Before we begin – let's catch up on the Libor scandal:

"The Global Banking Industry relies on London having virtually no regulatory oversight. The bulk of the Global financial crimes occur in London. David Cameron, of course, is keen to protect the franchise of the city of London – it's the big profit center for his country and his Government – essentially peddling in fraud."

That is the key point made by Max Keiser (7:20) in the above video. As Keiser points out, fraud and manipulation are rampant in the Global Financial Markets and have been for years. I've been saying so and we have great systems to profit from the manipulation of fraudulent markets but they wouldn't work so well if the markets were not a sham, would they?

That is the key point made by Max Keiser (7:20) in the above video. As Keiser points out, fraud and manipulation are rampant in the Global Financial Markets and have been for years. I've been saying so and we have great systems to profit from the manipulation of fraudulent markets but they wouldn't work so well if the markets were not a sham, would they?

While I'd love to go back to picking value stocks in clean market environment – I'm certainly not holding my breath. Fining BCS $450M for making Billions of Dollars in a conspiracy to defraud Trillions of Dollars of Global investors over periods of years means you shouldn't hold yours either. I'm pretty sure we can expect more of the same for a long, long time.

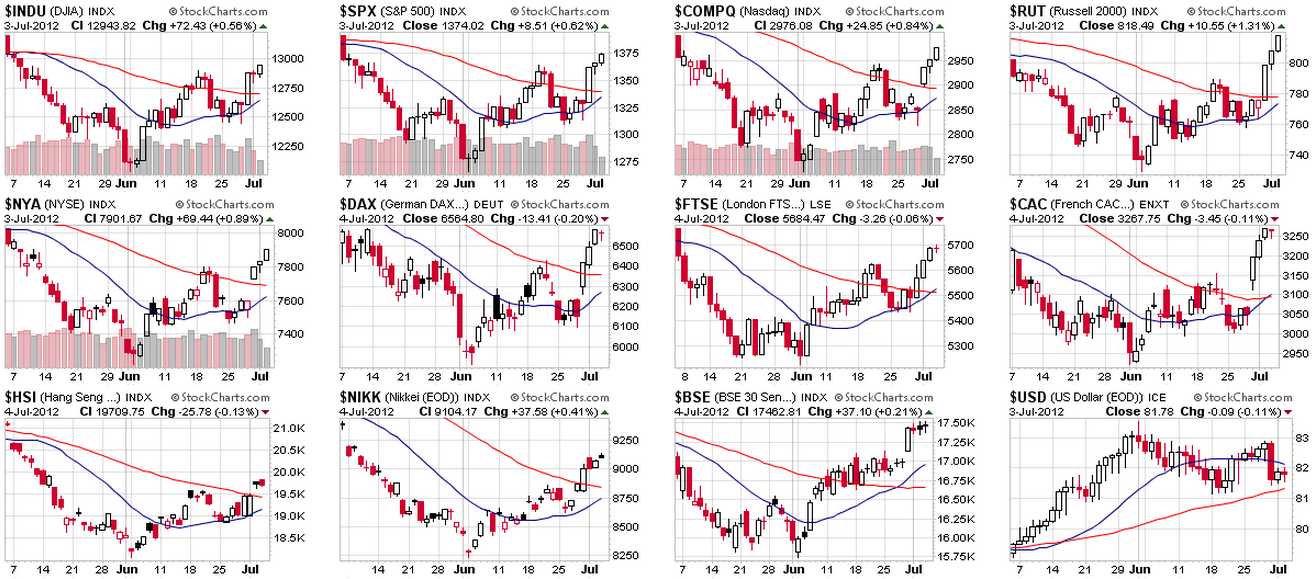

This morning the Euro and the Dollar have been flying up and down along with our index futures on rumors that China will or won't be easing (100-point swings in the Dow pre-market) or that the ECB will or won't ease and that other countries will or won't kick in stimulus. You know, the same old crap we've been hearing since early June – giving us roughly 10% gains across the International board – even as the Global Economic Data continues to decay:

We are still "constructively bullish" which is what led us to stay cashy and cautious short-term, while holding bullish on our long-term bets. We haven't got any strong downside bets as we have clear lines at those 50 dmas (red) with the 20 dmas (blue) curving up sharply to give us support before we feel compelled to go bearish again. Of course, this "rally" has been a lot of low-volume BS – hence the "cashy and cautious" stance. We have had no reason yet to actually go bearish and, since we added most of our long-term longs in early June – we have quite a while before we do become concerned.

8am Update: The ECB did cut rates by the expect 25 basis points to 0.75% (still higher than the Fed) but they did take that final step and cut the deposit rate to 0%. Overall, the effect has been to put the US futures back to flat but that's not too likely to last as the Dollar has jumped to 82.68 while the Euro falls to $1.2425 and even the Pound is being pounded down to $1.555. If the Euro fails to hold $1.24 – look out below!

8:30 Update: 374,000 Americans lost their jobs ahead of the Holiday week and, as you can see from the chart on the left – consumer trends are down, down and down.

8:30 Update: 374,000 Americans lost their jobs ahead of the Holiday week and, as you can see from the chart on the left – consumer trends are down, down and down.

With Consumer Spending making up 70% of the US GDP and Corporate Spending anemic and Government Spending on the decline – don't you think it's a little silly to rally into earnings? Oh yes, silly me – this news is so bad – it's GOOD! That's the entirety of the bullish premise on the market – not that things are getting better (they are not) – just that things are still bad enough that the G20 has no choice but to give the top 1% MORE FREE MONEY – and maybe even a little for the bottom 99% ahead of the election.

Oops, I've just talked myself into being more bearish. This 10% up move is STUPID and we've been with stupid for this nice 10% rally but I think it might be time to add a few bearish bets – no sense in sitting out a nice downturn if we can catch a ride, right?

Oops, I've just talked myself into being more bearish. This 10% up move is STUPID and we've been with stupid for this nice 10% rally but I think it might be time to add a few bearish bets – no sense in sitting out a nice downturn if we can catch a ride, right?

Our favorite downside play is still our disaster hedge of SQQQ. We have several iterations but our $25,000 Portfolios (aggressive and not) bought back the callers into Tuesday's rally and left us in the July $47 calls for net $1.75. They closed Tuesday at just $1.30 (down 25%) and our plan was to double down if the Nas spiked up this morning but, if not – we still like them for the downside hedge and we can, hopefully, resell $53 calls again for $1 or more on a dip and drop our net down to .75 or less.

Another hedge we liked was the AMZN Oct $165 puts at $2.15 – also from Tuesday. I think AMZN is eating a lot of up-front costs on those Kindles and the R&D on the new ones must be painful while the Big Box retailers are pushing back hard from all sides so I think they have a good chance of blowing their earnings report and I think if the overall market tanks, they will drop fast anyway. Keep in mind you don't need AMZN to drop $60 (30%) to make money on the puts. The Oct $185 puts are $3.80 so we can figure a $20 drop in AMZN (less than 10%) can net us a near double. THAT's a nice hedge!

Of course we'll find plenty of lovely things to short in Member Chat – especially oil as we head into the inventory report at 11, hopefully around $88.50. EDZ is back on our radar at $13.85, around where we began buying it in April before it ran up to $19.50. The lows on EDZ were $11.41 in early March and we can certainly sell puts below that line but keep in mind that Chinese stimulus can give us new lows – until it wears off – so cautious on that one still….

There was no coordination between the ECB, BoE, and PBOC (all easing today) other than the "usual exchange of views," the ECB's Draghi says. He sees weakening of growth in the whole of the euro area, including countries not previously experiencing such. Draghi also said the ECB doesn't want to get into the business of hoovering up the unwanted (at a given price) sovereign debt of troubled EU states and that's sending the Euro back below the $1.24 line with the Dollar shooting back to 82.92 and our futures coming near their lows just ahead of the open.

Wheeeeeeeeeeeeeeeee!