BIG day today!

BIG day today!

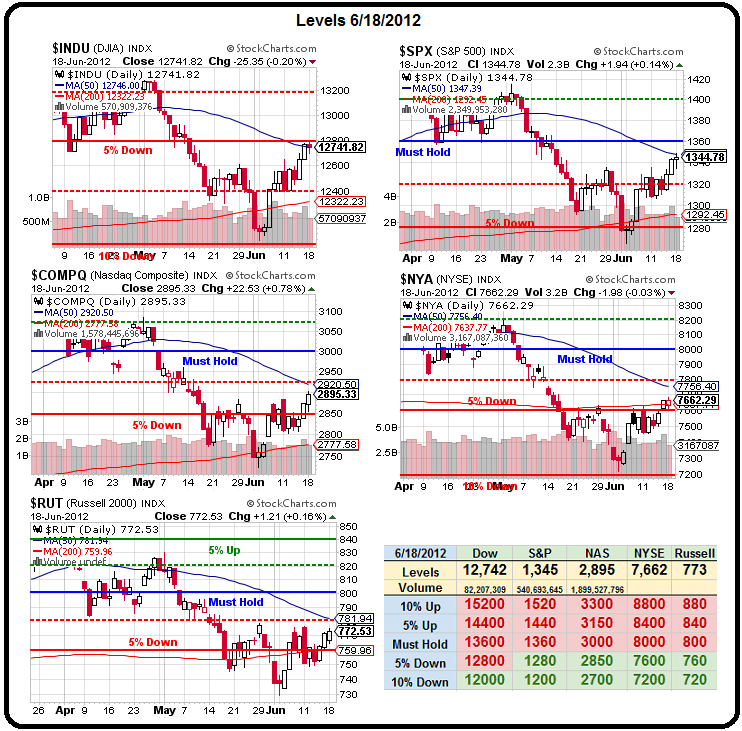

As you can see from the Big Chart, we are testing the 50 day moving averages on the Dow (12,746), S&P (1,347), Nasdaq (2,920), NYSE (7,756) and the Russell (781) IF all goes well and we move up from here. The Dow is already over and the S&P and Russell are close so we'll be watching them closely this morning to see if we should stay bullish or cash out our winners while we wait for some actual bullish news – because the rumors that are driving us higher so far are running out of steam.

The G20 meeting drags on in day 2 and we await their announcement. China dropped $43Bn into the IMF last night and India, Russia, Brazil and Mexico will also commit $10Bn EACH for another $40Bn and that brings the IMF's war chest up to $456Bn. Even Turkey put up $5Bn – we're talking about an all-out Global effort here so we expect A LOT more from the big guns.

Let's not dwell on what it means that Turkey has to bail out Europe and instead focus on Christine Lagarde's statement that the commitments demonstrate "the broad commitment of the membership to ensure the IMF has access to adequate resources to carry out its mandate in the interests of global financial stability." So now it's up to the G20 and that means it's up to Merkel today and Bernanke tomorrow.

Merkel faces mounting pressure to make even greater concessions, by putting Germany's financial muscle behind an integrated banking and borrowing system to keep the euro intact. The question is whether, after two years of muddling through, Europe's pre- eminent power can act quickly and decisively. "I think she will remain an incrementalist: we have not yet reached the point where it is obvious that we are hanging over the precipice," said Paul de Grauwe, a professor at the London School of Economics. "It looks again that what is going to come out is going to temporarily pacify markets until it is clear that it is not going to be sufficient."

Merkel faces mounting pressure to make even greater concessions, by putting Germany's financial muscle behind an integrated banking and borrowing system to keep the euro intact. The question is whether, after two years of muddling through, Europe's pre- eminent power can act quickly and decisively. "I think she will remain an incrementalist: we have not yet reached the point where it is obvious that we are hanging over the precipice," said Paul de Grauwe, a professor at the London School of Economics. "It looks again that what is going to come out is going to temporarily pacify markets until it is clear that it is not going to be sufficient."

For those of you who don't speak Economics – "not going to be sufficient" = DOOM!!!

All of our global indexes are on quite a tear in anticipation of more bailouts/QE from the G20 this week. If we don't get it – prepare for a real temper tantrum that is likely to send us to even lower lows for the year. I can't believe our leaders are willing to risk it but, then again they are almost all new at their job as the last bunch got thrown out in their most recent elections. Hopefully, they do the right thing as the markets are on the cusp of a rally – they just need a little push to get them over these humps:

Now THAT's a technical rally! I drew the 50% lines (from non-spike high to non-spike low) for the past 2 months in blue and you can see how perfectly they are lining up with the 50 dmas. The trick to analyzing a chart is to think about what your extrapolated data sets will do to the arc of the longer-term averages over the anticipated time period. To put it simply, we need those 50 dma's to begin to curve up, therefore we need data points to form ABOVE that red line or the line will be dragged DOWN to meet the lower data points and then the 50% line will fail as support as well and THEN (see Big Chart) the 200 dmas are in danger of curving down as well and we REALLY do not want that to happen!

See – that's everything you need to know about reading a chart in one easy lesson – stop thinking of them as static pictures and imagine the lines as dynamic entities that will be formed, going forward, by each additional data point (close) that goes on the graph and then you will begin to "see" what these things are supposed to be telling you.

See – that's everything you need to know about reading a chart in one easy lesson – stop thinking of them as static pictures and imagine the lines as dynamic entities that will be formed, going forward, by each additional data point (close) that goes on the graph and then you will begin to "see" what these things are supposed to be telling you.

So we NEED to close OVER those 50 dmas today or tomorrow or it will become much harder to reverse the trend that may turn that 50% mid-point into the top of a lower range and that can very quickly send us to a 5% lower low than the one we had 5% ago in early June. At this point, the TradeBots have done their job and pumped us back to these resistance lines but now it will take some Fundamental change (in the form of stimulus/QE) to get us over the hump and ready for the next 5% move higher.

5% on the S&P is 1,412 and that's 67 points higher than we are now and, per our Nobel Prize Soon to be Nominated formula – it costs $10Bn to buy one S&P point so we'll need $670Bn in fresh stimulus from the G20 and the Fed in addition to the $650Bn that is already anticipated in the run from the June lows of 1,280. So far we have $125Bn tossed at Spain last week and let's call it $100Bn from the BRICs to the IMF this morning, leaving us $1,095,000,000,000 short that will need be committed today and tomorrow or we can expect, in the very least, to be stuck in this lower trading range.

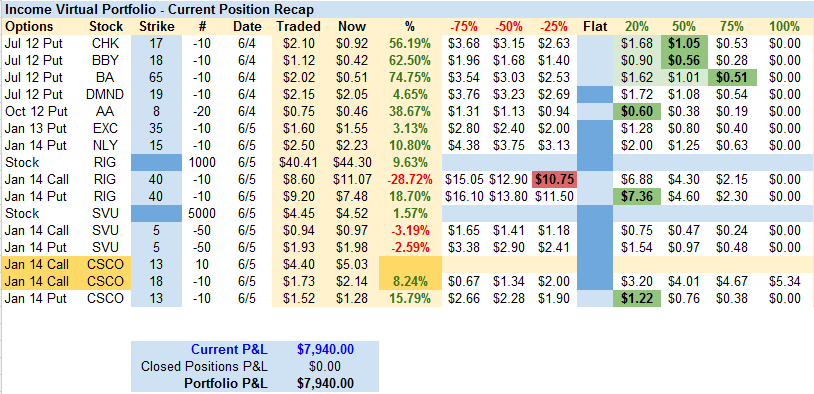

We remain optimistic, but cautiously so. After all, what's another $Trillion between G20 friends? That has been our bullish premise all month but yesterday, on the morning dip, we drew lines in the sand for cashing out our brand new Income Portfolio, which we began just two weeks ago with a virtual $500,000 and only deployed about 20% of it and already we're up about $8,000 ($7,940 at Friday's close) – which is so far ahead of our $4,000 a month income goal that we'd feel like real idiots if we blow it on a G20 failure.

Those first 5 short put plays were the same ones we featured in the June 3rd issue of Stock World Weekly and those 5 positions are providing most of the returns so we'll be raising our stops this morning and leaning towards cashing them out and letting our long-term positions ride as we won't mind a big sell-off there since we're already hedged for a 20% drop and we'd love to add more if they get cheaper as we're less than 20% invested so far.

Our smaller virtual portfolios are also off to the races and we added more bullish positions to the $5,000 Portfolio yesterday in anticipation of a bullish announcement from the G20 but, as Mark Cuban reminded us yesterday – "When your thesis is wrong, you don't wait – you just get out." Let's bear (don't say bear!) that in mind today and tomorrow as our thesis is we will get $1Tn in new commitments from the G20 and the Fed so about $600Bn today and at least $400Bn tomorrow or we're going to have to lighten up and add some more bear hedges.

In yesterday's morning Alert to Members I had noted:

Nice second chance this morning to take oil (/CL) long off that $82 (now 82.44) or at least a break back over the 82.50 line but very tight stops below. RUT (/TF) is testing 760 and that's another good bull line to play but make sure the S&P (/ES) is holding 1,330 or no play!

The S&P gave us no trouble and the Russell Futures were kind enough to jump to 770 yesterday for a $1,000 per contract pay-off and oil hit $84 yesterday for $1,500 per contract and this morning dropped to $82.50 again, giving us another entry and already it's hitting $84.50 just ahead of the bell – Futures are fun!

We had another nice opportunity to short TLT at $127 and we didn't pass that by. DMND ($18.25) got cheap again and FB is not a stock we like but SOCL was down at $13.75 so we went with the broader index play on Social Networking (with an option spread for leverage, of course for our Members), FAS was $82.50 but still one of our favorites along with XLF at $14.25 and SVU touched $4.30, which was good enough for us and CHK was too cheap at $17.76 so we hit it again (all with very clever spreads) but we took $2.75 and ran on HOV as that was a huge run and we're not greedy, are we?

So, on the whole, we were kind of gung-ho bullish yesterday and if we don't pop our levels we will become gung-ho bearish just as fast so be very careful out there. The best sign for the bulls will be the Dollar dropping below that 82 level – everything else will key off that.