That was the word from Uncle Ben yesterday as he testified before the Senate and, as we warned you in the morning post, without Dr. Bernanke firing those stage two boosters on the market:

We may fall gently back to our lows as we once again shift our focus to the G20 or we may blow up, along with the bullish expectations that have driven the market for the past two days – in which case, I don't know if the G20 will have enough fuel to pull us out of the tailspin that a lack of Fed action is likely to put us in.

So not much new to report this morning. We are, so far, in a relatively gentle descent – market-wise but we caught the danger signs as our gauges flashed warnings at us early yesterday and went from "Cashy and Cautious" back to CASH. As my morning Alert to Members, which went out at 9:53 yesterday morning, said:

Good morning – cash, Cash, CASH is King ahead of Bernanke at 10. Nice pop to lighten up into and that would go for the small portfolios too if I weren't playing them for an aggressively bullish hunch that Ben has no choice at this point, other than to at least strongly indicate that additional accommodative policy is likely warranted.

Oil is testing $87 (/CL) and is a great short here. $86 is still too much based on yesterday's inventory. If Ben fails to stimulate – it will drop like a rock but very, very dangerous to say the least.

Cash is so much more relaxing!!

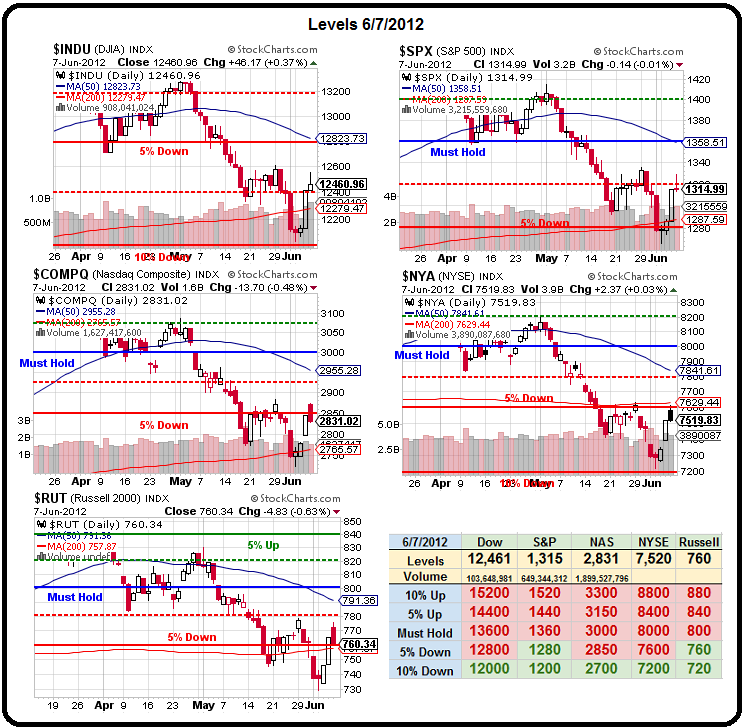

We recycled the 5 bearish trade ideas we didn't get to use the day before as all of our levels held but yesterday, our levels were S&P 1,310, Nas 2,850, Russell 760 and NYSE 7,600 and those quickly flashed failure warnings across the board and by 10:03 we got the text of Ben's speech and knew it was time to abandon ship. As the Q&A got underway, my 10:31 comment to Members was:

FAS Money/StJ – Up $10,000??? CASH!!!! (we started with $2,000)

Same goes for IWM at $5K and the $5KP at $1,435 for that matter. I guess we'll leave them up but holy cow – any rational person would take that and run in this market…

Ben is having to say NO MORE QE! many different ways – no one wants to hear it.

FAS Money is one of our small (not small anymore) virtual portfolios as are the $5KP and IWM Money. None of them have the buying power to ride out a massive dip so the proper play was to cash them out as they are all up huge for the year. Our super-aggressive $25KP is a lot more flexible and that one we're happy to play through as it's the aggressive carve-out (no more than 10%) of a much larger portfolio like our $500,000 Income Portfolio.

FAS Money is one of our small (not small anymore) virtual portfolios as are the $5KP and IWM Money. None of them have the buying power to ride out a massive dip so the proper play was to cash them out as they are all up huge for the year. Our super-aggressive $25KP is a lot more flexible and that one we're happy to play through as it's the aggressive carve-out (no more than 10%) of a much larger portfolio like our $500,000 Income Portfolio.

By 10:53 the writing was (to us) clearly on the wall as I said to Members: "All breaking down now – Dow is lagging so best short to chase at the moment (12,470 on /YM and $124.65 on DIA at 12,478)."

We had a nice dip to 12,430 in the futures by the day's end – good for $200 per contract and this morning we fell all the way to 12,300 for another $650 per contract and we played for the bounce at 7:27 am this morning with a long on Oil Futures (/CL) off the $82 line (a $5,000 per contract gain off our Futures short in the morning Alert!) and we had a nice run up to $83.75 already, which is very nice as oil is good for $10 per penny per contract or $750 – paying for our Egg McMuffins and letting us get back to cash ahead of the open.

The markets held up better than expected into the afternoon but our attitude didn't change. As we got a little surge back up at 1:55, I warned our Members once again:

Ah, now we're getting a little sensible action. DO NOT tell me you didn't have all day to cash out!

Dollar coming off the floor at 82.14, oil testing $85 and looks like it will fail into the 2:35 NYMEX close, Gold $1,589 and not looking strong there with silver 1% weaker than that and nat gas now $2.28! Even gasoline heading lower ($2.69) so what the hell is the energy sector happy about? Nothing – stupidness – NO QE FOR YOU!!!

At 2:29, we were getting impatient as we now were sitting on the morning short plays and off our longs and I noted to Members:

At 2:29, we were getting impatient as we now were sitting on the morning short plays and off our longs and I noted to Members:

Oil failing $85 again – I think below $84.50 into the close and that HAS to spook XOM off their 5% run in the last 3 days (one would think) and that should knock the Dow back a point and that's back to yesterday's close (12,400) so everything points to that happening EXCEPT the actual market action – which is stubbornly hanging on.

I'm baffled – how can people not want to take profits into the weekend off a 500-point pop in the Dow from Monday's low?

We should open today below that 12,400 mark and how we behave at that line (if we should get an attempt to get back over) should give us the story for the day. Overall, unless there is some big news, I expect we flatline into the weekend and that means we STILL have constructively bullish gains for the week but not enough so (as it's only a weak bounce overall) that we want to go bullish (or bearish) into the weekend.

Cash really is king and we feel like kings going into this weekend with nothing on our minds except working on our tans and the short trades we picked up in yesterday's Alert to Members. The G20 meeting isn't until the 18th in Mexico and that's AFTER the Greek elections, when the World may already be in flames so even if the market moves higher on Monday – who wants to bet on it lasting?

Cash really is king and we feel like kings going into this weekend with nothing on our minds except working on our tans and the short trades we picked up in yesterday's Alert to Members. The G20 meeting isn't until the 18th in Mexico and that's AFTER the Greek elections, when the World may already be in flames so even if the market moves higher on Monday – who wants to bet on it lasting?

We do have our bullish trades in the Income Portfolio but that is about 10% invested and those are brand new picks that can survive a 20% drop that we'd be happy to double down on if we have a 40% drop so not exactly a high-risk proposition there. On the GAMBLING side, we still have our bullish plays in the short-term and aggressive $25,000 Portfolio – just in case the EU or ECB or PBOC or BOJ or BOE step in over the weekend and wave their own stimulus wands but Bernanke just took the Fed off the table – at least through the next Fed meeting on the 19th – which WOULD be the perfect time to coordinate massive action with the G20.

Sadly, I think we're going to need it!