Courtesy of Lee Adler of the Wall Street Examiner

The US Government has had a blockbuster tax season. The numbers are stunning.

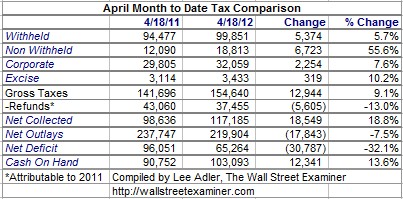

Withholding is collected throughout the year with no relation to the tax due date. So far for April, withheld taxes are running 5.7% ahead of last April through the 18th. That suggests that things are going well for the US economy so far this month. Non-withheld, individual income taxes, which are affected by the due date, were up a whopping 55.6%. However, that’s attributable to last year’s conditions, not this year, so let’s not get too excited about that. Much of it was due to capital gains taxes, and we know how often they come along (cue Stevie Wonder).

On the other hand, corporate taxes collected in April are relevant to this year. The mid April due date for corporate taxes is for estimated taxes for the first quarter of 2012. Corporate tax for the full year 2011 was due on March 15. Therefore, the April number is a clear indication that, so far this year, corporations appear to be doing 7.6% better than last year.

Excise taxes for the first quarter aren’t due until April 30, but I suspect many businesses pay along with their quarterly estimated taxes, so this may be a decent early indicator for these taxes for Q1. Excise taxes are collected on:

- Environmental products, such as domestic petroleum oil spills and ozone-depleting chemicals.

- Communications and air transportation taxes

- Fuels used in business

- Purchase of trucks, trailers, semi-trailers (at a percentage of the sales price)

- Ship passenger tax (per passenger)

- Manufacturers Taxes on coal, taxable tires, gas guzzlers, etc.

- Foreign insurance taxes

- Sport fishing equipment, fishing rods, poles, outboard motors, etc.

- Floor stocks tax on ozone-depleting chemicals

(Source)

These taxes would also appear to be an indicator of the direction of business conditions for the first quarter, although not the degree. So far, they’re up 10.2% in April.

Refunds are tied to last year, and they’re down versus 2010, suggesting that taxpayers owed more last year than in 2010 as the economy did better. No surprise there.

Interestingly, Uncle Sam has spent much less so far this month than last April to this point. The lower outlays and increased tax collections have sharply reduced the deficit for the month so far. I’m sure the government will make up that difference in outlays toward the end of the month. There’s no reason to expect material reductions in outlays yet. But just wait until the sequesters hit next year, if there’s no budget compromise. In that case, the austerity, and the impact on the economy will be ugly. Any reduction in government spending and/or increase in taxes will directly reduce economic activity. As the election draws closer it will be a game of chicken. Should be interesting.

Finally, the Treasury is flush with cash. That, and the strong tax collections should keep Treasury supply at or below expected levels at least for the next few weeks. There are hints, however, that recent economic momentum may be slowing, and that will impact the budget.

Look for more details on the fiscal trends that affect the Treasury and stock market in the Professional Edition Treasury update to be posted Friday.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE’s Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.