5.4%.

5.4%.

That's how much the Dollar has risen in the month of May. Should we be surprised then, that the S&P has fallen 7.2% – from 1,415 to 1,313? The Dow is down 900 points and that's 6.7% etc. Are the chart's, in fact, giving us a misleading view of how well our markets are doing? I said to Members in this morning's chat:

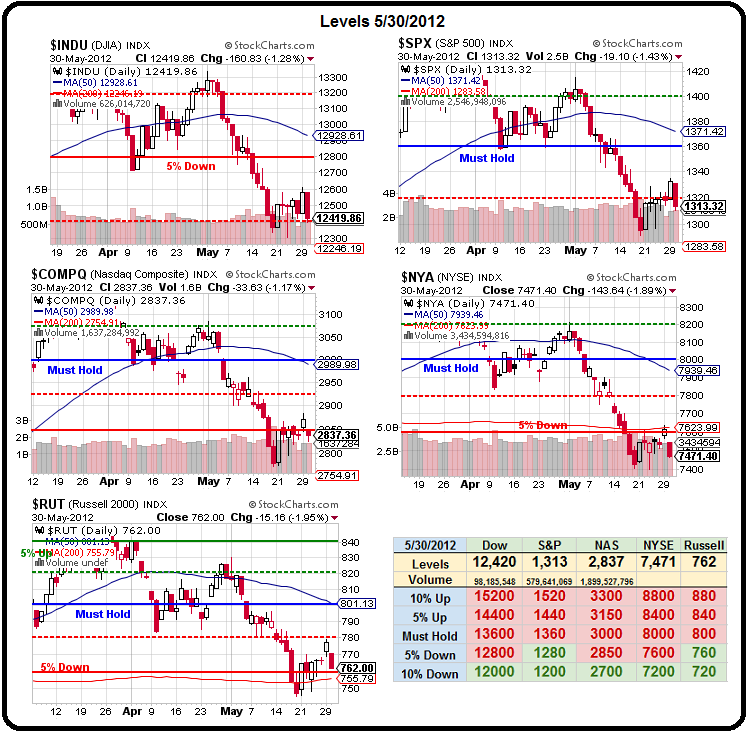

Big Chart still indicating a constructive floor although it doesn't feel like it. Don't forget we're supposed to adjust our lines vs the Dollar and the Dollar is up 5.4% in May. This is a BIG factor because it means ALL stocks should be 5.4% cheaper when you buy them with Dollars so look 2 2.5% lines higher and THAT's where we've recovered to – back to our April highs in a Dollar-neutral market.

Will the Dollar go up forever and keep shoving the indexes lower? Probably not and, if the Euro ever comes back and the Dollar falls – we will see a spectacular rally and all the bears will whine about how unfair it is ect. but I'll tell you right now it's a very simple and natural thing for us to have a sudden 2.5-5% pop on any can-kicking resolution from Europe and/or stimulus from the Fed.

It's very impressive that we've made any progress at all since the 21st as the Dollar has moved 2.4% since then (81-83) and that also means gold is holding up pretty well and gasoline is a huge rip-off as well as, of course TLT is up to 126.16 because the Dollars the notes are priced in are rising and that's part of your net gains in TBills too.

Back in the last Euro panic in 2010, when the Euro dropped to $1.19, the Dollar topped out at $88.71 but it was a spike high (that lasted May – July) and 83 was the consolidated top so we may get another blow-off top in the Dollar if there is no concrete action to "fix" the Euro and that can still drive stocks and commodities much lower which is why Cashy and Cautious remains a good strategy – especially when our CASH is gaining 6.4% a month in buying power!

What's most impressive about our bounce off the "bottom" over the past 10 days is that we've managed this DESPITE the Dollar jumping another 2.5%. We discussed Stock Market Physics last week and the rising Dollar is like increasing gravity in our market equations, making it much harder for the indexes to show progress as they are pulled down (in price) by the increasing value of the Dollars they are purchased in.

What's most impressive about our bounce off the "bottom" over the past 10 days is that we've managed this DESPITE the Dollar jumping another 2.5%. We discussed Stock Market Physics last week and the rising Dollar is like increasing gravity in our market equations, making it much harder for the indexes to show progress as they are pulled down (in price) by the increasing value of the Dollars they are purchased in.

Stocks, just like any marketable commodity, are priced in Dollars and if the buying power of my Dollar goes up 10% then I should expect to be able to buy one share of CVX for $97.50 instead of $108 the same way that, if I were in Paris and my Dollar went up 10%, that my croissant should be 10% cheaper at my next breakfast.

None of this is taken into account in standard TA and very few charts are adjusted for short-term moves in the Dollar which is amazingly foolish – kind of like deciding whether or not to dive off a cliff and deciding the water level isn't a factor – so you just make your decision based on "other stuff."

Notice the night and day difference between our major indexes priced in Dollars and priced in Euros. The Dow is actually HIGHER than it was at the end of April, as is the S&P. Gold is, as we would expect, holding up in adjusted currency terms but oil and copper are legitimately falling, no matter how you measure them and that too makes sense based on what we know about fundamental demand. Overall – it's not the markets that went crazy – it's the currency they are priced in!

At the beginning of May, AAPL was priced at $575 and could buy us 5.4 barrels of oil at $106 and today AAPL is at $582 and can buy us 6.6 barrels of oil at $88. Oil is just as arbitrary a thing to price AAPL in as Dollars but, priced in oil, AAPL is up 22% for the month. You'd better learn to think like this if we begin to have a deflationary market as it's all about RELATIVE asset protection as everything you own or want to buy gets cheaper and cheaper. This has been happening to Japan for 20 years now.

At the beginning of May, AAPL was priced at $575 and could buy us 5.4 barrels of oil at $106 and today AAPL is at $582 and can buy us 6.6 barrels of oil at $88. Oil is just as arbitrary a thing to price AAPL in as Dollars but, priced in oil, AAPL is up 22% for the month. You'd better learn to think like this if we begin to have a deflationary market as it's all about RELATIVE asset protection as everything you own or want to buy gets cheaper and cheaper. This has been happening to Japan for 20 years now.

I still maintain that without the FUEL of outside stimulus, our markets don't have the THRUST to fight the gravity of the rising Dollar and we will eventually keep drifting lower. We ran the numbers yesterday in Member Chat and came up with $10Bn of stimulus/bailouts required for each point above 1,200 on the S&P between now and the end of the year. So it will cost $1.5Tn in Global stimulus for us to finish the year at 1,350 while a lack of stimulus will run us back down to 1,200 – down 8.6% from where we are now.

While we are having fun with our bullish bottom-fishing, there's certainly no penalty for staying in cash as our cash gained 5.4% this month for an annualized 64.8% return on what's under our mattress (as long as it's in US Dollars) and there's certainly not too many stocks we can invest in that are likely to match the performance of doing nothing if we're going to have these monthly gains in our currency.

Yesterday I mentioned a few nice hedges that can return 1,000% and more if the market keeps tumbling and I sincerely hope we don't need to add more of them but we tested our $62 target on the QQQs yesterday, as expected, as well as our very reliable 12,400 line in the Dow and we played them bullish as planned but it really will be the last straw if those break down and the Dollar pops back over 83 because we're dangerously close to a major breakdown in the Euro, back to $1.19 and that will send the Dollar back to 88 and another 5% will melt off the markets as fast as we're losing our Arctic Ice Shelves to Global Warming (which is another thing our World leaders never get around to doing something about).

Yesterday I mentioned a few nice hedges that can return 1,000% and more if the market keeps tumbling and I sincerely hope we don't need to add more of them but we tested our $62 target on the QQQs yesterday, as expected, as well as our very reliable 12,400 line in the Dow and we played them bullish as planned but it really will be the last straw if those break down and the Dollar pops back over 83 because we're dangerously close to a major breakdown in the Euro, back to $1.19 and that will send the Dollar back to 88 and another 5% will melt off the markets as fast as we're losing our Arctic Ice Shelves to Global Warming (which is another thing our World leaders never get around to doing something about).

If I KNEW the EU leaders were not going to take any action – I'd be gung-ho bearish. Unfortunately, it won't take much at all to "fix" things over there for another 6 months and that will pop the Euro right back to $1.29 and the Dollar back to 80 and the markets up 2.5% or more and it could all happen any day so we need to play both sides of the fence – "just in case" while we wait for a break – one way or the other….