A default that isn’t a default and a sale that isn’t a sale

Courtesy of Bruce Krasting

One of the biggest frauds of the past few years took place yesterday. The International Swaps and Derivatives Association (ISDA) confirmed that no “event of default” has occurred with the Greek debt restructuring, therefore no payouts on any outstanding Greek Credit Default Swaps (CDS) contracts are due.

The following are just a few of the links this morning on those who disagree with the ISDA. I particularly liked Barry Ritholz’s comment, "Bullshit".

I wonder if the ISDA decision was not intended to end CDS contracts as a tool used in global finance. That certainly will be the consequence. Who in their right mind would buy an insurance policy on their sovereign bond exposure, knowing that the outcome is rigged and no payout can ever be expected?

I’ll go on record with this one. In less than one year, the bankers and political leaders in Europe will come to hate the ISDA decision. By destroying the private market for sovereign risk insurance, they have made it certain that Spain, Portugal and Italy will be locked out of the global bond market. Global investors were already shunning these countries. The ISDA decision on Greece will just make it worse for other countries that are considered potential default candidates.

There was another development yesterday that had parallels with the ISDA decision on Greece. The US Treasury sent out an email:

This is a technical discussion on Internal Revenue Service (IRS is Treasury) rule #382. This rule spells out how a company's Net Operating Losses (NOLs) are treated in the event that the company is sold to a third party. Rule 382 was introduced in 1986. The initial intent was to limit the sale of a company’s tax losses. Treasury had this to say about the importance of rule 382:

It is a longstanding principle of our tax code, which is designed to measure taxable income more accurately over time.

Rule 382 is longstanding, and it does measure income more accurately (and fairly).

There is no dispute as to what happened in 2009. A number of very large US banks went tapioca. Banks like Citi and BoA (and many others) would have had to close up shop if the government had not intervened. If the big banks were shuttered, it would have had very significant and lasting consequences. So the government implemented TARP. The government’s initial investment in the banks was in the form of preferred stock. The "Pref" was convertible to common (and later it was, for the most part, converted). Through this process the federal government became the TARP banks' controlling shareholders. To insure that the banks were doing what their new owners (the tax payers) wanted, the Treasury inserted individuals at the banks in supervisory positions.

What took place in 2009 is a classic definition of Change of Control. The active intervention by the Feds coupled with the public ownership/control of a majority of the common stock of the banks was functionally a sale.

If the transactions were treated as “sales” (which they were), rule 382 would have been triggered causing devastating consequences to the banks. The banks had hundreds of billions in losses (NOLs). The financial future of many of the TARP banks dependended on their ability to use the old losses to shelter future gains. Treasury agrees with that conclusion:

Treasury determined that guidance was necessary to clarify the scope and applicability of Section 382.

The Notices provide that Section 382 does not apply to the government’s investments—both its purchase and, within strict limitations, its subsequent sale of shares in private companies.

With that, the usual financial consequence of the change of control/sale that was precipitated by TARP were waived. This decision saved the banks. Treasury concurs:

Allowing those companies to keep their NOLs made them stronger businesses.

The US banking system and economy would look very different today if rule 382 had been applied to the change of control of the banks in 2009. Without the NOLs, the old banks had no assets. But the NOL’s were allowed to be retained; they were treated as an “asset”. This saved the banking system as we know it.

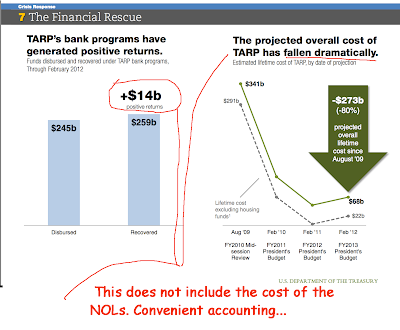

Separately, the administration is crowing about the "success" of TARP, and how little it cost:

In measuring the costs, the administration fails to include the losses that the government (aka the taxpayers) incurred as a result of the NOLs. The NOL’s are a backdoor bailout that the (now profitable) banks can use to avoid the taxes they would normally be paying.

Treasury makes an impassioned defense of its decision to allow the banks to avoid the 380 trap. I’ll let you decide if they make a convincing argument (Link).

The last sentence of the report sums up Treasury’s whole case:

The IRS Notices interpreted the law in the best interest of taxpayers.

This is the last sentence from the ISDA’s statement (Link) in defense of its decision on not calling a default on Greek debt:

In sum, we think the credit event/DC process is fair, transparent and well-tested. There’s simply no evidence to the contrary.

I think both of these statements are bullshit.

.