And we're out!

And we're out!

It might be a little early because we did get another $267Bn from the Fed yesterday but that plus $125Bn given to Spain and $100Bn to the IMF this month is "just" $492Bn and that, according to our calculations, should be good for 1,350 on the S&P, tops. If they want to get to 1,400 – they'll need another $500Bn from Europe and, while it is widely expected to come – the Fed came up short and if the EU comes up short as well, we could be talking flash crash so we took advantage of the pre-Fed run-up (as planned in yesterday's post) to get back to cash.

My morning Alert to Members was short and sweet:

Good morning!

I don't know if you guys usually click on my little links but this one was the most important of the day – Don't be white people – GET OUT!!!!

This one was so important that I tweeted it (you can follow me here) and Facebooked it (you can follow us here) and I even put it out on Seeking Alpha's Stock Talks (you can follow me here) so don't say I didn't warn you. Sure the market may go up as funds dress windows into the end of the Quarter/Half next week but we caught the run off the bottom this month so why push it when the upside looks limited and the downside does not?

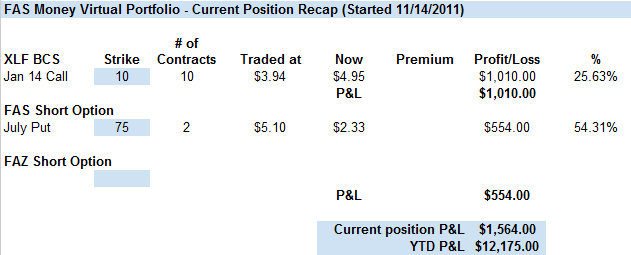

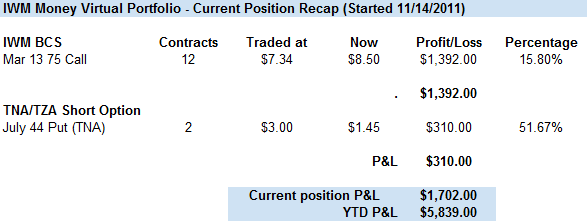

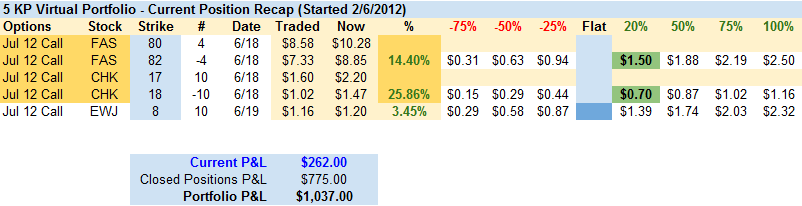

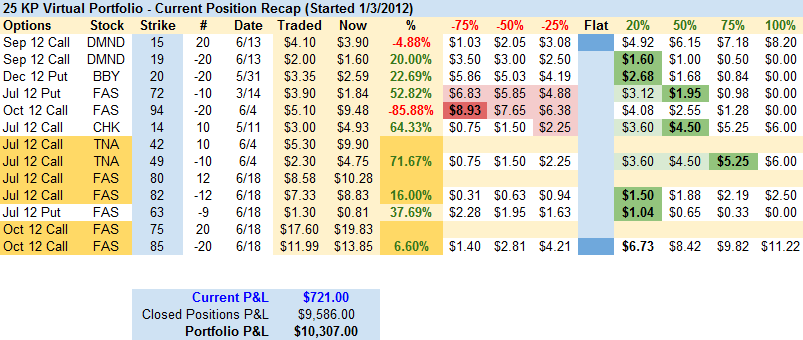

Other than 2014 spreads in our new Income Portfolio – all of our virtual portfolios went to cash rather than risking very nice first half gains. As of yesterday morning they were:

Much thanks to StJ for keeping these tracking portfolios – all back to cash now and hopefully we can match that performance in the second half of the year although I think we're going to ditch the very boring $5,000 Portfolio in favor of a $25,000 Portfolio with only ordinary margin (not a part of a larger portfolio like our Income Portfolio with that margin to draw on). So it will be more a bit more conservative than the aggressive $25KP but able to day-trade – unlike the $5KP and able to use ordinary margin – so better for learning basic option strategies.

Hopefully JP Morgan will sign up some of their traders as it seems the trading losses from the London Whale could hit $6Bn, according to the Post (not that you can believe them) and their unnamed sources. It is expected, however, that accounting tricks (depreciation of credit values, for example) will allow them to paper over the loss with Billions of adjusted "gains" so I wouldn't go betting against JPM but we WERE long and now we cashed out and we'll wait on earnings to decide what to do with the Financials.

Our own market thesis was for massive QE from the EU and the Fed and, since the Fed has hemmed and hawed once again and, so far, we really have nothing concrete from the EU to hang our hats on so why then should we hang out money out to dry on the HOPES (not a valid investing strategy) that we get more stimulus – which we know is not a real fix anyway?

Do you want to know what the scariest thing is? The chart on the left. That's the NYSE McClellan Oscillator (thanks David Fry), which is a breadth indicator derived from Net Advances, the number of advancing issues less the number of declining issues. The McClellan Oscillator is a momentum indicator that works similar to MACD.

Do you want to know what the scariest thing is? The chart on the left. That's the NYSE McClellan Oscillator (thanks David Fry), which is a breadth indicator derived from Net Advances, the number of advancing issues less the number of declining issues. The McClellan Oscillator is a momentum indicator that works similar to MACD.

Note how fast we went from oversold to overbought. Do you feel like we just had an epic rally to rival the 1,500-point run in the Dow last Summer? No? That's because we didn't. What we had was a 500-point run in the Dow that has pushed us to as overbought a condition as we had last October, when the Dow was at 12,284 and dropped 1,050 points over the next month.

The main takeaway from this chart is how QUICKLY we hit oversold. That indicates the "rally" has a very poor base and can just as quickly collapse with volume selling. In other words – it's pure window dressing. As David Fry notes: "Markets want to go higher because, cynically, it’s bonus time for portfolio managers and report card time for clients. After all Europe is not fixed and neither is the U.S. All we really have now globally is money printing and talk to buy time."

By the way, for those keeping score, note the spectacular run-up we had last June into the end of quarter – followed by a whole lot of nothing and then a 3-week, 24-point (18%) drop that caught everyone by surprise. Well, not everyone – we cashed in our Income Portfolio last year into the July 4th weekend for a lot of the same reasons that we're doing it now (we were way ahead and worried about a big dip).

By the way, for those keeping score, note the spectacular run-up we had last June into the end of quarter – followed by a whole lot of nothing and then a 3-week, 24-point (18%) drop that caught everyone by surprise. Well, not everyone – we cashed in our Income Portfolio last year into the July 4th weekend for a lot of the same reasons that we're doing it now (we were way ahead and worried about a big dip).

On the 2nd we had cashed in our $25,000 Portfolio as well as we hit our goal of a 6-month double and we TOOK THE MONEY AND RAN – something a lot of very successful traders forget to do – leading them to become less successful traders when the cycle inevitably turns back on them.

July 1st's post was titled "Stop the Rally, We Want to Get Off!" and I laid out my case for cashing out, despite the very impressive rally that took us back almost 5% off the June lows. We were confident in June to ride it out through the end of the month last year but, this year – due to the Fed and the EU/ECB dithering – we just don't think it's worth risking the weekend.

Giving Greece $229Bn provided us with a brief lift in July but it was all downhill from there and where were we shorting the Futures on the Greek news? It was S&P (/ES) 1,346 (now 1,351), Nas (/NQ) 2,415 (now 2,615), Dow (/YM) 12,720 (now 12,773) and RUT (/TF) 842.6 (now 779) so a big divergence of the Nas and the Rut since last Summer, which is why we like the RUT as an upside bull hedge – in case you really hate being in cash. Of course – for our non-futures players "Hedging for Disaster – 5 Plays that Make 500% if the Market Falls" was an across the board winner as well – something we'll be looking at AFTER we're sure we're breaking down (we waited until Aug 11th last year to get aggressively short and it worked out just fine).

That's right, we're in cash and we're expecting the market to sell off, which will make our cash more valuable as the Dollar rises and the market falls so we hedge our cash with BULLISH trades like UCO (ultra-long oil) at just $25.40 with oil at $81 this morning. UCO was at $45 at the beginning of May so lots of room to run and you can pick up the Aug $29 calls for $1.10 as a straight play on oil getting higher or you can bet oil won't drop below $75 and sell the USO (now $30.40) Oct $28 puts for $1.45 and buy the UCO Aug $22/25 bull call spread for $1.90 for net .45 on the $3 spread that's 100% in the money to start so we just need oil to hold $80 and the return on cash is 566% while the worst case is you end up long on USO at net $28.45, which is 6% below the current price or oil at $75.90.

That's right, we're in cash and we're expecting the market to sell off, which will make our cash more valuable as the Dollar rises and the market falls so we hedge our cash with BULLISH trades like UCO (ultra-long oil) at just $25.40 with oil at $81 this morning. UCO was at $45 at the beginning of May so lots of room to run and you can pick up the Aug $29 calls for $1.10 as a straight play on oil getting higher or you can bet oil won't drop below $75 and sell the USO (now $30.40) Oct $28 puts for $1.45 and buy the UCO Aug $22/25 bull call spread for $1.90 for net .45 on the $3 spread that's 100% in the money to start so we just need oil to hold $80 and the return on cash is 566% while the worst case is you end up long on USO at net $28.45, which is 6% below the current price or oil at $75.90.

So very easy to lever bullish if you are worried that a rally will make you feel left out. We'll also add bullish trade ideas for the Financials and the Russell but they won't be going in our virtual portfolios because what I really like – in case you have not gotten the message yet – is CASH! Cash is King and we can take some of that lovely, lovely cash and take a nice day off or even a long weekend off with the holiday coming up and, when we've had some time to relax – THEN we can see what kind of mess the markets are in and place some bets accordingly.

For the moment though – we can just relax, sit back and enjoy the show!