Just when I thought I could get bullish, they pull back again!

Just when I thought I could get bullish, they pull back again!

While still EXTREMELY skeptical of this rally, I AM trying to get in the spirit. As I noted yesterday, we have aggressive new levels that we determined in our weekend review of our 5% Rule and still need to see some more progress before we can throw caution to the wind and BUYBUYBUY like it's 1999. Despite our best efforts, the silly move in the Russell yesterday had me putting up a TZA hedge in our morning Member Chat:

RUT made a crazy move from 823 to 830 this morning for no good reason. TZA April $17 puts can be sold for $1 and the the $17/18 bull call spread can be bought for .42 for a net .58 credit for a $16.42 net entry with TZA currently at $17.73 so it's a hedge with a bet against RUT 850 in 30 days.

At 1:23, I followed up by saying: "Look at the RUT now, stuck at the 1.25% line. Obviously, 840 is the 5% move up from the new 800 base so we take that and expect an 8-point pullback but the indexes have been routinely overshooting by 20% (848) and even 40% (856) before pulling back so now that we're past 840 without a pullback, we'll just have to wait and see but, no matter what, we should expect to see 832 re-tested eventually, which is why I liked the TZA play as they crossed that line this morning."

As it worked out, that was the dead top of the RUT and we quickly got our break back below 840 and our ride down to 832 at the close. At 2:50, the Russell Futures failed to get back over 840 and my comment to Members was: "840 on RUT, this is the spot to press those shorts if ever." As you can see from the above chart – we went very nicely off a cliff right after that. JRW, our Russell expert had called the bull run and was ahead of me at 2:29, calling "Back to cash!" and my comment, also at 2:50 was:

As it worked out, that was the dead top of the RUT and we quickly got our break back below 840 and our ride down to 832 at the close. At 2:50, the Russell Futures failed to get back over 840 and my comment to Members was: "840 on RUT, this is the spot to press those shorts if ever." As you can see from the above chart – we went very nicely off a cliff right after that. JRW, our Russell expert had called the bull run and was ahead of me at 2:29, calling "Back to cash!" and my comment, also at 2:50 was:

Cash/JRW – I agree. As I said last week, better to miss 5% of the next round of foolishness than play this nonsense. Much fun as it seems to switch off the old brain and buy with the herd, I would hate to miss the opportunity to go short if this all breaks down as that's going to be one hugely profitable trade if it ever happens.

We're clearly at an inflection point and what we have to be on Alert for is a subtle change of sentiment from the media. The news is already bad, it's been bad all quarter – but only now are some analysts finally putting the pieces together. Suddenly S&P's Capital IQ is finding that projections for Q1 earnings are now as low as 0.5% growth, not even 1/4 of expectations by those people we lovingly refer to as "economorons," who are able to miss their estimates by HUNDREDS of percent on a regular basis yet remain employed.

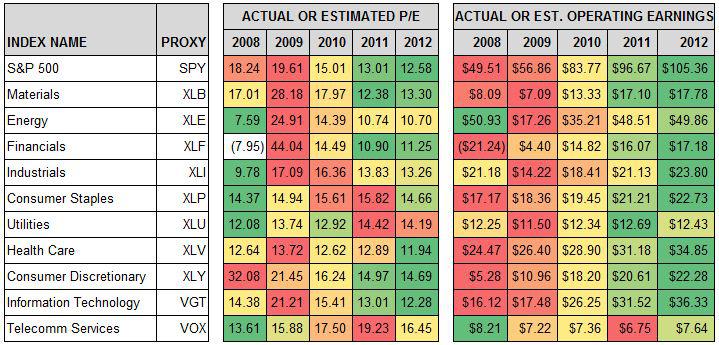

"Traders are now really fearful that companies are not going to be able to hit their earnings targets next time around," says Todd Schoenberger, managing director at LandColt Trading in Lewes, Del. "That may be the catalyst to really get stocks trending lower, and it could very well stay that way the rest of the year." S&P is expecting full-year earnings growth of 5 percent that would send the "500" to an aggregate of about $105 per share.

"Traders are now really fearful that companies are not going to be able to hit their earnings targets next time around," says Todd Schoenberger, managing director at LandColt Trading in Lewes, Del. "That may be the catalyst to really get stocks trending lower, and it could very well stay that way the rest of the year." S&P is expecting full-year earnings growth of 5 percent that would send the "500" to an aggregate of about $105 per share.

In this upcoming period earnings season officially kicks off April 10 when AA reports. The best sectors are expected to be Industrials (10% growth) followed by Information Technology (4%) and Consumer Discretionary (3%). The weakest sectors likely will be Materials (down 15.5%), Telecom (-14%) and Utilities (-4%), according to Sam Stovall, S&P's chief equity strategist. In all, six of the 10 S&P 500 sectors are likely to see earnings declines. Companies themselves have been preparing investors for a letdown, with the level of negative preannouncements at their highest level since the March 2009 market lows.

I pointed out way back on Feb 29th that a large portion of the S&P's projected 10% jump in 2012 profits were coming from one-time reversals of loan-loss reserves by the Financials. Their anticipation of a rosy economic outlook allows them to, once again, throw caution to the wind and minimize the cash set aside for a rainy day – declaring the cash they free up as profits. This has nothing to do with actual economic growth and the fact that the 2008 loan-loss reserves were inadequate to the tune of a $780Bn TARP bailout seems to have been a lesson lost on both the banks and their regulators as we are right back to where we were before the crisis exposed what idiots we were at the time.

Another one-time benefit that is boosting earnings are the tax-loss write-offs that are still on the books to the tune of almost $1Tn for US corporations. This allows them to drop much more money to the bottom line, tax-free, than they would under ordinary circumstances.

Another one-time benefit that is boosting earnings are the tax-loss write-offs that are still on the books to the tune of almost $1Tn for US corporations. This allows them to drop much more money to the bottom line, tax-free, than they would under ordinary circumstances.

X, for example, wrote off $1.7Bn in 2009 and another $464M in 2010 and even another $2M last year so they will have to earn over $2Bn before they have to pay taxes again and that will inflate their apparent net income by 35% – THIS is why you see a pop in S&P "earnings" – it has little to do with an economic "recovery" but that's the story they are selling.

As I'm still trying to get bullish, I won't get into the issues in Europe or China or the wobbly US local economies or the fact that the S&P is downgrading US CDOs in a move that may make current rates unsustainable. We won't discuss the fact that Hedge Funds dumped 78% of their 2-year TBills in last week or the IATA lowering their Airline profit forecast for 2012 by 14% China's slowdown (good slide show from BHP that sparked the morning sell-off) or the way China's Stock Market has become a complete, unregulated joke.

No, instead we will accentuate the positive and say that things are still looking good because they are looking good and looking good is all that matters, right Fernando? Will the market continue to look marvelous or will early Q1 earnings this week bring us back to reality – we are trying our best to keep an open mind…