Bloomberg Spews A Bunch Of Disingenuous Crap On Consumer Comfort

"Consumer Confidence Rises to 4-Year High"

That's just so wrong. So wrong. I mean, should we really be jumping up and down, shouting, "Hip Hip HOORAY! Hip Hip HOORAY!"

Uh… no.

Let's look at the first key point that Bloomberg made.

Household confidence improved last week to a four-year high as more Americans said the economy was improving and decided it was a good time to shop.

The Bloomberg Consumer Comfort Index (COMFCOMF) was minus 36.7 in the period ended March 4, the highest since April 2008, up from minus 38.8 in the prior period. The gauge on the state of the economy reached a one-year high, while the buying-climate measure climbed to a level last exceeded in December 2009.

Just the comparison to April 2008 is telling. Think about it. Where was the economy in April 2008? Only in the early stages of the worst economic depression in the US since 1932, if you want to make stupid year to year comparisons without explanation. This is pure garbage, cheerleading, public relations. It certainly isn't financial journalism, something the Bloomberg is occasionally good at. In this case, though, the Hizzoner the Mayor should be ashamed of himself.

After several more lines of bullish snorting, the writer allows Bloomberg's Joe Brusuelas to make what I think is really the key point in all this. "That said, consumer confidence remains at the low end of the historical range."

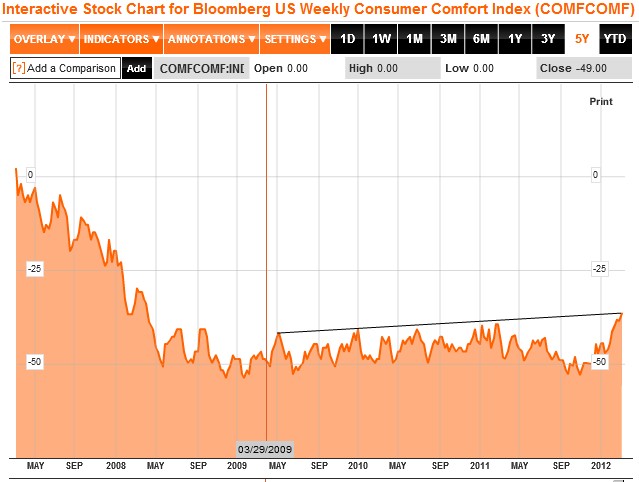

It's also true that it's at the high end of the range of the past 4 years but the issue is whether that's a good or bad thing. The reporter implies that it's a good thing. Here's the chart that accompanied the article.

http://www.bloomberg.com/

But let's have a little perspective, shall we. Bloomberg also has a link to their interactive chart for that indicator that allows a 5 year lookback. I've taken the liberty of drawing in a few straight lines to illustrate the trend using tools available on the website.

While the initial implication of the one year chart linked directly in the article was that sentiment had broken out, if you took the extra step to go to the interactive chart and zoom out, the picture became clearer. The index has only rallied to the high end of the trend range. Clearly, if it breaks out next week, that would suggest that the tide had turned. But all we see at this point is that it might, or it could be that this is high tide, and the next move will be back out to sea.

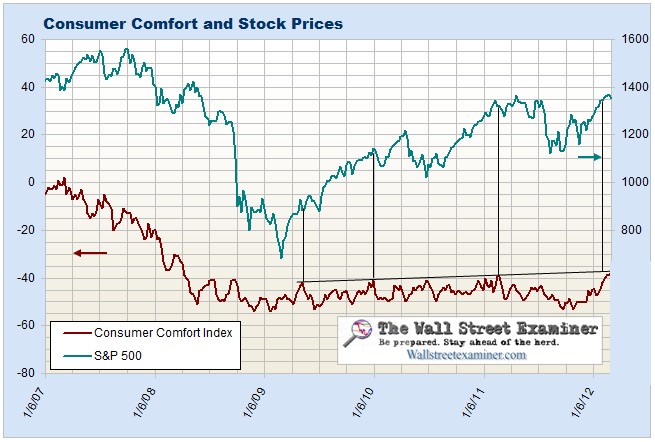

Furthermore, is there a correlation between these short term peaks in the sentiment trend and subsequent market behavior? The answer is, "Not so much."

Over the course of this recovery, yes, the sentiment peaks have tended to confirm the uptrend. But they also tend to follow the stock market, so they don't tell us anything we don't already know and they tend to mark less than good entry points in the short run.

So why are we even paying attention to this? The answer lies in the big picture, which Bloomberg hides by stopping its history at 5 years. The data goes all the way back to 1986 when ABC News first published the index.

Here's the historical data from the days before Bloomberg bought this index in February 2011. The red X marks approximately where the index stands now. I think you get the picture.

Source: http://www.

"Consumers" understand better than Bloomberg, better than professional economists and pundits, certainly better than Ben Bernanke who continues to rob the Aunt Millies of the world to pay off the banksters, indeed better than all the soothsayers and gurus of the financial world put together, where things stand. They know the deal.

Yes, a tiny handful of them are experiencing things being a little better. They're the ones that own stocks. But a minus 36.7 reading ain't exactly rolling in clover, especially when the historical average is around -12, and neutral is zero. In fact, from the perspective of "consumers" or perhaps more accurately, "We, the people" this "recovery" is even weaker than the one in 2003-2005, and the second wave of that recovery from 2005-2007. Americans recognize that, notwithstanding the minor trend of improvement of the past 3 years, we are still in deep, deep trouble. I guess Bloomberg just didn't want to trouble us with the facts. They have terminals to sell, where the market bigwigs have access to the whole story. Screw the rest of us. We're just fodder.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE’s Professional Edition risk free for 30 days!