$712,800,000,0000.

$712,800,000,0000.

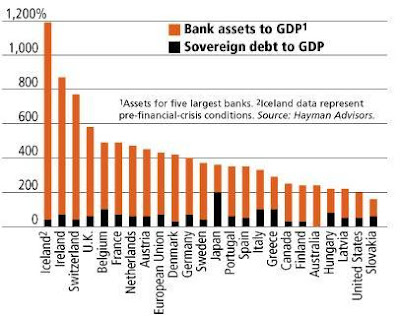

That's how much the ECB dished out to 800 lenders this morning – close to $1Bn per bank of cheap, 3-year loans in the hopes that they, in turn, will turn around and lend them out to people and businesses throughout the EU at less-than-cheap rates so the EU banks can make a nice profit and back-fill the gaping holes in their balance sheets that have been devastated by defaults and currently are being ignored by the mutually assured distraction that allows everyone's assets to be marked to fantasy.

As we saw yesterday, US foreclosures in Q4 were jumping at a rate of 100,000 per month – and that was before the settlement. There is a backlog of 4M homes in foreclosure in the US and Case-Shiller's Home Price Index have hit record lows on the 20-city Composite Index. So it's not just the $400Bn worth of losses on homes in foreclosure (4% of all homes) that have not been taken by the banks but the impuned damage of another $10Tn of asset devaluation on the other 96M homes that is being ignored by US banks.

Europe has more people and more homes and more unemployment than the US. While there is no convenient Case-Shiller report in the EU, we can reasonably expect that EU banks are at least as screwed as US banks and we're not even discussing their Trillions of questionably-valued bond holdings

So, when you watch the markets today and wonder how it's possible that a $712Bn injection of capital widely distributed throughout the European Banking System (exact details a guarded secret, of course) doesn't do anything to boost the markets – that's why.

I read the news today oh boy

Four thousand holes in Blackburn, Lancashire

And though the holes were rather small

They had to count them all

Now they know how many holes it takes to fill the Albert Hall.

Until we do an actual reconciliation of all the holes in all the banks around the World, we'll never have a true picture of where we stand. Of course there is a massive, Global Government conspiracy to cover this all up – the truth is simply too horrible to bear.

Until we do an actual reconciliation of all the holes in all the banks around the World, we'll never have a true picture of where we stand. Of course there is a massive, Global Government conspiracy to cover this all up – the truth is simply too horrible to bear.

That's why Ben Bernanke will once again perjure himself in front of Congress today and sing the same old song and dance he's been singing for 3 years now as he A) tells you everything is fine and B) tells you he still needs to pump Trillions of Dollars into the system at the expense of the taxpayers – despite the obvious inflation it's causing.

That's why we are seeing a shift in focus by the Fed towards "fixing" housing. The whole theory of market to fantasy is that we can keep up the charade and things will get better and housing (and commercial real estate) will re-inflate and then the banks can once again take a realistic look at their asset base. At the same time, we're all doing our best to kick those bond cans down the road as well – quite a lot of juggling going on – let's hope no one drops a ball or this act can end in total disaster!

Bank earnings are not quite what they seem either as banks take advantage of accounting rules that let them book a profit when the value of their bonds go down. That's like Greece declaring a $150Bn profit on the $200Bn worth of Greek bonds that were written down 75% in value – Greece didn't GET any money – they are just benefiting from having to pay less out down the road. While this is legitimate from a valuation standpoint – unless the banks plan on defaulting – it's also very misleading because, as they regain strength (if ever) that relationship will flow back the other way.

Another good game in bank valuations is deferred tax assets. One third of Citibank's book value is carry-forward tax losses, which only become valuable if the bank ever earns a profit. The devaluation of that particular asset as companies begin to close in on a bankruptcy is one of the main reasons you see these drastic, sudden dips in companies as they near the end. YRCW, for example, is a $70M company with Billions of Dollars of tax write-offs contributing to their enterprise value of $1.25Bn but good luck finding someone to pay that! Including their tax deferred assets, C has a book value of $60 a share – again, good luck finding someone to pay that.

But it's a Billion here and a Billion there all tucked away into those S&P "earnings" reports. Bob Pozen (linked above) estimates it was over $25Bn last year in the US and UK alone while the Globe pegs it around $10Bn PER QUARTER. Another banking trick cited by the Globe, which was responsible for 70% of JPM's profits in 2011, is the reduction of loan-loss reserves. These are completely random numbers as the bank simply decides what percentage of their $2Tn in loans are likely to default so a 1% change nets $20Bn in "income" whenever they desire. As you can see above, ALL of C's earnings last Q were loan loss releases.

Don't worry, if they drive their ratio too low and end up with more defaults than they expected – you'll bail them out – and you'll do it AFTER you lose your ass on their stock as reality causes it to plummet when they realize the losses they denied existed in order to pump up the stock price (getting you to buy it with your hard-earned money) and, of course, justify their bonuses.

Central bankers are operating under the supposition that you can fool consumers and investors into being confident – under the theory that confident investors and consumers will go out and spend money and boost the GDP enough to overcome the negative effect of Global Government cut-backs and that you will go out and borrow the money they gave to the banks for free and generate Billions of Dollars in profits for the banks so they can fill in the holes in their balance sheet before the next crisis forces their hand. As long as all those plates keep spinning – everything will be "fine."

Central bankers are operating under the supposition that you can fool consumers and investors into being confident – under the theory that confident investors and consumers will go out and spend money and boost the GDP enough to overcome the negative effect of Global Government cut-backs and that you will go out and borrow the money they gave to the banks for free and generate Billions of Dollars in profits for the banks so they can fill in the holes in their balance sheet before the next crisis forces their hand. As long as all those plates keep spinning – everything will be "fine."

So far, it's working great – no one (well, no one anyone listens to) is pointing out the scam because we all make more money in a bull market than we do in a bear market. That goes for my subscriptions, CNBC's rating, Bank earnings, Corporate Profits, Government Tax Receipts, Campaign Contributions, IPOs (Facebook's IPO will lead to $2.5Bn in California Income tax generation!), Commodity profits, etc. – Who would want to call an end to this party?

That's why these parties can go on longer than you would rationally expect and we are now in that critical stage where we're either exhausted and reality begins to set in OR someone delivers a fresh keg and someone else puts on a way better party tape and we kick this thing up a notch. The ECB just delivered a $712Bn keg but that, by itself won't be enough – the IMF and the Fed need to break out the hard stuff really soon or this party may crash and burn.

Meanwhile, as long as the S&P is holding our 1,360 line and now the Dow is over 13,000 (to all be confirmed with Nasdaq 3,000) – we're happy to stay and dance a little as well.