OK, now we are pushing it.

OK, now we are pushing it.

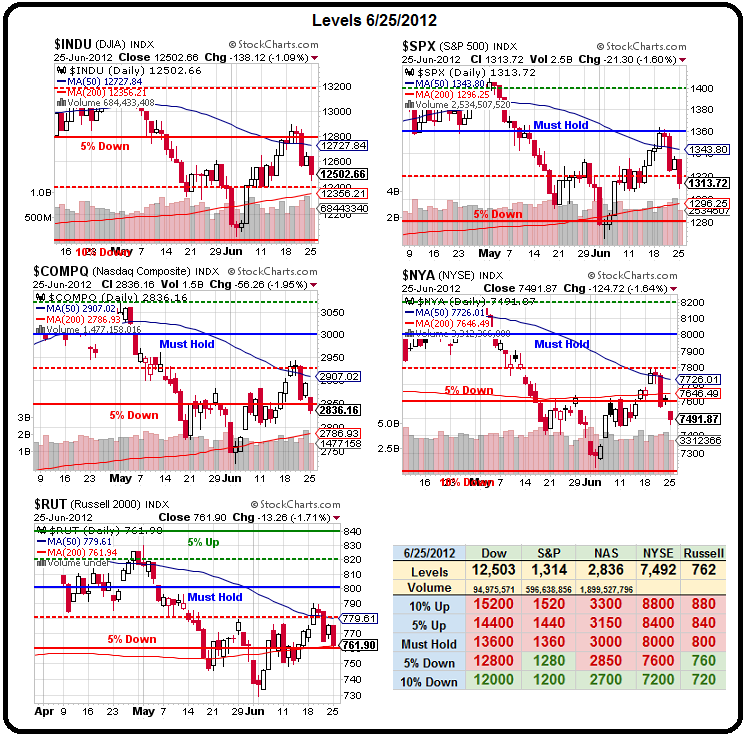

Our danger zone is the bottom of the top of those "V" patterns that we formed in the early June dip. Those lines must hold and they are roughly Dow 12,400, S&P 1,310, Nas 2,800, NYSE 7,450 and Russell 750 – all are holding so far but we really can't afford another red day here if we want to stay bullish.

Although we reminded Members to watch our primary hedges (TZA and EDZ spreads) in the Morning Alert – both of them have bullish offsets (short BTU and USO puts) that will zero out the trade if the market recovers – so we do remain generally bullish as long as our levels hold (and we can stop out our short puts and go more bearish if our levels fail).

Our other trades for the day were still bullish pokes from our very cashy positions – still hoping for the EU to lead us to the promised land – or at least give us a fix that gets us high for another day or two. That's all we need man, just a fix, come on Angela – do us a solid!

We added more CHK longs as they tested $17 again – that is one fun stock to trade if you have good range discipline! TLT got high again so we went short on them in both of our $25,000 Portfolios and we reiterated Friday's AAPL play (see Stock World Weekly) and we went long on oil Futures at $78.50 for a lunch-time trade and got a quick .75 gain ($750 per contract) along with the Dow at 12,400, which gave us a quick 50 points but "just" $5 per penny per contract ($250) for that one.

We added more CHK longs as they tested $17 again – that is one fun stock to trade if you have good range discipline! TLT got high again so we went short on them in both of our $25,000 Portfolios and we reiterated Friday's AAPL play (see Stock World Weekly) and we went long on oil Futures at $78.50 for a lunch-time trade and got a quick .75 gain ($750 per contract) along with the Dow at 12,400, which gave us a quick 50 points but "just" $5 per penny per contract ($250) for that one.

For the Futures-challenged, we added 20 USO July $29/30 bull call spreads at .52 to both our Aggressive and Regular $25,000 Portfolios and USO promptly shot up to $29.80, which is just lovely as we seek to turn $1,040 into $2,000 in 24 days with no margin required on the straight bull call spread. FAS was also too tempting to turn down and we went with a more aggressive spread there and that's using margin to get a 500% return in 24 days if all goes well.

So still bullish with what little cash we have in play. At the start of the day, we had committed just $750 of our $25,000 Portfolio, which means we have TONS of firepower to grab bearish plays – IF WE LOSE FAITH. But we still have faith – we still think our Global leaders are not going to repeat the mistakes of 2008 and they are not going to let the markets drop 20% through inaction but, if they do – oh boy are we going to make a fortune!

Speaking of fortunes, SVU has been on quite a tear on buyout rumors and one of my favorite Stupid Options Trick is to sell a ton of long premium in a company that is going to be bought out because, even if the rumor just solidifies, the long premium gets crushed and we get to cash out early.

Speaking of fortunes, SVU has been on quite a tear on buyout rumors and one of my favorite Stupid Options Trick is to sell a ton of long premium in a company that is going to be bought out because, even if the rumor just solidifies, the long premium gets crushed and we get to cash out early.

SVU was one of our featured trades in the May 6th edition of Stock World Weekly and the trade idea at the time was buying the stock for $5.54 and selling the 2014 $5 puts and calls for $2.10 for a net $3.44/4.22 entry (we took the money and ran on that one when they popped and we went to cash). The beauty of the trade is that, if SVU gets bought for $5 or more, you get your $5 early but, even if it simply holds $5 through 2014 – it's a very nice 45% gain anyway.

Now SVU is at $5.11 and the higher VIX has made the 2014 $5 puts and calls $2.90 so net $2.21/3.61 is a better spread than we had at the time with a 126% potential pay-off. We already have this trade in our Income Portfolio from when SVU was $4.45 on the 5th but the high VIX has pumped up the short puts and calls so still a great entry if you missed it earlier in the month.

Those are the kind of trades we like to take in an uncertain market. If SVU fails and gets put to us, we end up with 2x at $3.61 – that's 29% off the current price using our Buy/Write strategy feature in "How to Buy a Stock for a 15-20% Discount." The beauty of trades like this is that they are self-hedging. SVU can drop 10% and we still do very well, they can drop 20% and we're still not worried and 30% down is break-even on the trade (assuming we fail to adjust it) so we don't need to spend money covering them until/unless our worry lines do get broken. It's the perfect way to play an uncertain market – other than cash, of course.

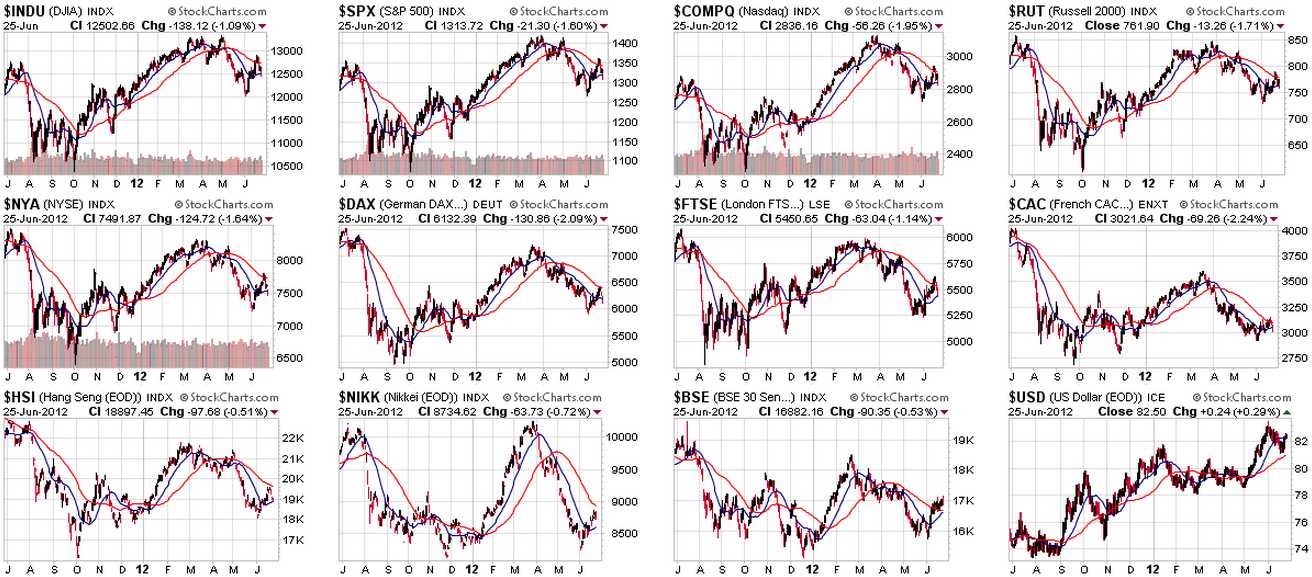

Don't knock cash – as you can see from Dave Fry's UUP chart, it's about 10% more valuable than it was last summer. Can you say that about your stock portfolio? Cash remains King as we wait for Europe to break one way or the other – as you can see, the whole World is testing their 50 dmas (and failing) but it takes more than a day or two to make a trend and we'll be just as skeptical of the run-up into Friday's close as we are about the 3-day sell-off that has sapped the bulls' wills:

Even Wolfgang Schauble told Der Spiegel yesterday "We Certainly Don't Want to Divide Europe," which continues the long-standing policy of Germany to unite Europe that has been in place since 1936:

The most important thing is that we create a fiscal union, one in which the nation states give up their jurisdiction in terms of fiscal policy. In addition, the problems of the Spanish financial institutions reveal, once again, that Europe would be better off with a bank union. We need a European supervisory authority, at least over the major lenders, which can then influence the banks directly. Then we can also save them with joint funds.

We should try to achieve all of this for the entire EU. Germany has always stood for an EU of the 27 countries. But in light of Britain's continued resistance to further integration steps, as we saw with the fiscal pact, there are limits to my optimism in this regard.

There are limits to our optimism as well and BoE Governor King has been laying the groundwork for further QE, telling Parliament he's "struck" by how much things have deteriorated in the last 6 weeks. "I am pessimistic [about the eurozone outlook]. I am particularly concerned because over two years now we have seen the situation in the euro area get worse and the problem being pushed down the road," he said.

There are limits to our optimism as well and BoE Governor King has been laying the groundwork for further QE, telling Parliament he's "struck" by how much things have deteriorated in the last 6 weeks. "I am pessimistic [about the eurozone outlook]. I am particularly concerned because over two years now we have seen the situation in the euro area get worse and the problem being pushed down the road," he said.

As I have been saying, this is like the end-game in chess and we are down to just a few possible moves – but I don't think the World leaders are ready to knock over their kings and resign just yet. Slowly but surely, they are beginning to realize austerity is a dead end – something we discussed this morning in Member Chat as I proposed that hyper-inflation was certainly preferable to austerity:

Death spiral – Without hyperinflation, we go down the drain. The people who are "unrealistic" are the ones who think you can pay off $16Tn in debt by cutting spending (especially if you don't increase collections). Cut spending and less money in circulation, less money in circulation means Governments have to offer more interest to attract money and then debt goes up anyway. You can use austerity when you are 10% in debt, 20% in debt, even 30% in debt but when you are 100% of your GDP in debt – that ship has sailed long ago.

Talk about kicking the can down the road – what's the austerity plan – 20 years of no spending until we pay off our debts? Our Government (and Europe about the same) currently spends $3.2Tn a year and takes in $2.2Tn for a $1Tn annual deficit and we have $16Tn in debt. So if we reduce spending by 66% and maintain collections (generally a mutually exclusive proposition) at the same level, then it will "only" take us 16 years to pay off the debt – if interest levels stay at 3% – otherwise we are totally screwed anyway.

So we scrap the army and SS and Medicare (but keep collecting the money for SS and Medicare anyway because that's currently $800Bn a year (1/3) of the Government's revenues) and another $500Bn of discretionary spending and then we're down to spending just $1.2Tn a year and collecting $2.2Tn and THEN austerity works (as long as there are no natural disasters, attacks on our country, wars or infrastructure emergencies). What a brilliant plan that is – so well thought out…

If we don't get our free money, look for one MoFo of a market withdrawal because we are hooked on stimulus and this is certainly no time to go cold turkey!