Well, we can't say this was unexpected.

Well, we can't say this was unexpected.

As I noted in yesterday's post, we didn't think much of the Spanish bailout and began shorting the Futures Sunday night. Amazingly, we still opened well above Friday's close and that gave us a great opportunity to cash out our longs and flip bearish. My comment in the Morning Alert to Members was:

As I mentioned above – this was a nice pop and shame on you for not taking bullish profits and running back to cash and we can wait patiently for the next obvious entry on whichever side we end up on.

AAPL is over our expected $580 target off our $555 entry so GREED not to take that and run at $586. They have their conference today and great expectations are always a good time to get out – see my note on AAPL at the end of Friday's chat.

Cash, cash, cash, cash is the way to play this mess. If they Dollar doesn't stay below 82.25 then there's nothing to be bullish about this morning as it means the Euro is going weak again just hours after a huge bailout – which makes perfect sense from a macro standpoint because $125Bn does nothing at all for Italy, Greece or anyone else or, as I said above – band-aids on bullet holes is all we have and the blood keeps flowing….

Our bearish play for the morning was TZA at $20.70, selling the July $19 puts for $1.25 and buying the $20/25 bull call spread for $1.30 for net .05 on the $5 spread. TZA popped up to $22.30 at the end of the day (up 7.7%) and the puts fell to .80 while the $20/25 spread finished the day at $1.80 for net $1 – a 1,900% gain on cash in a single day.

Our bearish play for the morning was TZA at $20.70, selling the July $19 puts for $1.25 and buying the $20/25 bull call spread for $1.30 for net .05 on the $5 spread. TZA popped up to $22.30 at the end of the day (up 7.7%) and the puts fell to .80 while the $20/25 spread finished the day at $1.80 for net $1 – a 1,900% gain on cash in a single day.

In practical terms buying 50 of the spreads would have cost $250 and netted $5,000 but keep in mind you create an obligation to buy 5,000 shares of TZA for net $19.05 ($95,250) and the margin requirement is roughly $12,000. This is why we like to be mainly in CASH in a choppy market. Having spare margin on the sidelines let's you make little trades like this during the day.

Even if you don't have a Portfolio Margin Account, there are other ways to sell short puts to offset the margin requirements and, of course, you can "just" buy the bull call spread, which had no margin requirement at $1.30 and finished the day at $1.80 for a straight 38% gain on the day. Up 38% in a day is a very nice way to hedge a 2.5% drop in the Russell. If you have $100,000 in longs that drop 2.5% ($2,500), then 40 of those hedges at $5,200 would have paid back $7,200 for a $2,000 gain on the day and that's all insurance is supposed to do – mitigate the damages! If you have margin to spare – then you can commit less cash and drastically increase the net gain (also increase downside risk, of course) but, if not – these are still spectacularly profitable ways to protect yourself.

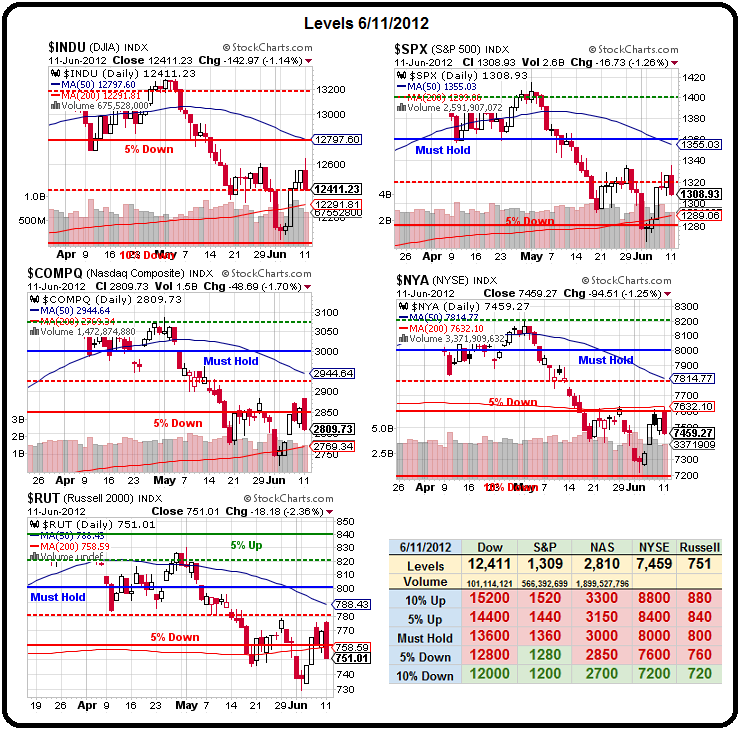

We love playing the Russell but it's not for the feint of heart. As you can see from David Fry's chart, 5 consecutive days where the net move was practically zero but each day we had roughly 2% swings. Working this trade with ultras like TZA and TNA gives us 6% daily swings yet, looking at our Big Chart above – we can see that the Russell is generally well-behaved within our 5% Rule.

We love playing the Russell but it's not for the feint of heart. As you can see from David Fry's chart, 5 consecutive days where the net move was practically zero but each day we had roughly 2% swings. Working this trade with ultras like TZA and TNA gives us 6% daily swings yet, looking at our Big Chart above – we can see that the Russell is generally well-behaved within our 5% Rule.

Also, once you put a nice hedge like that in place – THEN you can go bottom-fishing and we had 5 bullish trade ideas we liked yesterday as the market pushed back down to test the 1,310 line on the S&P, which we thought would hold but we ended the day at a disappointing 1,309, which kept us from going fully bullish at the end of the day.

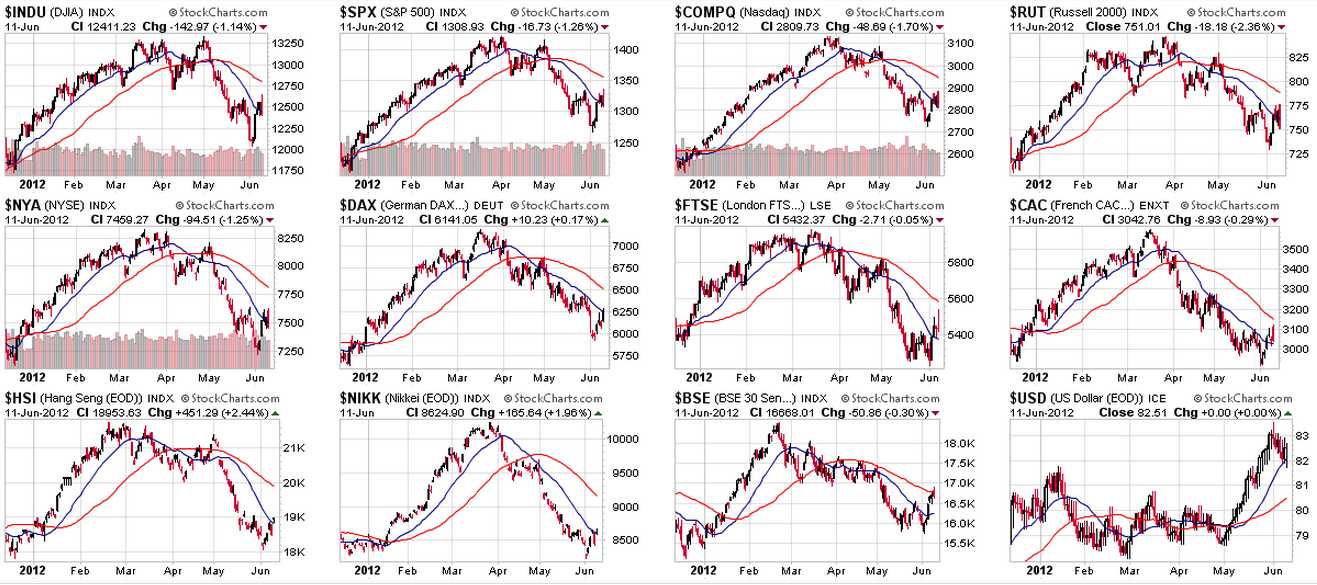

If we look at the Multi-Chart, we see that EVERYONE is testing their 20 dmas – which are all in decline EXCEPT the Dollar, which is testing it's rapidly rising 50 dma from above and it's already bounced off that this morning and plowed back to 83 – cutting the Futures back sharply with a 0.6% gain. That's the "increased gravity" we talked about last week that drags all stocks and commodities lower – as they are priced in dollars – but it also gives us the potential for a nice pop if the Dollar pulls back today – especially if it's coupled with an AAPL rally, back off $570 at yesterday's close.

The charts DO NOT look encouraging. Keep in mind that our only bullish premise is stimulus and, failing to get that – these ships of state may be sinking fast. Have I mentioned how much I like cash lately? TARP was nice, according to Andrew Ross Sorkin, but the unsung hero of staunching the post-Lehman bank panic was the government's quick move to raise the FDIC deposit insurance limit to $250K and fully backstop the money-market industry. Unless Europe does something similar, the €100B Spanish bailout is doomed to fail, he says.

Mario Monti hits the wires to call "totally inappropriate"comments from Austrian finmin Fekter that Italy "too will need support." What Monti did not say was that the comments were "totally untrue" – just inappropriate for one country's Finance Minister to point out how totally screwed another country is…

Mario Monti hits the wires to call "totally inappropriate"comments from Austrian finmin Fekter that Italy "too will need support." What Monti did not say was that the comments were "totally untrue" – just inappropriate for one country's Finance Minister to point out how totally screwed another country is…

As you can see from the poster on the left, tensions are running high in Italy, with the Communist party blaming Merkel for Italy's troubles. "Say no thanks to paying the IMU Banks through the EU," "European Union, Dictatorship of Banks and Monopolies," and "Control the European Union with Socialism" are roughly the headlines of this poster and, of course, the image of Merkel in that kind of uniform is meant to invoke a visceral response in Italians – very nasty stuff so let's not go around thinking Europe is in any way "fixed" as things are actually heating up to the boiling point.

Last Summer, we had the "Arab Spring" and this summer, with 50% youth unemployment in much of Europe (and America) we may see large segments of the populations taking to the streets – especially if Europe continues to employ all stick and no carrot policies.

So that's our bullish premise – Merkel doesn't want posters like this to be her legacy. Obama doesn't want to be a one-term President and, SURPRISE, Congresspeople aren't prepared to lose their jobs this Fall either – so stimulus it will be and we'll continue to do our bottom-fishing until we are FORCED to give up all hope of a recovery but, for now – this is just some healthy consolidation on the way to the inevitable QE3.

I hope we're right – because the alternative is very ugly…