Courtesy of Jesse's Cafe Americain

As Janet Tavakoli said the other day, the media coverage of this scandal has been a comedic lightweight fly by that no one in the know could possibly take seriously.

And as Chris Whalen said, we always have known where the money ended up. And that is a big part of the problem. Corzine is Too Big to Jail and the Banks are Too Big To Fail.

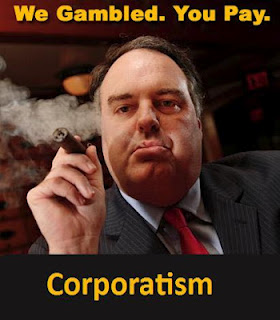

Perfect illustration of the credibility trap that is destroying the economy.

Now the elite New York Times chimes in with its own version of the mysteriously vaporizing, blameless money meme. Maybe someone should look in Judge Crater's pockets, or Jimmy Hoffa's wallet.

Et tu, Gray Lady?

As I said, I have now given up all hope of justice being done in this case. But I think obtaining some of the stolen customer money back from the banks and MF Global Holdings is still possible.

We're not in Kansas anymore, Toto. Smells more like 1920's Chicago.

What we need are The Untouchables, honest public servants not compromised in the web of a credibility trap.

NYT

Doubtful Signs of a Criminal Case Against MF Global

By AZAM AHMED and BEN PROTESS

February 28, 2012, 8:45 pmFederal authorities are struggling to find evidence to support a criminal case stemming from the collapse of MF Global, even after a federal grand jury in Chicago has issued subpoenas.

Investigators, unable to find a smoking gun amid thousands of e-mails and documents, increasingly suspect that chaos and poor risk control systems prompted the disappearance of more than $1 billion in customer money, according to several people involved in the case. (Are these the emails that the lawyer for the Creditors in the bankrputcy case had sole possession of for months? Vaporization by honest sloppiness – Jesse)

When the money first went missing, prosecutors in New York and Chicago scrambled to stake a claim. Now, four months later, both Preet S. Bharara, the United States attorney in Manhattan, and Patrick J. Fitzgerald, his counterpart in Chicago, are shying away from leading the case, one of those people involved in the case said.

Indeed, a number of federal prosecutors have expressed doubts to others involved in the case that anyone at MF Global — including the firm’s chief executive, Jon S. Corzine, and back-office employees in Chicago — intentionally misused customer money, said people involved in the case who were not authorized to speak publicly about the investigation.

The subpoenas by the grand jury in Chicago were disclosed by the CME Group, MF Global’s chief regulator, in a securities filing on Tuesday. But the grand jury, according to the person involved in the case, has yet to hear any evidence on the case — a sign that the investigation has yet to bear fruit.

Still, it is early in the investigation, and regulators and others have yet to finish plowing through the mountain of documentation they recently received from the company. (And what investigative principle suggests the wisdom of allowing the company to go over the evidence first before handing it over to the investigators? – Jesse) In addition, authorities have yet to interview key witnesses — including a person who is believed to have transferred client funds in the firm’s final days.

The inability to bring a criminal case would certainly disappoint thousands of clients, including farmers, traders and hedge fund managers, who are still without access to at least a third of their money.

The government is still hopeful it can file a civil suit against the company, people close to the case said, though doing so against a bankrupt firm with a long line of creditors could be seen as more symbolic than substantive.

Such a case would most likely center on the firm’s failure to safeguard client money, a cardinal sin in the world of futures firms. The penalty for improperly dipping into customer money is a roughly $140,000 fine, equal to about a thousandth of the overall shortfall that clients are enduring….

Read the rest here.