Yesterday did not count.

Yesterday did not count.

Until the end of day, the volume was low and, as you can see from Dave Fry's SPY chart, the morning pump was mostly erased by the end of the day. In fact, on the Russell and Nasdaq – it was entirely erased. What a friggin' joke, yet no one will investigate it and few will even question it.

As we often say at PSW – We don't care IF the game is rigged, as long as we know HOW the game is rigged and get to place our bets accordingly. In my Morning Alert to Members at 10:05, my comment on the move up was:

Not too many markets are open so super low-volume means we can pretty much ignore whatever's happening. Some wild gyrations at the open already with AAPL popping $10 to goose the Nas and they are spiking us up and down at will on this low volume.

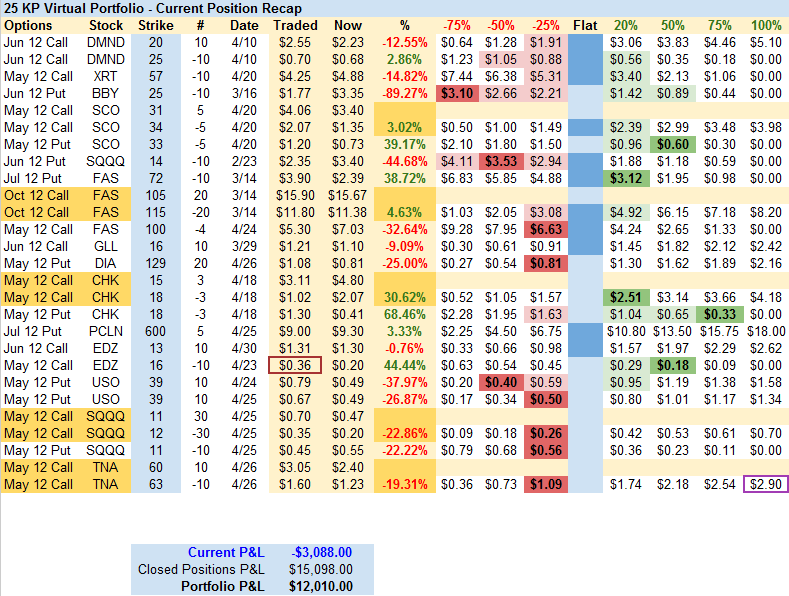

At 12:02 we made our planned adjustments to our 4 active virtual portfolios, taking advantage of the big, bad spike to move to cheap June bear positions and cash out our long plays and just get generally more aggressively bearish at what we thought was going to be the top for the day. The most aggressive move was made in our most aggressive, $25,000 Portfolio (pictured here from its 10am status BEFORE many changes were made), where we flipped our protective TNA hedge from bullish to very bearish – shifting the balance of the portfolio much more bearish with a single move:

At 12:02 we made our planned adjustments to our 4 active virtual portfolios, taking advantage of the big, bad spike to move to cheap June bear positions and cash out our long plays and just get generally more aggressively bearish at what we thought was going to be the top for the day. The most aggressive move was made in our most aggressive, $25,000 Portfolio (pictured here from its 10am status BEFORE many changes were made), where we flipped our protective TNA hedge from bullish to very bearish – shifting the balance of the portfolio much more bearish with a single move:

TNA – $60s are now $4 so let's take that and run on 5 (1/2), as that's more than we paid for the spread and we'll ride the $63s half-covered with a stop on 5 at $3 (now $2.25). Also, a stop on the 5 remaining $60s at $3, at which point we would reset the stop on the $63s, of course.

Needless to say, that trade worked out huge already as the $60s all stopped out at a $3.50 average ($3,500), which is $500 more than our max potential gain on the spread and the $63 calls already finished the day at $1.10 ($1,100) for a net of $2,400 (so far) off our $1,450 entry on 4/26 – so up 65% in less than a week on the trade we used to protect our bearish bets during the little rally we expected.

After hours, Members celebrated a huge win with PLX, who got approval from the FDA for Elelyso, something Pharmboy, who also writes a regular Biotech Investing column at Stock World Weekly, called to Members' attention way back on March 3rd (along with several other excellent picks):

Protalix (PLX) – FDA review is in May, and I like the prospects of them getting a thumbs up. I have owned shares in PLX for a very long time, and their technology is sound. Pfizer will help PLX sell their main enzyme replacement therapy, Taliglucerase alfa (this enzyme is part of the reason Sanofi bought Genzyme). PLX has a proprietary manufacturing technology which will give them an edge on pricing and thus garnering market share. With Pfizer's sales force behind them, I like PLX's chances. The technology is also transferable to many other disease treatments, so this is a long term holding in my portfolio. To play the FDA, I like the May $5/7.5 bull call spread for 80c (buy the $5 calls, sell the $7.5 calls), and sell the April $5 puts for 40c. IF the April $5 puts expire worthless, the bull call spread price cost basis is reduced to 40c. That means the maximum loss of 40c, or a maximum payout of $2.10.

PLX shot up to $7.91 last night and that trade is looking good for the full 525% profit potential so congratulations to Pharmboy and all the Biotech players at PSW!

Since last Monday, we've made a lot of picks in both directions. As we bid a fond farewell to our longs, we should review our status and see if there are any opportunities to go back to the well ahead of what we expect to be a fun week of selling for the markets (in order of selection by day, does not include Member Portfolio moves).

Since last Monday, we've made a lot of picks in both directions. As we bid a fond farewell to our longs, we should review our status and see if there are any opportunities to go back to the well ahead of what we expect to be a fun week of selling for the markets (in order of selection by day, does not include Member Portfolio moves).

Monday Market Meltdown – Global Wheeee Edition (April 23rd):

- CAT May $95 puts at $1.05, now .50 – down 52% (gone after earnings)

- DXD May $12 calls at $1.35, now .65 – down 44% (still playable)

- CHK at $17.20, now $18.05 – up 5%

- CMG June $375 puts at $5, selling May $475 calls for $4.75 for net .25, now net $2.95 – up 1,080% (was 1,860% when we killed it after earnings).

- UUP May $22 calls at .17, now .09 – down 47%

- EDZ May $14/17 bull call spread at .80, selling $13 puts for .65 for net .15, now net -.05 – down 133% (playable for the .05 credit).

- TNA Weekly $55 calls at .85, expired at $5.70 – up 570%

- FAS May $80 puts sold for $1.65, now .28 – up 489%

- (2) TQQQ May $103/110 bull call spread at $4 (now $9.22), selling (1) ISRG Jan $350 put at $4.40 (now $3) for net $3.60, now $15.44 – up 328%

- AAPL Weekly $575 calls at $20.75 (out at $39), selling May $590 calls for $22 (now $11) for net $1.25 credit, now net $29.25 – up 2,340% (so far)

- QQQ May $63/66 bull call spread at $1.90, now $2.47 – up 30%

- EDZ May $13/16 bull call spread at $1, now .50 – down 50% (still playable)

- NFLX complex earnings play – too complicated to summarize – did very well.

That was a very busy day, as it often is when we call a turn (we flipped more bullish into the end of month). As you can see, we try to balance with trade ideas on both sides as we really hate to be more than 60/40 in either direction and, amazingly, both bull and bear side trade ideas did fairly well – even without timing our exits (as we're just reflecting the current price as if they were left alone).

That was a very busy day, as it often is when we call a turn (we flipped more bullish into the end of month). As you can see, we try to balance with trade ideas on both sides as we really hate to be more than 60/40 in either direction and, amazingly, both bull and bear side trade ideas did fairly well – even without timing our exits (as we're just reflecting the current price as if they were left alone).

Tempting Tuesday – As Usual

I led off the Tuesday morning post saying: "Clearly, from the recent sell-off, we have a whole lot of bouncing to do… As we expected at the time, we made it to our 1,384 level on the S&P and then failed to hold it and now we come in for our 2nd tests of our 3 significant levels – 1,360, 1,372 and 1,384 – that's our range until it breaks and THEN we can make some directional bets. In this market chop, our best strategy has been to bet both ways."

- BWLD (3) Sept $90 calls at $5.80 ($1,740), selling (5) May $85 calls for $3.60 for net $60 credit, now $510 – up 950% (so far)

That was it on Tuesday – what a difference from a busy Monday! See how good we are at resisting temptation?

Whipsaw Wednesday – Apple Today Keeps the Fed at Bay

Whipsaw Wednesday – Apple Today Keeps the Fed at Bay

AAPL's earnings were great but Durable Goods was a disaster and my suggestion was to have IPhones and IPads reclassified as Durable Goods – Economy fixed! My comment on the situation in the morning post set the tone for the next week's action:

Can we survive 2 more months without another shot of QE? Doubtful, the bulls are already jonesing really bad and, as the great Gator explained, "I really hate having to resort to knocking older people in the head to get their money – but I'll do it – 'cause I'm a crack head!" The investing class is just as hooked on free money from the Fed as Gator was on $20s from his brother and they are just as willing to destroy older people's retirement accounts in order to get another hit from the Fed's Free Money Crack Pipe.

- DIA May $127 puts at .80, now .35 – down 56% (we moved to June hedges yesterday)

- (2) SQQQ May $11/12 bull call spread at .30, selling (1) $11 puts for .45 for net .15, now net .05 – down 66% (I still like this at net .05)

- GLW 2014 $12 buy/write at net $9.03/10.52 – on track.

- GLW 2014 $10/15 bull call spread at $2.75, selling Jan $15 puts for $2.10 for net .65, now .97 – up 49% (also, on track)

- PCLN July $580 puts at $9.60, now $7 – down 27% (we're in the $620 puts now)

- UUP May $21 calls at .90, now .85 – down 6% (will be back up this morning)

Federally Fueled Thursday – QE Maybe?

Federally Fueled Thursday – QE Maybe?

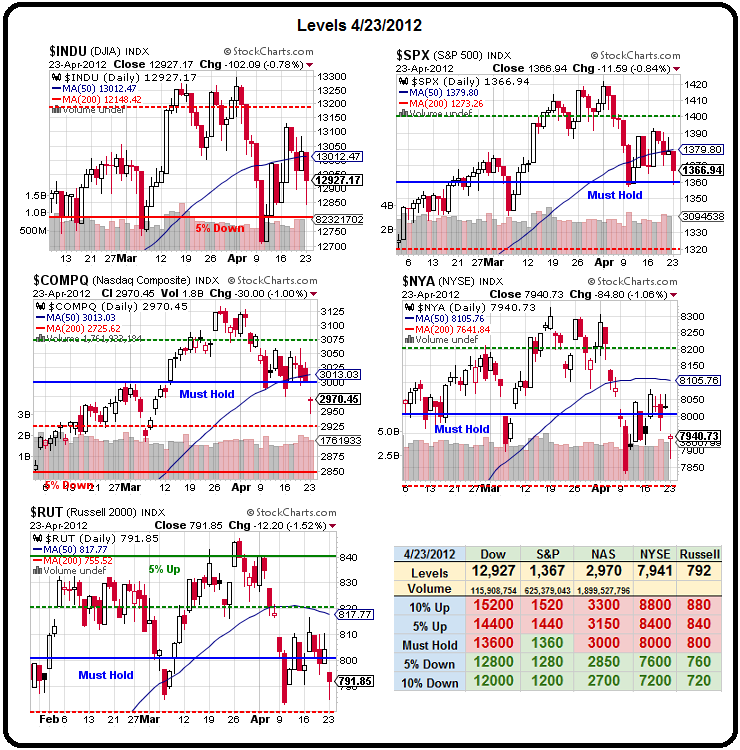

I put up our famous Multi-Chart with our predicted 50% bounce levels (that may be back in play going the other way shortly!) and my comment on the situation was:

We ARE willing to go technically bullish but I see death crosses – EVERYWHERE – as the 50 dmas fall below the 200 dmas and that, my friends, is NOT a bullish sign. Since the last time we looked at our Multi-Chart on the 16th, when we warned that the "miraculous" move up was masking overall downward momentum, those 50 dmas have now fallen below our 50% lines – also not a good technical sign.

Yesterday we wondered how many fools would rush in and buy as Bernanke and Company play the same old song and dance – again – and the answer, so far, is not too many as the volume was crap and the movement was crap. We'll see if the bulls can pull one out of their hats into the weekend but we'll be leaning bearish if we can't hold 3 of 5 of the US indexes over that 50% mark.

I can't imagine, this weekend, what's going to change that will make Euros and Yen more attractive.

- 3 AMZN July $220s at $4 ($1,200) out at $22 ($6,600), selling 5 May $210 calls for $2.15 ($1,075), now $21 ($10,500) for net $125, now net $3,775 – down 3,020% (obviously, we'll be rolling the short calls!)

- BAC Jan $7.50/10 bull call spread at $1.08, selling $7.50 puts for .82 for net .26, still net .26 (playable)

- TNA May $57/62 bull call spread at $2.70, selling CHK June $17 puts for $1.25 for net $1.45, now $1.77 – up 22%

- Jackie's Picks (take your daughter to work day) – SINA, AAPL, DIS, ASNA, MCD, CNK (she also called the Swiss National Bank incompetent).

That AMZN trade is a great illustration of how leverage can bite you in the back but we're confident that AMZN will not sustain $220, otherwise we would not have made the trade in the first place. Our gamble was the issues would show up in earnings, which they did, but a little bookkeeping magic kept the issues we see from being realized this quarter – though we quickly bailed on our longs.

Thank GDP it's Friday – Reality Check?

Thank GDP it's Friday – Reality Check?

My comment to Members in early morning chat (where we had a great discussion of market manipulation in general) was:

I still just want to short everything. My only reaction on Monday if we open down 500 points will be to kick myself for not shorting the crap out of this rally but it's just too crazy to make uni-directional bets. It's the last week in April next week and if the "sell in May" crowd want to exit at good prices – this is exactly what they need to do – spark a BS rally, have Cramer scream BUYBUYBUY until the retailers think they are missing out and then, when the sheeple move in – the funds move out, right on schedule in May.

In the morning post I asked: "Will the GDP be bad enough to be good?" and it was. I think we did pretty good on our morning prediction as we pretty much nailed our exit points yesterday as my Friday morning targets for this QE Maybe Rally were:

In the morning post I asked: "Will the GDP be bad enough to be good?" and it was. I think we did pretty good on our morning prediction as we pretty much nailed our exit points yesterday as my Friday morning targets for this QE Maybe Rally were:

We've already had a few hours of extensive conversation about the economic situation in Member Chat so let's just focus on how we can play the next half of the retrace back to our highs at Dow 13,300, S&P 1,420, Nas 3,200, NYSE 8,300 and Russell 850.

As it turns out, we topped out yesterday at Dow 1.333. S&P 1,415, Nasdaq 3,085, NYSE 8,210 and Russell 830 – a bit disappointing, no wonder we took the bullish money and ran at noon!

- PCLN July $600 puts at $8, now $9.25 – up 15% (still love shorting PCLN)

- AMZN May $220 calls sold for $9, now $12.75 – down 42%

- CHK Jan $12.50/17.50 bull call spread at $2.95, selling $14 puts for $1.80 for net $1.15, now $2.66 – up 131% (may be available again on disappointing earnings)

- HOV Jan $1/2 bull call spread at .60, selling $2 puts for .60 for net $0, now .05 – up infinity (still playable)

- HOV Jan 2014 $2 calls at .65, selling Jan $2 puts for .60 for net .05, still .05 (still playable)

- TZA Oct $15/21 bull call spread at $2, selling CHK Jan $15 puts at $2 for net .15 credit, now net .50 – up 233% (still playable if CHK falls today)

- HPQ Jan $23 puts sold for $1.85, now $1.65 – up 10%

- IMAX Jan $20 puts sold for $2, now $1.80 – up 10%

- (10) FAS July $109/119 bull call spreads at $4 ($4,000), selling 5 Oct $65 puts for $4 ($2,000) for net $2,000, now $1,400 – down 30% (still a good upside hedge).

- HOV Jan $1.50/2.50 bull call spread at .45, selling $2 puts for .55 for net .10 credit, now .05 credit – up 50% (still playable with smaller credit)

- AMZN Oct $175 puts at $5.40, now $5 – down 8% (still playable)

- USO June $38 puts at .69, now .60 – down 13% (still playable)

Another busy day on Friday as we once again prepared for a turn. That was the end of our quarterly free pick week and Membership is once again closed but I'm sure we'll do it again in July for those of you who wonder what it is we do all day at PSW. Overall, we're had 18 winners and 14 losers with 3 even so far but the bullish winners are off the table and our mostly bearish losers remain in play and hopefully a lot of those losers will turn around.

If the markets do hold up – aside from being very surprised, we'll be adding more bullish picks – starting with that FAS trade as QE – if it happens, will give a huge boost to the Financials.

Meanwhile, we watch and wait to see what sticks. Europe has been plunging since the open this morning and we're looking to open weak but it's a long way down just to get back to our Must Hold lines and, until those break, hope springs eternal for the bulls.