Gasoline Prices Approach Highest Ever; Who is to Blame?

Courtesy of Mish

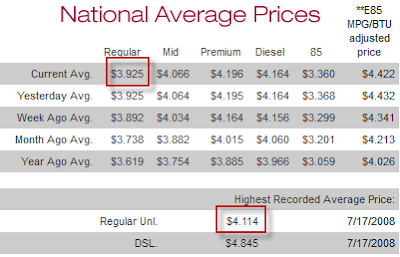

National gasoline prices inch ever so higher. The national average is now $3.925, approaching the all-time high of $4.114 on 7/17/2008 according to the Fuel Gauge Report.

Locally, my price in Northern Illinois is about $4.28. Illinois' average is $4.25. Prices in Chicago are higher.

Obama Finds Oil in Markets Is Sufficient to Sideline Iran

The New York Times reports Obama Finds Oil in Markets Is Sufficient to Sideline Iran.

After careful analysis of oil prices and months of negotiations, President Obama on Friday determined that there was sufficient oil in world markets to allow countries to significantly reduce their Iranian imports, clearing the way for Washington to impose severe new sanctions intended to slash Iran’s oil revenue and press Tehran to abandon its nuclear ambitions.

One senior official who had met with the Saudi leadership, said: “There was no resistance. They are more worried about a nuclear Iran than the Israelis are.”

Still officials said, the administration wanted to be sure that the Saudis were not talking a bigger game than they could deliver. The Saudis received a parade of visitors, including some from the Energy Department, to make the case that they had the technical capacity to pump out significantly more oil.

But some American officials remain skeptical. That is one reason Mr. Obama left open the option of reviewing this decision every few months. “We won’t know what the Saudis can do until we test it, and we’re about to,” the official said.

The new sanctions — which effectively force countries to choose between doing business with the United States and buying oil from Iran — threaten to fray diplomatic relationships with close allies that buy some of their crude from Tehran, like South Korea.

But in a conference call with reporters, senior administration officials said they were confident that they could put the sanctions in effect without damaging the global economy.

“There is no rational reason why oil prices are continuing to remain at these high levels,” the Saudi oil minister, Ali Naimi, wrote in an opinion article in The Financial Times this week. “I hope by speaking out on the issue that our intentions — and capabilities — are clear,” he said. “We want to see stronger European growth and realize that reasonable crude oil prices are key to this.”

By certifying that there is enough supply available, the administration is also trying to gain some leverage over Iran before a resumption of negotiations, expected on April 14.

Saudi Arabia Will Act to Lower Soaring Oil Prices

Ali Naimi, minister of petroleum and mineral resources in Saudi Arabia, claims Saudi Arabia Will Act to Lower Soaring Oil Prices

High international oil prices are bad news. Bad for Europe, bad for the US, bad for emerging economies and bad for the world’s poorest nations. A period of prolonged high prices is bad for all oil producing nations, including Saudi Arabia, and they are bad news for the energy industry more widely.

It is clear that sustained high prices are starting to take their toll on European economic growth targets. They are contributing to trade balance deficits and feeding inflationary pressures. It is an unsatisfactory situation and one Saudi Arabia is keen to help address. In an interconnected world, European economic growth is in our national interest. No one benefits from a stagnating European economy and we want to do what we can to help encourage growth.

It is clear that geopolitical tensions in the region, and concerns over supply, are helping to keep prices high.

Yet fundamentally the market remains balanced. It is the perceived potential shortage of oil keeping prices high – not the reality on the ground. There is no lack of supply. There is no demand which cannot be met. Total commercial stocks for OECD nations are within target, and there is at least 57 days forward cover, enough to handle almost any eventuality.

So what can Saudi Arabia actually do?

We want to correct the myth that there is, or could be, a shortage. It is an irrational fear, a fear without basis.

For the record, as things stand today, our inventories in Saudi Arabia and around the world are full. Our Rotterdam inventory is full, our Sidi Kerir facility is full, our Okinawa facility is full – 100 per cent full.

So the story is one of plenty. Supply is not the problem, and it has not been a problem in the recent past. There is no rational reason why oil prices are continuing to remain at these high levels.

I hope by speaking out on the issue that our intentions – and capabilities – are clear. We want to see stronger European growth and realise that reasonable crude oil prices are key to this.

Over the past 200 years, oil has powered incredible, and unprecedented, economic and social progress in Europe and the wider world. It has transformed our lives and will continue to power the global economy for many decades to come. It will only do so if prices reach a more reasonable level – so it is in all our interests to do what we can to achieve this aim.

Who is it Blame For High Oil Prices?

I am skeptical of the Saudi claim over the long haul. Near-term however, assuming you believe the Saudi story, then who is to blame?

The answer is not oil speculators. The answer is central banks pumping liquidity in unheard of amounts coupled with Mideast tensions caused by Obama's policy.

Central banks can print money, but they cannot determine where it goes, if anywhere. The Fed wants banks to lend and home prices to rise.

Instead, we have high global oil prices and arguably another stock market bubble.

So who is to blame? The answer is easy: Obama, the Fed, and central banks in general.

Don't look to Mitt Romney for the answer. His war-mongering policies exceed those of president Obama and that would likely make matters far worse.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com