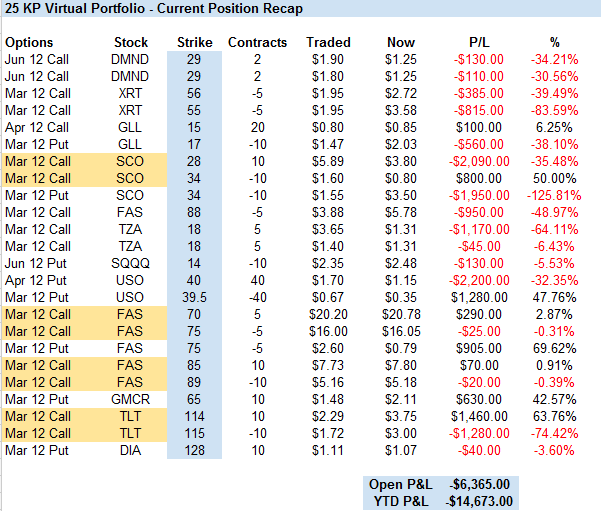

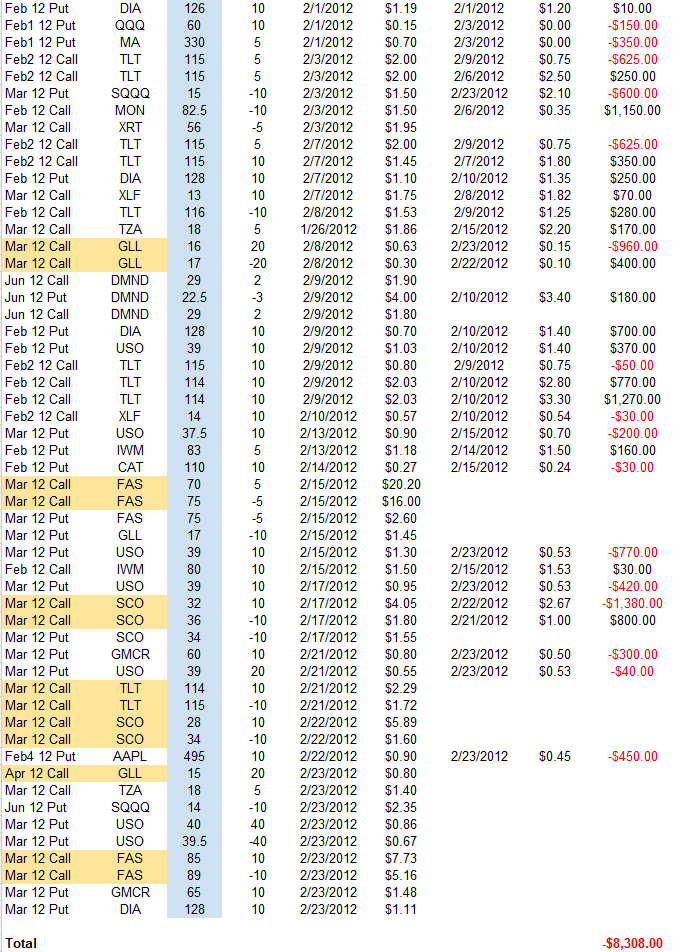

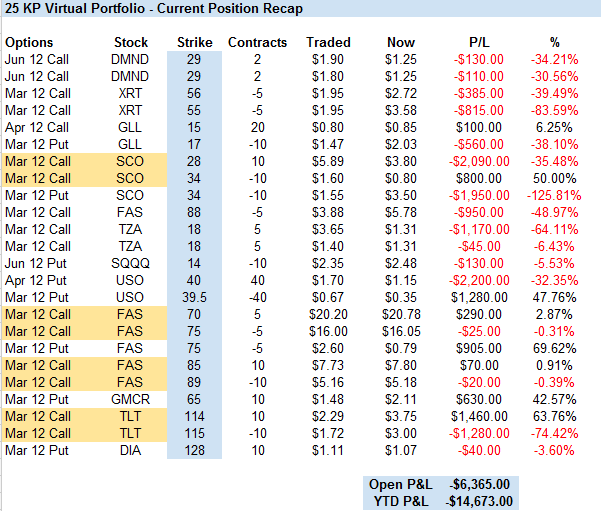

$25KP Portfolio

Comments about this portfolio can be found in Phil's daily post. I have included only February trades as the list of trade is getting too long to fit in the article.

Last update P&L - (-$5447.00)