Are you buying the dips?

Are you buying the dips?

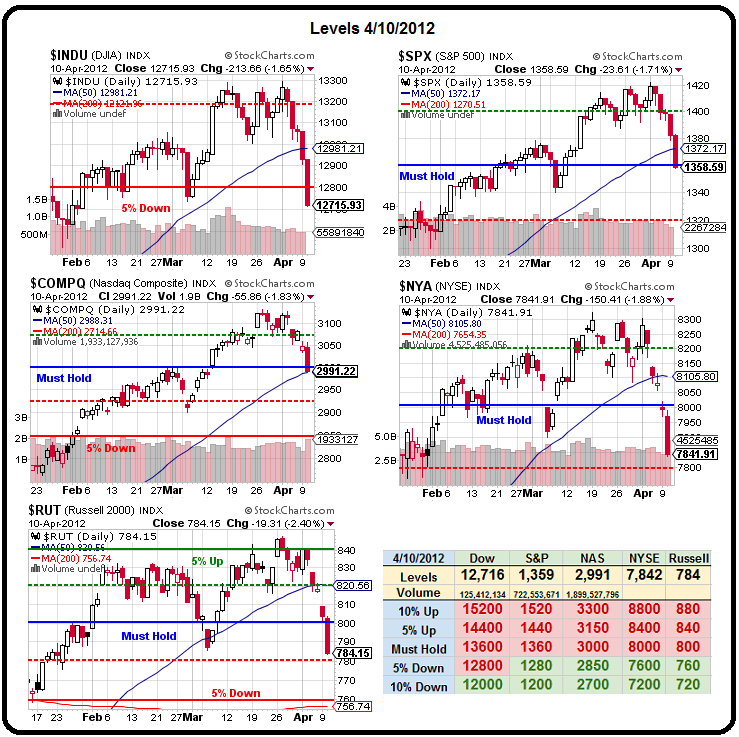

We're not yet. Notice that we've now blown 4 of our 5 Must Hold lines (the Dow never did make theirs, which kept us bearish in the first place) and, technically, the S&P failed to hold 1,360 as well but close enough to avoid panic so far.

Falling from 1,420 to 1,360 is 60 points so we'll be looking for a weak bounce (20% retracement) to 1,372 and a strong bounce (40%) past 1,384 would get us back in a buying mood but let's not count those chickens before they're hatched.

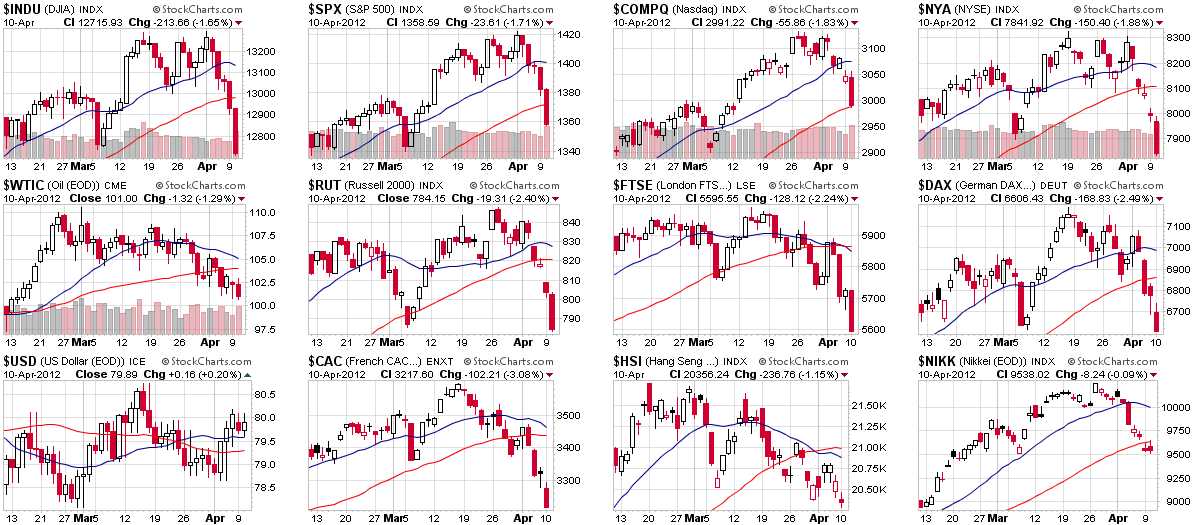

France and Germany are bouncing 1.5% this morning as the Euro stages a recovery back to that critical $1.31 line and the UK is up 0.77% (7:40) with the Pound back at $1.59. We noted in Member Chat that this seems like SNB buying to support that 1.20 line on EUR/CHF as we;re certainly not getting a move back up in copper ($3.65), Natural gas ($2.04) or gasoline ($3.24) that we'd expect if we had any additional stimulus or some sort of positive economic data. Even gold is down this morning ($1,659) so I do not have a lot of faith in this early-morning market movement so far.

Clearly we're not going to get excited about anything until our indexes can at least take back those 50 dma's (red lines) and the Dollar holding it's line at 79.60 is also bad news for the bulls. To keep that 1.5% gain in perspective, it's 88 points – back to 6,695 and we're down from 7,150 so "only" 5 more 1.5% up days to go and Germany is back on top.

This is always the tricky part about retracements – it's not so much what you get on the bounce (not even 20% on the DAX), but is the bounce going to be sustainable to get you to 6,850, which is the 20 dma (3% higher than we are now) and then to 7,000, which is the falling 50 dma – 5% over the current mark?

This is always the tricky part about retracements – it's not so much what you get on the bounce (not even 20% on the DAX), but is the bounce going to be sustainable to get you to 6,850, which is the 20 dma (3% higher than we are now) and then to 7,000, which is the falling 50 dma – 5% over the current mark?

Keep in mind that the longer it takes to retake the 50 dma, the more it curves down and then you are running into a declining 50 dma, which has a much better chance of rejecting you – especially as you are running out of gas after having to climb 5% just to get there.

With the S&P, we're now down 4.5% in 5 sessions so a 0.9% bounce is WEAK and won't even get us to that 50 dma at 1,370 or our 1,372 bounce target on our 5% Rule Big Chart. Anyway, enough of that TA BS – the real question is – do we have any FUNDAMENTAL REASON to get more bullish?

No, we do not.

Let's start with Poppa Germany, who just held a FAILED bond auction this morning. That's right, this morning Germany offered $6.54Bn worth of 10-year notes at 1.75% and only sold $5.07Bn as investors said "Nein!" to letting Germany hang on to their money for 10 years at below inflation interest rates. Italy, meanwhile, sold $14.4Bn in notes and got slammed – with the 3-month notes fetching 1.25% (up 150% from the last auction) and 2.84% on the 12-month notes (up 100% from the last auction).

The Italian T-bill auction came against a backdrop of mounting fears in the periphery, sparked in by questions over Spain's ability to reduce its budget deficit to the level of 5.3% of gross domestic product the Spanish government agreed with the European Union. As a result, Spanish yields have risen to levels unseen since early December last year, pulling along Italian yields, as the impact of the European Central Bank's liquidity injection is fading.

The Italian T-bill auction came against a backdrop of mounting fears in the periphery, sparked in by questions over Spain's ability to reduce its budget deficit to the level of 5.3% of gross domestic product the Spanish government agreed with the European Union. As a result, Spanish yields have risen to levels unseen since early December last year, pulling along Italian yields, as the impact of the European Central Bank's liquidity injection is fading.

Now you WISH that was the worst news out of Europe but our friends at the Financial Times got their hands on minutes from Friday's meeting of the Eurozone Finance Ministers and item #3 on their agenda was a 4-page report titled "Budgetary Situation in Italy" and, guess what – DISASTER!!! The report warns that any slippage in growth or a rise in borrowing rates could force the technocratic government of Mario Monti to start cutting again – something he has vowed not to do. The report states:

Still, Italy’s efforts to meet the headline budgetary targets may be hampered by the depressed growth outlook and relatively high interest rates. The government should stand ready to avoid any slippage in budgetary execution and take further action if needed. Also, any reduction in interest expenditure as well as proceeds from privatisations and real estate sales should be used to accelerate debt reduction.

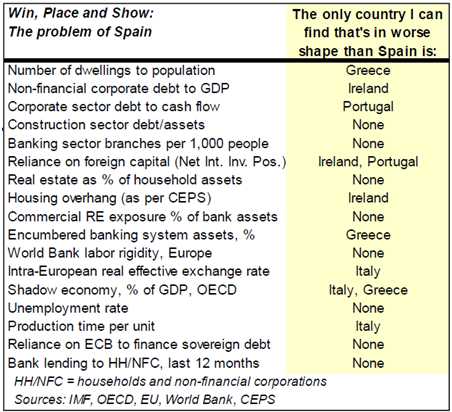

Italy is, however, a cake-walk compared to Spain. "Spain's economy is broken," says Jonathan Carmel, of Carmel Assett Management – after spending the past year combing through the numbers. At the peak of the housing bubble, 1 in 22 of the U.S. workforce was employed in the construction industry. In Spain, that number WAS 1 in 7.

Italy is, however, a cake-walk compared to Spain. "Spain's economy is broken," says Jonathan Carmel, of Carmel Assett Management – after spending the past year combing through the numbers. At the peak of the housing bubble, 1 in 22 of the U.S. workforce was employed in the construction industry. In Spain, that number WAS 1 in 7.

This is another one of those cases where I was way too far ahead of the curve as it was way back in April of 2010 when I wrote "The Pain in Spain will Hardly be Contained" – we are simply now finally starting to pay attention to the numbers.

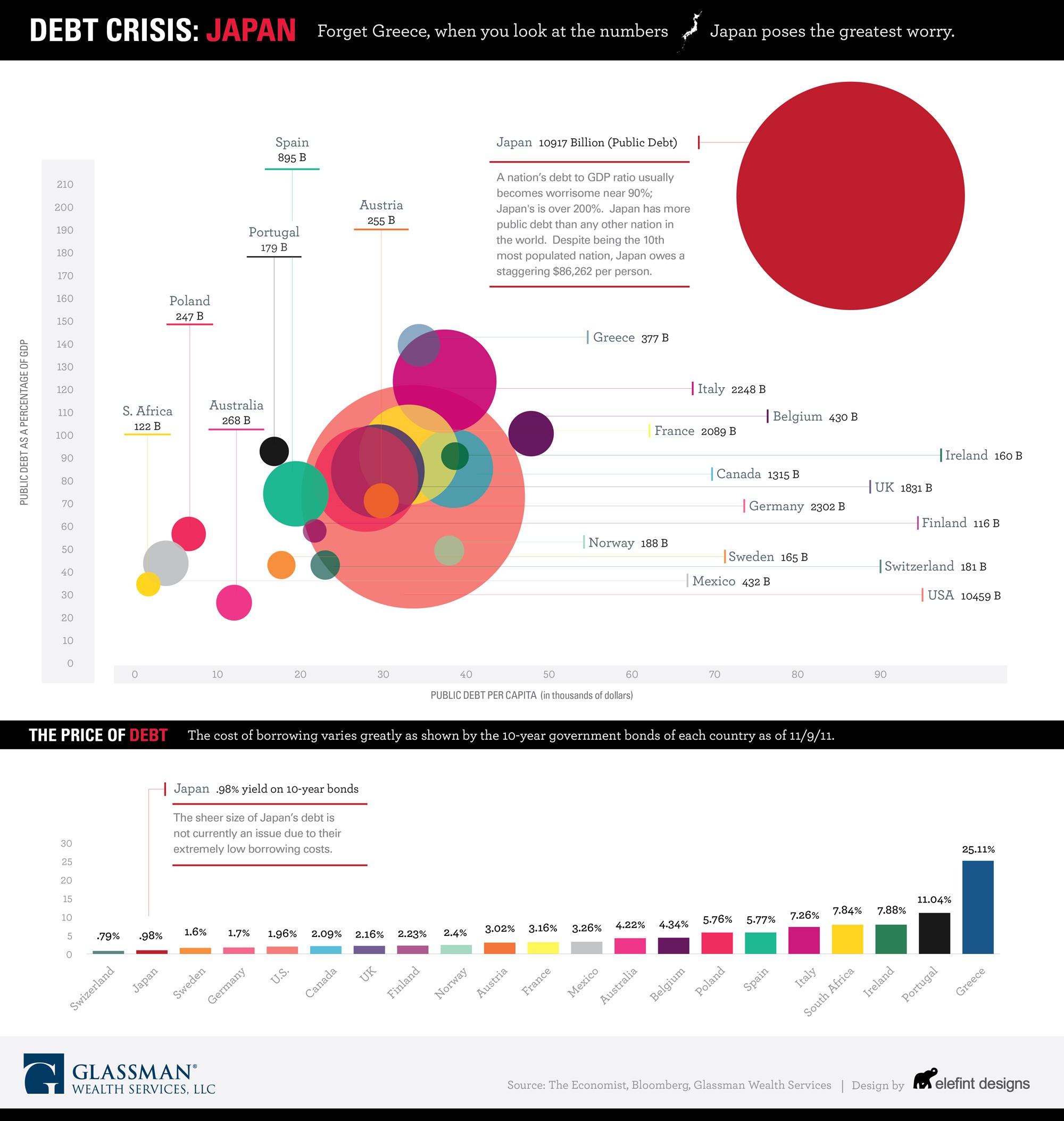

Spain is , in fact, turning so toxic that Japanese investors are turning their nose up at Spain's debt. Overall, Japanese investors sold a net €43.8B in euro-denominated debt in the year ended Feb 29th and show little intention of buying it back, as of now. "Our positions are quite limited," says a fund manager, "There's a 30% chance Spain becomes like Greece." That's kind of funny coming from Japan – who make Greece look like Norway by comparison:

If the BOJ is ever forced to pay a realistic rate of interest on their debt, that big red balloon will swell and explode and the shrapnel from that explosion will pop all those other debt bubbles one by one and there will be blood in the streets – and not just Wall Street as we're looking at a potential Global catastrophe of biblical proportions.

Also in Asia – much of China's recent growth has been an illusion, argues Satyajit Das, driven by staggering levels of loan growth, 20-25% of which may end up being written off. Commodity producers, machinery manufacturers, and Western governments – all dependent on money flowing from China – are going to be disappointed. Chinese vehicle sales fell 3.4% Y/Y in Q1, with passenger car sales off 1.3%.

Also in Asia – much of China's recent growth has been an illusion, argues Satyajit Das, driven by staggering levels of loan growth, 20-25% of which may end up being written off. Commodity producers, machinery manufacturers, and Western governments – all dependent on money flowing from China – are going to be disappointed. Chinese vehicle sales fell 3.4% Y/Y in Q1, with passenger car sales off 1.3%.

Yesterday the IMF said the outlook for global commodities is looking "pretty grim." It warns that the price of oil and other commodities are expected to decline this year and next on the back of weak global economic underpinnings, and that “sizable” threats to world growth could force a further fall.

Still feel like buying that dip?

Sorry, not trying to be depressing – just conveying the news… We'll get the results of our own 10-year note auction at 1pm this afternoon and then a look at the Fed's Beige Book, which is a gathering of anecdotal data from each of the Fed regions. That comes out a 2pm and I'm expecting a report that's worse than the last one – which wasn't so great.

We also have Fed speak from Lockhart (8:30), George (9:30), Rosengren (10:30), Bullard (4:00) and Yellen (7:30) so these people are just not going to leave us alone today. Our original plan was to go bullish after the BBook – on the assumption we'd still be selling off and the news would be so bad it would be good (giving the Fed the excuse to add more QE) and because Yellen is a dove and vice-chair of the Fed so she carries a lot of weight.

But the Futures are ahead of us and that's going to make it more of a "watch and wait" kind of day. We already have 3 bullish trade ideas from this morning's Member Chat, pending the Dollar failing to hold 79.75 and we also identified 6 Dow components we'll be looking to sell puts against (bullish) – taking advantage of the higher VIX before it goes away.