Courtesy of Nomi Prins

The Audacity of Bonuses At MF Global

The Audacity of Bonuses At MF Global

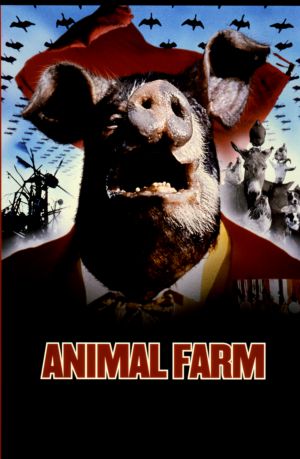

In the spirit of George Orwell’s Animal Farm commandment: “all animals are equal, but some animals are more equal then others” comes the galling news that bankruptcy trustee, Louis Freeh, could approve the defunct, MF Global to pay bonuses to certain senior executives. This, despite the fact that nearly $1.6 billion of customer funds remains “missing” or otherwise partially accounted for, yet beyond the reach of those customers, perhaps forever, since before the firm declared bankruptcy on October 31, 2011.

Another commonality between the MF Global incident and Animal Farm is the abject rewriting, or re-interpretation, of rules. At the farm, the rule ‘No animal shall drink alcohol” was ultimately ‘re-remembered’ as ‘No animal shall drink alcohol to excess.’ Absent opposition to this particular fact alteration, the pigs got drunk. It wasn’t pretty.

The Orwellian nature of finance is spiraling out of control. It was acutely demonstrated during the fall 2008, merge-and-be-bailed period, and subsequently, through mainstream acceptance that “too big to fail” validates the subsidization of reckless banking practices (bail first, ask questions or consider tepid regulation later), and the European debacle.

Three wrinkles of audacity underscore the potential MF Global bonus approvals. First, there is the moral responsibility layer. MF Global, classified as a broker-dealer wasn’t specifically subject to the investment-advisor fiduciary rule that requires ‘systemic safety and soundness’’ with respect to retail customers. But, comingling customers’ funds inappropriately with the firm’s, as former chief, Jon Corzine’s European bets were blowing up, was an abject misinterpretation of the rule's intent.

Aside from that, MF Global lied about funds segregation to its customers, which constitutes fraud. The final page of the firm’s brochure touts “the strict physical separation of clients’ assets from MF Global accounts.”

Separately, MF Global broker-dealer activities were subject to SEC oversight and restrictions on its use of client funds. During any normal investigation, like say for embezzlement, funds should be frozen until issues are resolved. Releasing any bonus pay until this matter is settled is just plain wrong.

The reason for possibly allowing bonuses for MF Global chief operating officer, Bradley I. Abelow, finance chief, Henri J. Steenkamp, and general counsel, Laurie R. Ferber follows the same twisted logic pervading Wall Street: no one else can do the job as well.

These people are apparently so special that despite incompetence, negligence or potential malfeasance in diverting customers’ funds away from their rightful spots, their expertise is critical to the bankruptcy proceeding. In that realm, their ‘job performance’ will help Freeh "maximize value for creditors of the company”. Translation: it will ensure banks like JPM Chase keep their cut, since customers are not creditors. Again, plain wrong.

But forget simple matters of right and wrong for a moment. After all, this is Big Finance: what's most important is what’s not necessarily what’s legal or illegal, but more practically, what you can get away with and what you can’t. In that regard, the sheer impotence of regulators, the Department of Justice, and the FBI are enabling factors in perpetuating financial crimes.

In early 1933, during the Depression that followed the 1929 Stock market Crash, Democratic president, FDR and Republican Treasury Secretary, William Woodin, declared a bank holiday, during which Treasury Department agents examined banks’ (which included at the time, broker-dealers) books to determine solidity and solvency.

Today, our regulatory bodies are incapable, or simply don’t want to be bothered with, tracing money and returning it to the public customers to whom it belongs. The inability to independently examine MF Global’s books, without its executive involved, reveals the sorry state of our financial system. In this post-Glass-Steagall-repeal world, the mixing of customer money and speculative betting – whether at a super-market bank or broker-dealer, whether involving subprime loans packages or European Sovereign debt, poses too dangerous a level of complexity. If regulatory bodies can’t, or won’t, diminish the related risk, more concrete Glass-Steagall boundaries throughout the financial framework should be resurrected.

Meanwhile, two senators have taken on the bonus-pay fight. Senator Amy Klobuchar (D., Minn.), member of the Senate Agriculture Committee investigating MF Global, wrote to Freeh that the plan is "unacceptable." Senator Jon Tester (D., Mont.), whose constituency includes a number of farmers with funds in the ‘missing’ category, called it "outrageous.”

On Sunday, Freeh's spokesperson released a statement saying the senators’ concerns were ‘noted’ and a final decision on the bonuses hadn’t been made. But to the extent that the money trails shrouding MF Global’s final moments remain more apparent to its former employees than external examiners, it’s likely the people involved in the wreckage, will be paid extra for sorting thru it. And, that’s an expensive, outrageous, shame.