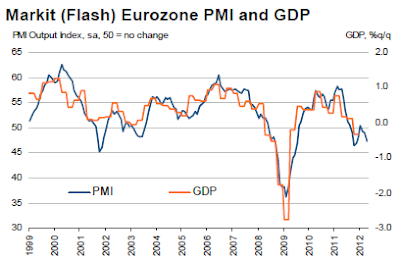

Eurozone Manufacturing PMI Hits 34 Month Low; German Manufacturing Hits 33 Month Low; Orders Drop Steeply Across the Board

Courtesy of Mish

Today, European data shattered two long held beliefs by Markit and in general, unthinking economists everywhere.

Shattered Myths

- European recession would be mild

- Germany would continue to diverge from the rest of Europe

Markit reports Eurozone sees stronger rate of decline at start of second quarter

- Flash Eurozone PMI Composite Output Index(1) at 47.4 (49.1 in March). 5-month low.

- Flash Eurozone Services PMI Activity Index(2) at 47.9 (49.2 in March). 5-month low.

- Flash Eurozone Manufacturing PMI (3) at 46.0 (47.7 in March). 34-month low.

- Flash Eurozone Manufacturing PMI Output

The Markit Eurozone PMI® Composite Output Index fell to a five-month low in April, according to the preliminary ‘flash’ reading which is based on around 85% of usual monthly replies. The index fell for the third month in a row to 47.4, down from 49.1 in March, to signal a faster rate of decline of private sector economic activity. Output has fallen seven times in the past eight months.

Output fell at the fastest rates for five months in both manufacturing and services, with the former seeing the steeper rate of decline.

France meanwhile saw output fall for the second month in a row, with the rate of decline accelerating to the fastest since October. Falling manufacturing output was accompanied by a steep deterioration in service sector activity.

Incoming new business fell for the ninth month in a row, registering the steepest decline since October. Manufacturing new orders fell particularly sharply, down for the eleventh month running and falling at the fastest rate since December. New business at service providers fell for the eighth successive month, showing the largest deterioration since October. New business fell at stronger rates in Germany, France and across the rest of the euro area as a whole.

With inflows of new orders continuing to deteriorate, backlogs of work fell across the region for the tenth successive month, declining at the sharpest pace since November. Backlogs fell at similar rates in both manufacturing and services although, while the former saw a slight easing in the rate of decline, the latter suffered the largest fall since September 2009.

The deteriorating pipeline of work led companies to cut staffing levels for the fourth straight month, with the rate of job losses running at the fastest since February 2010.

Eurozone Reality

Markit Finally accepts reality, albeit with a huge understatement "Prospects do not look good."

Really? After 5 months of making silly statements about "short, weak recession" complete with Germany bucking the trend, that is acceptance of reality, sort-of.

As Goes Europe, So Goes Germany and France

As I have been saying for at least six months, the Eurozone recession will be neither short nor mild. Spain, Greece, and Portugal are in outright depressions and Italy may head there.

Take a look at that chart above on the periphery vs. France and Germany. France has now caught up on the downside with the rest of Europe and Germany will follow.

Coupled with a huge slowdown in China, and a feeble and faltering recovery in the US, there is zero chance that France and the vaunted German export machine will decouple from the rest of Europe.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com