Courtesy of Jesse's Cafe Americain

"The final $680 million or so was transferred to other financial institutions with which MF Global did business, including a substantial portion that went to JPMorgan. Giddens said his team has "a solid basis for seeking the recovery of some of the funds that were transferred to JPMorgan," and is engaged in ongoing talks on the issue."

As they say in the trade, Q. E. D. (quod erat demonstrandum)

CNN Money

$1.6 billion in missing MF Global funds traced

By James O'Toole

April 24, 2012: 6:49 PM ETNEW YORK (CNNMoney) — Investigators probing the collapse of bankrupt brokerage MF Global said Tuesday that they have located the $1.6 billion in customer money that had gone missing from the firm.

But just how much of those funds can be returned to the firm's clients, and who will be held responsible for their misappropriation, remains to be seen.

James Giddens, the trustee overseeing the liquidation of MF Global Inc, told the Senate Banking Committee on Tuesday that his team's analysis of how the money went missing "is substantially concluded.""We can trace where the cash and securities in the firm went, and that we've done," Giddens said.

MF Global failed last year after its disclosure of billions of dollars worth of bets on risky European debt sparked a panic among investors. About $105 billion in cash left the firm in its last week, Giddens said, as clients withdrew their funds and trading partners called for increased margin payments, leaving the firm scrambling to make good on its obligations.

It has since emerged that MF Global tapped customer funds for its own use during this crisis and failed to replace them, in violation of industry rules.

Roughly $700 million of the missing money is now locked up with MF Global's subsidiary in the United Kingdom, where Giddens and his team are engaged in litigation to have it returned to U.S. customers. Giddens said he is "reasonably confident" that these funds will be recovered, though he added that it will be a lengthy process with no guarantee of success.

Another $220 million was transferred inadvertently from the accounts of securities customers to those of commodities customers. That money is now in limbo amid a dispute over which customers it belongs to, said Kent Jarrell, a spokesman for Giddens.

The final $680 million or so was transferred to other financial institutions with which MF Global did business, including a substantial portion that went to JPMorgan.

Giddens said his team has "a solid basis for seeking the recovery of some of the funds that were transferred to JPMorgan," and is engaged in ongoing talks on the issue. JPMorgan did not immediately return a request for comment….

Read the rest here.

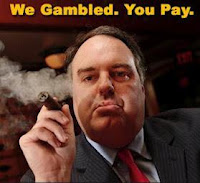

"But please, to our friends in the Big Media, could we stop saying that we don't know the location of the missing $1.6 billion of client funds from MF Global? The money is safe and sound at JPM and other counterparties. As with Goldman Sachs et al and American International Group, the banks have been bailed out at the cost of somebody else. And the various agencies of the federal government are complicit in the fraud…

The effort by former New Jersey governor and MF Global CEO Jon Corzine to save his firm by stealing customer funds seems to warrant further discussion, yet instead we have silence…

So why is it that the Large Media have such trouble reporting this story? The fact seems to be that the political powers that be in Washington are protecting JPM CEO Jamie Dimon from a possible career ending kind of stumble with respect to MF Global."

Chris Whalen, Institutional Risk Analyst, February 2012