Oh you people are such suckers!

Oh you people are such suckers!

You panic out of positions at rock bottom prices and you'll sit there like a deer in the headlights when we bounce back until we're already too high again and then you'll chase the top – only becoming fully invested after we've already exited. Don't blame me – I try to warn you, but no one listens to me.

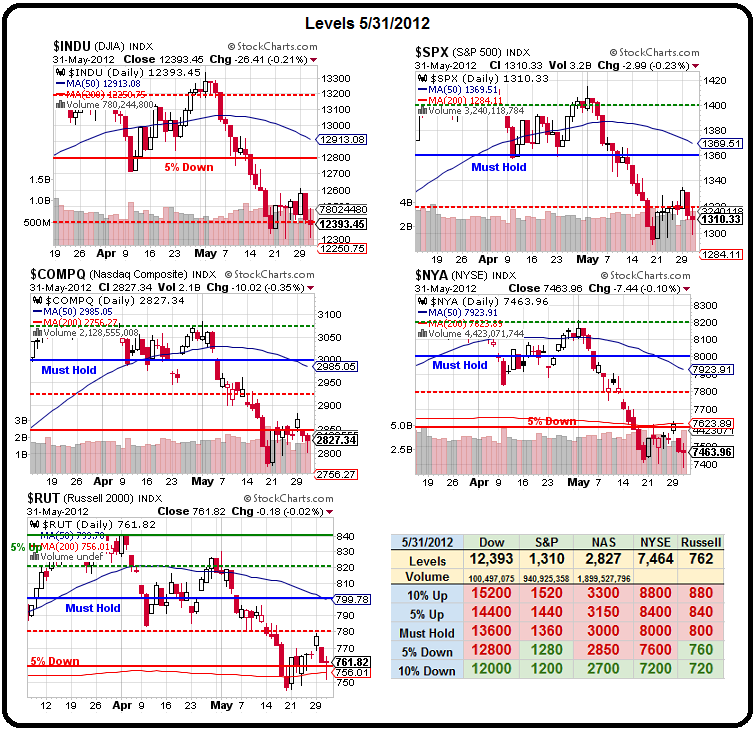

This morning the markets are in full panic more and that's fine with us as not only are we still "Cashy and Cautious" but what did we tell you Wednesday morning? "TZA July $19/25 bull call spread at $1.50, selling $18 puts for $1.05 for net .45" along with EDZ at $17.23 and SQQQ at $51.80. SQQQ is at $53.79 (up 3.8%) and EDZ is $17.90 (up 3.9% and the TZA hedge is already at net .80, which is up 77% in just two days (so far) – now that's a hedge! When you have your hedges in place, THEN you can bottom fish with impunity and boy is the fishing good out there!

Today we get our Non-Farm Payroll numbers and there's a rumor out there that it's a big miss at 120,000 or lower. CNBC has been pretty much reporting it as a fact all morning and Europe is freaking out for that and many other reasons so I had occasion to look back at last month's NFP report, where we predicted it would be a miss with the the title: "The Blow Jobs Deal to the Market Could be Huge." That was 10% ago on our indexes are back to testing last week's lows, where we began to get bullish with our Twice in a Lifetime List of stocks that are back at their 2009 panic lows which we still like enough to sell puts in (giving us an additional 15-20% discount on initial entry).

Today we get our Non-Farm Payroll numbers and there's a rumor out there that it's a big miss at 120,000 or lower. CNBC has been pretty much reporting it as a fact all morning and Europe is freaking out for that and many other reasons so I had occasion to look back at last month's NFP report, where we predicted it would be a miss with the the title: "The Blow Jobs Deal to the Market Could be Huge." That was 10% ago on our indexes are back to testing last week's lows, where we began to get bullish with our Twice in a Lifetime List of stocks that are back at their 2009 panic lows which we still like enough to sell puts in (giving us an additional 15-20% discount on initial entry).

That post capped off a week of bearish picks as we followed through with our plan to cash out into the April rally – it's those bearish profits we're now GAMBLING with as we bottom fish but, as noted above – we're hedging our bullish bets because there's no limit to how badly investors can freak out in the stock market – CASH remains KING!

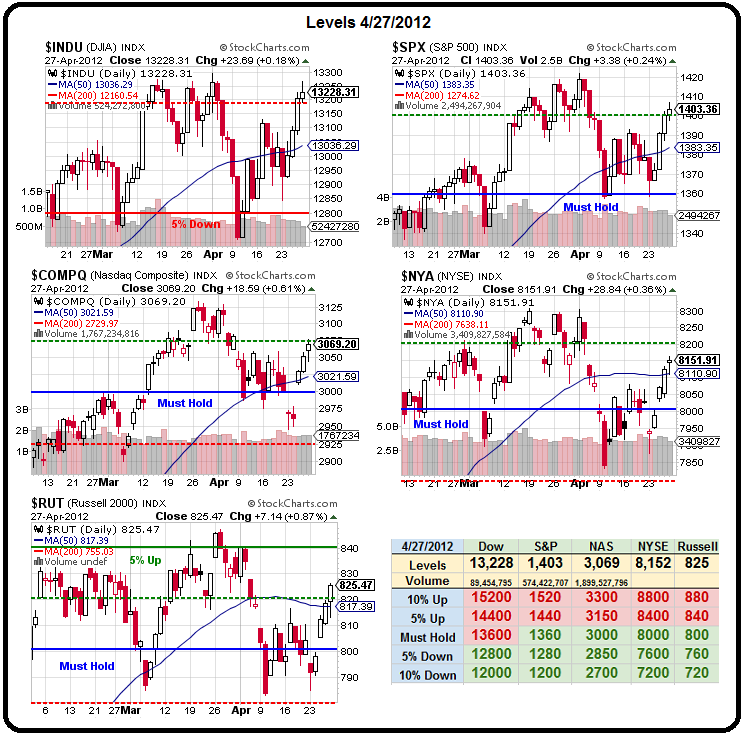

A quick review of the week leading up to the last NFP report is a nice view of how we played the Euphoria at S&P 1,415 (trade ideas pulled from Member Chat):

(4/30) April 30th and All is Well – ROFL!

(4/30) April 30th and All is Well – ROFL!

- PCLN July $620 puts at $11.45, now $33.50 – up 192%

- EDZ June $14 calls for $1.22, now $4.58 – up 275%

(5/1) Technical Tuesday – Holding the Line on Light Volume

- 3 CHK 2014 $25/35 bull call spreads at $1.85, selling 1 $18 put for $4 for net $1.55, now -$1.20 – down 177% (I like it better for a net $1.20 credit!)

- SQQQ June $11 calls at .75, now $2.25 – up 200%

- SCO June $30 calls at $4, now $19.50 – up 387%

- DIA July $122 puts at $1.14, now $1.35 – up 18%

- USO June $39 puts at .85, now $6.40 – up 652%

- SCO June $30/33 bull call spread at $1.80, selling May $34 puts for $1.65 (expired worthless) for net .15, now $2.95 – up 1,866%

- SCO June $33/36 bull call spread at $1, now $2.85 – up 185%

- VXX June $15/18 bull call spread at $1, selling June $18 puts for $3.20 for net $2.20 credit, now $2.20 – up 200%

(5/2) Will We Hold It Wednesday – NOW It's May

- CHK Jan $12.50/17.50 bull call spread at $3, selling $17.50 puts for $3.20 for net .20 credit, now $1.20 credit – down 500% (I still like it!)

- CHK June $15 calls at $2.75, now 2.35 – down 15%

(5/3) Thursday Follies – Europe "Fixed" Again

- LNKD June $90 puts at $3.30, now $2.45 – down 26%

- 4 LNKD July $120 calls at $6.30 ($2,520), selling 5 May $110 calls for $6.20 ($3,100) for a net $580 credit, now $560 – up 196%

- LNKD June $110/100 bear put spread at $5.60, now $7.70 – up 37%

- LNKD July $120/95 bear put spread at $12.50, now $17.10 – up 37%

- GMCR 2014 $25/35 bull call spread at $2.70, now $3.05 – up 13%

- GMCR 2014 $25 puts sold for $8, now $9 – down 13%

- ABX 2014 $30/45 bull call spread at $6.60, selling 2014 $30 puts for $3.40 for net $3.20, now $3.40 – up 6% (still a nice play)

- USO June $39 puts at $1.40, now $6.40 – up 357%

(5/4) Friday – The Blow Jobs Deal to the Market Could be Huge

- EDZ June $12/15 bull call spread at $1.10, selling $13 puts for $1 for net .10, now $3.10 – up 3,000%

- EDZ July $13/17 bull call spread at $1, selling $12 puts for $1.10 for net .10 credit, now $2.30 – up 2,400%

Of course we took a few bullish pokes along the way but that's what you are SUPPOSED to do with bearish profits. Mostly, as we are doing again this week, they were LONG-TERM entries by selling puts that are far out of the money. Our biggest mistake so far was not staying bearish through the bounce, but this very poor NFP report (+69,000 AND last report revised down to 79,000) bookends the month quite nicely.

Of course we took a few bullish pokes along the way but that's what you are SUPPOSED to do with bearish profits. Mostly, as we are doing again this week, they were LONG-TERM entries by selling puts that are far out of the money. Our biggest mistake so far was not staying bearish through the bounce, but this very poor NFP report (+69,000 AND last report revised down to 79,000) bookends the month quite nicely.

Clearly if we have no stimulus over the weekend, we'll be shifting much more bearish but we have our hedges and we have our cash and this is HOPEFULLY the bottom of that emotional chart where we have Capitulation, Despondency and Depression or, what we at PSW like to call – "a fantastic entry opportunity" in exactly the same way that Excitement, Thrills and Euphoria were our signal to head for the exits and flip short.

Again, I can only warn you about what's going to happen and suggest some trade ideas that might benefit. This is the blow-off bottom we've been waiting for and we'll see how much damage is done on this "terrible" news, which is exactly the kind of news that DOES put the Fed back in play. I don't like that our bullish investing premise is based on anticipation of Government interference but we have to play the cards we're dealt and, if this NFP report doesn't put the Fed and the other Central Banksters into action – then we'll be shorting this market down another 10% next week but, for now – it's time to fish!

I went over some bullish Dow components that I liked in Member Chat earlier this morning and I'm sure we'll have plenty of nice trade ideas once the market opens. Oil touched our long-term target of $82.50 (/CL) after the NFP report and of course that's a bouncy spot to go long and XLF may hit our $13.50 bottom target and, best of all, TLT could be up in the $130s, where it makes an excellent short – yes, it's going to be a fun day today and, if we head lower and Monday sucks – please note those two EDZ hedges from the 4th were our best gainers and that was AFTER the Dow already dropped 200 for the week – we know how to layer our hedges – that's not a problem (see yesterday's morning Alert to Members for our 2 recent aggressive short plays) – I just don't think we're going to need to.

Have a great weekend,

– Phil