Bad news will be good news!

Yesterday Fed Chairman, Ben Bernanke, reassured the markets that the Fed will be "Keeping interest rates low is still appropriate for our economy" (see statement) saying the committee had "had no difficulty coming to a consensus" about keeping rates low. Mr. Bernanke is "really laying the groundwork to show he's serious on holding the line on the federal-funds rate target until well into 2014," said Michael Dueker, chief economist at Russell Investments.

While this is not QE3, the promise of endless supplies of ZIRP "Free Money" was enough to kick the markets up a notch and we finished the day at the highs (we followed through with our morning plan of going bearish into the run-up in Member Chat) – up about one percent overall as the Dollar dove to month lows. In fact, the Dollar bottomed out at 78.9 this morning, the lowest level since early April, when the S&P was at 1,422 and the Dow was at 13,300.

What does it mean then, that the Dollar is back to it's lows but the markets are not back to their highs? Oil was $105, gold was $1,675, copper was $3.96 – all are lower now despite the Dollar being pressed back down to the lows. Therefore, the buying power of our Dollars is actually increasing (we can buy more stocks and commodities for the same Dollars we had in March) – even though it's not apparent from the charts.

Also not apparent then is the declining value of those stocks and commodities which seem, at this point, to only be supported by the Dollar's renewed weakness. So our market premise needs to very much focus on whether or not we believe the Dollar is a weaker currency than the Euro or the Yen. There is, of course, a tremendous difference between SAYING the Fed would ease under certain conditions – which is what Dr. Bernanke said yesterday – and ACTUALLY printing more money – something the Fed has not done since Operation Twist began way back on September 21st (when the Dollar was around 80.

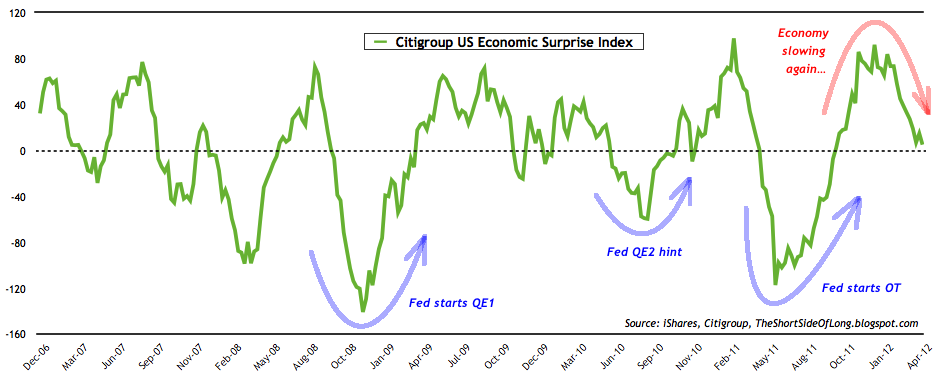

Operation Twist does run until the Fed's next meeting in June but we have been given no certainty from the Fed that QE3 or OT2 will follow – just a lot of vague promises from Uncle Ben telling us that – if we should fall – the Fed will be there to catch us. I believe that's what Jean-Claude Trichet said to Greece a couple of years ago – now both Trichet and Greece's dignity are long gone…

In fact, while we wait on our own housing and employment data, Ambrose Pritchard notes that the ECB says net demand for loans has fallen "to a significantly lower level than had been expected in the fourth quarter of 2011, with the decline driven in particular by a further sharp drop in financing needs for fixed investment." Demand fell 43% for household loans, and 30% for non-bank firms. Demand for housing loans fell 70% in Portugal, 44% in Italy, and 42% in the Netherlands in the first quarter of 2012. Enterprise loans fell 38% in Italy. The survey took place in late March and early April, and therefore includes the second of Mario Draghi’s €1 trillion liquidity infusion (LTRO).

In fact, while we wait on our own housing and employment data, Ambrose Pritchard notes that the ECB says net demand for loans has fallen "to a significantly lower level than had been expected in the fourth quarter of 2011, with the decline driven in particular by a further sharp drop in financing needs for fixed investment." Demand fell 43% for household loans, and 30% for non-bank firms. Demand for housing loans fell 70% in Portugal, 44% in Italy, and 42% in the Netherlands in the first quarter of 2012. Enterprise loans fell 38% in Italy. The survey took place in late March and early April, and therefore includes the second of Mario Draghi’s €1 trillion liquidity infusion (LTRO).

This slump in loan demand is more or less what happened during Japan’s Lost Decade as Mr and Mrs Watanabe shunned debt. Zero interest rates did nothing. The Bank of Japan was "pushing on a string" (though it never really launched bond purchases with any serious determination). It is true that banks have slowed the pace of credit tightening, but they are nevertheless still tightening. "A banking crisis remains very much in play for much of the region," said David Owen from Jefferies Fixed Income.

The IMF said last week that Europe’s banks would slash their balance sheets by €2 trillion – or 7% – by next year. This amounts to an economic shock. The Fund said deleveraging on this scale at a time of sharp fiscal tightening risks a "bad equilibrium". Indeed it does. It ensures hell for countries containing 200M people, or more. Judging by the rise of Sinn Fein, the Dutch Freedom Party, the Dutch Socialist Party (hard-Left), France’s Front National, and some true fire-breathers in Greece, they victims will not readily put up with this.

The IMF said last week that Europe’s banks would slash their balance sheets by €2 trillion – or 7% – by next year. This amounts to an economic shock. The Fund said deleveraging on this scale at a time of sharp fiscal tightening risks a "bad equilibrium". Indeed it does. It ensures hell for countries containing 200M people, or more. Judging by the rise of Sinn Fein, the Dutch Freedom Party, the Dutch Socialist Party (hard-Left), France’s Front National, and some true fire-breathers in Greece, they victims will not readily put up with this.

Julian Callow from Barclays Capital said there is no almost no historical precedent for the sort of deleveraging under way in the EMU periphery. Credit rose from 100pc of GDP to over 200pc in Ireland, Greece, Portugal, and Spain in the EMU boom. "This is far higher than in Japan during the 1980s. It is hard to find an historical parallel or any insight from economic theory for where we are going," he said.

Speaking of Japan, that country's ratio of debt to GDP is now 228% – almost double that of Greece and Italy and with a much bigger GDP (3rd in World). Already, the combined costs of interest on that debt and social security are approximately equal to total government tax revenue.

Speaking of Japan, that country's ratio of debt to GDP is now 228% – almost double that of Greece and Italy and with a much bigger GDP (3rd in World). Already, the combined costs of interest on that debt and social security are approximately equal to total government tax revenue.

Japan’s trade balance is about to go negative for the first time since 1980. Land values and Nikkei stock values have fallen to about 30 percent of 1989 levels. Now, educated young Japanese women are emigrating, Japanese companies are shifting production overseas (even to the U.S.), national politics are in gridlock (six prime ministers in the past five years), and last year Japan experienced its first mass street protests in decades.

The Bank of Japan is expected to throw another Trillion Yen onto the fire this Friday so, like many Fund Managers (see chart) – I really can't see the logic in being long on the Yen and, obviously, Europe is on the verge of having a Revolution if the ECB can't learn a tune other than "more austerity please" to solve their problems so why, why oh why is the Dollar below 79? As I said to Members early this morning when we decided to short the Futures – it does not make sense!

We'll still go bullish on the markets if we have to. As I mentioned yesterday, we'll be adding bullish positions this morning if we see 50% retraces of the monthly drops, which would be Dow 13,000, S&P 1,389 (adjusted up 5 points to eliminate AAPL effect), Nas 3,050, NYSE 8,050 and Russell 815. Usually we're good with 3 of 5 over but we didn't pull the trigger on more bull plays as the S&P and the NYSE are right on the line and the Nas has a long way to go – even with AAPL goosing it by 30 points yesterday.

We ARE willing to go technically bullish but I see death crosses – EVERYWHERE – as the 50 dmas fall below the 200 dmas and that, my friends, is NOT a bullish sign. Since the last time we looked at our Multi-Chart on the 16th, when we warned that the "miraculous" move up was masking overall downward momentum, those 50 dmas have now fallen below our 50% lines – also not a good technical sign.

Yesterday we wondered how many fools would rush in and buy as Bernanke and Company play the same old song and dance – again – and the answer, so far, is not too many as the volume was crap and the movement was crap. We'll see if the bulls can pull one out of their hats into the weekend but we'll be leaning bearish if we can't hold 3 of 5 of the US indexes over that 50% mark.

I can't imagine, this weekend, what's going to change that will make Euros and Yen more attractive.