Wheeeee, what a ride!

Wheeeee, what a ride!

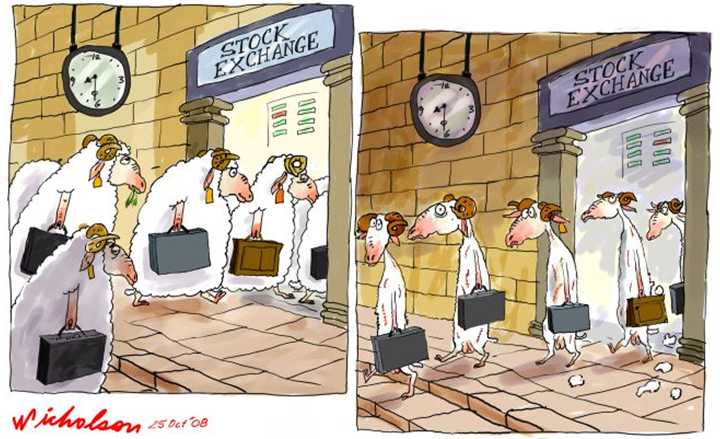

As you can see from David Fry's chart of the SPY, we're all over the place but, notably, there's a method to the market's madness as high-volume selling is followed by low-volume buying – allowing the funds to dump out onto the retail bagholders at top dollar while the carnival barkers in the MSM tell the sheeple to buy those f'ing dips.

Cramer said, in last night's show, that the Dow is composed of big international companies that were finally able to break free from concerns over Europe’s debt crisis. For the entire month of April, these stocks were held hostage to the Europe’s debt troubles. Cramer said most of these companies have no real ties to Europe, though, so the fears are overblown.

We ended up with what amounted to a frontsie-backsie day where all of the last month's winners, stocks that were unaffected by the weak euro and the miserable European stock markets, got pummeled, while the losers that had become risk free shorts because of an expected European decline were actually able to rally.

What a moron! Seriously – "frontsie-backsie"??? I guess he needs to treat his audience like they are 2 because bigger kids might realize that telling investors to ignore Europe would be just as idiotic as an Asian or European carnival barker telling the rubes over there to ignore America when making investment decisions. Is it really possible, in this day and age, that people still believe America is immune to what is happening in the rest of the World?

What a moron! Seriously – "frontsie-backsie"??? I guess he needs to treat his audience like they are 2 because bigger kids might realize that telling investors to ignore Europe would be just as idiotic as an Asian or European carnival barker telling the rubes over there to ignore America when making investment decisions. Is it really possible, in this day and age, that people still believe America is immune to what is happening in the rest of the World?

Look at the downtrend in the Global Commodities Index – do you think you are immune from that? I guess, to some extent we are, because CNBC's sponsors continue to use any excuse to pump up the PRICE of commodities, no matter how much DEMAND falls off (see yesterday's chart on gasoline volume consumption).

As Fundamental investors, we can often be a bit ahead of the curve but we find the market usually catches up to reality at some point. Cramer and his ilk know they can fool all of the people some of the time and some of the people all of the time (known as their "core audience") but even the mighty Corporate Media can't fool all of the people all of the time.

Almost a month ago, I asked the question "Are There Any Dips Left to Buy?" It turned out that, yes, there were quite a few, as the market went up for another week into the end of March. My comment in that morning's post, with the S&P at 1,392, was:

Has it already been a week since I said "Stop the Rally, We Want to Get Off"? As I noted in that post, we began our list of 12 Long Put Plays for members on Thursday of last week (near the end of what I called "A Weak Week of Denial") and some have already doubled while others, like Priceline.com (PCLN), have gotten even cheaper, which only makes us love them more.

I concluded that this rally was fake, Fake, FAKE and gave my reasons on Friday so no point in going over them again – now we're just watching and waiting to see what sticks as we haven't actually done a lot of technical damage (see Dave Fry's chart) – Yet!

In that morning's post (not including our many trade ideas in Member Chat – just the public ones), I put up the following trade ideas:

In that morning's post (not including our many trade ideas in Member Chat – just the public ones), I put up the following trade ideas:

- TZA (ultra-short Russell) April $17/18 bull call spread at .42, selling April $17 puts for $1 for a .58 credit – TZA is at $19.62 and, if it holds $18 through Friday's expiration, this trade idea returns $1.58 for a 272% gain in 5 weeks.

- TLT April $108/110 bull call spread at $1.15, selling $108 puts for $1.30 for a net .15 credit – TLT finished at $116.67 yesterday and, if they hold $110 through Friday, this trade returns $2.15 for a 1,433% gain in 5 weeks.

- CAT May $95 puts at .95, one of our Long-Put Ideas, are now $1.10 – up 15%

- SQQQ June $10/14 bull call spread at $1.05, selling $10 puts for .60 for net .55 – now $110 – up 100%

- DXD May $12 calls at $1.20 – now $1.35 – up 12%

That's not bad for 5 hedges, is it? In that morning's Alert to Members, we added a short on oil at $107.50 and our trade at the time, aside from the Futures, was the USO April $41 puts, which we doubled down to 40 contracts in our $25,000 Portfolio (one of our 7 active virtual portfolios for Members) at net $1.49 ($5,960) and they topped out at $2.76 ($11,040) last week for a near double – we've since moved on to a May position we're building into and, on the Futures (/CL), we're looking to short off the $104 line this morning.

We might have been right sooner but that was Friday and the following Monday the RUMORS began that the EU would put another $1.25Tn into the ESM (it was only $800M) and combine it with the extension of the $1Tn EFSF (it wasn't) and another $1Tn from the IMF (so far, MAYBE $600Bn). That propped up the market for another couple of days – but it was still too heavy!

We might have been right sooner but that was Friday and the following Monday the RUMORS began that the EU would put another $1.25Tn into the ESM (it was only $800M) and combine it with the extension of the $1Tn EFSF (it wasn't) and another $1Tn from the IMF (so far, MAYBE $600Bn). That propped up the market for another couple of days – but it was still too heavy!

On Wednesday (3/28), I asked if $3.5Tn was not enough to prop up the markets anymore, saying:

Despite the bullish turn of events (which we anticipated last week) we're more inclined to cash out our bullish trades into the excitement and press our bear bets and TOMORROW, if we're still over our levels – THEN we will scramble to add some aggressive bullish trades to our virtual portfolios. Again, I cannot stress enough that CASH is my preferred position because this market is tough to call and you need to be very flexible and very nimble to trade it.

That was also the day we began to make our case against PCLN, pointing out that, at $736, the market cap of Priceline had eclipsed the entire combined value of the airline sector. I mentioned our other favorite shorts that day, which were CMG, GMCR and FXI at $37.25 that day and that index is still $37.05. I think the big surprise from that post was the addition of the AAPL May $470 puts, which were $1.45 that day and a loss from our original $2.15 entry but we rolled them to the May $495 ($2.45) puts for $1 for a net $3.15 entry and yesterday those puts closed at $5.64 – up 79% from our too-early entry but better than a double for those who caught the trade late!

Nobody lost out with our other pick that morning, which was shorting the oil Futures (/CL) at $107.50 and picking up the USO April $40 puts for .65 – this time for our smaller $5,000 Portfolio, where each $65 (100 contract lots) was $95 yesterday but we were long gone after topping out at $1.86 last week (up 186%).

Nobody lost out with our other pick that morning, which was shorting the oil Futures (/CL) at $107.50 and picking up the USO April $40 puts for .65 – this time for our smaller $5,000 Portfolio, where each $65 (100 contract lots) was $95 yesterday but we were long gone after topping out at $1.86 last week (up 186%).

The following day we had the GDP release but I warned "Don't Get Excited, It's Just a Revision" and we updated our PCLN shorting strategy as we rolled into the July $520 puts, which were $5.50 at the time, now $7.20 (up 30%) but we ended up in a 2x position on the $560 puts and we finally exited that position at $11.70 yesterday in our $25,000 Portfolio for a very nice gain.

It's not that we don't feel PCLN can fall further – we're simply not willing to ride out the bounce we expected and are getting this morning – THEN we can re-position for the next round. My March 30th post was titled "March Goes Out Like a Lamb (to the Slaughter)" and on Monday, the 2nd, I warned the that the new quarter was "Not So Shiny." We worked on Good Friday (6th) and that was the last time I did a review with public Trade Ideas in which we discussed progress on the Long Put List (published in Stock World Weekly that weekend) as well as TLT, CMG, PCLN, USO and SCO (from my BNN interview earlier in the month) which is right on track for the full 433% gain on that spread.

The PCLN July $560s were only $6 that morning and, as I said, we took the money and ran at $11.70 but they did touch $12 for a clean double yesterday afternoon – not bad for 10 days! We were bearish on natural gas at $2.32 (now $2, which is actually a better percentage move than oil) and our QQQ May $67 puts at $1.08 were $2.36 as of yesterday (up 118%) and I mentioned my targets for this sell-off were Russell 775 (same target as I had in the March 5th interview) and S&P 1,325.

So far, the S&P bottomed out at 1,357 last week and the RUT hit 783 and we're now waiting to see if we'll be forced to go technically bullish if the indexes make it over our marks (see yesterday's morning Alert to Members or the chart from yesterday's post) to see if there is any reason to trigger our bullish spreads – which stand to do just as well as our bearish spreads did if we're going to move back to the top of the channel on more promises of free money raining down from Central Bank Heaven.

Either way – be careful out there!