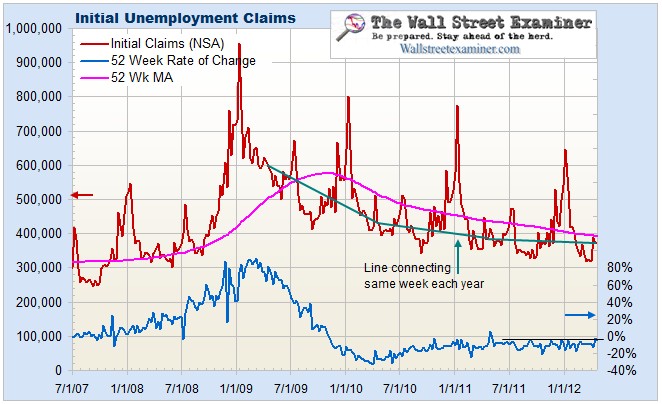

Courtesy of Lee Adler of the Wall Street Examiner

Improvement in first time unemployment claims is slowing. Actual, not seasonally manipulated data, including an adjustment for the usual weekly upward revision, shows that the year to year rate of change is on the cusp of a possible upside breakout, which would be good news for stock market bears if it happens.

Here’s why it’s mind blowing. I’ve plotted it below on an inverse scale with the S&P 500 overlaid.

That speaks for itself. As the improvement in claims has slowed, so have the gains in stock prices.

What’s the Fed’s role in all this? The chart below illustrates. As I have told my subscribers for years, the Fed triggered both the financial crash and the economic collapse when it pulled cash out of its System Open Market Account to fund the direct bailouts of AIG, Goldman Sacks and Pillages, Citi, DoucheBank et. al. Doing that crushed Lehman and other shaky Primary Dealers. Great for the ones that got the free money, bad for everybody else, especially working people and old retired people with a few bucks in savings. Yes, the depression would have happened anyway. The Fed just made it happen faster, more violently, and worse than it would have been, by transferring wealth from middle class workers and savers to the Lloyd Blankfiends and Jamie Demons of the world.

Lately, the Fed has gotten away with not growing its balance sheet because it is continuing to surreptitiously fund, cash out, and prop up the Primary Dealer casinos that own the Strip, …oops… the Street, to the tune of $30 billion a month in MBS buys. As long as it has done that, the layoffs and firings have continued to slow. There is zero chance that Fed will end this program in June because it knows what happens when it lets its balance sheet shrink, which it would if the MBS purchase end. Twist, the Treasury swap program is just a sideshow. The real game is the MBS replacements. That show must go on.

The Fed saw in the second round of QE that the trickle down theory of pimping the stock market to get the economy going just wasn’t paying the desired returns employment wise, and it was giving the old white farts around the table heartburn and gas because of the runaway rise in energy and commodity prices that it was causing. They denied responsibility. But we knew.

So Ben decided that it was time for the FOMClub to sit on their fat cat asses and just quietly keep feeding their Primary Dealer godfathers while continuing to starve all the little old retirees with a few bucks in a savings account. Oh, that’s right. Nothing left! As Paul Krugman says, ZIRP doesn’t matter because seniors live on Social Security, not savings.

That’s because they were forced to spend it all, you smug, clueless, craven, conscienceless intellectual fraud.

So there you have it, a couple of charts of the slings and arrows outrageous fortune, and the out of left field barbs that go with them when I get on a roll.

Until next time… with love.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE’s Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.