Michael Hudson: Debt: The Politics and Economics of Restructuring

Intro by Ilene

(Updated)

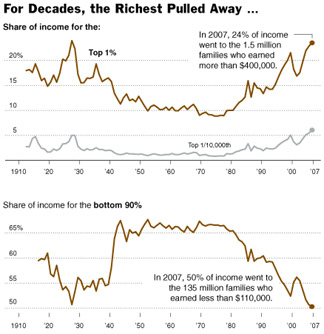

In the video below, Michael Hudson discusses how damaging "austerity" really is. It wastes labor and production, and leads to economic shrinkage. In the last 30 years, there's been a persistent widening of wealth disparity, an enormous redistribution of wealth between creditors and debtors. In the U.S., the top 1% have doubled their share of returns of wealth (interest, dividends, rent and capital gains).

PROBLEM: The winners will push economies into Depressions rather than give up their gains. They will continue "business as usual." The creditors will not write down debt. Instead, they embrace the notion of "austerity."

But austerity makes debts harder to pay. A shrinking economy has less tax revenue, and this exacerbates the budget deficit and leads to calls to cut back spending. Cutting back spending drains money from the economy, adding a tax drain to the debt drain. If you repay debt, the money doesn't get used to buy goods and services, markets shrink, and a declining spiral results. Without writing down the debt, the debt overhead and imposed austerity will shrink economies and polarize nations even further between debtors and creditors.

The choice: Write down debts or suffer a chronic, severe recession. There's no way to recover while the debt overhead remains in place.

That all debts can be repaid is an illusion.

Michael asserts that our economic models are quite flawed. In the U.S. 40% of the American labor budget goes to housing, about 15% goes to wage withholding for Social Security and medical care; other debt services (credit cards, student loans) is about 10%, and other taxes (income, sales) are about 10 to 15%. Of the take-home budgets of American workers, 75% is spent on non- goods and services. Only 25% is available for spending in the market. U.S. labor cannot compete with labor in economies that are less financialized, that have lower housing costs, where the government picks up infrastructure costs, and where the government basically has a lower cost structure.

The problem is POLITICAL. There's NO fair solution that everyone gains on.

We cannot grow our way out of debt with a debt burden as enormous as it is today. Someone has to lose. In the U.S. the banks are blocking a solution. Michael argues that under today's conditions in the U.S., we are robbing the 99% to pay the 1%. That is the political setting.

And that political setting is supported by a large portion of our population in terms of power and voice. Just read the comments to Bruce Krasting's "A Different Buffett Rule – One That Would Work" (posted at ZH) to see the strong reactions against Bruce's idea of taking some extra tax money from the richest folks to provide benefits to disabled people with devastating diseases – people qualifying for the Compassionate Allowance program of Social Security Disability.

The negative reaction seems to be based on the premise that the very rich fairly earned all their money, the poor are lazy, and the evil government should get out of the way.

But the system as it is operating now is stacked against the lower 99%; the playing field is hardly level.

And how is that? The government that dictates taxes also provides the framework, the laws and regulations governing our political, economic and financial systems. It created a system of crony capitalism that has enabled the 1+%ers to get to where they are and stay there. (I think the problem is at level higher than the top 1%, so I write 1%+.)

Charles Hugh Smith just published an excellent piece that explores the tensions between the need for a central government and the corruption of that government in Crony Capitalism and the Expansive Central State:

"Crony capitalism arises when an expansive Central State dominates the economy. The Central State can then protect crony-capitalist perquisites, cartels, quasi-monopolies and financialization skimming operations of the sort which now dominate the U.S. economy's primary profit centers.

"If we step back, the larger context is the purpose and role of establishing a State to protect its citizens from foreign and domestic predation and exploitation.

"The Central State is granted the sole power of coercion by its membership (citizenry) to protect the membership from the predation of individuals, concentrations of wealth and other subgroups seeking monopoly. They grant the State this extraordinary power to insure that no subgroup or individual can gain enough power to dominate the entire membership for their private gain and to protect freedom of faith, movement, expression, enterprise and association.

"Granting this power to the State creates a risk that the State itself may become predatory, supplanting the parasitic elements it was designed to limit…" (This excerpt was drawn from Resistance, Revolution, Liberation: A Model for Positive Change)

The government provides the freedom and assistance (deregulation, failure to enforce laws, bills that help perpetuate quasi-monopolies) that enable the top 1%+ to continue accumulating more and more of the country's total wealth. It is also charged with keeping those at the top safe from the rage brewing at the bottom.

The government provides the freedom and assistance (deregulation, failure to enforce laws, bills that help perpetuate quasi-monopolies) that enable the top 1%+ to continue accumulating more and more of the country's total wealth. It is also charged with keeping those at the top safe from the rage brewing at the bottom.

Within this context, the reality of the situation today, it makes perfect sense to try to take some income (interest, dividends, rent, capital gains) from the wealthiest to help pay for people who can't work to simply live.

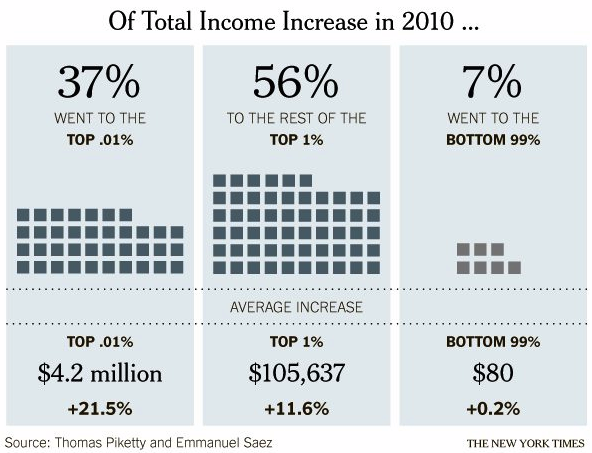

As Phil observed in $105,637 for Me, $80 for You!:

"Isn’t this economy FANTASTIC?

"It sure is for those of us in the top 1% (1.4M) – people earning over $352,000 in annual income. We made $105,637 more Dollars in 2010 than we did in 2009 – thanks in large part to the Fed’s fantastic policy of printing more and more money, which lets us borrow cheaply or invest with leverage in inflating equity as the Dollar collapses.

"Sure the Dollar collapsing hurts everyone – but an extra $105,637 keeps us ahead of inflation, right?

"I’m still jealous of course, as the top .01% (14,000 people) – who earn an average of $23.8M, were able to add another $4.2M to their annual incomes in 2010. That’s 52,500 TIMES the average $80 increase earned by the bottom 99%. (Chart above: source Thomas Piketty and Emmanuel Saez, NY Times.)

"That’s right, somehow, the riff-raff in the bottom 99% managed to grab 7% of the Nation’s total increase in income – clearly Congress needs to make immediate changes to prevent this travesty from happening again!

"Steve Rattner has a different opinion: 'The only way to redress the income imbalance is by implementing policies that are oriented toward reversing the forces that caused it. That means letting the Bush tax cuts expire for the wealthy and adding money to some of the programs that House Republicans seek to cut. Allowing this disparity to continue is both bad economic policy and bad social policy. We owe those at the bottom a fairer shot at moving up.'…

"Of course things seem fine if you are in the top 1%… and that means – very simply – less for the bottom 99%. When do we have the ideal amount? When we have 100% and the bottom 99% has zero? We already have 25% and in 2010 we captured 56% of the income gains, so our disproportionate share is, indeed, growing even more disproportionate every year…

"The top 1% have their own top 1%… the bottom 99% of the top 1% also got screwed, capturing just 1/3 of the gains for 1.4M while the top 14,000 took 66% of the pie.

"Just like in 1927, the stock market is roaring as the rich get richer and trickle their increased earnings into stocks and commodities, with commodities being the most fun as rich people get to buy things they don’t need…"

The structure of our economy needs to be taken down and rebuilt. This not just a problem of debt but a problem of theory.

Michael Hudson: Debt: The Politics and Economics of Restructuring

Courtesy of Jesse's Cafe Americain

Here is Michael Hudson's talk on Debt and Restructuring from April 13, 2012