Good morning sheeple!

Good morning sheeple!

After being jammed into equities all month on an endless string of empty promises, I'll bet you're wondering what to do next.

Well, isn't that the problem? You shouldn't be waiting for someone to tell you what to do with your money – it's ridiculous. The whole industry of Financial Advisers is ridiculous – swarms of leeches who prey on your confusion and take 1% of your money or more PER YEAR. Did it ever occur to you that 1% of your money per year is HALF of your money after 50 years in their care?

That's right, you work hard to make money, you sacrifice to save it and then you PAY someone else to take it from you and play with it. Isn't that silly? We pointed out on Monday that the average performance of even the best Financial Advisers is WORSE than flipping a coin yet still, the vast majority of people in this country let other people handle their investments – that's not even rational…

Of course, the Financial Community does their best to keep the whole thing as confusing as possible and the regulators pass rules that herd small investors into very narrow ranges of choices, most of which are funds that collect fees of some sort. How is it that our Grandparents did quite well for themselves just buying AT&T and putting it in a draw for 30 years – getting their dividend checks and benefitting from the growth of the company? Was Grandpa that much smarter than you?

No, he wasn't – he simply wasn't influenced by the Big Business-backed Mainstream Media who sell investments the way they used to sell cigarettes – telling consumers that many products that are dangerous to your financial health are actually good for you or, in the very least – will make you "cool".

Unfortunately, by accident or by design, investing and economics are not taught in our schools – other than to the business majors who end up going to work for the companies whose sole purpose in life is to get their hands on your money and rape you for fees – isn't is interesting how things worked out that way? All the "sophisticated" investors work AGAINST you and all the unsophisticated investors – the perennial bottom 99% – simply go to work and, if they accidentally accumulate enough money to save, they are ill-prepared to make good decisions which creates a "need" for Financial Advisers, who will then set about relieving the workers from about 1/2 of whatever they save through fees.

I spend a lot of my time teaching people how to break the cycle of dependency on the advice of others (and yes, I realize that's ironic but someone has to do it). At Philstockworld, we follow the model of "Give a man a fish and you feed him for a day but teach a man to fish and you feed him for life." We want to teach people to "be the house" not the gambler and to make those slow and steady profits over time that can build true wealth.

I spend a lot of my time teaching people how to break the cycle of dependency on the advice of others (and yes, I realize that's ironic but someone has to do it). At Philstockworld, we follow the model of "Give a man a fish and you feed him for a day but teach a man to fish and you feed him for life." We want to teach people to "be the house" not the gambler and to make those slow and steady profits over time that can build true wealth.

While a lot of people are turned off by the market manipulation – we love it. We love it because it's blatant and obvious and, most importantly, predictable and that allows us to profit from it.

All week long we've been nailing our oil calls and yesterday was no exception as I said in the morning post that oil would be selling off sharply – due to Fundamentals we have been discussing for ages – and I even outlined our in-progress SCO trade – the same one I gave out on TV on March, 5th – which was already up to net $260 per contract yesterday (up 246% from our net $75 entry) and is at net $3.25 as of yesterday's close, which is now up 333% since March 5th but up 25% since YESTERDAY MORNING!

Now I say the markets are fixed and there is an identifiable pattern that I can teach you to pick up on. It is possible that I'm wrong and they are not fixed and I am just psychic – but I have taught hundreds of people to be just as "psychic" based on my premise that the markets ARE fixed AND predictable – so I will choose to stick with my delusion, thank you! My "vision" at 9:44 in yesterday's Alert to Members was:

Watch the dollar, over 79.50 will not be good for market and of course oil futures are a go below the $105 line.

At 10:32 we had the Natural Gas report and my comment in Member Chat was: "Nat gas crushed on 57 bcf build! Bad for oil too so you might want to widen the stops." At 11:21 I noted: "Wow, Nat gas down to $2.17. Euro holding $1.325, Pound holding $1.585 with a bounce back over $1.59 already and Yen perking up (down/weaker) at 82.36 so not over for the bulls yet."

At 10:32 we had the Natural Gas report and my comment in Member Chat was: "Nat gas crushed on 57 bcf build! Bad for oil too so you might want to widen the stops." At 11:21 I noted: "Wow, Nat gas down to $2.17. Euro holding $1.325, Pound holding $1.585 with a bounce back over $1.59 already and Yen perking up (down/weaker) at 82.36 so not over for the bulls yet."

At 11:44 we decided to shift bullish as I said: "Volume is still low and we may get a save into tomorrow or sometime tomorrow but, unless it makes up A LOT of ground – we're still going to look toppy. Over Dow 13,000 in Futures is a bullish sign (now 12,988) and I think the RUT can be played bullish over 820 for a bounce but, coming down from 840 means still very bearish until they pop 825 and not impressive until over 828."

At 1pm, we began to take profits in our virtual $25,000 portfolio ($6,000 cashed in yesterday) and my comment to Members at the time was: "$103 was good money on oil for Futures players – I hope you took it and ran." I was actually early there as oil slipped another .87 but a $2,000 per contract gain in a single day on oil futures is a lot and we already had a lot of USO puts from the $25,000 portfolio so we hadn't gone bullish yet but, at 1:46 I warned our Members: "Oil has every reason to bounce off $102.50 back to $103.50 (the 50 dma) – if it doesn't, the 200 dma is at $95!" By 2:02 we stopped out of our USO April $41 puts at $2.25 with very nice 73% gains and we were done – until this morning as we now have our expected bounce back to $103.50!

I reminded Members at 2:46 that the action was right in line with our "conspiracy theory," saying:

I reminded Members at 2:46 that the action was right in line with our "conspiracy theory," saying:

It's what we expected, they can't do all the window-dressing in one day and this sell-off was very likely a big fund taking advantage of the pumpers and selling into them ahead of the EOQ so they are forced to buy all the crap he's selling. Once Mr. Seller exhausts himself, the pump-bots can take back over.

Those RUT (/TF) Futures turned out to be excellent bounce plays – 826 already puts the stop at 825 – congrats to the players!

As you can see from the chart above – that was one VERY profitable trade! We are out in the Futures as we flipped bearish in early morning Member Chat as we hit our 835 goal again and we're back to very cashy and very cautious into the weekend and we'll be adding back some more short positions into our $25KP during today's Member Chat as well as going over our Long Put List as we're still a little skeptical of all the bull that is being slung at the markets this week.

What's our biggest concern? It's still those pesky bottom 99% consumers and the fact that they simply don't have the money to support a 30% run-up in the market – unless, of course, actual earnings and revenues don't matter anymore – then we can carry on with our rally. And we might – we've seen it happen before and, if the Fed is promising endless supplies of free money – it's even a little bit rational to run stock prices higher ahead of the inevitable inflation.

HOWEVER – we are not going to see inflation until we see WAGE INFLATION and Personal Income was up just 0.2% in February vs. 0.4% expected and 0.3% prior so the bottom 99% gets half of what was expected but higher gas and food prices forced Personal Spending UP 0.8%, a 300% increase over January's 0.2% as the bottom 99% sink deeper and deeper into debt to keep running on this insane economic treadmill.

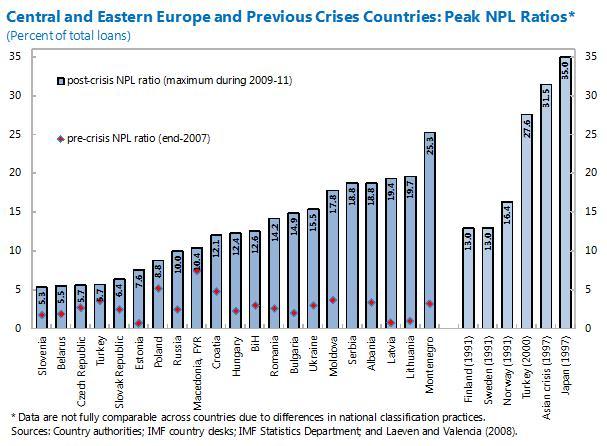

It's not just the US consumers that are under duress – German Retail Sales fell 1.1% against expectations by Economorons that they would be up 1.2% – almost a 200% miss! That's the 4th decline in 5 months but don't expect it to matter today as there are windows to be dressed, you know. That's not even the worst number out of Europe. The IMF is warning that, In emerging Europe, the share of loans classified as nonperforming—many of them household mortgages—have exploded from 3% before the crisis to 13%. As can be seen in the chart below, levels in some parts of the Baltics and Balkans are already at par with previous financial crises elsewhere – illustrated on this shocking chart:

Yes, cash is good, CASH IS KING!

If the markets run up today, you know we'll be shorting into the hype but, if they fail to run up today – look out below…

Have a great weekend,

– Phil