NOW things are getting interesting!

Who wants a market that goes up and up and up – where's the sport? Even the Nasdaq finally blew it's 15-week winning streak and that helped us decide to stay pretty bearish going into yesterday's close. This morning we went over the news and the week's data to position ourselves for the Futures and my conclusion to Members in our special 4:03 am Alert was:

Next week we get the BBook, PPI and CPI but the focus will be on earnings and AA is not likely to get us off to a good start so I simply don't see anything in particular to be bullish about at the moment.

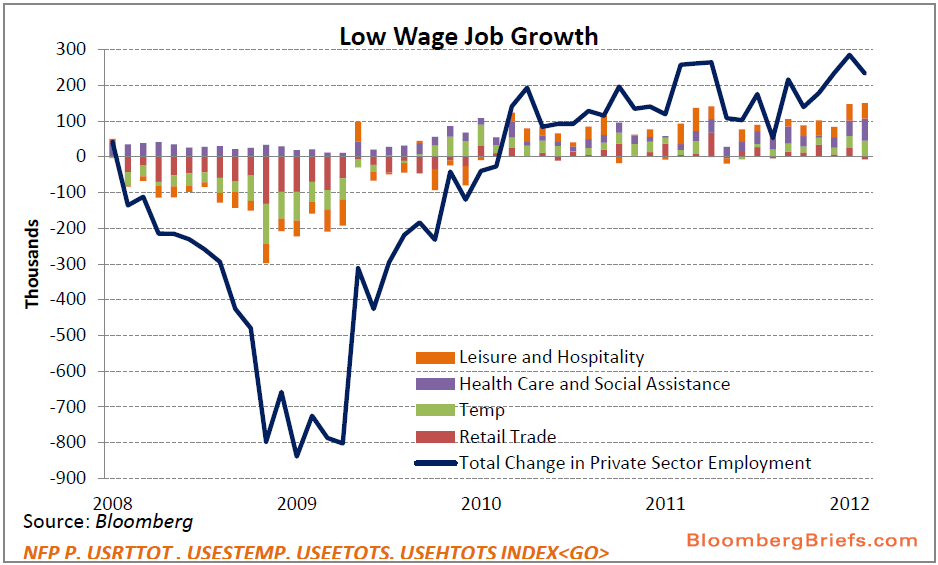

The point I had been making (with many charts and graphs) was that it didn't matter if we added even 250,000 jobs – it still isn't enough to begin to fill in the hole in any meaningful way and, even more important, the QUALITY of jobs we have been adding is TERRIBLE!

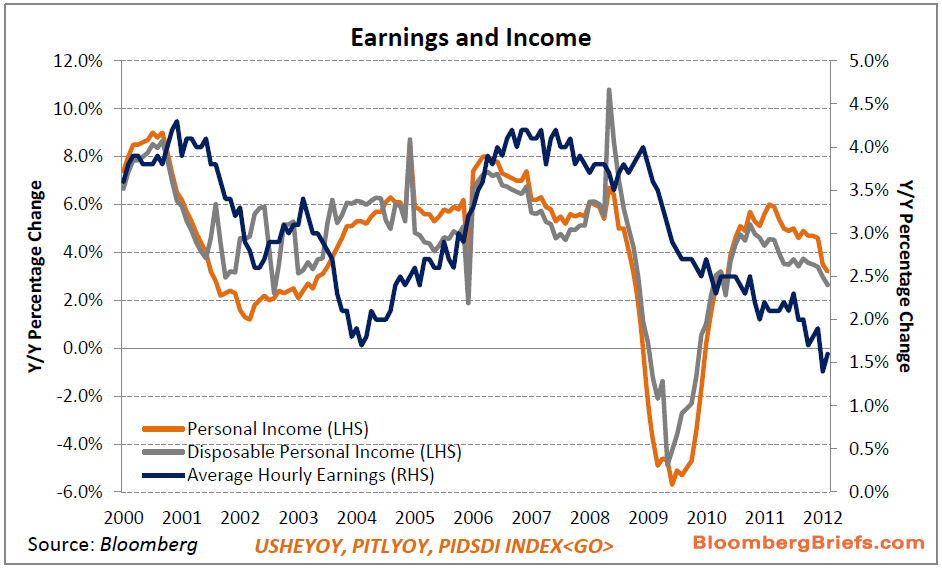

It doesn't matter if you give everyone a job if they are only minimum wage jobs. We need our consumers to have an income to spend and aside from inflation (real inflation, not the Fed's BS numbers) eating into their buying power, when someone loses a $50,000 job and replaces it with a $35,000 job – that's NOT an improving economy – not for the long run, anyway.

Of course the stock market will like it, at first – as lower wages paid for the same job = greater Corporate Profits but that only works as long as there are people outside your country who have money to buy your goods.

Of course the stock market will like it, at first – as lower wages paid for the same job = greater Corporate Profits but that only works as long as there are people outside your country who have money to buy your goods.

As we noted just yesterday with the Retail Reports, the high-end stores are doing very well as the top 10% is doing well but those serving the bottom 90% are struggling because, clearly, these people are running out of money. While the market has been content to "ignore and soar" during this gathering storm, now we begin to see the size of the wave that's coming in and it's starting to look scary indeed…

8:30 Update: An anemic 120,000 Jobs added in March! That's about 1/2 of what was expected by Economorons, who can't even get a handle on a major, critical number like Payrolls – how scary is that? So many of the assumptions made regarding long-term earnings, deficits, consumer demand, etc. are based on economic forecasts that are COMPLETELY WRONG!

We, at Philstockworld, have access to the same information that these "Economists" do (less, I would think) yet our little group is able to consistently get things right while the "professionals" haven't been right – at all – other than the occasional accident from time to time. Just this morning, in fact, ahead of this TERRIBLE jobs report, Mb22 was saying in our Member Chat:

I was at a table of 14 people last night, two were laid off this week, one was laid off last month, and one is closing up his business because he is losing money on it. I know this is only anecdotal and not a representative sampling, but it certainly shakes faith that things are getting stronger. (I live in the Raleigh Durham area.)

There – in one short paragraph, we have better information from Mb22 than we had from an entire week of drivel on the MSM. When you have a group of intelligent, engaged investors from around the World, like we do at PSW, it's amazing what you can find out in the course of a day's conversation! Our Build a Berkshire Workshop (Members Only) is a project we are undertaking to harness the market intelligence we have available to us and it's a very exciting project (and Members, please be sure to get into the database Craig has set up).

The Futures, are of course, down sharply and I love to say "I told you so" so, I told you so (especially Econodoc over at Seeking Alpha, who I really hope wised up this week). As I mentioned in Wednesday morning's post, in last week's issue of Stock World Weekly (An Executive's Summary of the Global Markets by Philstockworld) we featured our famous Long Put List. I even encouraged non-Members to at least sign up for a FREE TRIAL, so they could read the list and prepare themselves for the coming crash.

The Futures, are of course, down sharply and I love to say "I told you so" so, I told you so (especially Econodoc over at Seeking Alpha, who I really hope wised up this week). As I mentioned in Wednesday morning's post, in last week's issue of Stock World Weekly (An Executive's Summary of the Global Markets by Philstockworld) we featured our famous Long Put List. I even encouraged non-Members to at least sign up for a FREE TRIAL, so they could read the list and prepare themselves for the coming crash.

I also put up a trade idea for TLT, the April $110/111 bull call spread at .57, which should be well on track for a 75% gain on Monday. This is just the stuff we give you for free people! That's why my conscience is very clear when I do get the opportunity to say – I told you so!

Of course 75% is nothing compared to some of our other picks. While we're still waiting for PCLN and CMG to give up the ghost, on Wednesday, 3/28 we also gave out free trade ideas of the AAPL May $495 puts at $2.45, which were $1.79 (down 26%) as of yesterday's close but should be interesting on Monday. In that same post I also mentioned the USO April $40 puts at .65, which we liked so much we added them to our virtual $5,000 Portfolio and those topped out at $1.81 this week, up 178% in 7 days for a very nice annualized 9,280%!

We also called the oil Futures short at $107.50 the previous day and they were down to $105.50 on Wednesday morning but that was still the high point since and another $4+ was made after on the Futures and, at $10 per penny per contract, the ride from $107.50 to $101 in a week was good for $6,500 per contract. Yesterday, oil got back to our lower shorting line at $103.50 and we, of course, added a new SCO trade idea in Member Chat – that should do well on Monday as well!

On Thursday, the 29th, we discussed our prior SCO trade (the one I had given out on BNN earlier in the month), which was already up 246% at the halfway mark, with a goal of hitting 433% at April Expirations on the 19th. Even making a later entry, getting from 246% to 433% is a nice 76% additional ROI. We also discussed our rolling strategy for PCLN puts, which are now up to the July $560 puts at $6 and we're still only in our 1x round!

We also discussed in detail why we were still bearish on Natural Gas (/NG in Futures) at $2.32 and Nat Gas finished the week way down at $2.09 – still with no floor in sight. Last Friday, March 30th, I summed things up as we finalized our month's plan to "Sell in March and Go Away" with the post I titled "Friday Fade – March Goes Out Like a Lamb (To the Slaughter)" where I concluded the post with:

We also discussed in detail why we were still bearish on Natural Gas (/NG in Futures) at $2.32 and Nat Gas finished the week way down at $2.09 – still with no floor in sight. Last Friday, March 30th, I summed things up as we finalized our month's plan to "Sell in March and Go Away" with the post I titled "Friday Fade – March Goes Out Like a Lamb (To the Slaughter)" where I concluded the post with:

Yes, cash is good, CASH IS KING!

If the markets run up today, you know we'll be shorting into the hype but, if they fail to run up today – look out below…

Monday's post was titled "New Quarter Not so Shiny" and I reviewed the "disturbing data" saying:

These are NOT cards you want to be playing with unless you are forced. That's the thing, GS, JPM, MS, Fund Managers, etc – they HAVE to play. Since they have to play whatever cards that are dealt – they do the logical thing – THEY BLUFF! Although what's scary about the Banksters is that, when they bluff, it's like the dealer bluffing because they control so much of the game and their only real goal is to get you to play so they can rake your money (see Friday's post for more on this scam).

Europe is CLEARLY in a Recession, yet no one is willing to call it. Asia has been contracting all year and there's nothing too exciting about the US data either (only when compared to the crash) yet the markets are partying like it's 1999 – as if there is literally not a care in the World. Yet US Corporations – the same ones that are supposedly doing so great – have dropped the equity participation of their pension funds to decade lows.

We've already discussed record levels of insider selling at US Corporations and, as you can see from the chart on the right, volume is drying up as the markets rally – indicating the "smart" money is heading for the exits as those fools rush in to hold the bags. Speaking of bagholders – congrats to all of our GRPN shorters as that company is finally imploding as the Company reports "Material Weaness" and restates their quarterly revenue. Gee, maybe they aren't worth $10Bn with $3Bn in revenues and no profits…

In Tuesday's post, we discussed why we were shorting CMG and their $8.50 burritos and my short call in that morning's post – available for FREE to the general public – was the QQQ May $67 puts at $1.08, which actually opened at .96 and finished the week at $1.28, up 33% in 2 days being what we call at PSW "a good start." I also listed a DDM bullish spread, which we did add to our very bearish $25KP as a hedge, but my comment for the post was:

We still favor cash in this very uncertain market but we've been more enthusiastic about adding bearish trade ideas, on the whole. Our very bearish, very aggressive, short-term $25,000 Portfolio gained a virtual $20,000 in the past two weeks DESPITE the fact that we're re-testing the tippy top of the market.

That's because we are essentially doing the opposite of "buying the dips", which is "selling the rips" – taking advantage of the excitement of the bulls, who are whipped into an almost daily frenzy by these low-volume rallies.

Two days ago was "Wednesday Wheeeee – No More QE For You!" and things were already going our way so we discussed 10 BULLISH Trade Ideas – the same 10 we had used when we were bullish back on 2/22 as trades to watch on the way back down. Those QQQ May $67 puts were just $1.07 on Wednesday morning so of course we re-picked them – as that was our original target entry from Tuesday's post. Up .21 from Wednesday is still a nice 19% gain in a day on yesterday's close and boy do we sleep well over a long weekend having hedges like that!

Two days ago was "Wednesday Wheeeee – No More QE For You!" and things were already going our way so we discussed 10 BULLISH Trade Ideas – the same 10 we had used when we were bullish back on 2/22 as trades to watch on the way back down. Those QQQ May $67 puts were just $1.07 on Wednesday morning so of course we re-picked them – as that was our original target entry from Tuesday's post. Up .21 from Wednesday is still a nice 19% gain in a day on yesterday's close and boy do we sleep well over a long weekend having hedges like that!

I also mentioned our short on the Russell Futures (/TF) below the 836 line and that's already on the 800 line this morning at $100 per point per contract and Oil Futures (/CL), as usual, at our $103.50 line, where we caught a nice dip to $101.50 for $2,000 per contract gains. And, of course, I continued to mention PCLN, where the July $560 puts were just $7 (now $6), saying "If they are going to keep offering cheaper puts on PCLN ahead of earnings – we'll take 'em!"

Yesterday it was in the bag as Goldman Sachs finally capitulated and flip-flopped to an S&P 1,250 call – even lower than my March 2nd prediction for a 10% correction to RUT 775, which would be roughly S&P 1,325. I guess we'll see next week how things shake out but it's not to early to congratulate the bears, who had a very rough ride in March but have already been well-rewarded in the first week of April.

Have a great holiday weekend,

– Phil