Yay AAPL!

Yay AAPL!

A meteoric 10% rise pre-market is being celebrated by the Global markets even though it's really only part of the way back to the $644 high that was, very recently, supposed to be a stepping stone on the way to $1,000. Are we really going to get all excited just because AAPL's earnings didn't suck? That seems kind of silly as I'm pretty sure they were never going to get to $1,000 by just earning $10 a share per quarter, were they?

I have nothing bad to say about AAPL. We were bearish on them at $640 but $550 was our buy target and we didn't take direct action on AAPL yesterday as we were worried they might disappoint so our 1:31 bullish trade idea for Members was the QQQ June $60/63 bull call spread at $2.35 and those should be well on their way to $3 this morning as the Qs are up 2% to $66 pre-market already.

I mentioned in yesterday's post that we had already played TQQQ (ultra-long Nasdaq) the day before and that one was the more aggressive May $103/110 bull call spread at $4, selling ISRG Jan $350 puts for $4.40 for a net .40 credit on the $10 spread. Any offset would do, of course but we REALLY wouldn't mind owning ISRG for $350 if it goes on sale (now $560) but, if not, we'll take the free money. As a 3x ultra, TQQQ will be up 6% this morning, already at our $110 goal and, if they can hold it, we're looking at a very nice 150% gain on just the bull spread with a 2,600% gain on the full spread – either way, not a bad way to play!

We had also taken the QQQ MAY $63/66 bull call spread at $1.90 on Monday and that deal was so good we didn't feel we needed an offset. That's the difference between catching the bottom, like we did on Monday and chasing a run, as we did with the Qs on Tuesday – the rewards of being contrarian investors!

We had also taken the QQQ MAY $63/66 bull call spread at $1.90 on Monday and that deal was so good we didn't feel we needed an offset. That's the difference between catching the bottom, like we did on Monday and chasing a run, as we did with the Qs on Tuesday – the rewards of being contrarian investors!

One trade that may not be going well for us was the AAPL weekly $575 calls, which we bought for $20.75 against the sale of the May $590s for $22 for a net $1.25 credit. We didn't think AAPL would pop $600 so fast, so we're a little worried about that one. Our other shorts – on BWLD, NFLX, CMG and PCLN were, of course, huge winners as well as BIDU and others on our Long Put List (see Stock World Weekly for full list) – some of which will be playable again if we get a good Nasdaq bounce.

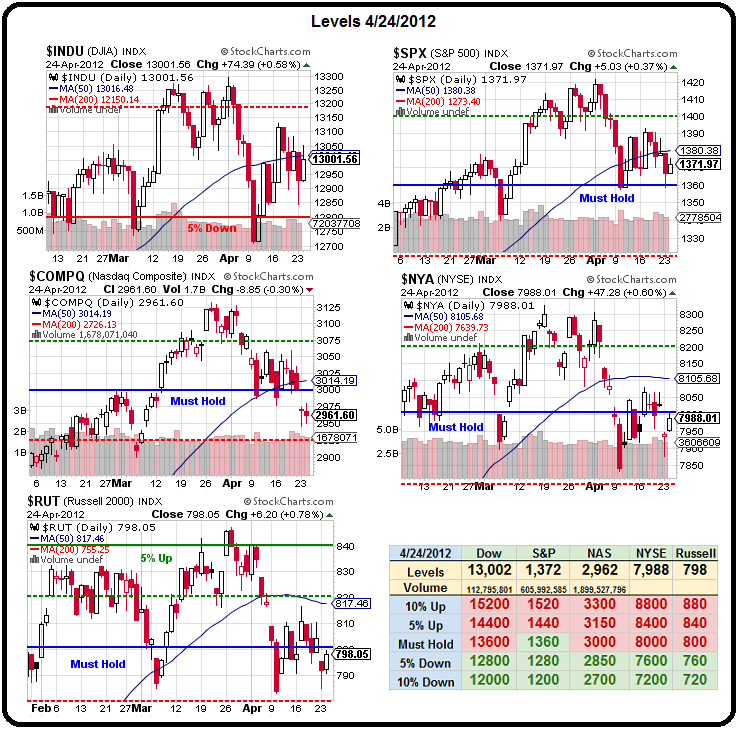

As you can see from our Big Chart, the S&P came within 0.03 of our bounce target at 1,372 and we should gap open to our 2nd bounce level at 1,384 this morning unless Durable Goods are a disaster. That will put our 50% retracements back in play at Dow(13,000), S&P (1,395), Nasdaq (3,075) NYSE (8,050) and Russell(815). If we manage to get 3 of 5 of those back over the line – it's time to make some bullish bets but I think they'll act as resistance today and the lack of more QE from the Fed will put a stake through the heart of this little rally before it has a chance to gather more steam.

8:30 Update: Oh no – the tragedy of FACTS! Durable Goods are a DISASTER – down 4.2% vs. down 1.5% expected (Economorons miss by 180%) and Ex-Transport we're still down 1.1% vs. up 0.4% expected – a horrendous 375% miss by the people who follow this sort of thing for a living. How many completely clueless data forecasts can one rally be based on? On the bright side, this news is so bad it might be good – in that it may bring the Fed back to the table.

I think the obvious solution to this problem is to have IPhones and IPads reclassified as Durable Goods – problem solved! Although the report has taken our Futures down a notch, as I said – this news is so bad it's good and now we can all wait breathlessly for the FOMC announcement at 12:30 but that doesn't matter because then we get the FOMC forecasts at 2pm and then Bernanke holds a press conference at 2:15 and THEN – maybe – then it will finally sink in that there will not be another round of QE – at least until the Fed's next meeting on June 20th.

Can we survive 2 more months without another shot of QE? Doubtful, the bulls are already jonesing really bad and, as the great Gator explained, "I really hate having to resort to knocking older people in the head to get their money – but I'll do it – 'cause I'm a crack head!" The investing class is just as hooked on free money from the Fed as Gator was on $20s from his brother and they are just as willing to destroy older people's retirement accounts in order to get another hit from the Fed's Free Money Crack Pipe.

Can we survive 2 more months without another shot of QE? Doubtful, the bulls are already jonesing really bad and, as the great Gator explained, "I really hate having to resort to knocking older people in the head to get their money – but I'll do it – 'cause I'm a crack head!" The investing class is just as hooked on free money from the Fed as Gator was on $20s from his brother and they are just as willing to destroy older people's retirement accounts in order to get another hit from the Fed's Free Money Crack Pipe.

How can we expect the markets to react when Uncle Ben tells us we're not getting our fix today? They will howl and they will scream and they will have a little tantrum and that's how we're going to play it this morning – taking the opportunity to add to our bearish bets – assuming they survive into the bell. Already (8:53) oil is collapsing back to $103.30 from a silly spike up to $104.50 and we have inventories at 10:30 where anything less than a 5Mb draw is probably going to send us back to $102. You KNOW we already have those shorts locked in!

EconoMontor had a good article yesterday titled "What Ever Happened to Peak Oil" and, as you can see from the chart on the right – production has never been higher – even as demand falls off a cliff due to a combination of persistent high prices and advances in energy conversation that are being prioritized more and more each day by Global Consumers.

Keep in mind that chart is JUST oil – coal and natural gas have also never been more available and, despite Fukushima, nuclear power isn't going away either. Even as production ramps up to record levels, the economies of scale are driving polysilicone (the material used to make solar panels) to record lows – at $22.10 per kilogram vs. $475 per kilogram in 2008. This is enabling a sea change in major solar projects, with many previously iffy conversions now becoming viable from a cost-effectiveness standpoint. Once the energy cartel loses a customer to solar – they don't get them back and, in case you haven't noticed – we're not creating a lot of new businesses to pick up the demand slack lately…

I guess now, looking back, my call to short FSLR at $300 in May of 2008 was a pretty good idea (now $18.64). I don't do a lot of big write-ups on stocks so this was a treat and a great example of how Cramer pumps a complete joke of a stock, even when it's miles past all rational valuations. I think my little graphic from that FSLR post says it all – unfortunately.

I guess now, looking back, my call to short FSLR at $300 in May of 2008 was a pretty good idea (now $18.64). I don't do a lot of big write-ups on stocks so this was a treat and a great example of how Cramer pumps a complete joke of a stock, even when it's miles past all rational valuations. I think my little graphic from that FSLR post says it all – unfortunately.

We'll see how many fools rush in to this morning's AAPL rally. We'll be adding to our short positions ahead of the Fed and letting our longs ride unless 1,384 fails to hold on the S&P – that would make us bearish real fast! As I noted yesterday, we took trades on both sides in the expectation we'd get violent swings one way or another. In a perfect world, we'll cash out on this violent swing to the upside and then cash in on the next violent move down – maybe at 2:30!

Be careful out there!