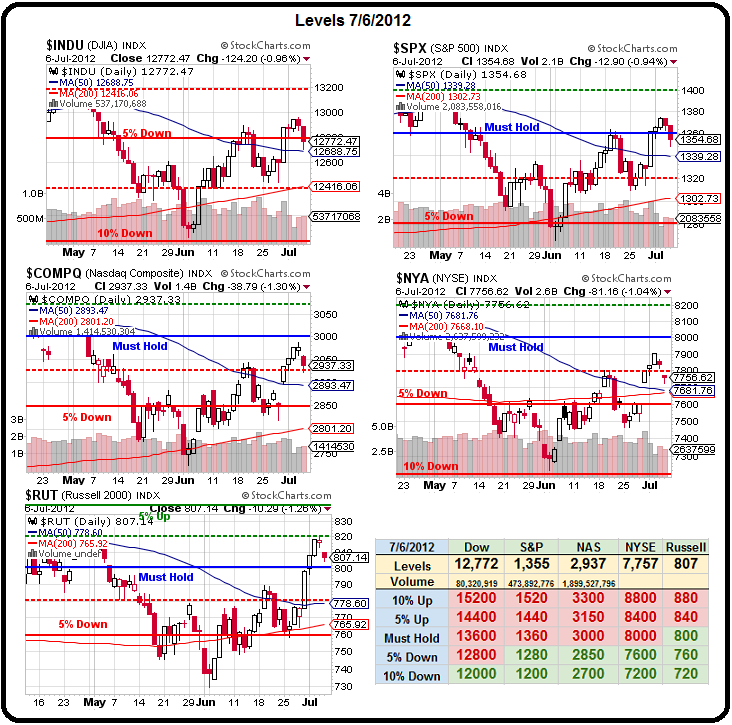

This is not very encouraging:

This is not very encouraging:

There's a reason we flipped bearish ahead of the holiday last week as the run-up seemed fake, Fake, FAKE – just more low-volume, manipulated BS on bad news that lead to the anticipation of more QE but, as I noted earlier in the month, the G20 already fumbled that ball and the bears, while not yet in control – are certainly marching back down-field.

Remember, our bullish premise was never about anything more than QE and there was simply not enough QE offered (at $10Bn per S&P point per 6 months) to push us back over 1,400.

Now we face the potential horror of earnings season which may be somewhat abated by the accounting changes allowed in the Transportation bill that we discussed last week. While those changes may provide a one-time boost to earnings of many Billions of Dollars – the strong Dollar will also be a big negative to the recognition of International revenues and International revenues ain't so hot in the first place.

While taking some bearish flyers over the weekend (see Stock World Weekly for details) – our primary position is to stay cashy and cautious as we watch this little drama play out in earnings' first week. AA reports tonight and we'll see how they end up accounting for their substantial pension obligations under the new rules and that will give us a big more of a clue as to how to play the rest.

While taking some bearish flyers over the weekend (see Stock World Weekly for details) – our primary position is to stay cashy and cautious as we watch this little drama play out in earnings' first week. AA reports tonight and we'll see how they end up accounting for their substantial pension obligations under the new rules and that will give us a big more of a clue as to how to play the rest.

We also have a ton of Fed speak this week as the US looks to peddle over $100Bn worth of new debt and, with the 10-year auction on Wednesday (right before the release of the FOMC minutes at 2pm) and the 30-year on Thursday – it has often been a very good bet to play the market lower into those auctions as nothing sells bonds like a stock market panic, right?

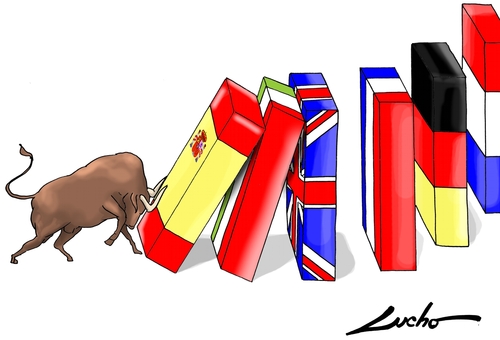

Perhaps that's Spain's problem – not enough market panic – as Spanish debt flies back to that danger zone at 7%, just two weeks after they are "fixed" by the EU, ECB and IMF. Spanish Prime Minister, Mariano Rajoy, may unveil a third austerity round within days as his six-month- old government tries to avoid a second bailout amid hemorrhaging tax receipts. Rajoy said on July 2 the time has come to “press the accelerator pedal” as he tries to tame bond yields. Government officials have said they are considering raising taxes on gas and products that have a reduced rate, such as food, hotels and restaurants.

Spain’s return to recession is undermining efforts to cut the Euro area’s third-largest budget deficit as tax receipts shrivel. Ten-year bond yields climbed back above 7 percent today as European finance ministers meet to discuss the worsening debt crisis. “I have my doubts because it is very difficult to boost receipts amid austerity,” Antonio Javier Ramos Llanos, economy professor at Madrid’s Universidad Pontificia Comillas, said in an interview. “Citizens see they are paying more tax and public services cost more. That doesn’t incite them to spend at all.”

Spain’s return to recession is undermining efforts to cut the Euro area’s third-largest budget deficit as tax receipts shrivel. Ten-year bond yields climbed back above 7 percent today as European finance ministers meet to discuss the worsening debt crisis. “I have my doubts because it is very difficult to boost receipts amid austerity,” Antonio Javier Ramos Llanos, economy professor at Madrid’s Universidad Pontificia Comillas, said in an interview. “Citizens see they are paying more tax and public services cost more. That doesn’t incite them to spend at all.”

Hong Kong and Vietnam signaled growth may fall short of government forecasts this year as Asian policy makers stepped up efforts to protect their economies and currency markets from the worsening global outlook. Hong Kong may revise its 2012 economic forecast next month, Financial Secretary John Tsang said on July 7. In Vietnam, Deputy Prime Minister Vu Van Ninh said the country may miss its growth target and the central bank told lenders to cut borrowing costs on existing loans to help businesses. The Philippines unveiled plans to contain currency gains that may hurt exports. According to Bloomberg:

Interest-rate cuts by central banks in China and Europe last week underscore the risks to the world economy as the euro area’s fiscal crisis deepens, U.S. employment gains falter and Asia’s expansion slows. The International Monetary Fund will reduce its estimate for global growth this year, Managing Director Christine Lagarde said July 6 ahead of the publication of the lender’s updated economic outlook next week.

“Given the ongoing deterioration in Eurozone and U.S. growth indicators in recent months, there is little prospect for a material improvement” in emerging market exports while domestic demand also “looks set to remain soft in the near- term,” Nick Chamie, global head of foreign-exchange strategy at Royal Bank of Canada in Toronto, said in a July 6 note. “We see further evidence that growth weakness will extend well into” the third quarter.

The bank cut its aggregate growth forecast for emerging markets this year to a “very weak” 4.7 percent from 5.5 percent, Chamie wrote.

No wonder we liked EDZ at $14 last week. Even as they took off on Friday, in our morning Alert to Members at 9:45, we were still able to grab the Aug $14/18 bull call spread for $1.20, selling the Aug $14 puts for $1 for net .20 on the $4 spread that's already $1 in the money as of Friday's close – NOW THAT's A HEDGE!

Back home, Already, 42 companies, including F and TXN, have warned investors that profits will be lower than initially expected, in large part because of slowing demand from customers around the world, particularly in Europe.

Analysts say the darkening outlook is only partly baked into current share prices. Adam Parker, Morgan Stanley's chief stock strategist, predicts Standard & Poor's 500-stock index will finish the year at 1167, about 14% below where it is now. "The pillar of strength is U.S. corporate earnings, and now we're seeing signs that that is cracking," he says.

Analysts say the darkening outlook is only partly baked into current share prices. Adam Parker, Morgan Stanley's chief stock strategist, predicts Standard & Poor's 500-stock index will finish the year at 1167, about 14% below where it is now. "The pillar of strength is U.S. corporate earnings, and now we're seeing signs that that is cracking," he says.

Most analysts now expect the S&P 500 companies to generate a total of $25.21 in earnings per share this quarter, down from expectations of $25.89 at the beginning of the quarter, according to S&P Capital IQ.

Will the low expections running headlong into major accounting changes end up being bullish for the market? We certainly know you can fool some of the people all of the time but they're going to have to fool all of they people in order to pull this one off as we're already up about 5% for the year on very thin trading with no major volume capitulations so far.

US coroprations are going to have to show us the Q2 money before we're willing to pull any of ours off the sidelines!