On Sweet Deals and No Deals

Courtesy of Bruce Krasting

I’m sure that everyone will be glad that executive compensation at Fannie and Freddie (F/F) has been cut. These are public companies that exist at the whim of the taxpayers. As such, the compensation for the folks pulling the levers at F/F should conform to salaries that the president gets, right?

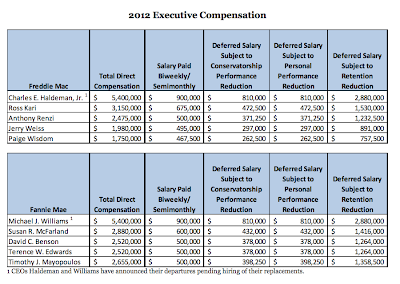

Well, not quite right. The President makes a cool $400 grand. Congressmen get $175K. The 2012 compensation for the senior executives at F/F tops these numbers by a wide margin:

.

The F/F top brass get nice cushy salaries plus incentive compensation (annual bonuses). Given that F/F are losing money hand over fist, you would think that some of that incentive comp might not get paid. Most of it is. In 2011, 82% of incentive comp was paid.

A large portion of total compensation is paid in the form of a retention bonuses. If the top folks stay in their jobs, they get paid this amount. If they quit before their contracts are up, they still get paid most of their retention bonus. There is a formula that sets the payout that discounts the contractual amount by 2% per month for each month prior to January 2014.

Not surprisingly, both Charles Halderman Jr. and Michael Williams, the CEOs at F/F, have both announced their resignations. As a consequence, they will only be getting 60% of the combined $5.8 million of their deferred comp. amounts. Basically, they will each be getting $1.8mm for not working. A very sweet deal indeed.

Note: The 2012 total compensation package for the CEO's at F/F is down 74% from what it was before the SHTF in 2008. So I guess we should be happy that we are paying folks to lose money at only one-quarter of the rate we once were.

.

As of noon on Monday the NYSE is headed for the lowest daily volume of the year. The Vix is falling with the low turnover. It’s pushing the levels last we saw in May – August of last year. (See Zero Hedge for details Link)

.

.

I can’t imagine a worse status quo. We have complacent markets. Turnover and liquidity are drying up. The market's ability to absorb a shock of any kind is weak.

There is going to be a shock; there always is. The vulnerable stock market is due for a correction. I’m just wondering what the shock will be that brings it on.

.