Courtesy of Bruce Krasting

There was a big fight in D.C. this past week over student loans.

The issue is a scheduled increase in interest on new student loans from 3.4% to 6.4% set for July 1. Clearly this is a dumb plan. I don’t see any political opposition to the idea that the summer of 2012 is a horrible time to double the cost of student loans. It will shock no one that the ‘solutions’ being put forward by the politicos are the same ones they propose for every other problem.

The House Republicans have put forward a Bill to extend the 3.4% rate for a year. The cost (increased deficit) of the twelve month extension is $6B. The Republicans want to offset the $6B with (surprise) $12B in reduced spending for the Affordable Care-Act. The Republicans love to trade marbles for reduced Obamacare. They want a 2-1 reduction in medical spending versus education costs. Maybe the “Reds” have the chips to push this outcome. They might settle for a 1-1 deal, but the White House will hate this outcome.

The Senate Democrats want to raise taxes on those making over $250K to offset the cost of the one-year deferral. Their argument is similar to the Buffett tax plan they tried a few weeks ago. Lacking support, it was so clear it wouldn't pass that it was never voted on. I would give the Senate legislation on student loans a zero chance in the House. It is D.O.A.

There will be the same ideological pissing match and the same result. We will get a one-year extension “paid” for with “promised” reductions in expenses starting in 2017. Another kick of the can, and another big problem in 2013.

This is what happens over a crummy $6B. On January 1, 2013, there are cutbacks and higher taxes totaling $500B scheduled. The coming “Tax Armageddon” is supposed to be resolved in a lame duck session of Congress after the November election. There is a “zero” chance of that working out.

I have been following the evolution of new global lease accounting standards. At the heart of this issue is the recognition that a lease is just another form of debt, and that the debt should be put on the balance sheet of the lessor. The big hitters in the US leasing business (and their accountants) have opposed the new standards. At this point 100 countries have signed on to the new accounting rules, but the adoption has been delayed by the good old USA.

At the G-20 meeting last week, finance ministers extended the deadline for the our rule makers to adopt the new rules till June, 2013. That date is already 30 months late. My guess is that there will be another delay, and the source of the delay will be the powerful companies, (think GE) that have a lot to lose if a lease is treated as debt (as it should be).

The Foxes are the cops in this hen house. When it comes to accounting and full disclosure, nothing has changed.

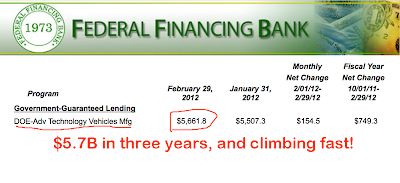

GE has dug itself deeper into the electric car business:

It’s all well and good if GE wants to put its shareholders at risk on the future of electric cars. My concerns are that a great deal of money is being spent by D.C. on this effort, and that GE's, Jeff Immelt, is the President’s policy adviser. Jeff blows smoke in Obama’s face and the government doles out billions to support GE, Ford, Fisker, Tesla and others.

It’s not as if Natgas cars are some untested concept. Brazil has been using them for thirty years. Globally, there are about 15m Natgas powered vehicles. Of that amount only 300,000 (2%) are in the US.

So why is the government, the car manufactures and the energy companies avoiding this opportunity? The answer is that it is much more profitable to sell expensive gasoline to consumers than it is to sell cheap Natgas.

Note: Honda makes a Natgas powered car. This vehicle was named Green Car of the year in 2011 as it gets 31 miles to the gallon with much lower emissions than gas powered cars. If there were a distribution system available, these cars would be more popular than electric cars. The cost of running cars on Natgas is about half of the cost of a gas car.

Why is the government supporting one technology over another? Why is it supporting the expensive alternative versus the cheaper one? Another example of the foxes being the cops.

There was very little net movement in the major currencies last week. I was surprised that the Euro did not weaken. The news is terrible. There is a very good chance that the French and Greek elections on May 6 will bring about political changes that will undermine the stability of the EU.

If the French kick out Sarkozy (I think they will) then the chances of Spain getting a desperately needed rescue package will fall to zero. Without France standing shoulder to shoulder with Germany in support of the Euro, the whole experiment may fall into the crapper. Yet the Euro managed to eek out a small weekly gain against the buck.

Some are attributing the relative strength of the Euro to ongoing capital repatriation by the EU banks as they reduce their non-Euro assets. (Zero Hedge) Others are suggesting that large existing EURUSD short positions are the problem.

Maybe, but I’m catching a whiff of dollar weakness. I don’t pay that much attention to the hourly trading action in FX, but I do watch how the USD trades when news comes out. When there has been “good news” the dollar has not traded higher. When there is “bad news” (the weak GDP report) the dollar has traded lower.

I believe that the US is currently in 3rd place in the race to the bottom. The EU and Japan are leading this race. So this makes me (reluctantly) a dollar bull. I’m not getting fat on this position, I’m not even getting fed, so I cut some positions on Friday. I took a small loss on some recently acquired USDYEN and took a nice profit on an older (smaller) position on USDYEN that I picked up under 79.00. I took the net gains and bought one month puts on the EURUSD.

Note: The EURCHF has been trading at less than 1/8th percent away from the intervention level of 1.2000 for over a month. This is an accident waiting to happen. It looks very quiet on the charts, but there is a steam kettle with a hot fire underneath this chart. If the French election goes against Sarkozy, I have to believe the kettle is going to blow a few rivets.

I have no exposure in the CHF crosses, but I’m watching the action. If the Swiss National Bank is forced to support its peg over the next few weeks, it will send a bunch of other lighting bolts flying.

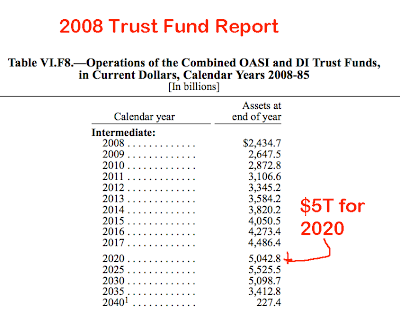

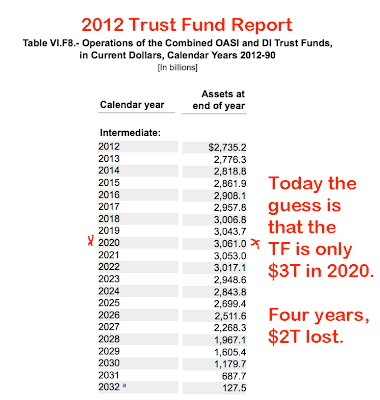

I’ve been trying to stir the pot on Social Security this week after the release of the annual report (Link). I thought the report was ample evidence to stimulate a discussion of what changes are needed at SS, and by when. I was wrong. The terrible report and its terrible conclusions have been ignored. The typical response I get from the Defenders of SS is,

“The Trust Fund behind SS was always scheduled to run out some day; that it's happening ahead of schedule does not matter at all.”

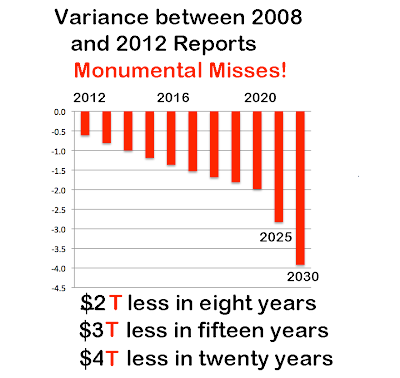

To those who do not see the fire burning here I point to the following slides from the 2008 and 2012 reports to Congress:

The base case assumption on the timing of the peak in the TF balance has changed dramatically over the past four years:

Social Security is going to eat our lunch much faster than the public thinks. Those who think that this does not matter and that nothing should be done are dead wrong.

Note: I get a lot of flack about my focus on the Trust Fund (TF). I agree with those who say, “There is no Trust Fund”. The accounting on this is just a sham. But TF accounting is the reality in D.C., and that is not going to change. So I push on the deteriorating status of the Trust Fund (that doesn’t exist) in an effort to raise a red flag.

.