Pic source: DougW at Wikipedia

“FORD HAS A BETTER IDEA” ON HOW TO INCREASE EARNINGS: NOT REALLY

Courtesy of The Grumpy Old Accountants

Remember that old slogan from the 1960s? Unfortunately, we do! And in January we heard about Ford’s great year in 2011, having increased net income by a substantial amount. Was this due to Ford having a “better idea?” We waited until the firm issued its 10-K to find out, so that we had some audited statements and footnotes to read. Not surprisingly, the Company’s annual report leaves us underwhelmed.

The reason for our angst? Over half of Ford’s net income is coming from the reversal of its deferred tax asset valuation allowances! You may recall that we first expressed our displeasure with corporate managers who pumped earnings via creative tax accounting inRite Aid: Is Management Selling Drugs or Using Them? In Ford’s case, the Company juiced its bottom line by $11,541 to $20,213 (all dollar numbers are in millions), an increase of over 57 percent, with the stroke of a pen. To accomplish this, Ford simply increased deferred tax assets by $11,541 and reduced income tax expense! Without this adjustment, net income would have been a more humble but realistic $8,672, more in line with 2010’s $6,561 or 2009’s $2,717. Clearly, earnings quality has been compromised.

It is interesting to note that Ford buried the specifics of this “transaction” in Schedule II Valuation and Qualifying Accounts (FSS-1 of the Company’s 10-K), rather than reporting it upfront in the MD&A or the tax footnote. Schedule II clearly reveals that much of the Company’s earnings increase was achieved by substantially reducing the allowance account for deferred tax assets. The beginning balance in 2011 was $15,664; by the end of the year, the Company had reduced the allowance account to a mere $1,545. That’s a reduction of $14,119!

We have a couple of problems with this valuation allowance driven “earnings” pop. The FASB requires the firm to record a valuation allowance for deferred tax assets whenever it is “more likely than not” (more than 50 percent) that specific tax assets will not be realized. According to Ford’s 2008 MD&A, the Company gradually built up its deferred tax asset valuation allowance to $17.8 billion through increases of $2.7 billion in 2006 (SFAS No. 158 adoption), $1.4 billion in 2007 (FIN 48 adoption), and $9.3 billion in 2008 (U.S. taxable losses). In that same report (page 53), the Company acknowledges that:

A return to profitability in our North America operations would result in a reversal of a portion of the valuation allowance relating to realized deferred tax assets, but we many not change our judgment of the need for a full valuation allowance on our remaining deferred tax assets. A sustained period of North America profitability could cause a change in our judgment of the remaining deferred tax assets. In that case, it is likely that we would reverse some or all of the remaining deferred tax asset valuation allowance. (emphasis added)

So what does GAAP say about reversing this allowance? According to ASC 740, there are a number of positive factors that might suggest that an allowance is not necessary. Principal among these is that there is evidence of sufficient future taxable income, exclusive of reversing temporary differences and carry-forwards. Ford’s 2011 income tax footnote (note 22) outlines the Company’s reversal decision:

At the end of 2011, our U.S. operations had returned to a position of cumulative profits for the most recent three-year period. We concluded that this record of cumulative profitability in recent years, our ten consecutive quarters of pre-tax operating profits, our successful completion of labor negotiations with the UAW, and our business plan showing continued profitability, provide assurance that our future tax benefits more likely than not will be realized. (emphasis added)

Note the “three-year period” language in the note discussion. This is no accident. This is the arbitrary standard created by the Big Four accounting firms (not the standard-setters) to justify either additions or deletions to the tax asset valuation allowance. And not surprisingly, the accountants once again are focused on arbitrary benchmarks, and not reality.

We simply are not convinced that the Company has demonstrated an ability to generate sufficient taxable income to realize reported tax assets. Based on their 2011 total net deferred tax assets of $14,429, and assuming an effective tax rate of 35 percent, Ford needs over $41 billion in future taxable income to realize these assets. Given the Ford’s history, not to mention that of the auto industry, who really thinks this likely right now?

And then there are the economic and political risks that accountants ignore because they can’t be quantified. We do not share Ford’s optimism that the economy is recovering. What recovery exists in the U.S. likely will be temporary as it is supported by massive market manipulations by the Fed, which are just as likely to backfire, given the preponderance of unsustainable debt and the risks for inflation.

Further, the European sovereign debt crisis is far from over. Yes, an accord has been reached among the various European countries, but even now there is discussion that, behind the scenes, Greece is reneging the deal and, worse, that it will default even with the debt relief. In addition, Spain and Italy are suffering their own financial crises. Any of these can lead to major troubles in the Euro zone, which in turn will lead to difficulties for Ford.

Our second concern pivots on cash flows, which don’t support Ford’s net income, thereby confirming the pathetically low quality of earnings. Call us old fashioned, but Financial Analysis 101 raises red flags when net income is rising and operating cash flows are declining, precisely what Ford is reporting for the past three years!

We also can assess this by comparing free cash flow with net income. If the earnings have good quality, this ratio should be one or higher. If the ratio is below one, then the earnings have low quality. In Ford’s case, we obtain the following:

|

2011 |

2010 |

2009 |

|

| Free cash flow/net income |

0.27 |

1.13 |

4.20 |

| Free cash flow/adjusted net income |

0.63 |

N/A |

N/A |

The 2009 and 2010 earnings numbers have reasonably decent quality. However, the 2011 income, by comparison, is in the toilet. Interestingly, even if one reduces the income for the valuation reversal effect, the ratio is still below one.

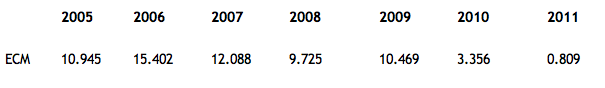

Similarly, the Company’s Excess Cash Margin metric (((operating cash flows minus operating earnings) / revenue) * 100) for the past seven years shows a deteriorating trend.

Accordingly, we don’t think much of Ford’s income number, even if it is higher than past years. In short, more than half of Ford’s income is suspect and the rest does not correlate well with cash flows. We suggest a closer look at Ford’s “better idea.”Ford’s declining ECM suggests that operating earnings are growing more quickly, or declining more slowly than operating cash flows. Neither is a good sign or is sustainable.

This essay reflects the opinion of the authors and not necessarily the opinions of The Pennsylvania State University, The American College, or Villanova University.