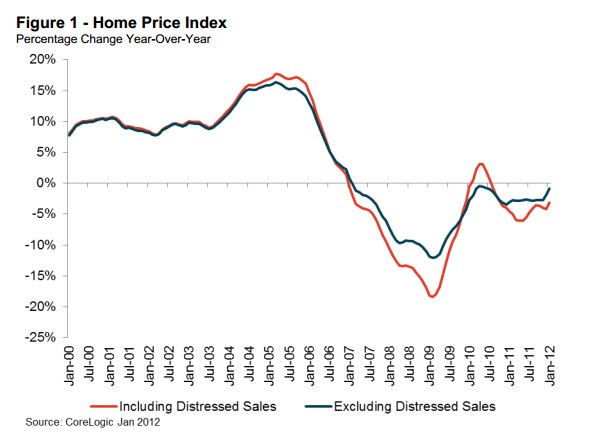

CoreLogic Data Shows House Price Declines Slowing

Courtesy of Lee Adler of the Wall Street Examiner

CoreLogic’s data for January closed house sales (mostly November contracts) shows a year over year decline of 3.1% nationally. The month to month decline was 1%. However, the 12 month rate of decline has been slowing sharply.

According to CoreLogic, 6 of the 10 largest metropolitan markets in the US showed year over year declines while 4 showed increases.

By contrast, Housingtracker.net, which tracks listing prices in real time showed that January listing prices nationally were up 4% year over year, while being down 1% month to month in January, as active listing inventories tightened. Inventory was down 17% year over year in January.

According to Housingtracker.net the trend of declining inventory and rising asking prices has continued to the present:

As of March 05 2012 there were about 858,688 single family and condo homes listed for sale in the 54 metro areas we track.1 The median asking price of these homes was estimated to be $224,322.2Since this time last year, the inventory of homes for sale has decreased by 20.5% and the median price has increased by 3.9%.

Listing prices rose 1.7% month to month in March, while inventory coincidentally also rose by 1.7%. This is a normal seasonal aspect of the housing market as both demand and supply begin to increase after a January low. The increase in March 2011 was also 1.7%. These were the lowest rates of March increase since 2007.

Over the last 6 years, subsequently reported housing prices have tracked real time listing prices with a close correlation. This is the first time that listing prices have had a positive divergence versus subsequently revealed sale prices for the same period. Whether this reflects the reduction in supply, or newly unrealistic seller expectations is not yet known, but if active listings continue to shrink in number, as long as demand remains stable even at these low levels, then prices should stabilize and begin to rise. The year of year rate of change data seems to support this trend.

I address the issue of whether the housing market has bottomed in If The Guilty (Mortgage Mafia) Are Never Punished, Housing Will Never Recover.