If it's Tuesday we must be bouncing!

If it's Tuesday we must be bouncing!

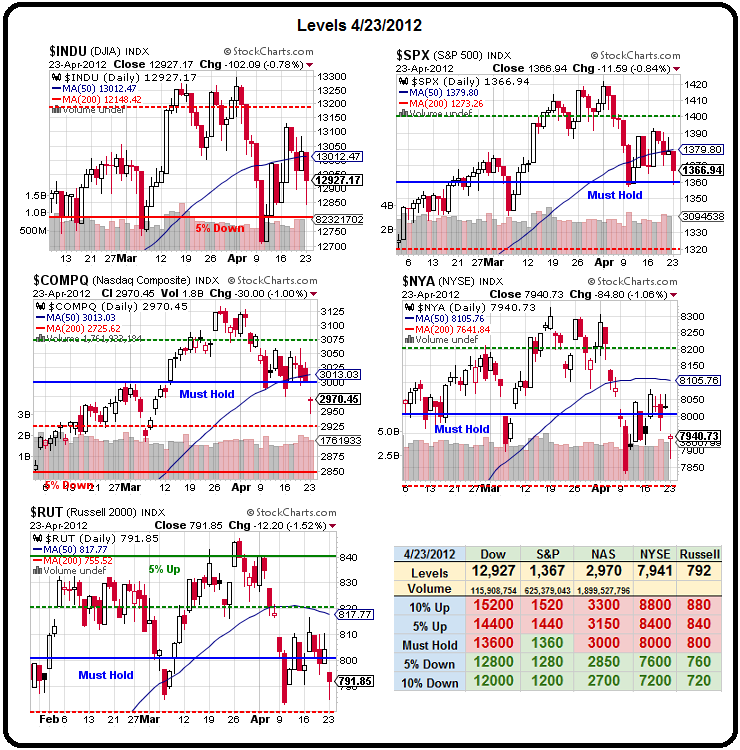

Clearly, from the recent sell-off, we have a whole lot of bouncing to do. Yesterday we failed our Must Hold lines on the Nasdaq, the NYSE and the Russell (the Dow never got there) and the S&P was briefly below 1,360 and recovered to end the day at 1,366 – still below our weak bounce level of 1,372.

That leaves us in the same place as we were on the 11th, when I titled the morning post – "Weak Bounces and Beige Books." As we expected at the time, we made it to our 1,384 level on the S&P and then failed to hold it and now we come in for our 2nd tests of our 3 significant levels – 1,360, 1,372 and 1,384 – that's our range until it breaks and THEN we can make some directional bets.

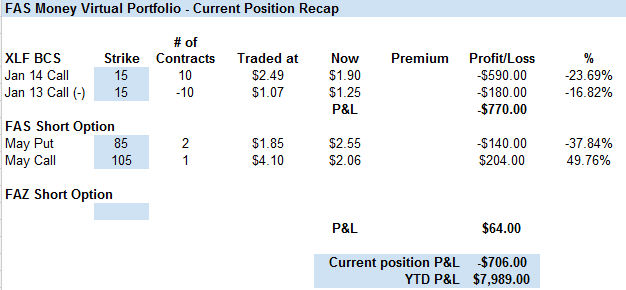

In this market chop, our best strategy has been to bet both ways and our virtual $25,000 Portfolio is now up about $16,000 for the year but that's nothing compared to our completely neutral FAS Money Portfolio, which has turned a $2,000 spread into almost $8,000 in profits in the same 4 months – just using our very simple strategy of selling premium on a regular basis:

Last year's FAS Money Portfolio was also a great performer and it's a great time to get started following as the current position is down $706 so you sure didn't miss anything but a loss by taking up the current position. It's a great exercise to set up a virtual portfolio and follow these trades along as we are constantly managing these positions to maximize the amount of premium we sell so it's a great practice portfolio for rolling and adjusting short positions, teaching you the value of BEING THE HOUSE!

Speaking of investing value – don't miss our contest to win 2 passes to Berkshire Hathaway's Annual Shareholder Meeting! Hopefully we'll get a nice report from whoever wins – it's always good to get a little insight into what the Oracle of Omaha is thinking.

Speaking of investing value – don't miss our contest to win 2 passes to Berkshire Hathaway's Annual Shareholder Meeting! Hopefully we'll get a nice report from whoever wins – it's always good to get a little insight into what the Oracle of Omaha is thinking.

My thinking is that – while our Virtual Portfolios are all performing very well this year – I still can't shake my overall feeling that the markets are very weak internally. Today we are hoping that AAPL will save us (earnings this evening) and tomorrow we hope Bernanke will save us (Fed at 12:30, Bernanke speaks at 2pm) and then we'll be hoping our Q1 GDP comes in better than expected – although by then, we will have not gotten QE3 and maybe the bulls will hope the GDP is a disaster and brings the Fed back to the table.

I don't see it though – until and unless Europe actually collapses, there is no sense in the Fed using up their own firepower simply to keep the stock market overpriced. The situation remains that we would be gung-ho bearish if NOT for the constant fear of Central Bank manipulation – whether from our own Federal Banksters or those in foreign lands like the BOJ, who indicated they are "likely" to ease monetary policy on Friday – which will be a neat trick as their rate is already 0.1%.

With interest rates virtually at zero, the BOJ has adopted as its main policy tool a program under which it buys assets ranging from government bonds to corporate debt and trust funds investing in property and shares. Any expansion in the program would come mainly in the form of government bonds, although there is a slim chance the BOJ may also pledge to buy more exchange-traded funds (ETFs) depending on the size of increase, now rumored to be 10 TRILLION Yen ($123Bn).

With interest rates virtually at zero, the BOJ has adopted as its main policy tool a program under which it buys assets ranging from government bonds to corporate debt and trust funds investing in property and shares. Any expansion in the program would come mainly in the form of government bonds, although there is a slim chance the BOJ may also pledge to buy more exchange-traded funds (ETFs) depending on the size of increase, now rumored to be 10 TRILLION Yen ($123Bn).

Clearly it is time to practice saying Quadrillion – as the BOJ is clearly on the way to doing a Quadrillion something and you don't want to look like an economic dork by tripping over the word so just practice saying Quadrillion a few times every day so, when the situation comes up, you'll be able so say it like a pro when you discuss how totally F'd up the Global economy is.

Our futures were up this morning (we shorted them) and already, at 8:52 they are beginning to falter. Oil (/CL) is back at our magical $103.50 line and we love that short as we felt the Dollar was artificially held down all day yesterday and it's going to be very difficult to keep the Dollar down today with Japan's total QE package now moving past the 0.1 Quadrillion Yen level (see – it came up already!).

AAPL is already worth a 65 Trillion Yen and there are plenty of estimates on the street that put them over a tenth of a Quadrillion within a year. OK, so it's still a stretch to use it but Zimbabwe was there in 2008 and the way our Central Banksters are printing paper – the rest of us are bound to follow suit if we keep moving down this path.

Speaking of things that are inflating – oil went the wrong way on us this morning as we failed to get a break below the $103.50 line and now it's rocketing back up to $104, where we'll be happy to not only short a rejection on that line (/CL) but to re-position for some USO puts ahead of tomorrow's inventory report.

Speaking of things that are inflating – oil went the wrong way on us this morning as we failed to get a break below the $103.50 line and now it's rocketing back up to $104, where we'll be happy to not only short a rejection on that line (/CL) but to re-position for some USO puts ahead of tomorrow's inventory report.

It's not so much oil being a glut (though it's a huge glut against low demand) as it is about the Dollar very likely to go back over 80 tomorrow on a failure by the Fed to dump more QE on the market. A stronger Dollar should put a hit on both oil ($104) and gold ($1,645), both of which we will be betting on into the Fed meeting. Of course, if the madness persists and we do get QE3 tomorrow – then it will be time, once again, to go gung-ho bullish on those Financials.

In yesterday's chat, we played both sides of the fence, with trade ideas for an EDZ spread as well as a TNA spread early in the morning. As they both have potential for over 500% pay-offs – the only thing we fear is NOT moving one way or the other. We already went bullish on FAS with short puts to offset our bearish bets and we cashed out half of our DIA puts at 11:07 – taking the money and running on those aggressively bearish bets. Later in the day we added a TZA spread but then went with TQQQ to go the other way and then we had another EDZ idea as we REALLY think the emerging markets are due for an "event".

We put a complex bet on AAPL on the premise they stay under $590 through May expirations, my long trade idea on AAPL was to simply pick up a bull call spread on the Qs since we only call it the AAPLdaq anyway these days. We did a complex spread on NFLX that will be interesting this morning and our last two trades, at 3:40 were small bearish adjustments to our FAS Money and IWM Money Portfolios – selling a bit more bullish premium into the afternoon pop.

We'll mostly be watching and waiting now into tomorrow's Fed Meeting and Bernanke's 2pm comments 1,360 really MUST hold on the S&P but there's nothing real about a rally that can't get that index back over 1,384 and hold it.