Saved by the 50 DMA's!

Saved by the 50 DMA's!

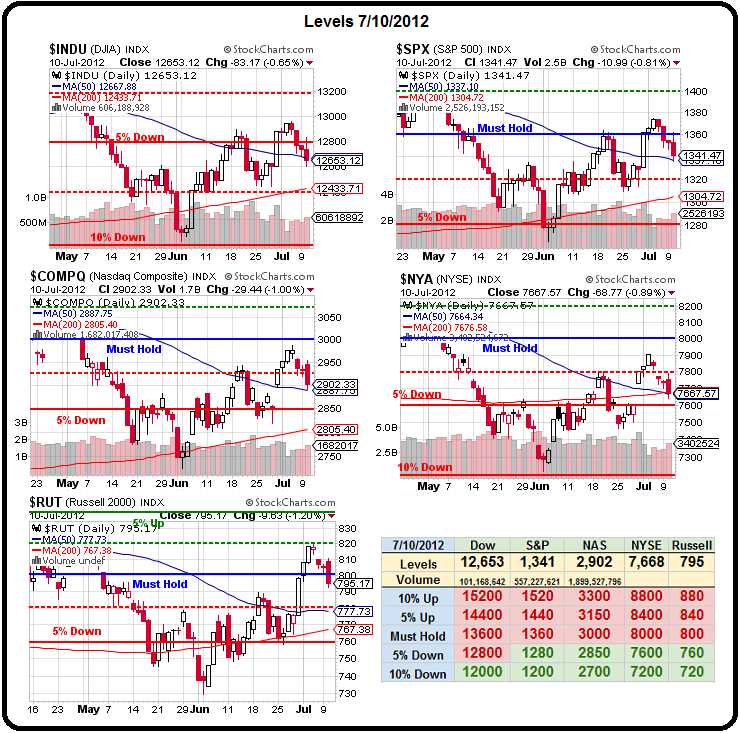

Who said investing is hard? 4 of our 5 major indexes fall in synch and stop dead at the 50 day moving average that we've been watching on our Big Chart for over two months now as bullish support. Yawn…

Of course, if you think this can possibly be result of individual decisions made by millions of global investors than it's you that need to wake up. This is a completely machine-driven market and that's a GOOD thing if you follow our charts, as they give you very clear indications of all the major inflection points.

I'm not at all a TA guy – I merely accept the fact that the markets are fixed and the moves are coordinated and we set our points accordingly according to our 5% Rule, which works best in Bot-driven markets. Since we only adjust our Big Chart once a year or less – it lets us dispense with all that TA BS in less than two minutes a day and move on to more important things like – FUNDAMENTALS!

What we can do, however, is combine our view of the Big Chart with some fundamentals to figure out what the market will do at serious inflection points. Note on Dave Fry's SPY chart, we get a good view of the weak 50 dma.

What we can do, however, is combine our view of the Big Chart with some fundamentals to figure out what the market will do at serious inflection points. Note on Dave Fry's SPY chart, we get a good view of the weak 50 dma.

Before we despair, however, look at that upwardly jammin' 200 dma – that sucker is going to pop the index like it was hit with a tennis racket at right about 1,320 in about 2 weeks so we have a jittery sell-off in a choppy early earnings season to look forward to and then something good happening at the end of the month to spark a rally.

Oh sorry, I planned to conclude with that but it's so freakin' obvious – why waste time with exposition?

Going back to the Big Chart, you can see on the S&P (and the others) that we still have a constructively bullish "M" pattern where the lows are lining up in an up-trend that mirrors the rising 200 dma. Obviously, if we fail to hold these 50 dmas – the next stop is that 200 DMA, which is generally intersecting the 2.5% lines on each index but forget those – it's all about the NYSE, which is our broadest index and is already testing its 200 dma AND the 50 DMA at 7,650 – so there's an easy line to keep our eye on for a market pass/fail indicator.

Fundamentally, we have to ask ourselves WHY the NYSE should hold 7,650 as well as asking ourselves why the NYSE should fail to hold 7,650 and, when we have a preponderance of evidence on one side or the other, we shift our bets.

Fundamentally, we have to ask ourselves WHY the NYSE should hold 7,650 as well as asking ourselves why the NYSE should fail to hold 7,650 and, when we have a preponderance of evidence on one side or the other, we shift our bets.

When we made our double-top in early July, we flipped bearish as there simply wasn't enough good news to justify that run. Now we have to decide if there is enough bad news to justify returning to the top of the V panic sell-off we had in June. at about 1,320 on the S&P and 7,500 on the NYSE. Have we really made no fundamental progress in over a month?

Sadly, the answer there may be no. Just this morning, Spain's PM Rajoy announced another $81Bn in deficit savings by raising taxes and cutting unemployment benefits for the 22% of the country that are out of work. The taxes are VAT taxes, which disproportionately impact the poor and the soon-to-be-much-poorer unemployed. Apparently, we are still entertaining this completely insane austerity BS as the cure-all for whatever ails the EU so no, we have not made any progress since the crash of early July – our "leaders" are still completely insane and we can expect riots in Spain any day now.

Meanwhile, Germany's Parliament has pushed back until September a decision on whether or not the ESM is contstitutional (from Germany's perspective) while Spain is pushing back the planned stress tests on their 14 largest banks until November. Meanwhile, Spain is rumored to be buying a very large dog so they can later claim it ate their homework next time they need to delay something.

Portugal's international creditors may soon have to ease terms of the country's bailout to prevent the plan from derailing as the government faces setbacks in attaining its deficit goals. Prime Minister Pedro Passos Coelho's struggle to meet deficit pledges were further hampered last week when about $2.5 billion of planned cuts to pensions and civil servants' holiday pay were ruled unconstitutional. With Portugal's 10-year bond yield above 10%, returning to the markets next year may be untenable, requiring more international aid despite the premier's insistence he won't seek concessions

While all this is going on and with the fiscal cliff looming, our Conservative friends will be happy to know the Republicans in Congress will be voting to repeal the Health Care Reform Bill. This will be the 31st time the House has voted to repeal all or part of the bill and it will be the 31st time the Senate rejects them but the GOP continues to display gross constitutional ignorance as they do it yet again today. Or, perhaps they are not ignorant and simply don't care that they have wasted 31 days of Congress' time (and countless hours of staff time at the taxpayers' expense) in order to score cheap political points – we report, you decide.

While all this is going on and with the fiscal cliff looming, our Conservative friends will be happy to know the Republicans in Congress will be voting to repeal the Health Care Reform Bill. This will be the 31st time the House has voted to repeal all or part of the bill and it will be the 31st time the Senate rejects them but the GOP continues to display gross constitutional ignorance as they do it yet again today. Or, perhaps they are not ignorant and simply don't care that they have wasted 31 days of Congress' time (and countless hours of staff time at the taxpayers' expense) in order to score cheap political points – we report, you decide.

What the GOP is being successful at is blocking the extention of the Bush Tax Cuts to 132.5M American taxpayers who earn under $250,000 a year in order to force an extension of the tax cuts to 1.5M Americans who make $250,000 or more per year – including just 3.5% of all small businesses – contrary to all the BS you hear from the MSM. Well, we got Health Care Reform over the GOP's dead body, perhaps we can also get tax cuts for 99% of Americans over their dead bodies as well…

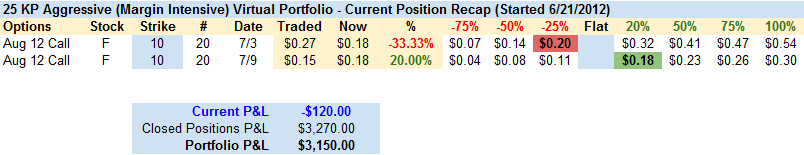

EDZ (see Monday's post for our trade idea in that ETF) continues to fly as we wait for the International shoe to drop. Even yesterday, we added a modified version of the trade to our Aggressive $25,000 Portfolio, which only had a so far losing F trade remaining so we're very bearish at the moment but in no mood to bottom-fish for balance unless our levels hold. The $25KPA is up a virtual 24.6% as we move into month number 2 and we're pretty much all cash:

That's what cashy and cautious looks like folks – we don't know (or care) which way the market is going to run – we just look for opportunities to buy low and sell high and get the hell back to cash as soon as we realize a small gain. Do that over and over again and it does tend to add up but we can also sleep well at night and that's worth more than cash these days!