It’s That Time of The Month, Employment Data Leads To Investment Mood Syndrome

Courtesy of Lee Adler of the Wall Street Examiner

Every month the gummit’s Bureau of Liar Statistics (BLS) dutifully reports reams and reams of data on the employment situation in the US. Some of it is actually useful. The rest is reported by the mainstream financial news media.

Every month the gummit’s Bureau of Liar Statistics (BLS) dutifully reports reams and reams of data on the employment situation in the US. Some of it is actually useful. The rest is reported by the mainstream financial news media.

The BLS reports both seasonally adjusted (SA) data and not seasonally adjusted (NSA) data. The NSA data is the actual number collected via the monthly surveys. The SA number is the massaged, wishful thinking number. It’s a kind of abstract impressionism, where an idealized view of reality may or may not represent actual reality. Seasonal adjustment is based on past averages but sometimes patterns change and the economy veers off from what had been past norms. That’s when SA numbers are particularly misleading. Then the BLS usually comes in and revises 5 or 10 years of past data, which is a stupid and futile gesture after the damage has been done.

I like to look at the real numbers, the NSA data. It’s easy to compare it with the same month from prior years to see if the momentum of growth is positive or negative. Sometimes, the real numbers actually confirm the abstract impressionism of the SA numbers.

I’m usually prepared to rant and rave about how misleading the SA numbers are each month, but this month I can’t do that. The raw, actual numbers were, surprisingly, pretty good.

The cheerleaders looking at total SA nonfarm payrolls as a beat of the consensus were sort of on the right page. It’s purely random that that happened, but it is what it is. Employment grew in February. The growth was consistent with the 1% or so real growth in wage tax collections for the month, which I track in my weekly Treasury market updates (available by risk free trial).

The important number is full time employment. The total employment figures that the mainstream touts include part time employment. Part time jobs don’t pay the mortgage, and probably don’t pay the car payment either. Part time jobs don’t permit people to buy houses and cars, take vacations, send their kids to college, or provide health insurance for their families. They are usually low wage hourly jobs that barely provide minimum subsistence.

For much of the past 3 years, strong growth in part time jobs has inflated the total employment number and made the employment picture, as bad as it was, actually look better than it was. From February 2008 to February 2012 the economy added almost 3 million part time jobs. Total employment is down by 3.9 million jobs over that time. The problem is that there are 6.9 million fewer people working full time. That’s a big hole to climb out of.

This month’s report confirmed that on an actual NSA basis, the numbers are climbing. Full time employment rose by 708,000 month to month in February. February is virtually always an up month, so in order to determine whether that’s a good number or not, I look at years past. Last month’s jump of 708,000 compares with 358,000 in February 2011. The average February increase over the 10 years from 2002 to 2011 was 191,000. The average of non recession years in that period was 314,000. In the peak bubble year of 2006, full time jobs increased by 428,000 in February. Any way you slice it, this February was a good month.

On a year to year basis, February showed an increase of 1.86 million versus February 2011. That compares with a year over year gain of 1.63 million in February 2011, suggesting that upside momentum is increasing. Contrast that with 2010, when 3.85 million jobs were lost and 2009 when 6.5 million were lost. Excluding those two years, the average yearly gain of non recession years over the past 10 years was 809,000. Once again this month’s numbers look good by comparison.

It’s inarguable that there’s been some improvement, but the real issues are whether it will continue and what the data means from an investment standpoint. In other words, is this as far as money printing and defecate spending can take us? And what’s the correlation with stock and bond prices? Is this data useful in that regard?

Numbers are fine, but I’m into visuals. Visuals provide context. The numbers sound great. But when we look at a picture of them, the magnitude of the problem, if there is one, becomes far more clear and vivid. That’s why I like to put the data into a chart form that tells a story that I can understand, and that hopefully I can use to better illustrate the issues for you.

The first chart shows the long term trend back to 1982, along with the annual rate of change. I used it to test the question of whether this is as good as it gets. Can things continue to improve? The chart doesn’t give a direct answer, but it suggests that over the past 3 months the economy has reached an inflection point. In terms of how market chartists and technicians might look at it, the trend has met resistance. The question is whether it will break out in the months ahead, stay stuck at a low rate of growth, or roll over and begin contracting again.

While there’s been improvement since the bottom in 2009-10, the economy is still stuck in a range. There’s been no breakout. The next 5 months are the time of year when full time employment zooms higher. Normally May is the month when total employment reaches the prior year’s high, and June is the month it breaks out. The economy needs to add more than 2 million jobs by this June in order to break last year’s high.

Is it doable? Here’s the problem. The Fed has apparently fired its last bullet. It can’t expand its balance sheet any more without further stimulating raging commodities inflation. It has managed to stimulate some employment growth with massive money printing. I think it’s reached the limit of that because of the commodity problem.

When the ECB in particular printed money, much of it flowed into the US markets and banking system, boosting the US economy. I cover these flows in the weekly Fed and Treasury Reports. My analysis of money flows revealed that ECB money printing boosted liquidity in the US, helped to boost stock prices and suppress US bond yields, and thereby stimulated the US economy. Paradoxically, while everyone worried about the probability of a catastrophe, the Fed and the Obama Administration got lucky thanks to the crisis in Europe.

But the ECB has most likely maxed out what it can do on the money printing front, given the response in commodities. Bond vigilantes have been replaced by commodity vigilantes, and they are likely to prevent the central banks from doing much more in the way of stimulus.

That leaves the US Gummit. It’s an election year. The primary job of politicians, including Republican Congressmen, is to get re-elected. Enough of them will vote to spend money to do that, so there will be no cuts this year before November. Deficit spending will be pedal to the metal. If anything will keep the economy from contracting, that will be it, but without central bank tailwinds, it’s doubtful that jobs will expand much more from here. So I suspect that the secular trend of the declining employment growth rate will not be materially broken over the next 6 months. At best, it will probably remain stuck near the top of the range.

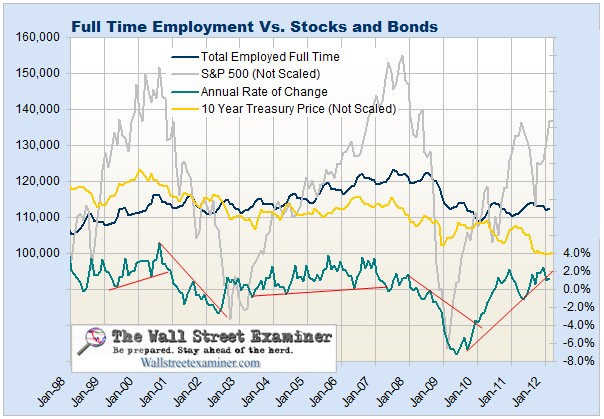

The other question is of what relevance is this to the market. The next chart zooms in on the past dozen years, showing the full time employment trend versus the trend of stocks and bonds.

This chart shows that stock prices and bond yields track well with the growth rate of full time employment, with varying degrees of lead and lag. The question that interests me here is whether this is a top. So I want to see how this indicator behaved relative to stocks and bonds in 2000 and 2007. In 2000 the decline in stock prices led the breakdown in employment growth momentum (the annual rate of change) by several months. The drop in bond yields was also slightly ahead.

But in 2007, employment growth slowed sharply a few months before stocks began to break down, and ahead of the decline in bond yields. The full time employment trend break was a leading indicator in that case. In that sense, the employment growth rate is now at an inflection point. If it ticks up from here, the uptrend in the stock market is supported. But if the employment growth rate ticks down, the trend break could signal the beginning of the end for the bull run in stocks.

Perhaps more interesting is the negative divergence that has developed between rising employment growth and falling bondy yields since 2010. This suggests that Treasuries may be in a bubble, just as stocks were in 2007. True, perhaps employment growth is too slow to rationally concern bond investors. With massive government defecate spending likely for the rest of this year, the time to become concerned has probably arrived. Employment growth is at an inflection point and if the growth rate picks up, Treasury yields should go up with it and so may the nascent bubble in stock prices.

*****

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE’s Professional Edition risk free for 30 days!

© Copyright 2012, The Wall Street Examiner Company Inc. All rights reserved.

Attention third party re-publishers: This article may be reposted only in its entirety with a prominent link to http://wallstreetexaminer.com or other page on this website. Any changes to the article, or other use without the expressed written consent of Lee Adler is unauthorized. Thank you for your understanding and support. Reposting this article without the required linkage to The Wall Street Examiner will be grounds for your non surgical testiclectomy and other legal measures. If you’d like the opportunity to possibly generate revenue from reposting these articles, join the Wall Street Examiner affiliate program.