Bernanke Leaks, Spills the Punch

Courtesy of Bruce Krasting

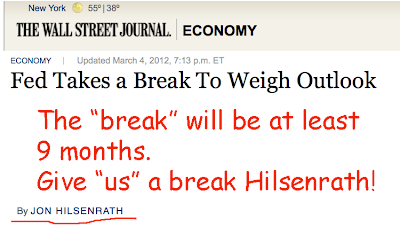

Jon Hilsenrath, at the WSJ, must have had a phone call with Ben Bernanke on Saturday. Accordingly, Jon put an article out just in time to influence the market on Monday morning. The headline says it all:

.

No doubt, Bernanke is watching the price of crude and the tape is telling him his inflation forecast is no good. The leak this evening is just Ben’s way of hinting to the market that he understands where we are on inflation, and he is not going to stir the pot anymore than he has.

The WSJ article indicates that the Fed is on hold for at least three months, till June. Moreover, Bernanke can’t do anything big on the monetary front within five months before a national election. Therefore, the next legitimate time for another LSAP/QE is in December of 2012.

Bernanke’s leak to Hilsenrath is not really new news. I have been saying that Ben is "done" for some time. This confirms it.

I don’t expect this development to significantly move markets. I see it as being mildly dollar supportive (other bigger factors are at play). It should put a floor under bond yields, but I don’t see this as a reason to sell bonds. It might very well take some froth out of the stock markets. I don’t see it affecting the price of crude one way or the other (again, bigger factors will drive crude).

Ben and Jon aren’t taking away the punch bowl just yet. We have a very long road ahead of ZIRP, and already bloated Fed balance sheets. I think the Fed is keeping the punch bowl full, but not putting any alcohol in it. Bernanke’s new punch might quench your thirst, but it won't get you high.

.

Note:

Said it before, I'll say it again. I’m disgusted that Bernanke uses Hilsenrath and the WSJ as his go-to place to leak monetary policy. Bernanke made a big deal about improving transparency at the Fed recently. He just blew any credibility that he might have gained. Nothing has changed. Ben B. is a leaker.

.