Courtesy of William K. Black, at New Economic Perspectives

On March 7, 2012, I testified before the Senate Committee on the Judiciary on the failure to prosecute the elite fraudulent financial CEOs who drove the ongoing crisis. The first witness testifying to the committee was Assistant Attorney General for the Civil Rights Division, Thomas Perez [pic, right]. The focus of the hearing was Countrywide’s massive racial and ethnic discrimination against minorities. Perez testified that there were over 200,000 identified victims of discrimination by Countrywide and that the settlement his office negotiated led to a payment that was 50 times larger than the largest previous settlement. Perez testified that each of these victims of Countrywide’s discrimination will receive between one and two thousand dollars.

On March 7, 2012, I testified before the Senate Committee on the Judiciary on the failure to prosecute the elite fraudulent financial CEOs who drove the ongoing crisis. The first witness testifying to the committee was Assistant Attorney General for the Civil Rights Division, Thomas Perez [pic, right]. The focus of the hearing was Countrywide’s massive racial and ethnic discrimination against minorities. Perez testified that there were over 200,000 identified victims of discrimination by Countrywide and that the settlement his office negotiated led to a payment that was 50 times larger than the largest previous settlement. Perez testified that each of these victims of Countrywide’s discrimination will receive between one and two thousand dollars.

Perez used a baseball metaphor to explain his Division’s response to the endemic discrimination that characterized nonprime lending during the ongoing crisis. He said that the Division lacked any power to achieve a “home run.” He characterized his Division as producing a series of “singles and doubles.” The Division reviewed 2.5 million loans in its investigation of discrimination by Countrywide.

Perez said that when he was a state official in Maryland the housing finance industry worked constructively with him to stop liar’s loans. He expressed complete inability to understand why effective bank internal controls were non-existent at problem banks. Their persistently failed controls mystified him because, as he correctly observed, strong internal controls make a bank healthier and more profitable.

I testified about three topics. First, I explained why the underlying endemic mortgage origination fraud by lenders who made liar’s loans inherently produced endemic predatory and discriminatory lending, foreclosure fraud, and fraudulent sales of mortgages. Second, I showed that the financial regulatory agencies and the Justice Department were allowing such fraud to occur with impunity from criminal sanction. Third, I set forth what would be required to reprise the successes of our actions that held the elite S&L frauds that drove that debacle accountable.

In discussing the second topic I testified:

“The elite financial frauds are treating the United States of America’s criminal justice system and financial markets with utter contempt. They believe they can become wealthy – with impunity – through frauds that cost U.S. households $11 trillion dollars and cost seven million Americans their jobs. Not a single elite fraudster who was instrumental in making the millions of fraudulent loans that drove the crisis has even been indicted – over seven years after the FBI’s September 2004 warnings that there was an “epidemic” of mortgage fraud that would cause a financial “crisis” if it were not stopped. Here is how bad the situation has become. The firms that specialized in making huge amounts of “stated income” loans called such loans “liar’s loans.” This was publicly reported – and nothing effective was done by the markets, by self-regulation, by federal regulators, or by federal prosecutors to stop frauds that were as brazen as they were massive.”

I began my oral testimony by applying Perez’ baseball metaphor to the Justice Department’s failure to prosecute the CEOs that ran the accounting control frauds that drove the ongoing crisis. I explained that civil settlements were one thing, but criminal prosecutions were the big leagues. In the big leagues, I noted that the CEOs of the elite bank were pitching a “perfect game” because none of them had been prosecuted for making or selling millions of fraudulent mortgage loans. Moreover, all the outs were “Ks” – strikeouts. Indeed, the strikeouts were all “called” third strikes – the Justice Department constantly “got caught looking.” It never even got its bat off the shoulder and took a swing (no elite CEO has even been indicted for the fraudulent origination or sale of mortgages).

I began my oral testimony by applying Perez’ baseball metaphor to the Justice Department’s failure to prosecute the CEOs that ran the accounting control frauds that drove the ongoing crisis. I explained that civil settlements were one thing, but criminal prosecutions were the big leagues. In the big leagues, I noted that the CEOs of the elite bank were pitching a “perfect game” because none of them had been prosecuted for making or selling millions of fraudulent mortgage loans. Moreover, all the outs were “Ks” – strikeouts. Indeed, the strikeouts were all “called” third strikes – the Justice Department constantly “got caught looking.” It never even got its bat off the shoulder and took a swing (no elite CEO has even been indicted for the fraudulent origination or sale of mortgages).

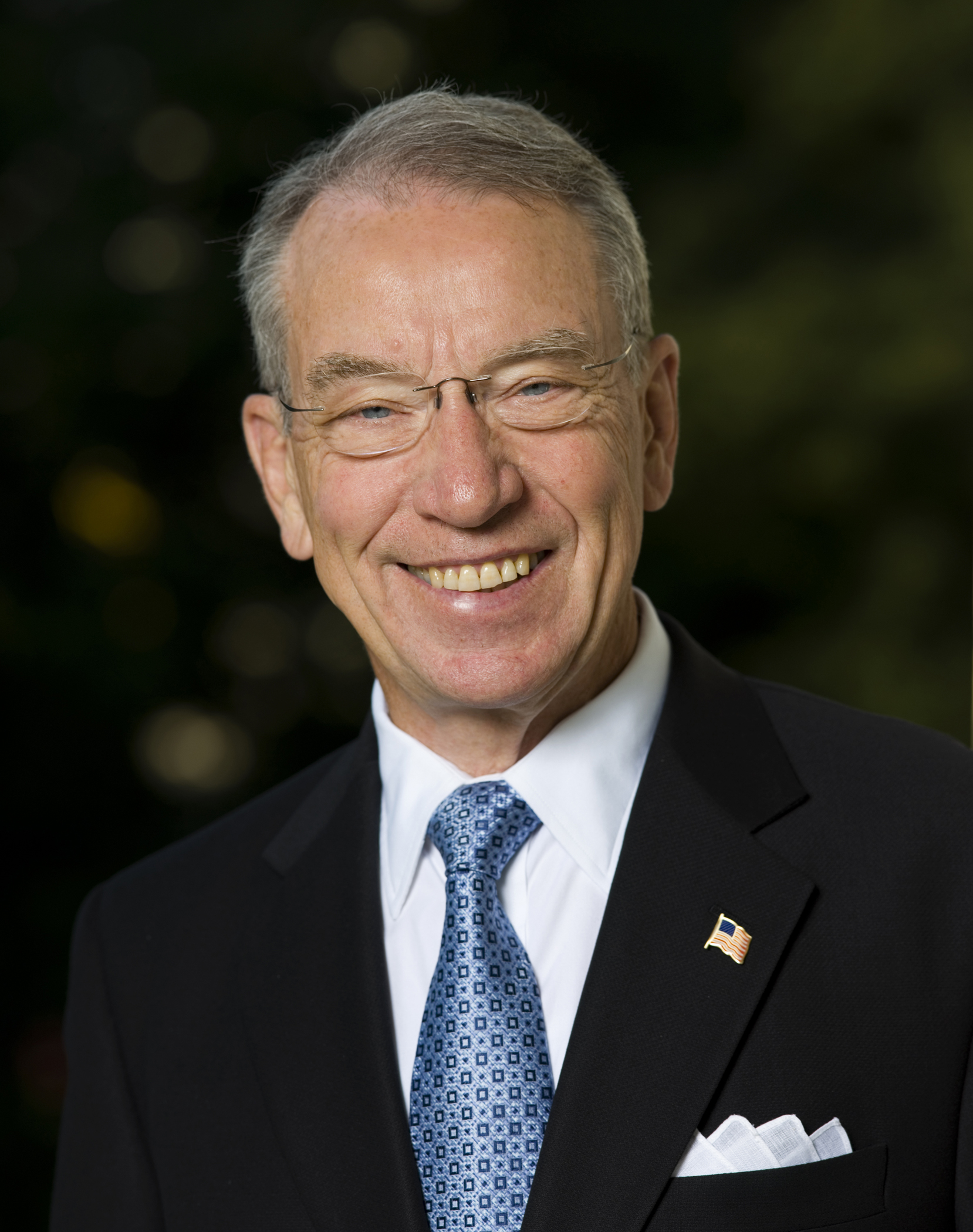

Senator Grassley [pic, right] shared my concerns.

At a Capitol Hill hearing Wednesday on foreclosure abuse and lending discrimination practices, Grassley said the DOJ has done a “terrible job” of prosecuting financial crimes. He said: “The Justice Department has brought no criminal cases against any of the major Wall Street banks or executives who are responsible for the financial crisis.”

Grassley’s criticisms caused the Justice Department to make a critical mistake.

In response to a Legal Times request, DOJ issued a written statement on the criticism. “The Department of Justice, through our U.S. Attorneys’ Offices and litigating divisions, has brought thousands of mortgage fraud cases over the past three years, and secured numerous convictions against CEOs, CFOs, board members, presidents and other executives of Wall Street firms and banks for financial crimes,” DOJ spokeswoman Laura Sweeney said.

Grassley requested the list by the end of the month.

The Justice Department’s problem is that Grassley’s criticism was correct. The Department’s response was deliberately unresponsive. The Department has prosecuted a few thousand of the millions of cases of mortgage fraud. As I explain below, the Department has described the cases it has brought as equivalent to “white collar street crime.” These cases are worse than useless because they ensured that the Department could not devote resources to investigating and prosecuting the “major Wall Street firms and banks responsible for the financial crisis.” It is true that the Department has convicted some senior officers of “Wall Street firms and banks for financial crimes,” but that does not contradict Grassley’s statements. The convictions of elite “Wall Street bankers” have not been for making or selling fraudulent mortgages – the frauds that hyper-inflated the bubble and drove the financial crisis. They have been for offenses such as insider trading and unauthorized trading. Madoff did not make or sell fraudulent mortgages. Overall, Department prosecutions for financial institution frauds are down by over one-half since 20 years ago. Indeed, such prosecutions under Obama are even lower than they were under President Bush.

Source: Syracuse University’s TRAC issued a report on November 11, 2011 entitled “Criminal Prosecutions for Financial Institution Fraud Continue to Fall.”

Perez’ Version of History is False: the Industry Fought to Continue Fraudulent Lending

Two other aspects of Perez’ testimony discouraged me the most. First, his claim that the industry worked constructively to stop liar’s loans is false. The industry massively increased liar’s loans after private and public experts in mortgage fraud warned that liar’s loans were “an open invitation to fraudsters” and that mortgage origination fraud was “epidemic.” Sheila Bair testified before the Financial Crisis Inquiry Commission (FCIC) that stopping liar’s loans would have been the single most effective means of preventing the crisis.

“I think nipping this in the bud in 2000 and 2011 with some strong consumer rules applying across the board that just simply said you’ve got to document a customer’s income to make sure they can repay the loan, you’ve got to make sure the income is sufficient to pay the loans when the interest rate resets, just simple rules like that . . . could have done a lot to stop this [FCIC Report: 79].”

The next paragraph of the report goes on to discuss the industry response to governmental criticism of liar’s loans and proposals to discourage or forbid liar’s loans. It specifically discusses the industry reaction in Baltimore – Maryland’s largest city.

After Bair was nominated to her position at Treasury, and when she was making the rounds on Capitol Hill, Senator Paul Sarbanes, chairman of the Committee on Banking, Housing, and Urban Affairs, told her about lending problems in Baltimore, where foreclosures were on the rise. He asked Bair to read the HUD-Treasury report on predatory lending, and she became interested in the issue. Sarbanes introduced legislation to remedy the problem, but it faced significant resistance from the mortgage industry and within Congress, Bair told the Commission. Bair decided to try to get the industry to adopt a set of “best practices” that would include a voluntary ban on mortgages that strip borrowers of their equity, and would offer borrowers the opportunity to avoid prepayment penalties by agreeing instead to pay a higher interest rate. She reached out to Edward Gramlich, a governor at the Fed who shared her concerns, to enlist his help in getting companies to abide by these rules. Bair said that Gramlich didn’t talk out of school but made it clear to her that the Fed avenue wasn’t going to happen. Similarly, Sandra Braunstein, the director of the Division of Consumer and Community Affairs at the Fed, said that Gramlich told the staff that Greenspan was not interested in increased regulation.

When Bair and Gramlich approached a number of lenders about the voluntary program, Bair said some originators appeared willing to participate. But the Wall Street firms that securitized the loans resisted, saying that they were concerned about possible liability if they did not adhere to the proposed best practices, she recalled. The effort died [pp. 79-80].

One of the members of Senate Committee on the Judiciary, Senator Schumer, has particular reason to know this history of industry and regulatory refusal to stop making millions of fraudulent liar’s loans because he, and a number of his colleagues on the banking committee sought to convince Ben Bernanke to use the Fed’s unique authority under the Home Ownership and Equity Protection Act of 1994 (HOEPA) to end liar’s loans. (A study found that the incidence of fraud in liar’s loans was 90 percent.) Senator Dodd authored the letter to Bernanke (co-signed by nine other Senators serving on the banking committee) on April 23, 2007. The letter appears to have finally prompted Bernanke to end the making of fraudulent liar’s loans. (Investigations have shown that it was overwhelmingly lenders and their agents that put the lies in liar’s loans.)

The Justice Department’s reinvention of history to defend – rather than prosecute – the fraudulent members of the industry that made millions of fraudulent liar’s loans is one of the great problems. The rot is so deep that the FBI announced its “partnership” with the Mortgage Bankers Association (MBA) to respond to the epidemic of mortgage fraud – the trade association of the “perps” – under Mukasey. Holder has left this obscene partnership in place even though it has proven worse than useless. The FBI and the Justice Department adopted, with no critical analysis, the MBA’s ridiculous “definition” of mortgage fraud. The MBA “definition”, which the Justice Department repeatedly parrots, defines accounting control fraud out of existence.

Perez does not understand why Accounting Control Frauds Suborn “Controls”

Perez’ inability to understand why the lenders making liar’s loans had exceptionally poor internal controls demonstrates that even the senior ranks of the Justice Department have failed to learn about “control fraud” by reading the criminology literature, the law literature, the regulatory literature, the economics literature, any of the hundreds of articles in the leading newspapers and financial press, or the testimony of leading criminologists to the FCIC and to the Senate and the House. Control frauds commit the overwhelmingly bulk of discrimination by financial institutions, so Perez has compelling incentives to learn about control frauds.

The CEOs of lenders engaged in accounting control fraud gut effective underwriting and suborn effective internal controls because doing so is essential to maximize the firm’s (fictional) reported income, which maximizes their compensation. The “recipe” for a lender engaged in accounting control fraud has four ingredients: extremely rapid growth through making terrible loans at a premium yield, while employing extreme leverage, and providing only grossly inadequate allowances for the inevitable severe losses. The recipe makes accounting fraud a “sure thing” that promptly makes the CEO wealthy through modern executive compensation (which allows him to loot “his” bank with impunity if the regulators, the FBI, and the prosecutors are ignorant of accounting control fraud schemes).

A bank that is growing massively by making bad loans must gut its underwriting and suborn or defeat its internal and external controls because the bank’s underwriting and internal controls are designed to prevent the bank’s personnel from making large numbers of bad loans. The person controlling a seemingly legitimate bank (typically, the CEO) has the unique ability to suborn internal and external controls and gut underwriting. The CEO can use compensation and the ability to hire, promote, fire, praise, or criticize officers, employees, and outside professionals to suborn “controls” and pervert them into fraud allies.

In one of those examples of the impossibility of competing with unintentional self-parody, the Business Roundtable, the trade association of the largest U.S. firms, chose Franklin Raines as its spokesperson to respond to media enquiries about the Enron era accounting control frauds. Business Week asked Raines why the epidemic of accounting control fraud was occurring.

“We’ve had a terrible scandal on Wall Street. What is your view?

Investment banking is a business that’s so denominated in dollars that the temptations are great, so you have to have very strong rules. My experience is where there is a one-to-one relation between if I do X, money will hit my pocket, you tend to see people doing X a lot. You’ve got to be very careful about that. Don’t just say: “If you hit this revenue number, your bonus is going to be this.” It sets up an incentive that’s overwhelming. You wave enough money in front of people, and good people will do bad things.”

Raines learned that the unit that should have been most resistant to this “overwhelming” financial incentive, Internal Audit; had succumbed to the perverse incentive. Mr. Rajappa, Senior Vice President for Operations Risk and Internal Audit instructed his internal auditors in a formal address in 2000 (and provided the text of the speech to Raines). (“6.46” refers to the earnings per share (EPS) number that triggered maximum bonuses.)

By now every one of you must have 6.46 branded in your brains. You must be able to say it in your sleep, you must be able to recite it forwards and backwards, you must have a raging fire in your belly that burns away all doubts, you must live, breath and dream 6.46, you must be obsessed on 6.46…. After all, thanks to Frank [Raines], we all have a lot of money riding on it…. We must do this with a fiery determination, not on some days, not on most days but day in and day out, give it your best, not 50%, not 75%, not 100%, but 150%. Remember, Frank has given us an opportunity to earn notjust our salaries, benefits, raises, ESPP, but substantially over and above if we make 6.46. So it is our moral obligation to give well above our 100% and if we do this, we would have made tangible contributions to Frank’s goals (emphasis in original).

Raines did not react to the speech with horror even though internal audit’s defining mantra is the auditor’s need to maintain complete independence. Raines responded by giving Rajappa suggestions on how to strengthen the talk. Unsurprisingly, the SEC charged that Fannie Mae engaged in accounting fraud under Raines for the purpose of maximizing the senior executives’ compensation. Sadly, the Department of Justice failed to prosecute.

The Department of Justice’s Leadership Fails to Comprehend Control Fraud or its Risks

The Department of Justice is broken when it comes to prosecuting control frauds. It no longer even understands that they exist and cause greater financial losses than all other forms of property crime – combined. In addition to Perez’ befuddlement at the pervasive and persistent collapse of internal controls at the control frauds that made liar’s loans, consider three similarly revealing comments by senior Justice Department officials.

The U.S. Attorney in one of epicenters of mortgage fraud has a crippling conceptual failure because of his inability to understand the concept of looting.

Not everyone agrees that such a case can be successful. Benjamin Wagner, a U.S. Attorney who is actively prosecuting mortgage fraud cases in Sacramento, Calif., points out that banks lose money when a loan turns out to be fraudulent. An investor in loans who documents fraud can force a bank to buy the loan back. But convincing a jury that executives intended to make fraudulent loans, and thus should be held criminally responsible, may be too difficult of a hurdle for prosecutors.

“It doesn’t make any sense to me that they would be deliberately defrauding themselves,” Wagner said.

Wagner has confused himself with his pronouns. “They” refers to the CEO. “Themselves” refers to the bank. The CEO has a “sure thing” – he can grow wealthy very quickly by looting the bank through the accounting fraud recipe. He is not looting himself. The title of George Akerlof and Paul Romer’s famous 1993 article (“Looting: the Economic Underworld of Bankruptcy for Profit”) says it all. The CEO is quickly enriched by looting “his” bank. Akerlof and Romer emphasized that accounting control fraud is a “sure thing.” (Akerlof was named a Nobel Laureate in Economics in 2001.)

Attorney General Mukasey (under President Bush during the ongoing crisis) infamously refused to create a national task force against mortgage fraud, dismissing it as merely the equivalent of “white-collar street crime.”

Mukasey was correct on one level. The mortgage frauds he instructed FBI agents to investigate were equivalent to white-collar street crimes. They were relatively small cases. None of the major lenders that (collectively) fraudulently originated and sold millions of mortgages was even investigated. Mukasey conveniently forgot that the FBI investigations reported only relatively minor mortgage frauds because he he had assigned the FBI to ignore the elite frauds and undertake the hopeless and useless act of spending all their resources on investigating a tiny number of the millions of smaller fraudulent mortgage loans.

The third embarrassing indicator of the senior Justice Department leadership’s lack of interest in and knowledge of the fraudulent mortgage lenders is Attorney General Holder’s testimony before FCIC. The FBI is, at least officially, part of the Justice Department. (It is an independent duchy in practice.) The Justice Department’s great success with regard to mortgage fraud is the FBI’s September 2004 warning that there was an “epidemic” of mortgage fraud and its prediction that it would cause a financial “crisis” if it were not stopped. The head of an agency’s testimony to an entity like FCIC is drafted by senior staff with expertise in the subject matter and reviewed by senior officials. The centerpiece of Holder’s testimony should have been his Department’s prescient 2004 warning, the critical errors his predecessor (Mukasey) made in rejecting the FBI’s recommendation that its investigations be redirected to focus on the largest fraudulent originators and sellers of mortgages and that he establish a national task force against mortgage fraud. Holder would then explain that he had created the national task force and would vigorously investigate and prosecute the elite frauds. But Holder did not make either of the first two points. The FCIC Chairman, Phil Angelides, immediately asked Holder about the FBI’s September 2004 warning. Holder was accompanied by the head of the Criminal Division and the usual flock of aides. Holder’s answer to Angelides was: “I’m not familiar myself with that [FBI] statement.”

http://neweconomicperspectives.org/2011/11/virgin-crisis-systematically-ignoring.html

Holder’s top aides and expert staffers who prepared his testimony, prepped him for the hearing, and accompanied him must not have known about the FBI’s warning because none of them whispered the answer or passed a note to their boss. The entire senior leadership of the Justice Department did not know about its most praiseworthy action – and didn’t bother to find out in preparing to testify before the national commission investigating the causes of the crisis.

Angelides has written an op ed urging Holder to change his policies and prosecute the elite frauds. Angelides expressed his dismay at Holder’s ludicrous claim that under his leadership the Department’s “record of success has been nothing less than historic” in prosecuting financial frauds.

Conclusion

Why have our two most recent Attorney Generals failed to investigate the largest and most destructive financial frauds in world history or even learn from those with expertise about how such frauds operate? Holder’s aides have now put him in an impossible position by claiming that Senator Grassley’s statement about the continuing failure to prosecute the Wall Street senior officers who drove the financial crisis by making, purchasing, and selling millions of fraudulent mortgages is false. Grassley has called their bluff and demanded that the Justice Department list the specific prosecutions and convictions of these elite officers controlling the major accounting control frauds. We know what will come next from Holder, a list of hundreds of cases designed to hide the fact that Grassley’s statement is true. Reporters will have to spend days going through the list while Holder’s press flacks trumpet his “historic” “record of success.” At the end of the process, Grassley will be proven correct. Holder hopes that the media will have moved on and forgotten the story before Grassley is shown to have gotten it right. I suggest that we use the web to organize a cooperative fact-checking effort that will expose Holder’s effort at obfuscation by the next business day.